BOJ QT And Steeper Yield Curve

Despite the slowdown in the pick-up in BOJ QT, monthly bond purchases are set to slow from Yen4.1trn pm to Yen2.1trn pm by Q1 2027. With bond maturities BOJ QT is getting bigger and will mean that supply pressures continue to drive yield curve steepening. We see 1.85% 10yr JGB yields by end 2025.

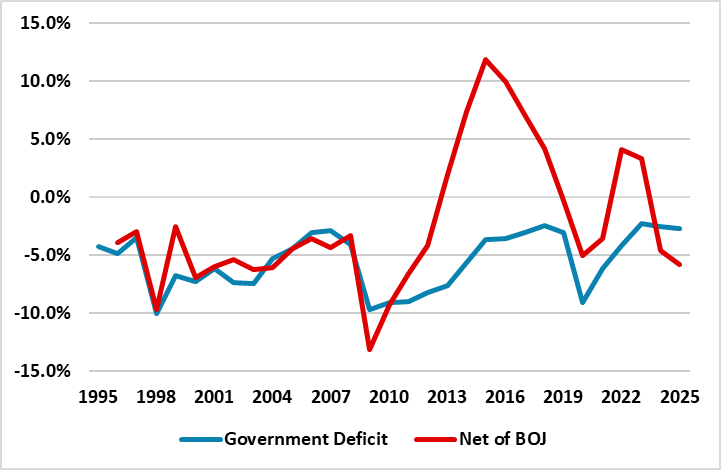

Figure 1: Fiscal Deficit and Adjusted for BOJ QE/QT (% of GDP)

Source: Continuum Economics.

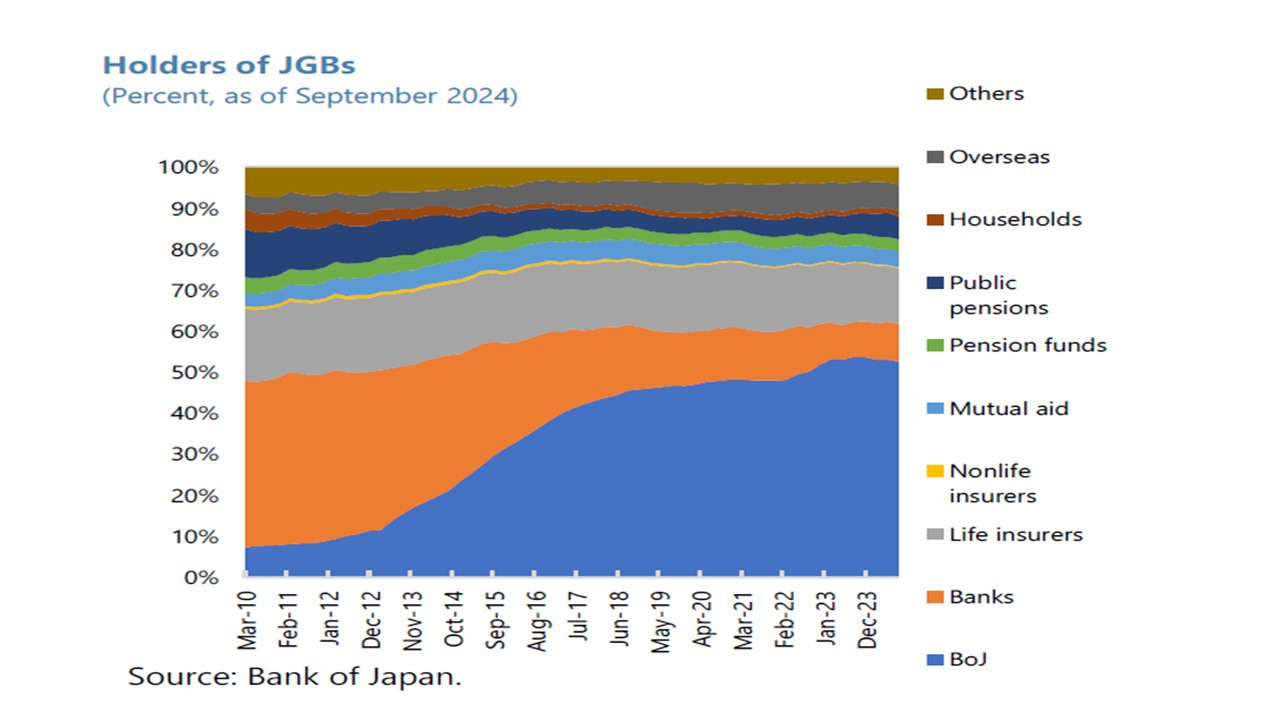

The BOJ meet market expectations by announcing a slowing of extra QT to Y200bln per quarter from April 2026, which has been meet calmly by the JGB market on the announcement. However, the flow reality of QT is more important than the initial announcement effect. We are concerned that the BOJ QT is getting incrementally larger, with bond buying set to slow in steps from Yen4.1trn pm currently to Yen2.1trn by Q1 2027. This put a lot of pressure on other buyers in the private sector to absorb supply. In Figure 1, we amend the government deficit with QE/QT from the BOJ. After the 2013 bond buying surge, BOJ QE indirectly financed the government deficit and ran down other holders of JGB’s (Figure 2). The government deficit and BOJ QT is now close to 5% of GDP, which domestic and foreign investors need to absorb. Sometimes this will be smooth, but other times end investors will demand a yield premium. Renewed yield curve steepening is a theme for JGB’s into 2026.

So far this has been seen most noticeably in 20-40yr, as life insurance and pension fund buying has bought short to mid-dates. However, the steepness of the curve between the 10yr and 20-30yr risks 10yr yields being dragged higher by 20-30yr. 10yr can also be pushed higher by 2yr, as further BOJ rate hikes are delivered.

Figure 2: JGB Holders by Sector (%)

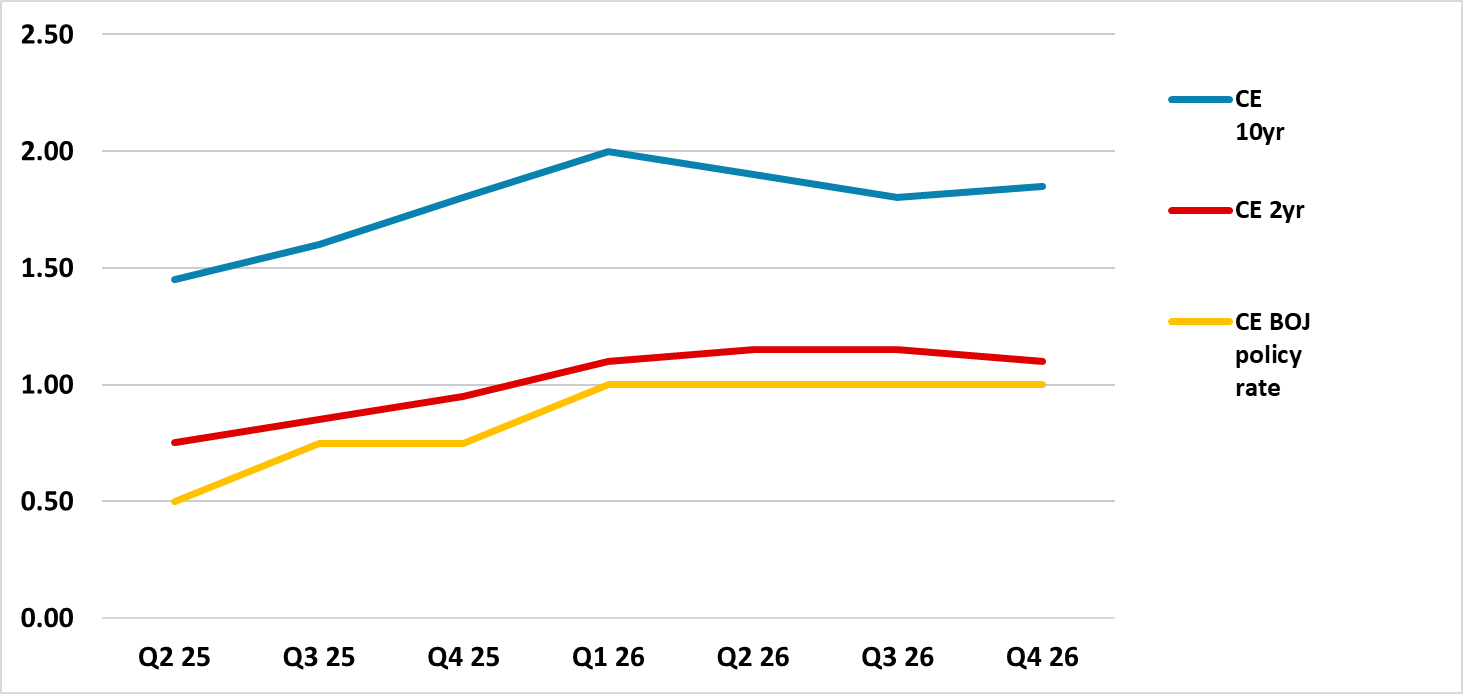

Expectations of BOJ policy normalization remain key for 2yr JGB’s. The expectations are that this will be at a slow pace, with the next 25bps hike not fully discounted until Q1 2026. The tariffs and trade threats have tempered BOJ action for now. However, inflation remains consistent with the case for BOJ normalization to deliver a further 25bps hike in 2025 and we see the prospect of an earlier than expected hike in September/October 2025 after a trade deal is done with the U.S. We see 2yr yields at 0.95% end 2025 (Figure 3). For 2026, we see consumer spending being soft, which dampens inflation and causes a CPI move back just below 2%. This can slow the BOJ normalization pace versus 2025 and we see only one 25bps BOJ hike in 2026. This can still push up 2yr yields further.

10yr yields will be impacted by this BOJ action, but the widespread expectation is that the BOJ will lift the policy rate to 1% or slightly above over the next 2 years will reinforce a positive shaped yield curve. Some will take the view that the BOJ will slow bond purchases to a JPY2trn pm pace by Q1 2027, which would equate to sizeable net QT. However, we feel that GDP and inflation will not be high enough for the BOJ to be confident of such an acceleration in QT. Combined with a steeper curve, we would see the BOJ slowing QT step up in 2027 or perhaps stopping the pick-up in QT and leaving Yen2.0-2.5trn on bond purchases pm and accepting that QT will extend into the 2030’s. Even so, the BOJ JGB holdings are falling faster than the 1999-2007 period when holdings were small up/small down or flat. During this period the 10-2yr yield curve averaged 100-125bps. Though Japan’s budget deficit is not excessive, it is still large enough to argue for higher 10yr yields in an era of QT and also changing demand among Japanese end investors for long-dated bonds. High 20 and 30yr yields in Japan also provide competition with 10yr yields. We see 10yr yields at 1.80% end 2025 and 1.85% end 2026 (Figure 3).

Figure 3: 10, 2yr JGB and BOJ Policy Rate Forecasts (%) Source: Continuum Economics

Source: Continuum Economics