Japan

View:

September 12, 2025

Taiwan: Grey Warfare or Naval Quarantine?

September 12, 2025 11:15 AM UTC

· The most likely option for China is to continue the air and naval grey warfare around Taiwan, combined with support for pro-China factions in Taiwan parliament to build pressure for reunification at some stage. With invasion being too high risk for President Xi (with the U.S. main

September 10, 2025

DM Rates: Steeper Yield Curves: More to Come?

September 10, 2025 10:55 AM UTC

Steeper yield curves are a function of monetary easing cycles, budget deficits, lower central bank holdings of government bonds, a move towards pre GFC real rates and shifting demand from pensions funds and life insurance companies. Scope exists for further steepening in the U.S., EZ and UK with m

September 08, 2025

September 01, 2025

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 28, 2025

August 25, 2025

Jackson Hole: Fed/ECB/BOJ and BOE on Labor Markets

August 25, 2025 9:02 AM UTC

Fed Powell focused on the cyclical softening of employment to back a more dovish undertone. In contrast other central bank heads focused on structural labor market issues. While ECB Lagarde was pleased with the post COVID EZ picture, current economic softness still leaves us forecasting two furt

August 19, 2025

China Slow Diversification: Gold And Others

August 19, 2025 8:05 AM UTC

China’s diversification from U.S. Treasuries appears to be at a slow pace. Gold is the obvious alternative if geopolitical tensions were to rise or skyrocket in the scenario of a China invasion of Taiwan. However, Gold holdings are merely creeping higher and suggesting no urgency from China

August 18, 2025

U.S. Strategic Fiscal Comparisons

August 18, 2025 9:05 AM UTC

The U.S. short average term to maturity is a structural fiscal weakness if higher rates lift U.S. government interest costs close to the nominal GDP trend. Hence, Trump’s pressure for fiscal dominance of the Fed to deliver lower policy rates and reduce U.S. government interest rate costs. Howeve

August 13, 2025

China: Echoes of Japan?

August 13, 2025 8:05 AM UTC

Overall, some of China’s private businesses and households are suffering from Japan’s style balance sheet recession. Combined with slowing productivity and a shrinking workforce, this points to slower trend growth in the coming years. However, fiscal stimulus and the clean-up of Loca

August 05, 2025

DM Rates: Slowdown Debate Trump’s Independence Question for Now

August 5, 2025 9:50 AM UTC

U.S. Treasury spreads versus other DM government bond markets or 10-2yr U.S. Treasuries are not yet showing a risk premium from the Trump administration attacks on the Fed and economic data. Debate over whether the U.S. is seeing a soft or hard landing are reemerging and this will dominate the outlo

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

August 01, 2025

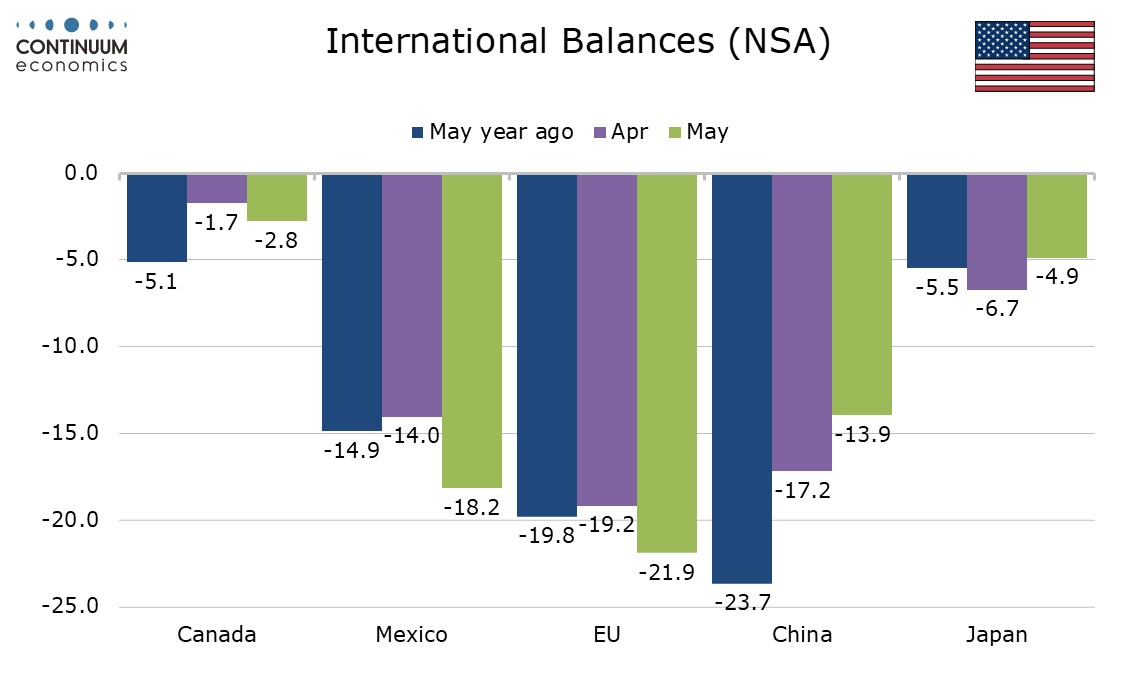

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 31, 2025

July 30, 2025

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

July 29, 2025

July 23, 2025

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 21, 2025

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

July 14, 2025

Tariffs: Seeking a Trigger for the TACO Trade

July 14, 2025 4:28 PM UTC

It has been fairly clear for some time that 10% represented a likely floor for the eventual Trump tariff regime. However, expectations that Trump would not be willing to go dramatically above that are being tested. A rate in the mid-teens still looks the most likely outcome, as the economic damage t

July 03, 2025

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

July 02, 2025

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica

July 01, 2025

Trump Tariffs: Poker Face?

July 1, 2025 12:55 PM UTC

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be fol

June 30, 2025

U.S. and Asia Defense Partners

June 30, 2025 7:30 AM UTC

· Japan, S Korea and Australia could eventually agree to some extra commitment to increase (self) defence spending in the next 5-10 years though perhaps not targets like NATO countries. This could come as part of the trade deal negotiations currently underway. Japan and S Korea

June 26, 2025

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

June 23, 2025

DM Rates Outlook: Yield Curve Steepening?

June 23, 2025 8:30 AM UTC

• We see the U.S. yield curve steepening in the next 6-18 months. 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias in H2 2026. 10yr U.S. Treasury yields face a tug of war between lower short-dated y

Japan Outlook: Hot Inflation Partially Transitory

June 23, 2025 3:00 AM UTC

· Growth in private consumption remains sluggish in Q1 2025 on negative real wages. Wage hike in 2025 so far looks little affected by U.S. tariffs and should remain above 2% for the rest of 2025. The subtle change in business price/wage setting behavior will be supportive for consum

June 17, 2025

BOJ QT And Steeper Yield Curve

June 17, 2025 8:41 AM UTC

Despite the slowdown in the pick-up in BOJ QT, monthly bond purchases are set to slow from Yen4.1trn pm to Yen2.1trn pm by Q1 2027. With bond maturities BOJ QT is getting bigger and will mean that supply pressures continue to drive yield curve steepening. We see 1.85% 10yr JGB yields by end 2025

June 12, 2025

Trump Tariffs: China and July 9 Reciprocal Deadline

June 12, 2025 7:17 AM UTC

We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tariff to 15-20% imposed by the U.S., most likely agreed in Q4 2025 and to be implemented in 2026. However, a 35% probability exist of no deal and this could eventually mean higher tariffs (Fig

June 03, 2025

Nato Summit 5% Target and Trump

June 3, 2025 10:48 AM UTC

Trump’s natural instincts will likely see extra pressure applied on Europe in the coming weeks to commit to 5%, but we do not see existential threats from Trump. In the end, our baseline is that NATO will agree a “soft” aim of 5% (3.5% hard military spending and 1.5% infrastructure/cybersecu

June 02, 2025

Trump’s 50% Steel And Aluminum: Negotiating Leverage?

June 2, 2025 7:42 AM UTC

• President Donald Trump increase in steel and aluminum tariffs from 25% to 50% is not just about boosting the steel and aluminum industry. It also a demonstration that Trump remains in control of tariffs and can aggressively change tariffs to increase negotiating leverage. It is a mess

May 30, 2025

Tax Foreigners Assets: How To Lose Friends

May 30, 2025 9:12 AM UTC

Increasing taxes on dividends on U.S. equities and corporate bond coupons would alarm foreign investors and hurt the USD and U.S. equities, as it would amplifies foreign investors concerns that they are overweight U.S. assets and the USD. Starting a capital war with investors into the U.S. is

May 29, 2025

Court Stops Trump Reciprocal and Fentanyl Tariff

May 29, 2025 7:18 AM UTC

• The Trump administration will likely follow a multi-track response by appealing the judgement but also fast-tracking section 232 product tariffs for pharmaceuticals and semiconductors. The administration could also consider section 301 or 122 tariffs (the latter 15% for 150 days against c

May 27, 2025

May 26, 2025

Likely U.S. Tariff Scenario for Japan

May 26, 2025 5:36 AM UTC

After the U.S.-UK trade deal announcement, most countries are looking forward to lower tariffs. U.S.-Japan high level remarks are so far positive but lack concrete commitment. The U.S. has said that 10% tariff will be a baseline and we do not see Japan to be an exemption. However, we have a likely t

May 13, 2025

Markets: Less U.S. Recession Risk, But Trade Headwinds

May 13, 2025 9:38 AM UTC

Though we had expected a U.S./China trade truce, the terms are more favorable to U.S. growth than we anticipated. Combined with the UK framework deal, we have revised down the probability of a U.S. recession from 35% to 20%. In turn we have revised up the end 2025 and end 2026 S&P500 forecasts t

May 12, 2025

Trump Tariffs: China and UK Precedents

May 12, 2025 8:02 AM UTC

The U.S./China have announced major reductions in reciprocal tariffs to 10% with other measures postponed for 90 days. Though the U.S. is still imposing an extra 20% due to fentanyl, China will likely make some moves that could also help to reduce this. This is in line with our previous thinki

May 09, 2025

Household Divergence Into the Downturn?

May 9, 2025 10:55 AM UTC

Overall, the shock faced by the U.S. from tariffs is a negative supply shock, which can then be followed by job losses and restrained income and consumption growth. This 2 round can be amplified if a hard landing is seen and quickens job losses, which would really hurt low income households. Howev

May 06, 2025

Tariff Man

May 6, 2025 8:45 AM UTC

With the U.S. equity market having rebounded, President Donald Trump instinct on tariffs have seen threats of pharma tariffs and a 100% tariff on non U.S. films. Slow progress is also reported on bilateral deals, despite White House PR spin. However, Trump will see pressure rising from three so

May 05, 2025

Markets: China Truce Hopes and More Data

May 5, 2025 8:05 AM UTC

The direction of travel is towards a U.S./China truce followed by postponing/cancelling most reciprocal tariffs and then trade negotiations. While the markets could cheer this as good news, incoming economic data in May and June is the most critical issue. We still see the U.S. imposing an average

May 01, 2025

April 30, 2025

China South China Sea Tensions

April 30, 2025 10:30 AM UTC

We see recent China activity as part of the normal grey warfare for long-term influence in the South China sea. It has involved the use of China coastguard and militia fishing boats rather than China PLA Navy, though the risk of escalation between the Philippines and China remains. China likely wa