Turkiye: Macroeconomic Problems Limit Long Term Growth

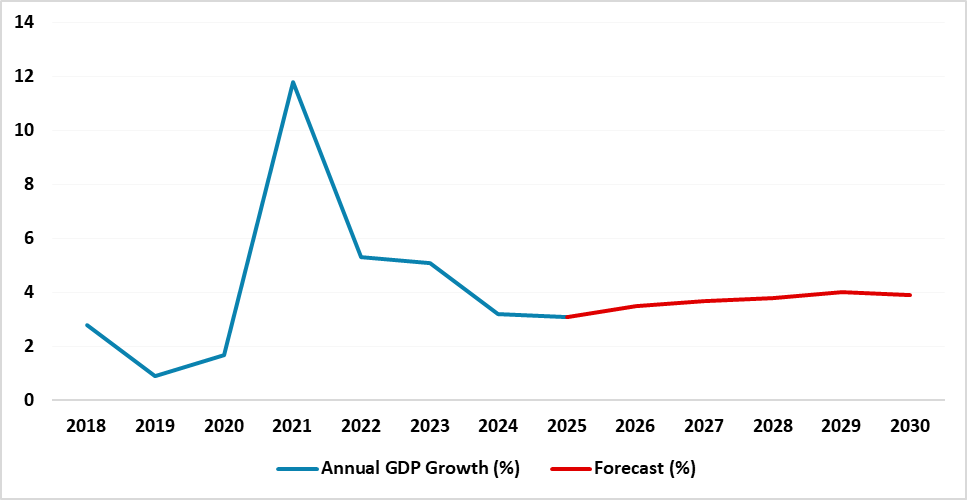

Bottom line: We forecast 3.5%-4.0% GDP growth in Turkiye in the 2026-2030 period. We are concerned with the macroeconomic problems will stay critical until 2027/2028, including stubborn inflation, trade and budget deficits, and weakening Turkish Lira (TRY). Despite growing population and young labor force are strong drivers for Turkish GDP growth in the coming years, structural headwinds like low productivity growth, sticky inflation, weakening FDI, and strong demand for imports will continue to be significant headwinds risking Turkiye’s economy's upward deviation from a balanced growth trajectory in 2027-2030. The disinflation process slowing down is a major concern while other risk factors include the growing size of the informal sector and high labor underutilization rate. We anticipate GDP growth to remain moderate at 3.1% and 3.5% in 2025 and 2026, respectively, given previous tight monetary policy, modest fiscal tightening, and subdued global growth amid increased uncertainty.

Figure 1: Turkiye GDP Growth Forecasts to 2030 (%)

Source: Continuum Economics/Datastream

A number of forces impact our long-term growth forecast for Turkiye.

· Growing population and strong labor force: The labor force continues to widen. We feel that there will be an increase in the working age population and a higher participation rate in 2026-2030, thanks to young Turkish labor force, and migration form Central Asia and Middle East. The Turkish government recently announced that it plans to build homes for low-income citizens in major cities starting from November 2025 can be a driver on Turkish growth in the 2025-30 period considering construction is one of the engine sectors for Turkish economy. Two major drags which could negatively impact the size of the labor force are the application of a recent law, which decreased the eligibility for retirement at a younger age (EYT in Turkish) setting new conditions for retirement, and fall in the number of Syrian immigrants working in Turkiye after approximately 500,000 Syrian refugees returned to Syria since Assad's ouster in December 2024.

· Population dividend and productivity: Turkiye will be helped by its population dividend, with the labor force also set to grow 2026-2030. Despite shift towards more orthodox economic policies help productivity, low Turkish labor productivity growth is still a major headwind due to lack of innovation and smart management. Turkiye requires structural reforms to enhance productivity to achieve high growth, such as encouraging job creation and investments improving productivity, reallocating workers across productive sectors, labor training focused on catching the latest manufacturing and technological developments and redesigning investments support scheme.

· Innovation and technological investments remain limited: Turkiye still have a lot of catch up growth and productivity momentum with advanced economies due to limited infrastructure and technological investments which can provide a benefit to productivity if they are fixed, but this is not a priority since solving macroeconomic problems remains at the top of the list. The widespread adoption of 5G in Turkey as of April 1, 2026 is expected to accelerate growth moderately by boosting the digital economy, increasing productivity in various sectors, and creating new jobs.

· Manufacturing and industrial production are strong: The driving force behind the growth continues to be the manufacturing industry. Despite the cloudy macro outlook, we expect strong consumer demand will continue to boost domestic industrial production amid greater outlays on social support and higher wages. In the 2nd half of the 2020’s, this can produce modest benefits to GDP growth.

· Weak vocational education and cross-sectoral labor force mobility remain as the additional structural constraints. Vocational education-training remain weak, and Turkish labor productivity growth falling behind the EU causing a threat for our GDP growth projections.

· Imports growing faster than exports and structural headwinds: Turkiye is highly dependent on energy imports, which is needed to stimulate economic growth in the country. Ongoing wars in Ukraine in Gaza, Trump’s additional tariffs, and geopolitical tensions affecting terms of foreign trade also creating proinflationary risks for Turkiye. Higher-than-expected oil prices could present additional downside risks to growth, and exports growing slower than imports will likely jeopardize the GDP expansion beyond 2026/2027. The ballooning current account deficit (CAD), and international debt service requirements would likely exacerbate the need for foreign exchange in 2026-2028. (Note: It is worth mentioning that the World Bank predicts Turkish CAD to widen as growth recovers, reaching 1.2% in 2025 and 2% by 2027).

· Akkuyu nuclear power plant: Turkiye will start operating the first reactor of the Akkuyu Nuclear Power Plant in 2026 (and all four reactors by 2028) to meet energy demand, and we think this can partly relieve the energy need particularly after 2027/2028, and positively contribute to GDP growth.

· Increasing FDI could help but problems regarding rule of law: Attracting foreign direct investment and winning back investors’ credibility could help GDP expansion; while the arrests of opposition mayors in 2025 and problems regarding the application of the rule of law will likely limit the increase in FDI in the next five years.

· Controlling stubborn inflation is key: Inflation continues to be the core problem for the country, and we foresee average inflation to stand at 34.5% and 22.2% for 2025 and 2026, respectively. Despite inflation expectations are easing only gradually, strong private consumption and sticky food and services inflation jeopardize the ongoing disinflation process. Any premature easing of monetary policy could prompt domestic investors to seek foreign exchange, potentially putting pressure on the exchange rate, inflation, and reserves; thus we think CBRT will have to be careful in reducing the key rate since Mth/Mth inflation readings be key as CBRT will want to avoid reigniting inflation with too aggressive rate normalization.