BoJ Review: As Expected

The BoJ has kept rates unchanged at 0.5% in the June 17th meeting

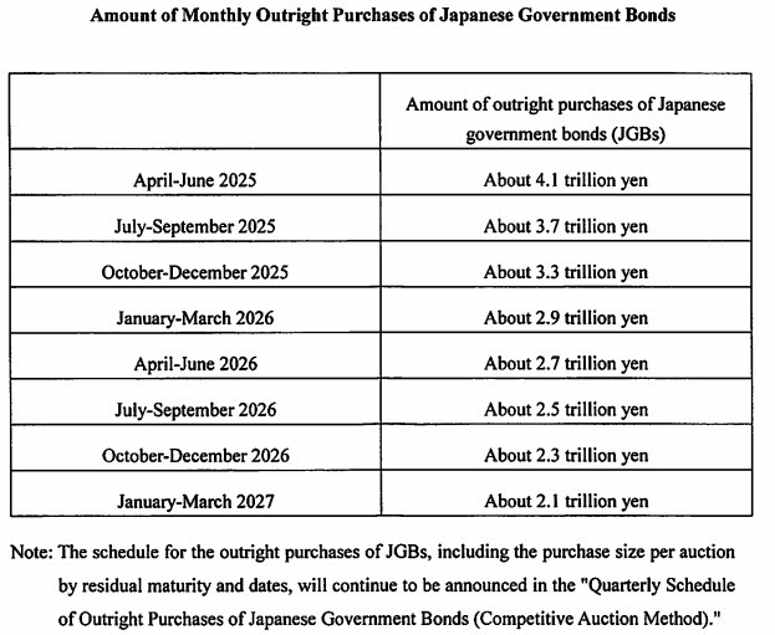

Bond purchase tapering at 200 billion JPY after Q2 2026

The BoJ has kept rates unchanged at 0.5% in the June meeting with forward guidance "It is extremely uncertain how trade and other policies in each jurisdiction will evolve and how overseas economic activity and prices will react to them". It suggest even the BoJ themselves are uncertain of the path forward as the trade conflict between U.S. and Japan remains. While Inflation is red hot above 3%, the BoJ continues to downplay it with transitory factors. Underlying inflation, on the other hand, has been attributed to the change in business price/wage setting dynamics.

For bond purchase tapering, the BoJ will be reducing the amount purchased by 200 billion JPY as widely expected. By Q1 2027, the amount of outright purchase will be roughly 2 trillion JPY.

The remark from Japanese PM Ishida on Monday has poured cool water on expectation of a trade deal to be reached soon. Trump also seems to be distracted by the geopolitical tension between Israel and Iran by departing the G7 summit early. Our central forecast sees the BoJ to hike by 25bps in the September meeting if a trade deal is to be reached before. They will likely suggest more tightening to come if economic development is favorable. Still, the terminal rate is likely to be 1% as we forecast the mid term inflation outlook to be treading lower.