Turkiye Inflation Preview: Inflation will Slightly Soften in October Despite Risks Dominate

Bottom line: After hitting 33.3% annually in September, we expect Turkiye’s inflation will likely soften moderately to around 32.5% in October while upside-tilted inflation risks limiting the downward trend during the ongoing disinflationary process. September inflation suggested that the pace of the decline in inflation will be slower-than-expected due to sticky food and services prices, and we foresee MoM inflation in October will stand at around 2% and 2.3%. October print will be announced by Turkish Statistical Institute (TUIK) on November 3.

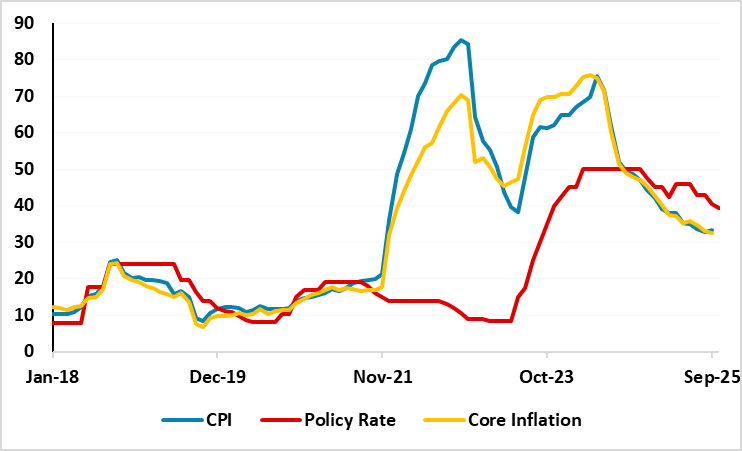

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – October 2025

Source: Continuum Economics

Turkiye’s annual inflation saw its first increase since May 2024 in September and edged up to 33.3% y/y from 32.9% y/y in August driven by higher education, housing and food prices. Monthly inflation surprised on the upside reaching 3.23% while September inflation suggested that the pace of the decline in inflation will be slower-than-expected due to sticky food and services prices.

We expect consumer price index will soften moderately to around 32.5% in October as upside-tilted inflation risks limiting the downward trend during the ongoing disinflationary process. (Note: July print will be announced by TUIK on November 3). We foresee MoM inflation in September will stand at around 2% and 2.3%.

According to the Market Participants Survey published by the Central Bank of the Republic of Turkey (CBRT) in October, participants' year-end consumer inflation (CPI) expectations have recently increased from 29.9% to 31.8%. The 12-month ahead consumer inflation expectation surged from 22.3% to 23.3% in this period. (Figure 2)

Figure 2: Inflation Expectations (%), October 2025 – October 2027

Source: CBRT Survey (October 2025)

Commenting on the inflation trajectory, Treasury and Finance Minister Mehmet Simsek recently signalled that end-year inflation in 2025 will likely be higher-than-expected since food prices continue to stay above forecasts due to agricultural frost and drought. Simsek added that education and other related items contributed significantly to monthly inflation in September as the school season started, and referred to sticky services prices.

It is worth noting that CBRT predicts end year-end inflation to stand at 24%, with an upper band of 29%. We also expect the slowdown in inflation to continue, but with a slower pace in Q4 as the extent of the decline will be determined by energy prices, food and services inflation, global developments, and TRY volatility.

We continue to envisage it will be (very) difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation becomes stickier requiring high interest to remain for some time. We think the road to bringing inflation back down to single-digit levels will be very bumpy, and the inflation getting there before 2027 remains (very) unlikely, despite CBRT expects the opposite.