Turkiye Inflation Preview: Inflation will Likely Soften to 32.0% in November

Bottom line: After hitting 32.9% annually in October, we expect Turkiye’s inflation will likely soften to around 32.0% in November backed by moderate food prices while upside-tilted inflation risks continue to limit the downward trend during the ongoing disinflationary process. We foresee MoM inflation in November will stand at around 1.6%-1.9% as there is an improvement compared to October. November print will be announced by Turkish Statistical Institute (TUIK) on December 3.

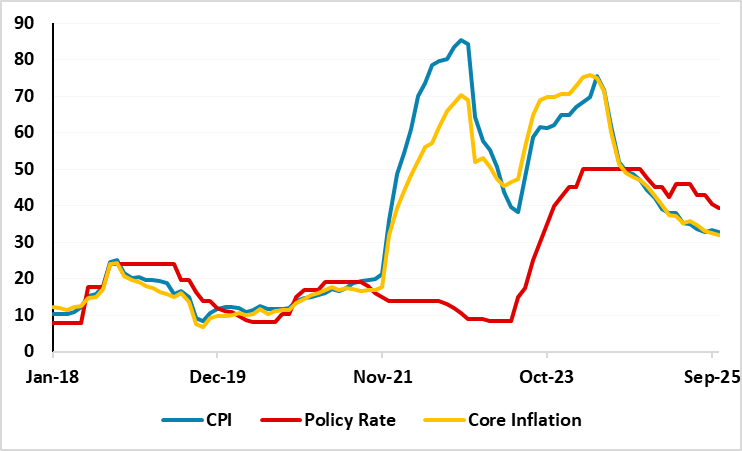

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – October 2025

Source: Continuum Economics

Turkiye’s annual inflation hit 32.9% in October driven by higher services and food prices. Monthly inflation reaching 2.5% in October suggested that the pace of the decline in inflation will likely be slower-than-expected. The disinflationary effects of the depreciation trend, which gradually eased from late July and then mid-October, are partly being felt.

We expect inflation will soften to around 32.0% in November backed by moderate food prices while upside-tilted inflation risks continue to limit the downward trend during the ongoing disinflationary process. We foresee MoM inflation in November will stand at around 1.6%-1.9% as there is an improvement compared to October. (Note: November print will be announced by TUIK on December 3). Our average inflation forecasts stand at 34.5% and 22.2% for 2025 and 2026, respectively considering inflation expectations and pricing behavior remain fragile.

According to the market participants survey published by the Central Bank of the Republic of Turkey (CBRT) in October, participants' year-end consumer inflation (CPI) expectations recently increased from 29.9% to 31.8%. The 12-month ahead consumer inflation expectation surged from 22.3% to 23.3% in this period. (Figure 2)

Figure 2: Inflation Expectations (%), October 2025 – October 2027

Source: CBRT Survey

CBRT predicts end year-end inflation to stand at 24%, with an upper band of 29%. We also expect the slowdown in inflation to continue, but with a slower pace in Q4 as the inflation will stay over the CBRT’s upper band at the end of the year. We continue to envisage it will be (very) difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation becomes stickier requiring high interest to remain for some time, and CBRT will have to be cautious with the size of the rate cuts in 2026.