Tourism and Services Income Helped Turkish Current Account in August

Bottom Line: According to the figures announced by the Central Bank of Turkiye (CBRT) on October 13, Turkiye’s current account surplus (CAS) stood at USD5.5 billion in August 2025 from USD4.9 billion in the same month of the previous year, hitting the largest on record, thanks to strong tourism and services revenues during the summer season and higher investment flows partly offsetting the goods trade which posted a deficit of USD2.8 billion in August. We think this is a temporary relief to external finances since we expect current account deficit to return back to country’s agenda in Q4 2025.

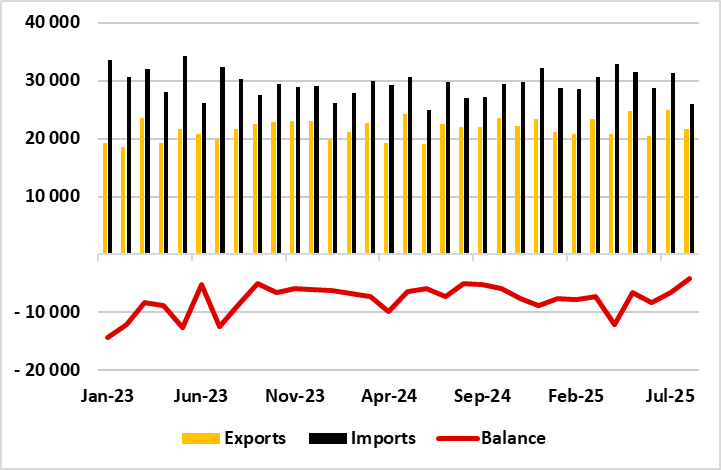

Figure 1: Turkish Foreign Trade (Million USD), January 2023 – August 2025

Source: Continuum Economics

According to the figures announced by the Central Bank of Turkiye (CBRT) on October 13, Turkiye’s current account surplus (CAS) stood at $5.5 billion in August 2025 surging from $4.9 billion surplus in the same month of the previous year and a $1.77 billion surplus in July, thanks to strong tourism and services revenues during the summer season coupled with narrower trade gap and higher investment flows. We think this was a temporary relief to external finances since we expect current account deficit to return back to country’s agenda in Q4 once the summer season is over.

The goods account shortfall edged down slightly to USD2.8 billion in August from USD2.9 billion during the same month of the previous year as the fall in trade deficit April 2025 was remarkable. The primary income deficit shrank to USD1.2 billion from USD1.5 billion.

The improvement in the current account was partly driven by a moderate increase in the services surplus. In August, net inflows from services balance totalled USD9.5 billion, with transportation and travel services generating net revenues of USD2.8 billion and USD7.7 billion, respectively. On the financing side, net inflows from direct investments amounted to USD986 million, the CBRT data showed.

Speaking about the CAS, Treasury and Finance Minister Mehmet Simsek wrote on X on October 13 that " We recorded the highest monthly current account surplus in our history with USD5.5 billion. This improvement in the current account deficit reduces our country's need for external financing."

The Medium-Term-Program (MTP) published in September sees the CA/GDP ratio at 1.4% in 2025, which is estimated to fall to 1.3% in 2026 and 1.2% in 2027, before reaching 1% in 2028. The deficit is seen narrowing to USD18.5 billion by 2028, from USD22.6 billion this year, according to the program.

We think increasing geopolitical risks and volatile food and global energy prices will continue to put pressure on Turkish CAB in 2026 as we expect CBRT to resume its easing cycle. Regional tensions in Ukraine and in the Middle East will be critical for Turkiye's CAB. The government hopes to fill in any gaps in the CA by tourism revenues or via a possible hike in the export revenues following the devaluation, but these would likely have limited impacts. We think attracting consistent FDI inflows, winning back investors’ credibility and cutting persistent trade deficit will have to remain the key agenda items for Turkiye in 2026 to reach a permanent CAB.