Household Divergence Into the Downturn?

Overall, the shock faced by the U.S. from tariffs is a negative supply shock, which can then be followed by job losses and restrained income and consumption growth. This 2 round can be amplified if a hard landing is seen and quickens job losses, which would really hurt low income households. However, the U.S. household sector has some resilience from high net wealth and low household debt/GDP that can sustain mid to high net worth households. In contrast, other DM economies face a negative demand shock from exports mainly to the U.S. that can spread to job losses and restrained income and consumption. A modest slowdown in other DM countries is more likely to be met by less overtime and labor hoarding, which means less of a hit to consumers.

Our economists are watching consumer spending closely going into the downturn triggered by U.S. tariffs to see whether it amplifies slowdowns or not. What should be highlighted?

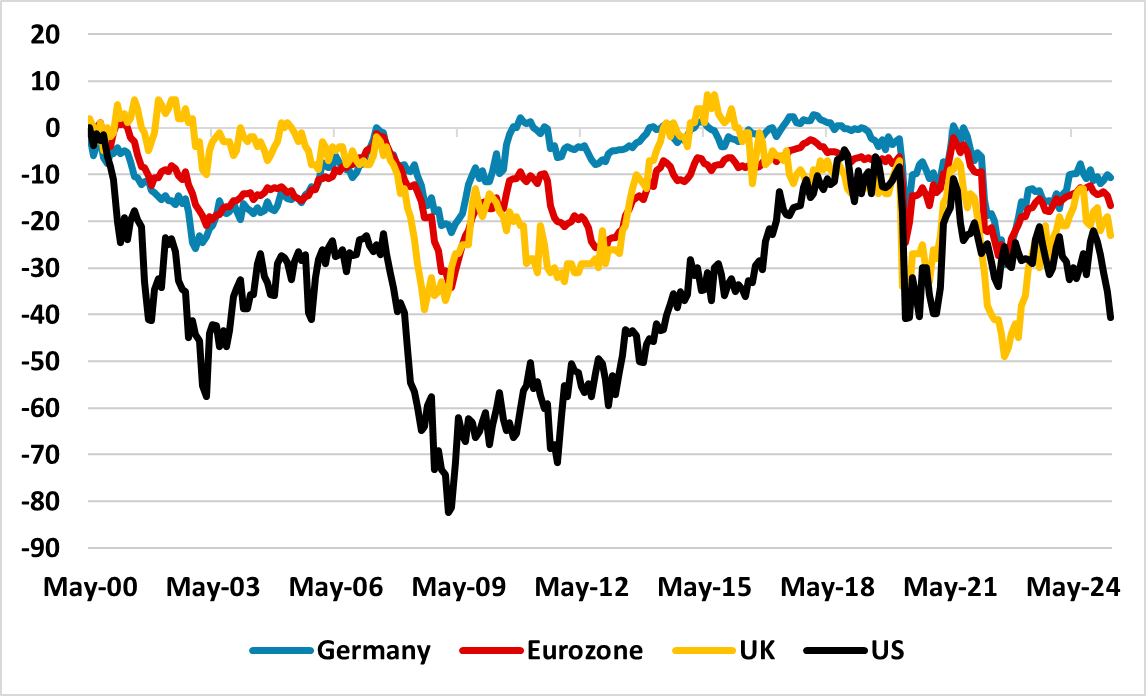

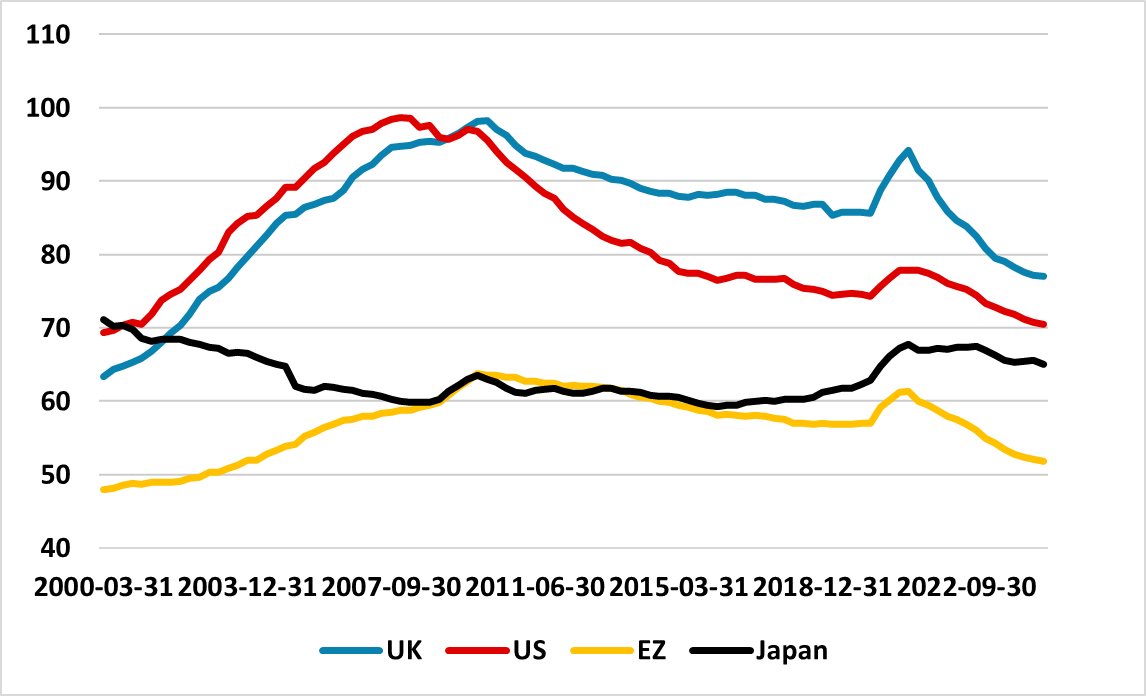

Figure 1: Consumer Confidence Select Big DM’s Rebased 2000 = 0 (%)

Source: Datastream/Continuum Economics

The critical point is the different impact of tariffs on the U.S. versus other DM economies. The U.S. is imposing extra reciprocal and product tariffs on all countries, which trade deals are unlikely to go below the minimum 10% -- we do look for a U.S./China trade truce; negotiations and lower reciprocal tariffs in the interim (here). This produces a negative supply shock, where tight supply and high prices can restrict consumption first round and job losses can impact income/consumption second round. In contrast, other DM economies face a negative demand shock from exports mainly to the U.S. that can spread to job losses and restrained income and consumption. Consumer confidence can also feedthrough to impact actual spending and so far the big hit has been to U.S. consumer confidence (Figure 1). Europe could also get a positive supply shock if a Ukraine peace deal emerges that lowers natural gas prices and household utility bills, but this is uncertain (here), although it is also benefitting from lower freight prices. However, there is also the risk of marked rise in imports from China to EZ as the latter seeks alternative markets to that of the U.S. This would very likely be mainly in consumer goods and would thus put downward pressures on EZ inflation. In turn this would boost EZ spending power, the key question being whether such additional imports would add to overall consumer spending or displace a portion!

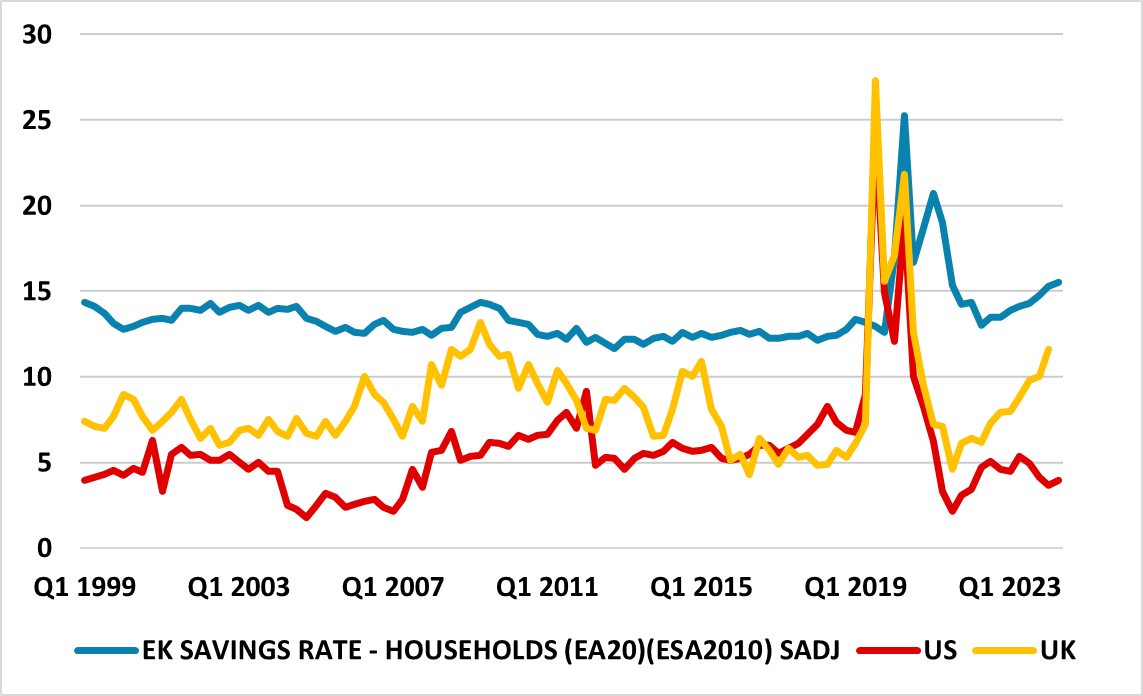

The other cyclical context is the starting point for household savings and employment. Figure 2 shows that U.S. households savings ratio is low, which partially reflects the distribution of income in the U.S. with lower to mid-income households feeling the cost of living crisis since 2019 and with the stimulus cheques having been spent. In contrast, higher European household savings ratio could provide some support for consumption if needed.

Figure 2: Household Savings Ratio/GDP Select Big DM’s (%)

Source: Datastream/Continuum Economics

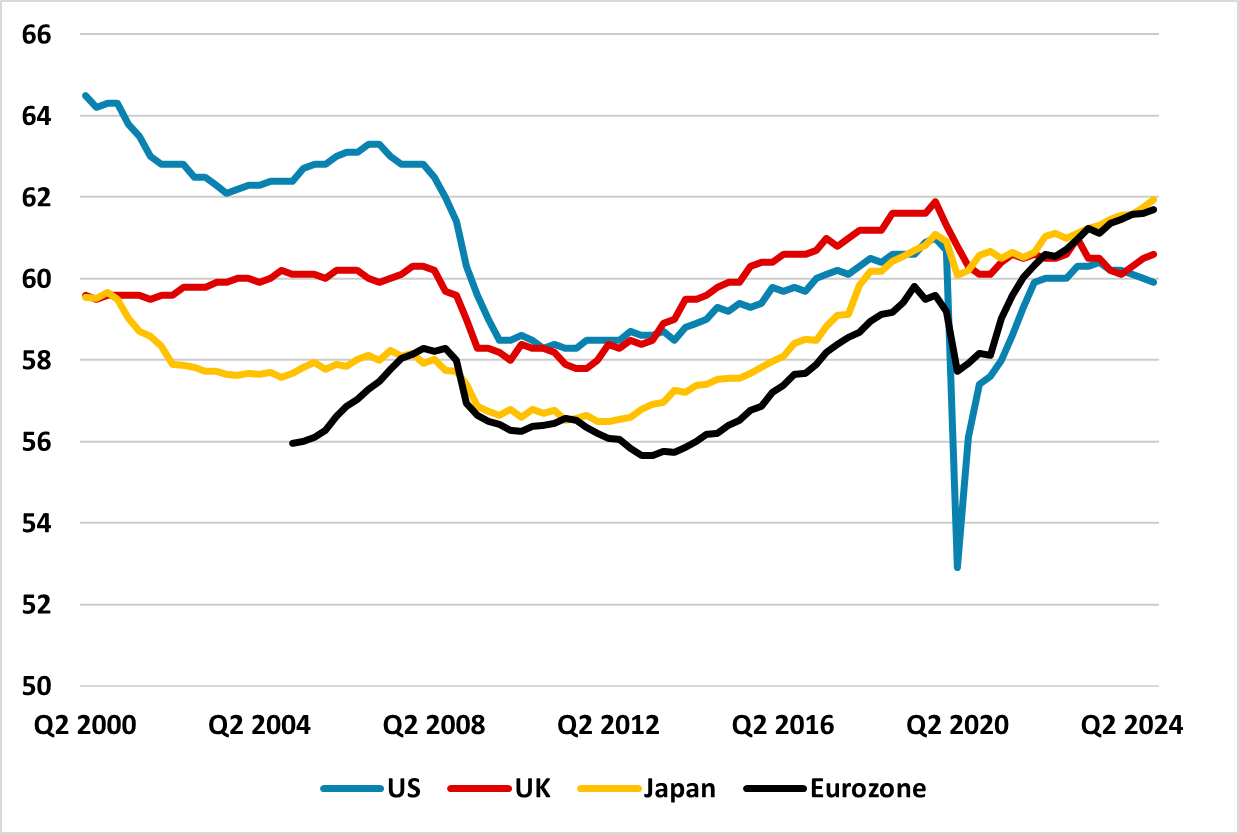

Meanwhile, employment is good in DM economies over the long-term (Figure 3). Nevertheless, the U.S. economy has a tipping point where a harder landing is likely to prompt quicker job cuts and weak income and consumption growth. Additionally, a structural headwind is that new illegal arrivals into the U.S. have collapsed under the new Trump administration, which will mean less natural employment growth versus 2022-24. In contrast, in other DM economies skill mismatches means that the cyclical economic situation would likely have to get bad before major job losses and instead a modest slowdown is more likely to be meet by less overtime and labor hoarding – note UK is seeing employment falls already due to tighter fiscal policy/high rates etc.

Figure 3: Employment Rate Percentage of Population (%)

Source: Datastream/Continuum Economics

However, U.S. households have balance sheet resilience. Figure 4 shows the secular rise in U.S. household wealth, both due to the rise in the U.S. equity market in the last decade and rebound in house prices from the GFC. While the propensity to spending out of wealth is lower than out of income, middle to high net worth U.S. households have sustained the economic expansion through the turbulence of COVID and the Ukraine war. Though we do see some downside for the U.S. equity market in our baseline view (here), a consumer wealth hit would only occur with a recession driven bear market. Meanwhile, a house price crash is highly unlikely, both given the Fed Funds trajectory and structural U.S. house demand/supply imbalances. The EZ has also seen an upswing is net wealth, though like the U.S. this is skewed to middle to high net worth households.

Figure 4: U.S. and EZ Household Net Wealth/GDP (%)

Source: Fred St Louis/ECB/Eurostat

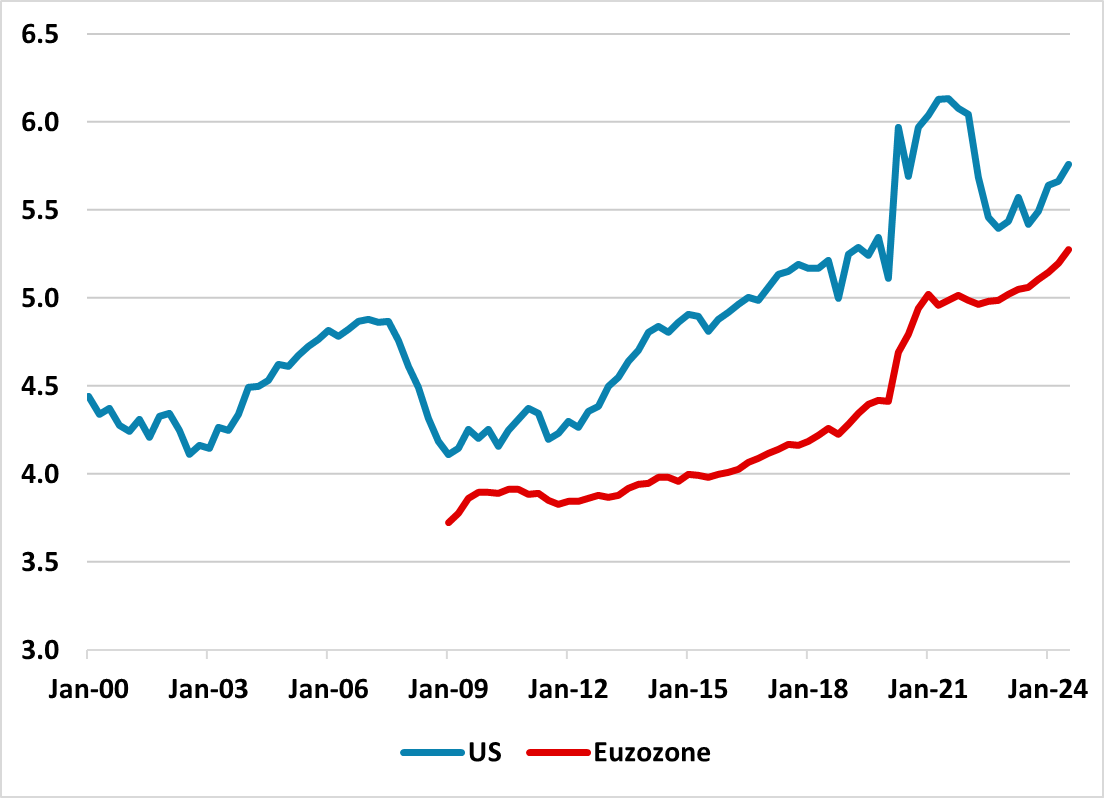

A 2 angle on the balance sheet is that U.S. household debt/GDP at 70% is down significantly versus the GFC and back to 2000 levels (Figure 5). U.S. household have scope on a long-term basis to actually increase borrowing to GDP provided that Fed Funds swings back towards the neutral policy rate. The same holds true for EZ and UK.

Figure 5: Household Debt/GDP Select Big DM’s (%)

Source: BIS/Continuum Economics

Overall, the shock faced by the U.S. from tariffs is a negative supply shock, which can then be followed by job losses and restrained income and consumption growth. This 2 round can be amplified if a hard landing is seen and quickens job losses, which would really hurt low income households. However, the U.S. household sector has some resilience from high net wealth and low household debt/GDP that can sustain mid to high net worth households. In contrast, other DM economies face a negative demand shock from exports mainly to the U.S. that can spread to job losses and restrained income and consumption. A modest slowdown is more likely to be met by less overtime and labor hoarding, which means less of a hit to consumers.