Argentina

View:

September 23, 2025

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

September 08, 2025

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 03, 2025

April 28, 2025

Argentina: Activity Continues Growing

April 28, 2025 1:15 PM UTC

Argentina’s economy grew 2.3% in February and 6% year-on-year, showing continued short-term recovery driven by financial and mining sectors. However, rising imports and an overvalued exchange rate are straining reserves, despite IMF support. While agricultural exports may ease pressure mid-year, s

April 15, 2025

Argentina: Moving to Phase 3, Bands Flotation

April 15, 2025 8:33 PM UTC

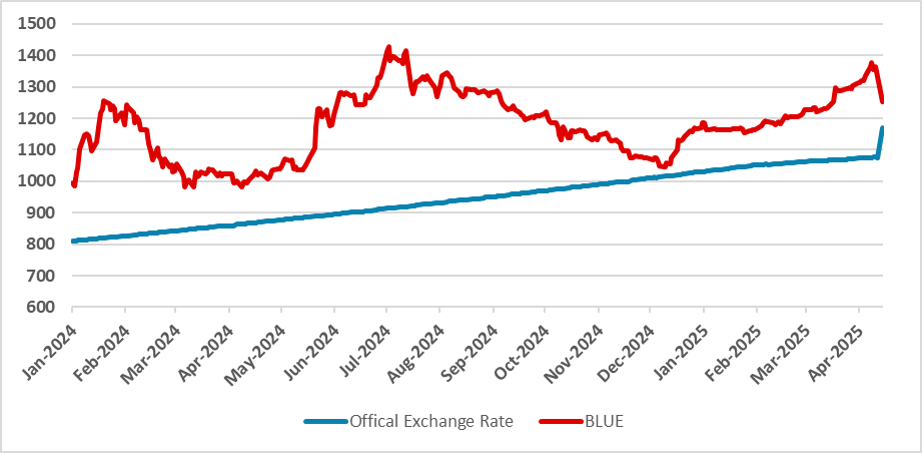

Argentina launched Phase 3 of its macro plan, ending currency restrictions for individuals and securing a USD 20B IMF deal to stabilize falling reserves. The Central Bank shifted from a crawling peg to a target band exchange rate regime, allowing for a 1% monthly devaluation within ARS 1,000–1,400

April 04, 2025

Argentina: Reserves Depleting, New Devaluation?

April 4, 2025 6:28 PM UTC

Argentina's foreign reserves have recently fallen to USD 26 billion, the lowest since February 2024, largely due to Central Bank bond payments and difficulties acquiring USD. While internal demand recovers, imports are outpacing exports, complicating reserve accumulation. Additionally, maturing Cent

March 27, 2025

March 26, 2025

LatAm Outlook: Navigating the Uncertainty

March 26, 2025 9:56 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico institutional reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump victory, and the menaces of Trump imposing tar

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

March 12, 2025

Argentina: Fresh IMF Deal on the Pipeline

March 12, 2025 12:00 AM UTC

The Argentine government has issued an emergency decree to authorize a new IMF deal, potentially worth USD 20 billion, to pay off Treasury debt to the Central Bank. This deal includes a 4-year grace period and 10-year repayment terms. The government aims to stabilize reserves, delay debt amortizatio

March 05, 2025

February 27, 2025

Argentina: Recovery Complete?

February 27, 2025 2:32 PM UTC

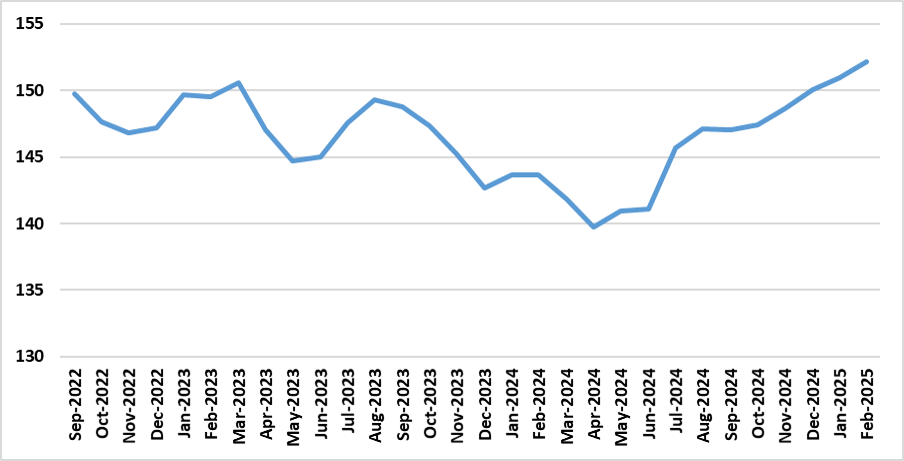

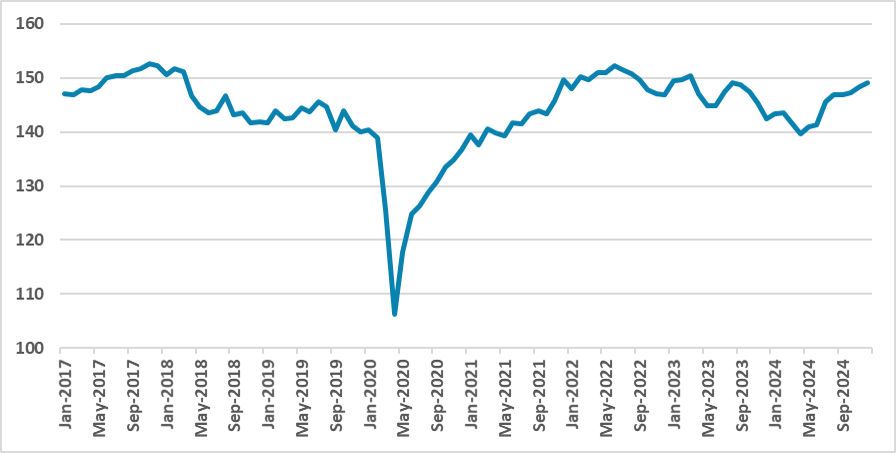

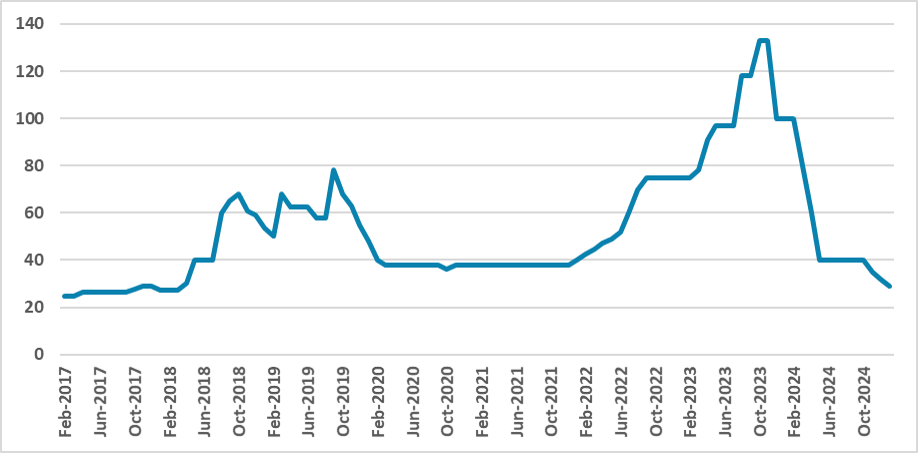

Argentina’s economy showed signs of recovery in December, growing 0.5% m/m and 1.2% q/q in Q4, with a 4.7% annual increase. The banking and trade sectors saw strong growth, but construction and industry stagnated. Despite progress, challenges remain, including inflation above 2%, a current account

February 20, 2025

Argentina: Primary Surpluses Continues

February 20, 2025 6:18 PM UTC

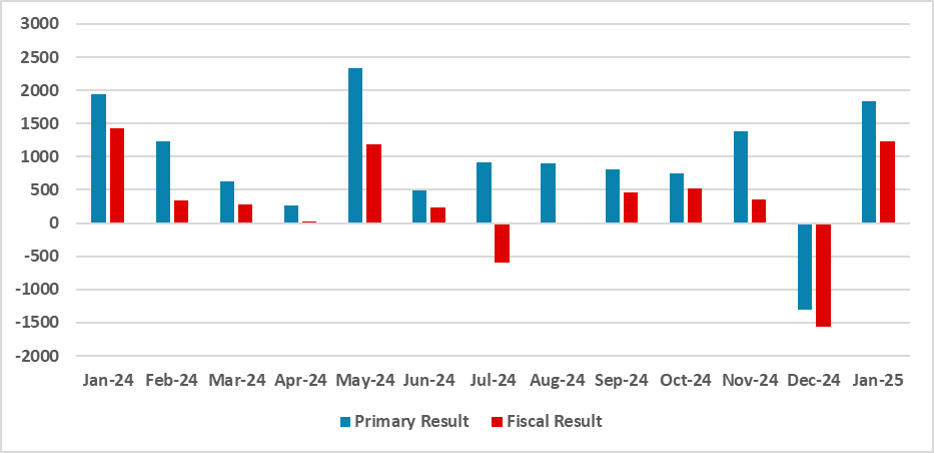

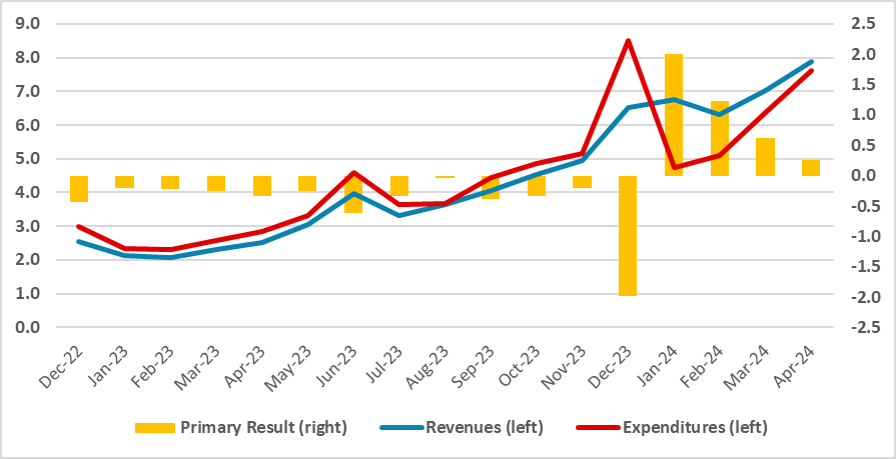

Argentina’s fiscal anchor under Milei remains the key stabilizer, with inflation gradually declining and the crawling peg rate cut to 1% monthly. A primary surplus of USD 8 billion was achieved in 2024 through spending cuts, while capital controls and IMF support help manage low reserves. For 2025

February 14, 2025

Argentina CPI Review: January Relief but Inflation Fight Continues

February 14, 2025 7:05 PM UTC

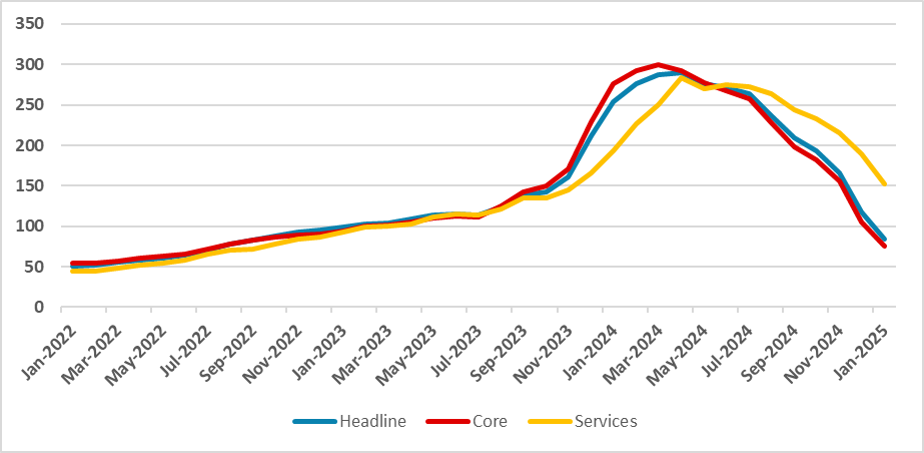

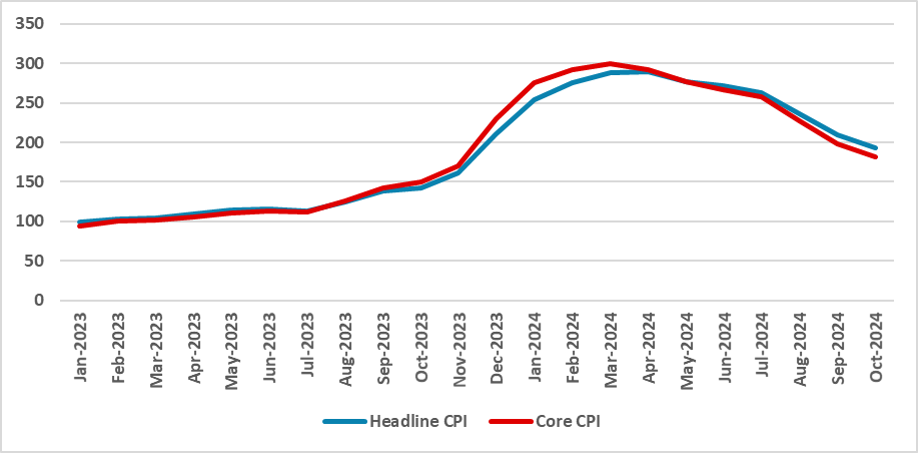

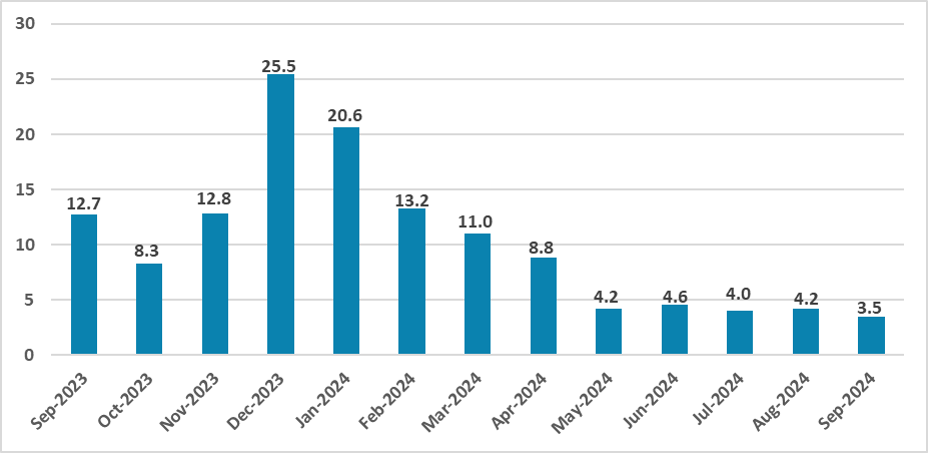

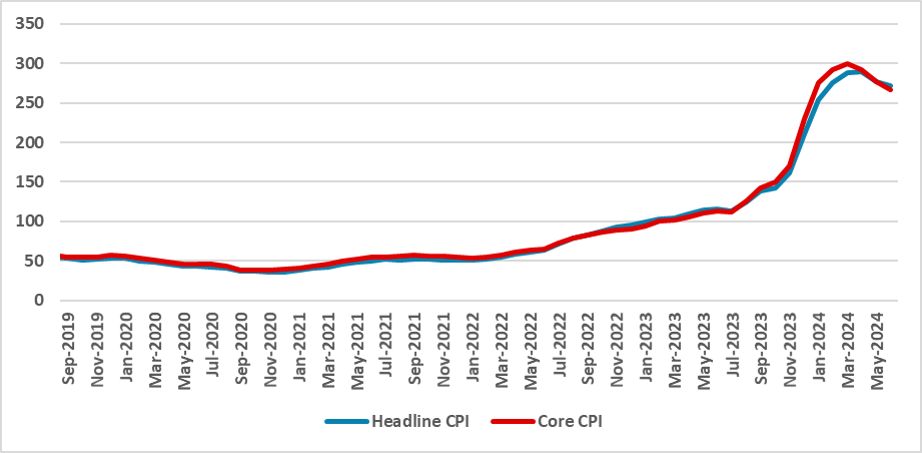

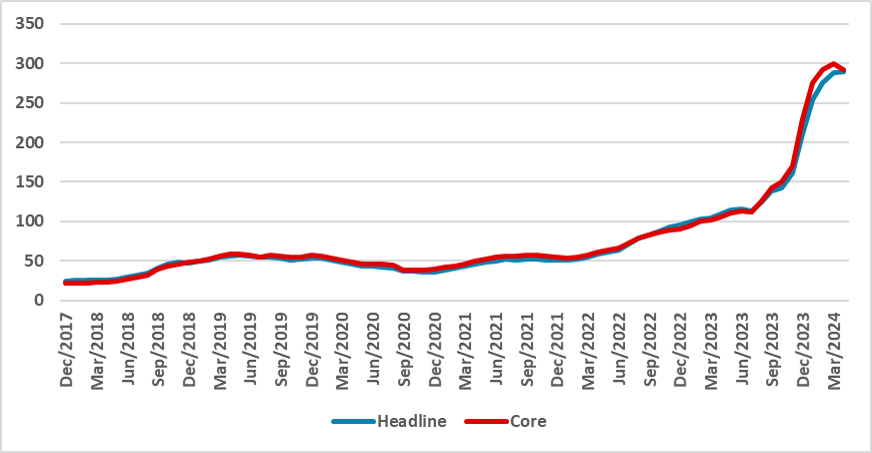

Argentina’s CPI rose 2.2% in January, slightly below forecasts, with Y/Y inflation dropping to 84% from 116%. Core CPI increased by 2.4%, accumulating 75% annual inflation. Inflation is expected to decline as devaluation effects fade, though inertia may keep it above 2% in the first half. Services

February 06, 2025

Argentina: Lower Rates, Conditions to Lift the Controls

February 6, 2025 6:16 PM UTC

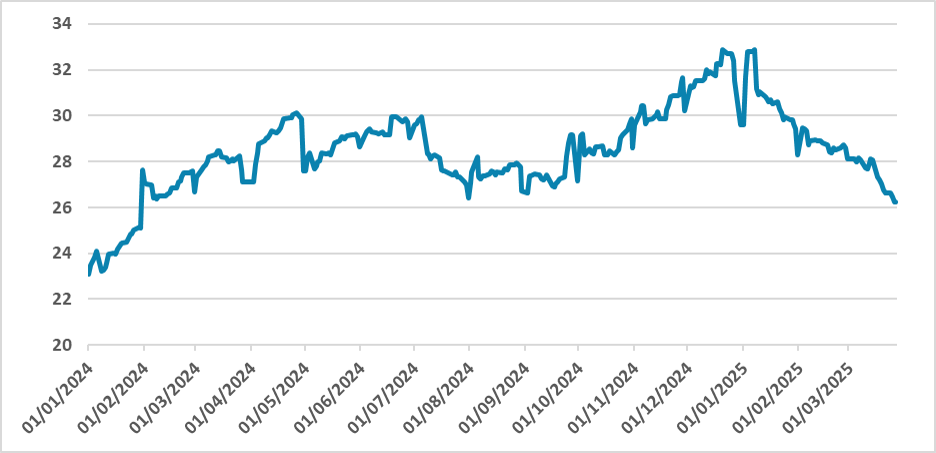

The Argentine Central Bank cut rates to 29%, citing improved inflation expectations. Rather than using a contractionary policy, it aims to curb monetary base growth through fiscal consolidation. Inflation is below 3%, with a 2% target feasible by mid-year. However, the 1% crawling peg risks eroding

January 22, 2025

Argentina: Adjusting the Anchor

January 22, 2025 2:40 PM UTC

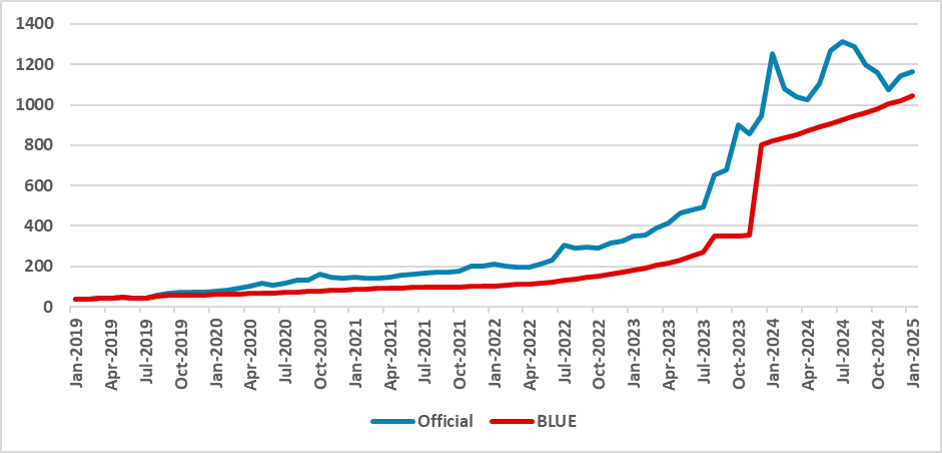

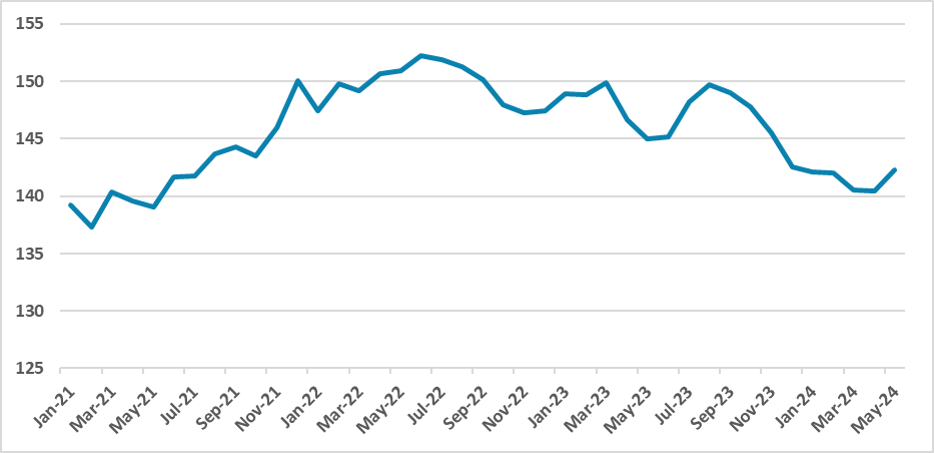

Argentina is refining its monetary framework as inflation stabilizes below 3.0% (m/m), marking progress after double-digit levels. Key measures include halting Peso issuance, fiscal adjustments, sterilization to stabilize the monetary base, and diminishing the pace of depreciation of the official ex

December 30, 2024

December 24, 2024

December Outlook Webinar on Jan 7: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 24, 2024 8:30 AM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 20, 2024

December 19, 2024

Outlook Overview: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 19, 2024 9:25 AM UTC

· The U.S. economy momentum remains reasonable before President elect Trump’s policies impact in 2025 and 2026. While high uncertainty exists on the scale and timing of policies, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 18, 2024

LatAm Outlook: Economic Shifts

December 18, 2024 5:21 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico legal reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump elections, although we see tariffs in 2025 as unlikely

Jan 7 Outlook Webinar: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 18, 2024 1:23 PM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 06, 2024

November 13, 2024

Argentina CPI Review: Monthly Inflation Drops to 2.7%

November 13, 2024 3:09 PM UTC

Argentina's October CPI rose by 2.7%, hitting a three-year low and reducing the Y/Y inflation to 192%. Milei’s fiscal shock plan aims to curb inflation, with anticipated tariff adjustments potentially keeping inflation near 3% monthly in the next month. With inflation dropping Argentine government

October 22, 2024

Argentina: Milei’s Plan Going Smoothly

October 22, 2024 5:51 PM UTC

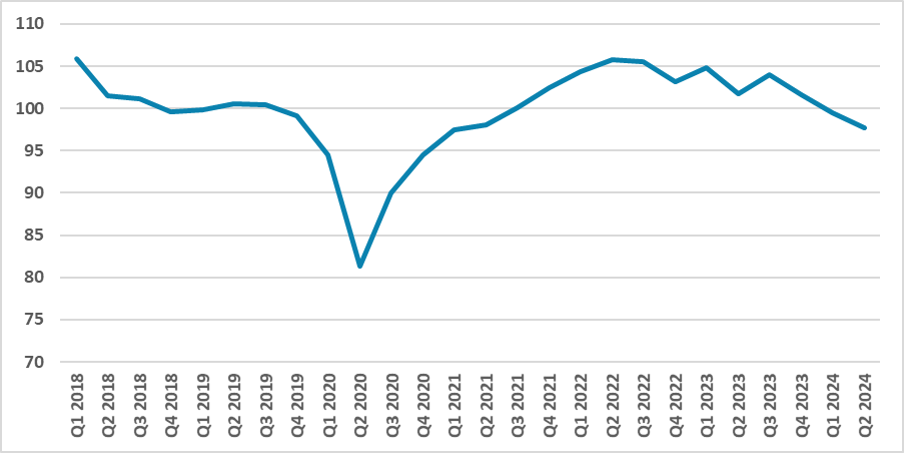

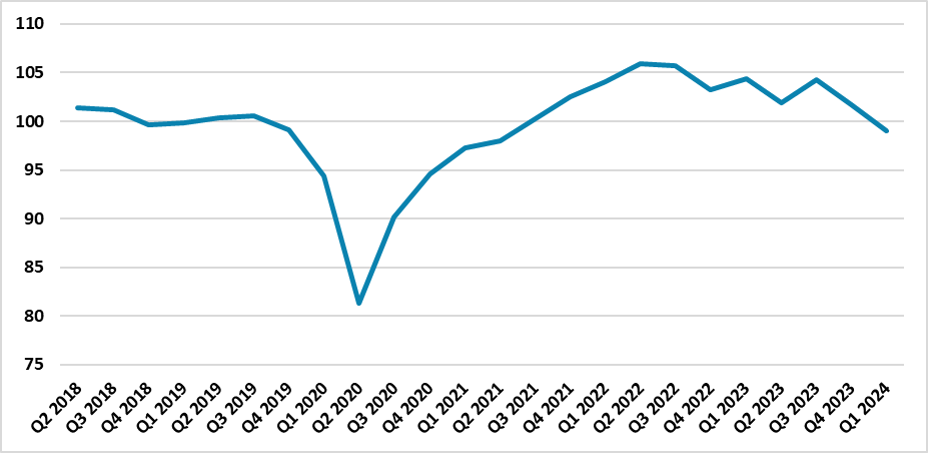

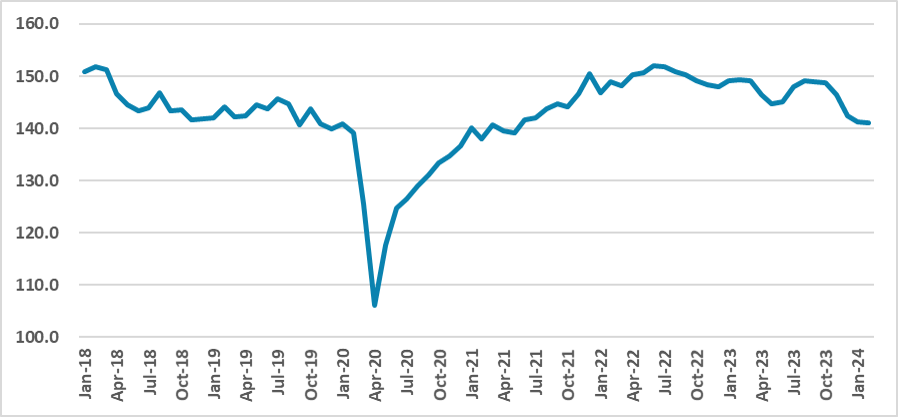

Since taking office, Milei's administration has focused on tackling Argentina's fiscal and monetary imbalances, implementing a shock fiscal plan to reduce expenditures by 4% in 2024. Fiscal surpluses have been recorded monthly, but the adjustment has caused three consecutive quarters of economic con

October 17, 2024

September 25, 2024

Outlook Overview: Rate Cuts But How Far?

September 25, 2024 7:30 AM UTC

· The U.S. economy is slowing, with the critical question being whether this is a soft or harder landing. Our broad analysis leaves us inclined to the soft landing view into 2025, though we shall watch real sector data closely over the next 3-6 months to check the trajectory. Else

September 24, 2024

LatAm Outlook: Diverging Patterns

September 24, 2024 12:54 PM UTC

· Brazil and Mexico started to diverge in terms of growth. While we see Brazil GDP growing above 3.0% in 2024 (pushed by the internal demand), we see Mexico’s growth decelerating to 1.3%, due to weaker demand from U.S. and contractionary monetary policy. In 2025, we see Brazil growing

September 19, 2024

Argentina GDP Review: 1.7% Contraction in Q2

September 19, 2024 1:38 PM UTC

Argentina’s GDP contracted by 1.7% in Q2 2024, marking three consecutive quarters of decline, largely due to Milei’s economic reforms. While agriculture grew by 80%, industry and consumption sharply declined. A 4.9% contraction is expected for 2024, with limited recovery in 2025, far below gover

September 15, 2024

Sep 27 Outlook Webinar: Rate Cuts But How Far?

September 15, 2024 10:30 AM UTC

Uncertainty about whether the U.S. economy will have a soft or hard landing is growing as the market approaches Q4. This is shaping the debate regarding the scale of easing through the remainder of 2024 and 2025 by the Fed. European easing is underway, but how much further will central ba

September 12, 2024

Argentina CPI Review: 4.2% only in August

September 12, 2024 2:18 PM UTC

Argentina’s CPI rose 4.2% in August, surpassing market expectations, with Y/Y inflation falling to 236% from 260%. Public service tariff adjustments, particularly in Transport and Housing, were key inflation drivers. Food prices increased 3.5%, while goods CPI grew 3.2%, suggesting a slowing infla

August 22, 2024

Argentina: Economy Continues to Shrink

August 22, 2024 2:08 PM UTC

Argentina’s economy contracted by 0.3% in June (m/m), according to INDEC’s monthly activity indicator and, in quarterly terms, it will accumulate three consecutive quarter of contraction. Despite an 80% annual rise in agricultural activity due to base effects, other sectors like construction and

August 15, 2024

Argentina: CPI at 4.0% in July

August 15, 2024 2:52 PM UTC

Argentina's July CPI rose 4.0%, the lowest since January 2022, yet still above the 2% crawling peg, suggesting real exchange rate appreciation. Year-over-year CPI fell to 263% from 271% in June, with further declines anticipated. Despite some inflation reduction under Milei, price distortions and re

August 13, 2024

Argentina CPI Preview: Inflation Continues to Slowdown

August 13, 2024 12:57 PM UTC

On July 14 Argentina National Statistics Institute (INDEC) will release CPI data for July. Argentina's fiscal adjustment and zero ARS emissions strategy have eased inflation, reducing CPI growth from 20% in January to 3.5% in July. However, the crawling peg exchange rate policy and lack of internati

July 26, 2024

Argentina: Making Sense of the Three Stages Plan

July 26, 2024 2:51 PM UTC

The Central Bank of Argentina's plan for macroeconomic stabilization includes three stages: an orthodox fiscal exit, establishing an orthodox monetary framework, and prudently lifting FX controls. The fiscal deficit reduction has helped end the monetization of the deficit, while transitioning to a c

July 19, 2024

Argentina: Agriculture Drives Growth in May

July 19, 2024 1:10 PM UTC

The Argentine economy showed a 1.3% growth in May, driven mainly by the recovering agricultural sector, which is 100% higher than last year. However, other sectors like manufacturing and construction continue to lag. Despite the growth, economic recovery is uncertain due to fiscal adjustments, excha

July 15, 2024

Argentina: June CPI and Cleaning the Central Bank Balance

July 15, 2024 1:24 PM UTC

Argentina's CPI rose by 4.6% in June, up from 4.1% in May, missing market expectations of 5.1%. The Y/Y CPI fell to 271%. Housing items saw the highest increase at 14.2%, while core CPI growth slowed to 3.0%. Inflation may stabilize around 4.0% monthly. The Central Bank of Argentina's policies are m

July 12, 2024

June 25, 2024

Argentina GDP: Economy Shrinks 2.6% in the First Quarter

June 25, 2024 2:16 PM UTC

Argentina's GDP shrank by 2.6% in Q1, entering a technical recession. Investments and consumption dropped significantly, while agriculture grew. This contraction, driven by Milei's economic policies, is expected to continue in Q2, with rising unemployment and poverty. A slightly recovery is anticipa

Outlook Overview: Cyclical and Structural Forces

June 25, 2024 10:15 AM UTC

• The global economy is showing signs of healing, as inflation comes back towards targets and growth recovers momentum in some economies. Nevertheless, the cyclical headwind of lagged monetary tightening remains in DM countries, and will likely be one of the forces slowing the U.S. economy

June 24, 2024

LatAm Outlook: Pausing the Cuts

June 24, 2024 6:00 PM UTC

· Brazil and Mexico growth will decelerate from the growth rates in 2023. The stronger basis of comparisons in 2023 and the tight monetary policy will diminish growth during 2024. Brazil robust Agricultural growth will not repeat in 2023 while Mexico is on the limit of growing due to a

May 22, 2024

Argentina: Fourth Consecutive Month of Primary Surplus but It is Reducing

May 22, 2024 2:44 PM UTC

Argentina has delivered the fourth consecutive months of primary surplus. Most of this surplus comes from cutting the consumption of goods and services by the national administration and mainly by the pace of revenues growth which surpassed the growth of expenditures. However, the surpluses are redu

May 15, 2024

Argentina CPI Review: Monthly Inflation Drops to One Digit

May 15, 2024 12:18 PM UTC

Argentina's April CPI dropped to 8.8% after six months above 10%, with Y/Y CPI at 289%. Key rises included housing (+36%) and communication (+14.2%). Javier Milei's program and fiscal adjustments have reduced monetary emissions to zero, easing inflation. The Central Bank cut the policy rate to 40%.

April 26, 2024

Argentina: Activity is Shrinking but that is the Price to Stabilize

April 26, 2024 5:52 PM UTC

The INDEC data for February reveals a 0.2% economic shrinkage, signalling a 5.1% drop since August 2023, potentially leading to a Q1 2024 recession. High inflation and fiscal adjustments are primary causes. Some foresee 0% April inflation due to price realignment and stable ARS. Despite low reserves

April 18, 2024

April 14, 2024

Argentina CPI Review: Small Improvements Amid the Uncertainty

April 14, 2024 1:26 PM UTC

The INDEC's March CPI data reveals an 11.0% increase, down from February's 13.2%. Annually, Argentine CPI rose by 287% (Y/Y), with core CPI below 10%. Despite past shocks, we foresee continued monthly CPI slowdown. Argentina focuses on fiscal measures and on stabilize the exchange rate to accumulate

March 25, 2024

March 22, 2024

LatAm Outlook: Getting Deeper in the Cutting Cycle

March 22, 2024 7:04 PM UTC

· Brazil and Mexico growth will decelerate from the growth rates seen in 2023. The stronger basis of comparisons in 2023 and the tight monetary policy will diminish growth during 2024. Brazil robust agricultural growth will not repeat in 2024, while Mexico growth is restrained by a tigh