EMEA

View:

January 06, 2026

Markets 2026

January 6, 2026 9:58 AM UTC

• For financial markets, the muddle through for global economics and policy provides support for risk assets, combined with solid earnings prospects from some of the magnificent 7. However, U.S. equities are once again significantly overvalued and we look for a 5-10% correction in 2026, b

January 05, 2026

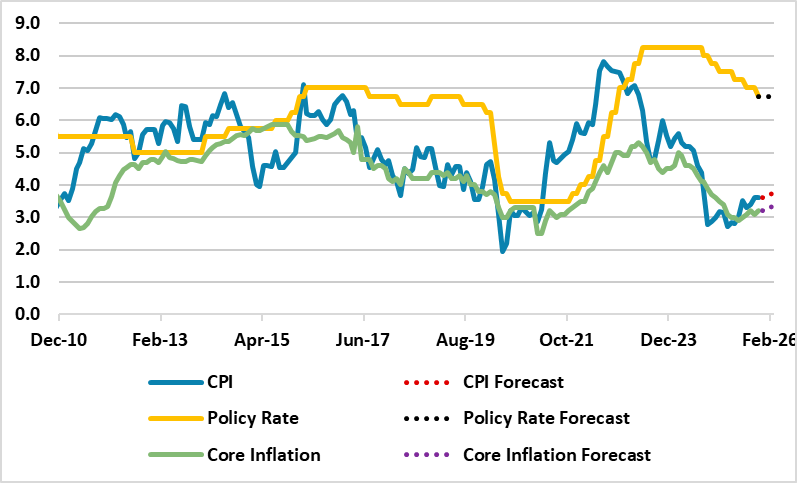

Turkiye Closes the Year with Inflation Easing to 30.9% y/y in December

January 5, 2026 11:25 AM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on January 5, Turkiye’s inflation softened to 30.9% y/y in December backed by the lagged impacts of previous monetary tightening. Food, housing and education drove the inflation in December as education prices recorde

January 02, 2026

December 23, 2025

Trump’s Peace Framework as a Path to a Late 2026 Settlement?

December 23, 2025 1:48 PM UTC

Bottom Line: With Russia maintaining its long-held demands in Ukraine and negotiations intensifying around President Trump’s latest peace proposal, our baseline view is that this framework will serve as the primary catalyst for a settlement. We anticipate a Russia-friendly peace deal (70% probabil

December 22, 2025

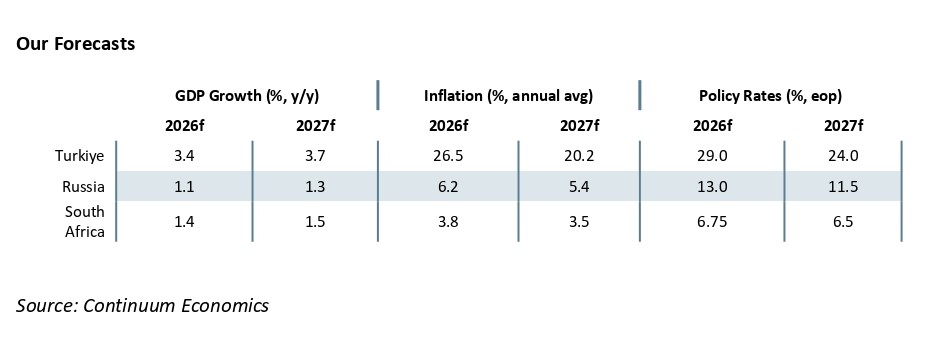

Russia’s Inflation is Expected to Continue to Soften in December

December 22, 2025 2:11 PM UTC

Bottom Line: After edging down to 6.6% in November, we expect Russian inflation to continue its decreasing pattern in December owing to lagged impacts of previous aggressive monetary tightening and relative resilience of RUB. December inflation figures will be announced on December 29, and we forese

December 19, 2025

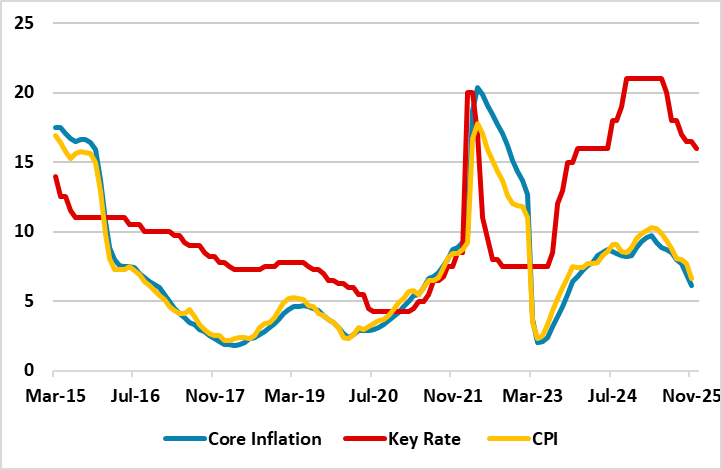

Easing Cycle Continues: CBR Reduced Key Rate to 16% on December 19

December 19, 2025 11:09 AM UTC

Bottom Line: As expected, Central Bank of Russia (CBR) reduced the key rate by 50 bps to 16% during the MPC on December 19 since the pace of the fall in inflation accelerated in November. CBR said in its written statement that monetary policy will remain tight for a long period, and further decision

December 18, 2025

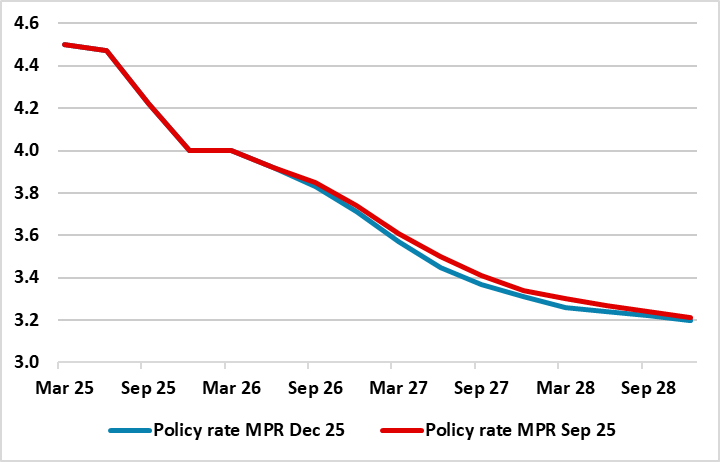

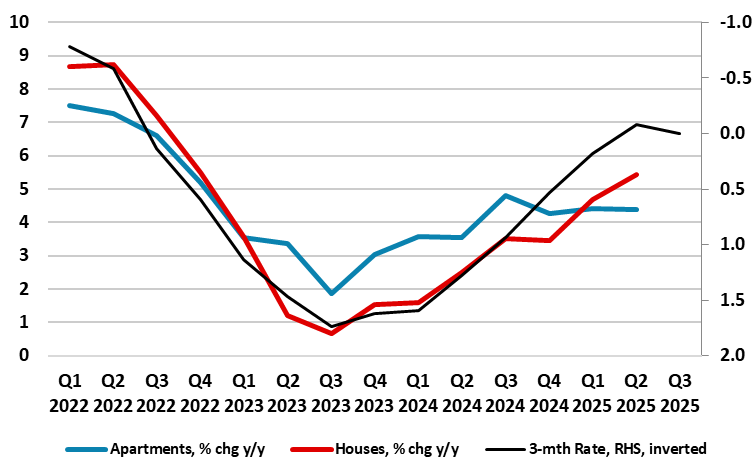

Norges Bank Review: Still Far Too Cautious Despite Clear Output Gap

December 18, 2025 9:40 AM UTC

As expected, no change in policy and little shift in rhetoric and/or outlook was the message from the Norges Bank’s latest verdict. After two 25 bp cuts this year (to 4.0%), this month saw a second successive unchanged verdict with the policy outlook also retained (Figure 1). This was consistent

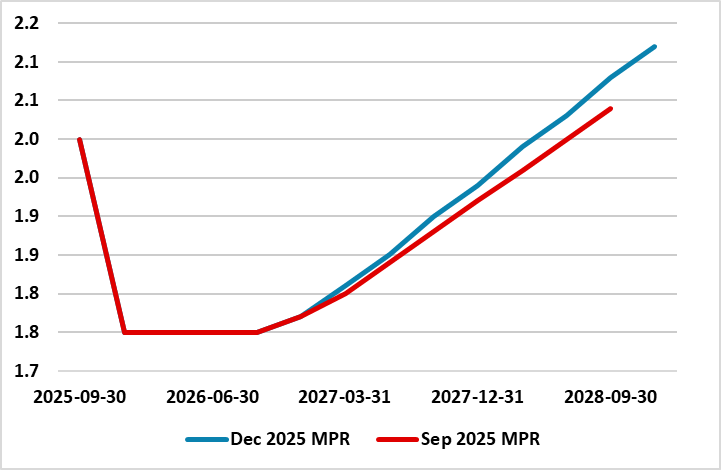

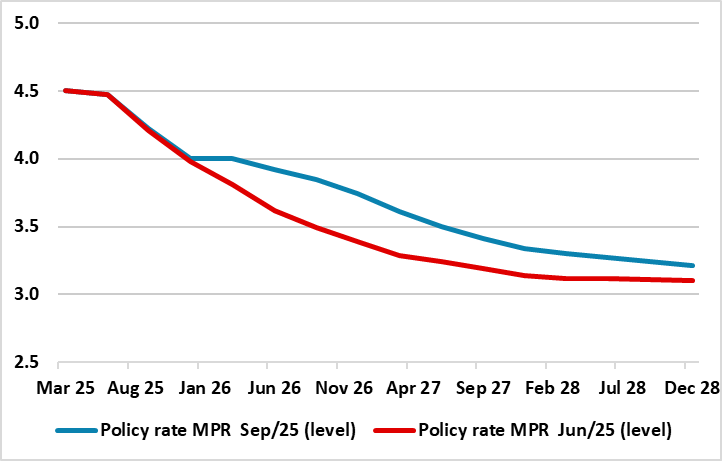

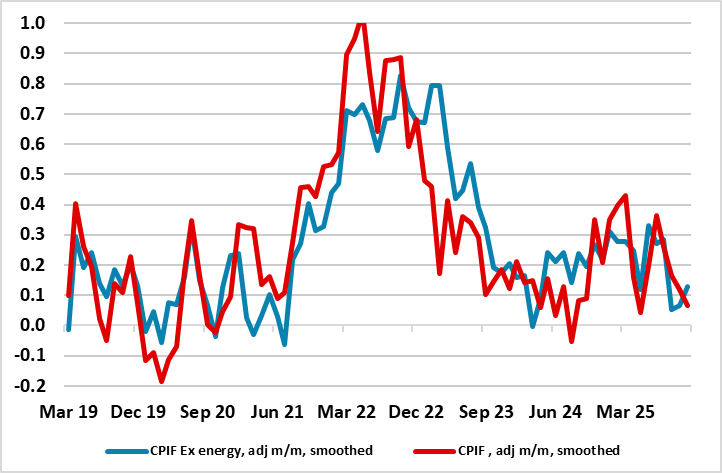

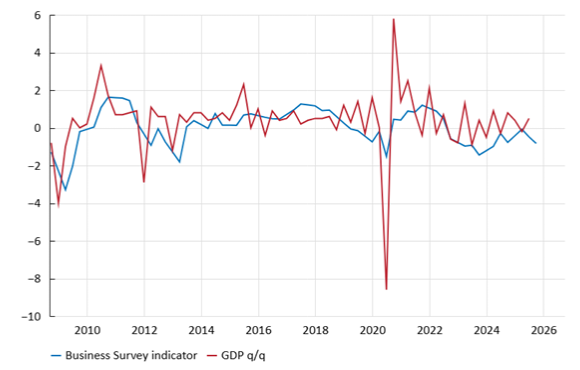

Sweden Riksbank Review: On Hold and For Some Time Ahead?

December 18, 2025 8:54 AM UTC

As widely anticipated, the Riksbank kept policy on hold with the key rate left (again) at 1.75%. It does seem as if the Riksbank Board is (very) pleased with the data flow since its last and very probably final rate cut on Sep 23. GDP saw a strong and unexpected Q3 showing of over 1% q/q while p

December 17, 2025

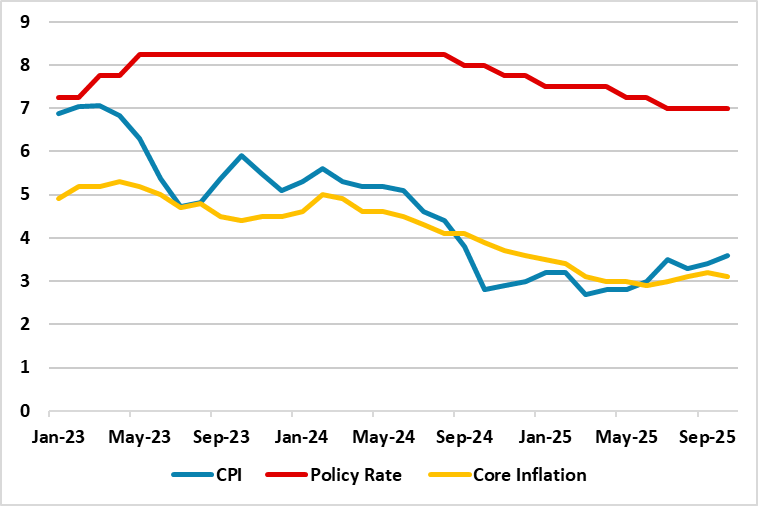

South Africa Inflation Moderately Softens to 3.5% y/y in November

December 17, 2025 5:08 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on December 17 that annual inflation softened moderately to 3.5% y/y in November from 3.6% the previous month, but food and restaurant prices remained worrisome. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 pe

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 16, 2025

Commodities Outlook: A Balancing Act

December 16, 2025 10:15 AM UTC

Global oil demand is expected to be modest, with weak consumption in the U.S. and China, while India will support demand in 2026 and 2027. Non-OPEC supply is expected to expand moderately in 2026, whereas OPEC’s policy will respond to demand but remains puzzling. Supply trends in 2027 are likely t

EMEA Outlook: Uncertainties Give Mixed Signals

December 16, 2025 7:00 AM UTC

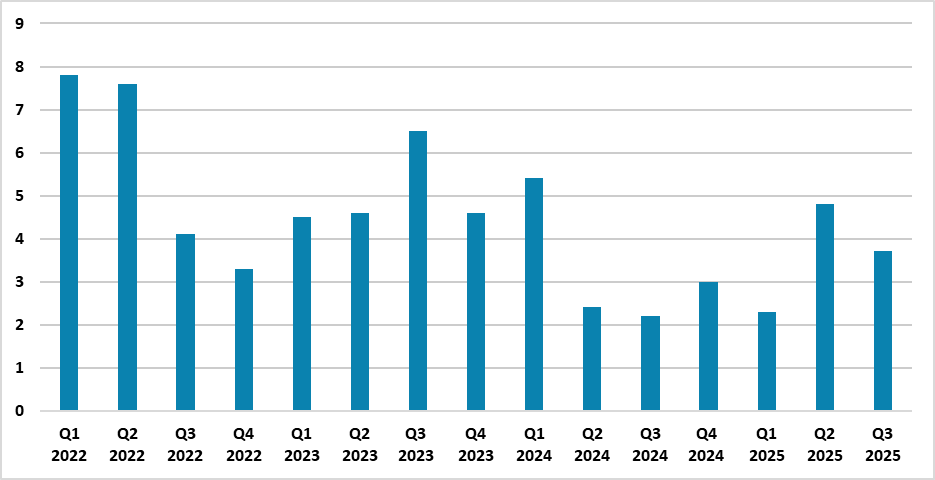

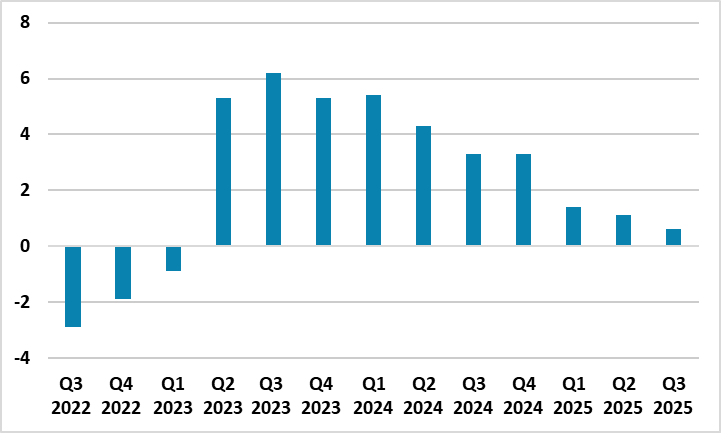

· In South Africa, we foresee average headline inflation will stand at 3.8% and 3.5% in 2026 and 2027, respectively. Upside risks to inflation remain such as, utility costs, and supply chain destructions. We see growth to be 1.4% and 1.5% in 2026 and 2027, respectively. Risks to the growth

December 12, 2025

Equities Outlook: Choppy Up For 2026 and Down for 2027?

December 12, 2025 8:05 AM UTC

· The U.S. equity market is underpinned by the bullish AI/tech story and a soft economic landing into 2026. However, overvaluation is clear and this leaves the market vulnerable to a 5-10% correction on moderate bad news e.g. economic data. We see the S&P500 having a choppy year a

December 11, 2025

Softer November CPI Print Encouraged CBRT to Cut Key Rate to 38% on December 11

December 11, 2025 8:54 PM UTC

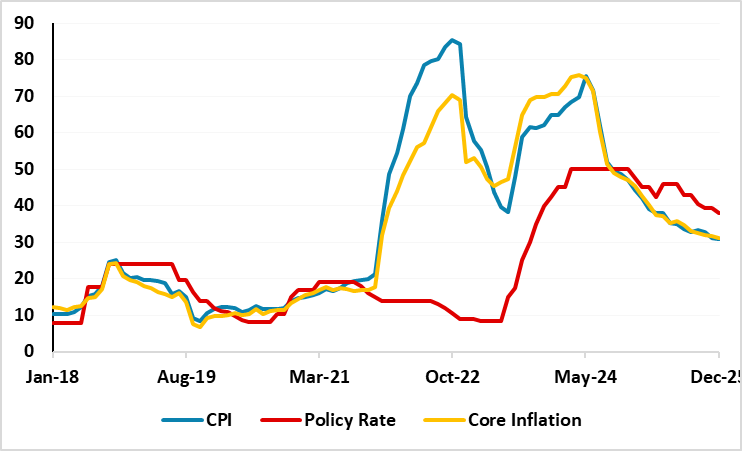

Bottom Line: As we expected, Central Bank of Turkiye (CBRT) cut the policy rate by 150 bps to 38% during the MPC meeting on December 11 encouraged by softer November inflation. The committee said inflation expectations and pricing behavior are showing signs of improvement even as they continue to po

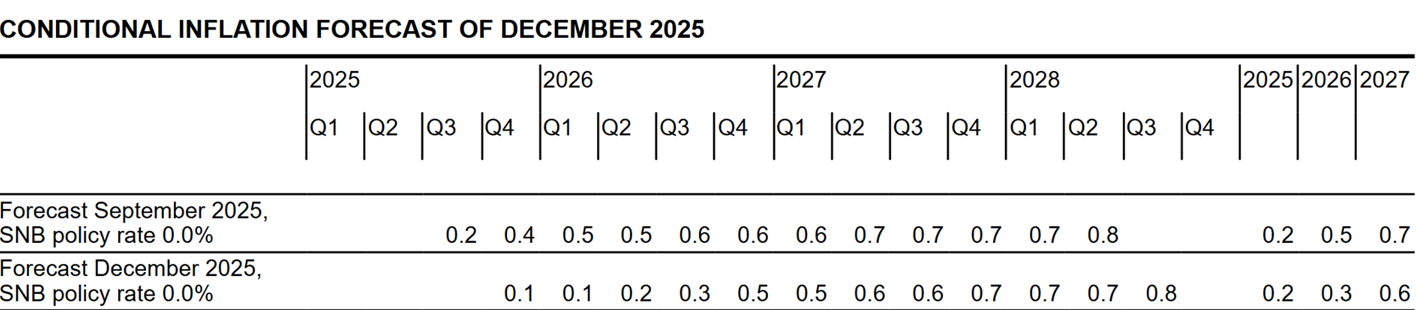

Swiss SNB Review: Preserving Ammunition

December 11, 2025 9:39 AM UTC

Although the tone of the economic outlook was a little perkier, the latest SNB analysis saw no real change. Policy was unchanged, as widely expected, with little shift in the forecast fir either growth or inflation. Overall it sees medium-term inflation at 0.6% (Figure 1), this despite a gloomy

Exceeding Expectations: Russia Inflation Eased Fast to 6.6% y/y in November

December 11, 2025 8:15 AM UTC

Bottom Line: Russian inflation continued its decreasing pattern in November and edged down to 6.6% owing to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB despite food and services prices continued to surge in November. We think the inflation will continue

December 10, 2025

Norges Bank Preview (Dec 18): Still Far Too Cautious

December 10, 2025 9:17 AM UTC

No change in policy and little shift in rhetoric was the message from the Norges Bank’s latest verdict. After what was to some a surprise (and seemingly far from a formality) move in September, in which the Norges Bank cut is policy rate by a further 25 bp to 4.0%, we see no change at the loomin

December 09, 2025

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

December 08, 2025

Sweden Riksbank Preview (Dec 18): Policy to be Unchanged and little Move in Projections?

December 8, 2025 1:18 PM UTC

As we anticipated in our review, the Riksbank Board will be very pleased with the data flow since its last and very probably final rate cut on Sep 23 (to 1.75%). GDP saw a strong and unexpected Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confir

December 04, 2025

SNB Preview (Dec 11). Still Staying at Zero – And For Some Time?

December 4, 2025 8:10 AM UTC

Along with just about everyone, we see unchanged SNB policy when it gives it next quarterly assessment on Dec 11. It is likely to retain what were modest growth outlook for this and next year and still see inflation nearer zero than the 2% upper target (figure 1). But this will be enough to just

December 03, 2025

Turkiye’s Inflation Eased to 31.1% y/y in November, Hitting Below Expectations

December 3, 2025 1:40 PM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on December 3, Turkiye’s inflation softened to 31.1% y/y in November backed by moderate unprocessed food prices. We continue to think upside-tilted inflation risks will likely limit the downward trend during the disin

December 02, 2025

South African GDP Growth Hit 2.1% y/y in Q3, Marking the Fastest Expansion Since Q3 2022

December 2, 2025 8:03 PM UTC

Bottom Line: Department of Statistics of South Africa (Stats SA) announced Q3 GDP growth on December 2. South African economy grew by 2.1% YoY in Q3, the fastest expansion since Q3 2022. We think that the growth momentum will continue to be supported by low inflation, improved consumer sentiment, fe

December 01, 2025

Turkish Economy Expanded by 3.7% in Q3 Backed by Robust HH Consumption and Investments

December 1, 2025 10:41 AM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced GDP growth for Q3 on December 1. Turkish economy grew by 3.7% YoY in Q3 backed by household consumption, investments, and government spending.

November 27, 2025

Turkiye GDP Growth Preview: Economy will Expand by Around 4% in Q3

November 27, 2025 4:22 PM UTC

Bottom Line: Turkish Statistical Institute (TUIK) will announce Q3 GDP growth on December 1 and we expect that Turkish economy will expand around 4.0% YoY backed by investments, strong construction and industry activities in Q3. Of course, growth figure could hit below our expectations due to the we

November 24, 2025

Turkiye Inflation Preview: Inflation will Likely Soften to 32.0% in November

November 24, 2025 6:43 PM UTC

Bottom line: After hitting 32.9% annually in October, we expect Turkiye’s inflation will likely soften to around 32.0% in November backed by moderate food prices while upside-tilted inflation risks continue to limit the downward trend during the ongoing disinflationary process. We foresee MoM in

Japan Aging: Consumption Lessons for Eurozone/China?

November 24, 2025 10:55 AM UTC

· China will likely suffer slowing consumption from population aging in the coming years, as consumption per head falls for over 55’s and large scale immigration is not a likelihood. China’s household wealth is also heavily concentrated in falling illiquid residential property. Chin

November 21, 2025

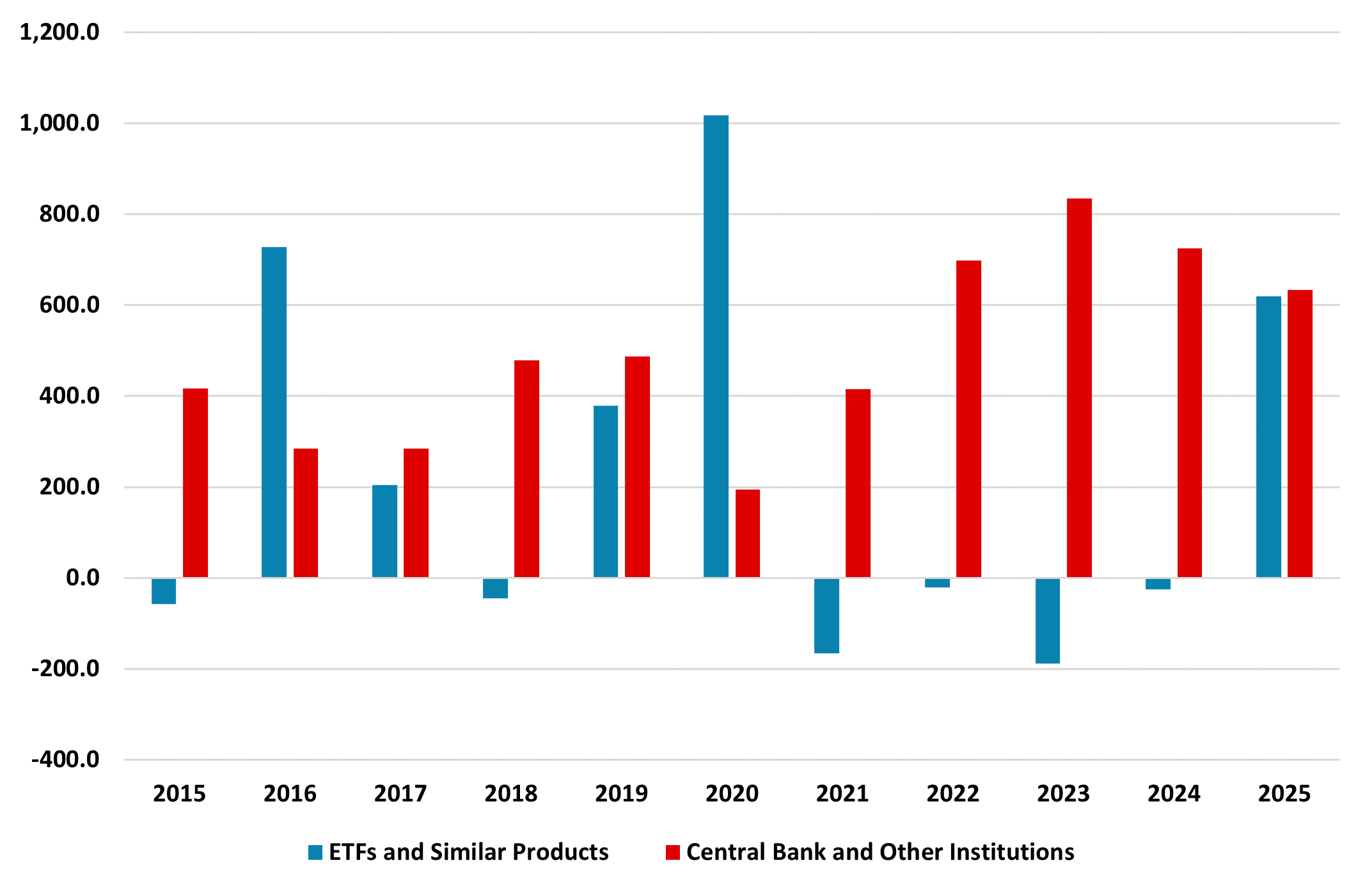

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 20, 2025

SARB Reduced Key Rate to 6.75% Following Favorable Inflation Outlook

November 20, 2025 3:21 PM UTC

Bottom Line: South African Reserve Bank (SARB) cut the policy rate by 25 bps to 6.75% during the MPC on November 20 owing to moderate inflation, stronger ZAR, few power cuts (loadshedding) in Q3, balanced growth risks, and lower oil prices. The MPC decision was unanimous. SARB governor Kganyago ment

November 19, 2025

South Africa Inflation Edged Up to 3.6% y/y in October, Marking the Highest Reading Since September 2024

November 19, 2025 3:53 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on November 19 that annual inflation edged up to 3.6% YoY in October due to accelerated transport, alcoholic beverages and tobacco, and recreation costs. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 percenta

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 17, 2025

Financial Stability Risks: Vulnerable To A Recession

November 17, 2025 1:00 PM UTC

The November Fed financial stability review highlights continued concern over hedge funds and insurance company leverage, while the IMF GSFR is concerned about U.S. equity market overvaluation and growing links between banks and non-bank financial intermediaries. However, the main adverse shock wo

November 14, 2025

Slowest Rate of Growth for Russia Since Q1 2023: 0.6% y/y in Q3 2025

November 14, 2025 6:06 PM UTC

Bottom Line: According to Ministry of Economic Development’s preliminary figures, Russia's GDP expanded by a moderate 0.6% y/y in Q3, marking the slowest rate of growth since Q1 2023 showing the economic slowdown in Russia is more evident now. We think Central Bank of Russia’s (CBR) previous agg

Russia’s Inflation Softened to 7.7% y/y in October

November 14, 2025 5:00 PM UTC

Bottom Line: As expected, Russian inflation continued its decreasing pattern in October and edged down to 7.7% thanks to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB particularly after July. Despite fall in inflation; we think the inflation will continue

November 11, 2025

EZ Rates: 2026 ECB Easing But 2027 French Crisis?

November 11, 2025 9:45 AM UTC

· Financial conditions are tighter than suggested by a 2% ECB depo rate, which will both dampen an EZ economic pick-up and cause further disinflation. We see the ECB delivering two further 25bps cuts to a 1.5% ECB depo rate, which can mean a further decline in 2yr Bund yields. Howev

November 06, 2025

Russia’s Inflation is Expected to Continue to Soften in October Likely Hitting Below 8.0% y/y

November 6, 2025 2:39 PM UTC

Bottom Line: We expect Russian inflation to continue its decreasing pattern in October thanks to lagged impacts of previous aggressive monetary tightening coupled with softening food prices and decreasing core inflation. October inflation figures will be announced on November 14, and we foresee Yr/Y

Norges Bank Review: All Ready For December Cut?

November 6, 2025 9:31 AM UTC

No change in policy and little shift in rhetoric was the message from the Norges Bank’s latest verdict. After what was to some a surprise (and seemingly far from a formality) move in September, in which the Norges Bank cut is policy rate by a further 25 bp to 4.0%, we see no change at Nov 6 verd

November 05, 2025

Sweden Riksbank Review: Board Sticks to it Plans

November 5, 2025 9:44 AM UTC

As we anticipated in our preview, the Riksbank Board is pleased with the data flow since its last and very probably final rate cut on Sep 23 (to 1.75%). GDP indicators suggest a strong Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confirming (bot

November 03, 2025

Inflation Slightly Edged Down in October: But MoM Stood High at 2.5%

November 3, 2025 10:50 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced October inflation figures on November 3. Turkiye’s y/y inflation moderately softened to around 32.9% in October from 33.3% in September while upside-tilted inflation risks continued limiting the downward trend during the ongoing disinfla

October 30, 2025

Turkiye: Macroeconomic Problems Limit Long Term Growth

October 30, 2025 12:25 PM UTC

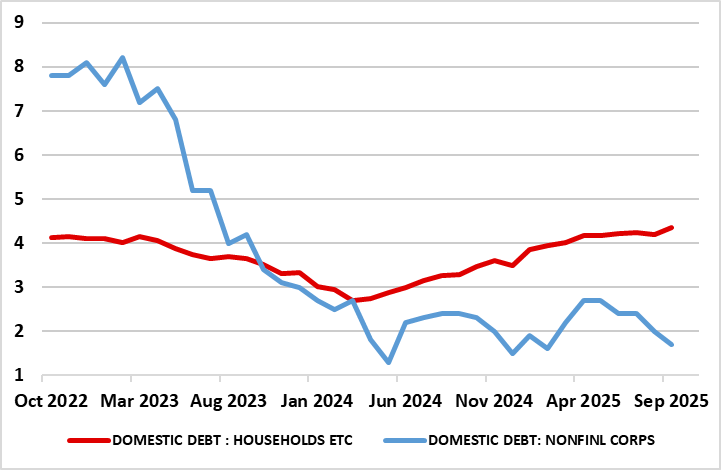

Bottom line: We forecast 3.5%-4.0% GDP growth in Turkiye in the 2026-2030 period. We are concerned with the macroeconomic problems will stay critical until 2027/2028, including stubborn inflation, trade and budget deficits, and weakening Turkish Lira (TRY). Despite growing population and young labor

October 29, 2025

Sweden Riksbank Preview (Nov 5): Board to Reveal Little More?

October 29, 2025 10:35 AM UTC

Having delivered what was described as a final rate cut last time around (ie Sep 23), the Riksbank Board will be pleased with the data flow since. GDP indicators suggest a strong Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confirming suspicions

October 28, 2025

Turkiye Inflation Preview: Inflation will Slightly Soften in October Despite Risks Dominate

October 28, 2025 4:43 PM UTC

Bottom line: After hitting 33.3% annually in September, we expect Turkiye’s inflation will likely soften moderately to around 32.5% in October while upside-tilted inflation risks limiting the downward trend during the ongoing disinflationary process. September inflation suggested that the pace o

October 27, 2025

Norges Bank Preview (Nov 6): On Hold but Another Cut Flagged By End-Year

October 27, 2025 9:26 AM UTC

After what was to some a surprise move in September, in which the Norges Bank cut is policy rate by a further 25 bp to 4.0%, we see no change at Nov 6 verdict. After all, there will be no fresh forecasts, albeit with the Board likely to reinforce existing hints of a further 25 bp move at the Dec 1

October 24, 2025

Unexpectedly, CBR Reduced Key Rate to 16.5% on October 24

October 24, 2025 4:53 PM UTC

Bottom Line: Despite we expected Central Bank of Russia (CBR) to hold the policy rate constant at 17% during the next MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine stepped up hitting oil refineries in Russia; CBR de

October 23, 2025

Turkiye MPC Review: Cautious CBRT Reduced Key Rate by 100 bps to 39.5%

October 23, 2025 2:18 PM UTC

Bottom Line: As we expected, Central Bank of Turkiye (CBRT) cut the policy rate by 100 bps to 39.5% during the MPC meeting on October 23 citing slowdown in disinflationary process due to renewed inflationary risks. Our end year key rate prediction remains at 37.0% for 2025 despite the fact that it w

October 22, 2025

South Africa Inflation Slightly Surged to 3.4% YoY in September

October 22, 2025 2:01 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on October 22 that annual inflation edged up to 3.4% YoY in September from 3.3% YoY in August due to accelerated housing, restaurant and utilities costs. Despite inflation is still within the South African Reserve Bank’s (SARB) 3%-6% targe

October 20, 2025

Turkiye MPC Preview: CBRT will Likely Continue its Easing Cycle on October 23

October 20, 2025 7:00 AM UTC

Bottom Line: We think Central Bank of Turkiye (CBRT) will likely reduce the policy rate to 39%-39.5% during the MPC meeting scheduled for October 23 taking deceleration trend in inflation and relative TRY stability into account. We think CBRT will have to proceed carefully on interest-rate adjustmen

October 16, 2025

Preview: CBR will Likely Hold the Key Rate Stable at 17% on October 24

October 16, 2025 1:09 PM UTC

Bottom Line: We expect Central Bank of Russia (CBR) to hold the policy rate constant at 17% during the next MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine stepped up hitting oil refineries in Russia; which could also

October 13, 2025

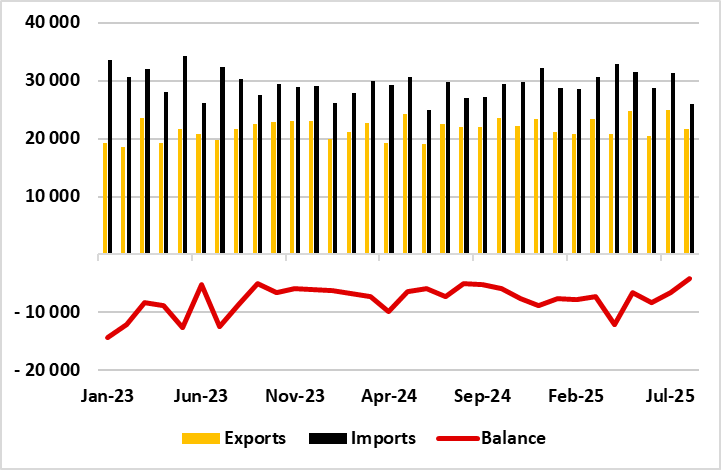

Tourism and Services Income Helped Turkish Current Account in August

October 13, 2025 1:59 PM UTC

Bottom Line: According to the figures announced by the Central Bank of Turkiye (CBRT) on October 13, Turkiye’s current account surplus (CAS) stood at USD5.5 billion in August 2025 from USD4.9 billion in the same month of the previous year, hitting the largest on record, thanks to strong tourism an