Russia’s Inflation Softened to 7.7% y/y in October

Bottom Line: As expected, Russian inflation continued its decreasing pattern in October and edged down to 7.7% thanks to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB particularly after July. Despite fall in inflation; we think the inflation will continue to stay higher than Central Bank of Russia’s (CBR) 4% target in 2026 due to high inflation expectations, adverse effects of the VAT increase coupled with continued surge in military spending. Our 2026 average headline inflation projection stays at 6.1% as the war in Ukraine continues and sanctions dominate.

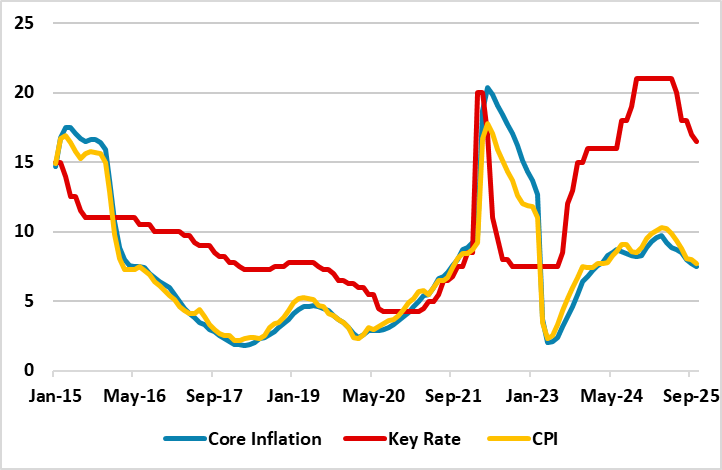

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – November 2025

Source: Continuum Economics

Rosstat announced October inflation figures on November 14. After annual inflation edged down to 8.0% y/y in September, the decreasing trend continued in October and inflation hit 7.7% y/y thanks to lagged impacts of previous aggressive monetary tightening coupled with RUB’s relative resilience. Monthly CPI rose by 0.5% in October, after a rise of 0.3% in the pervious month.

Despite inflation eased for the seventh straight month in October, we foresee inflation will continue to stay higher than Central Bank of Russia’s 4% target in 2026 since the country continues to be squeezed by the sanctions and the war in Ukraine, along with risks such as planned tax increases and higher utility tariffs potentially keeping the inflation over 4.0% in 2026.

It is worth noting that CBR announced in its midterm outlook that average quarterly inflation will be at the level of 6.8-8.7% annually in Q4, and added annual inflation as of 2025 year-end will evolve at the level of 6.5-7%. Despite CBR predicts annual inflation will decline to 4.0–5.0% in 2026 while underlying inflation is expected to reach 4% in 2026 H2, we think this is very unlikely due to proinflationary risks such as high inflation expectations, the effects of the VAT increase, and a possible deterioration in the terms of external trade.

Our 2026 average headline inflation projection stays at 6.1% taking into account that current inflationary pressures are expected to temporarily increase early 2026. We believe a peace deal in Ukraine is the real key to ease pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a full-scale peace deal in Ukraine is unlikely in the short term.