South Africa Inflation Edged Up to 3.6% y/y in October, Marking the Highest Reading Since September 2024

Bottom Line: Statistics South Africa (Stats SA) announced on November 19 that annual inflation edged up to 3.6% YoY in October due to accelerated transport, alcoholic beverages and tobacco, and recreation costs. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 percentage point tolerance band of new 3% target announced last week, we think unpredictable outlook for the global economy, increases in utility costs, and climate-related agricultural disruptions will likely continue to pressurize prices in 2026.

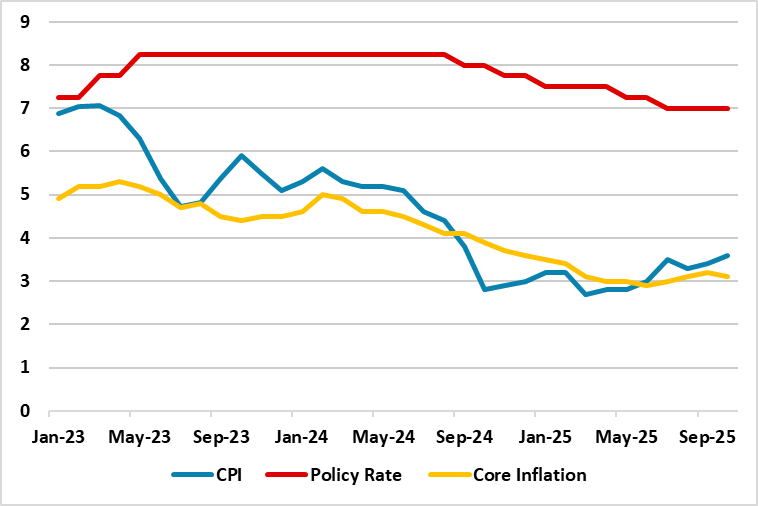

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – October 2025

Source: Continuum Economics

After hitting 3.4% in September, annual inflation ticked up to 3.6% YoY in October due to elevated transport, alcoholic beverages and tobacco, and recreation costs. According to StatsSA announcement on November 19, the annual rate for transport turned positive following 13 months of deflation, rising from ‑0.1% y/y in September to 1.5% y/y in October. Fuel prices increased by 0.1% between September and October, with petrol rising by 0.2%. The index for recreation, sport & culture increased to 3.4% y/y from 2.9% y/y in September.

On the downside, annual inflation for food & NAB weakened to 3.9% from 4.5% y/y in September. The food and NAB categories which witnessed a slowdown included vegetables; fruits and nuts; cold and hot beverages; sugar, confectionery and desserts; and meat.

MoM prices edged up by 0.1% after surging by 0.2% in September. Annual core inflation rate slightly edged down to 3.1% in October, from a seven-month high of 3.2% in September. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 percentage point tolerance band of new 3% target announced last week, we think stubborn price pressures signal the uncertainty over the inflation outlook in the upcoming months since unpredictable outlook for the global economy, increase in utility costs, and climate-related agricultural disruptions will likely continue to pressurize prices in 2026.

Despite concerns, one good news for South Africa’s inflation outlook was the drop in inflation expectations in Q3. The Bureau for Economic Research’s (BER) latest survey for the South African Reserve Bank (SARB) demonstrated that five-year inflation expectations have slipped to 4.2% in Q3, down from 4.4% last quarter, which marked the lowest forecast since the addition of this question to the survey in 2011.

In addition to this, the country has experienced few power cuts (loadshedding) after Q2, which was also positive for the outlook. Eskom announced on November 1 that the country has gone 168 consecutive days without loadshedding, with only 26 hours recorded between April 1 and October 9, 2025. (Note: Some energy analysts think blackouts are still a threat and further power disruptions are likely). Eskom’s summer outlook covering the period September 1, 2025 to March 31, 2026, projected no load shedding due to sustained improvements in plant performance from the generation recovery plan.

Under current circumstances, we continue to foresee average inflation will hit 3.4% in 2025. We believe the keys for South African inflation trajectory will be the global developments, tariffs, oil prices and government’s determination to address the electricity shortages, logistical constraints and financing needs, heading towards 2026.