Argentina GDP: Economy Shrinks 2.6% in the First Quarter

Argentina's GDP shrank by 2.6% in Q1, entering a technical recession. Investments and consumption dropped significantly, while agriculture grew. This contraction, driven by Milei's economic policies, is expected to continue in Q2, with rising unemployment and poverty. A slightly recovery is anticipated in the second half, with a 4.0% contraction forecast for 2024.

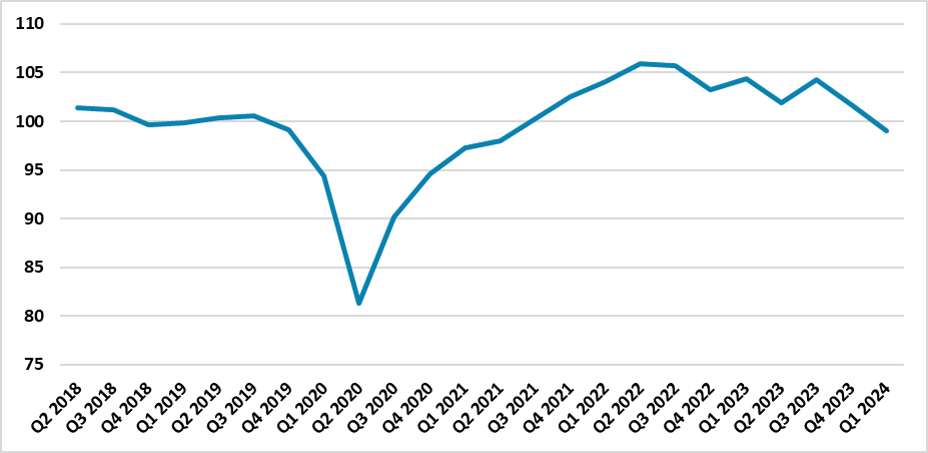

Figure 1: Argentina’s GDP (Seasonally Adjusted, 2019 = 100)

Source: INDEC

The National Institute of Statistics (INDEC) has finally released the GDP figures for the first quarter in Argentina. The data show that the economy has shrunk by 2.6% (q/q), slightly better than market expectations of 3.0%, according to Bloomberg. Compared to the same quarter of 2023, the Argentine GDP is 5.1% lower. This puts Argentina in a technical recession, accumulating two consecutive quarters of contraction.

From the demand perspective, investments have seen the biggest drop, shrinking by 13.2% (q/q) during the quarter. Consumption fell by 2.3% while net exports expanded by 11.4%, fueled by a drop in imports. By sector, construction registered the biggest drop (19.7%) while manufacturing dropped by 13.7%. Agriculture has grown by 10.4%, being the positive news for the Argentine GDP.

The recession is a result of the first months of Milei's government, which has a clear strategy of diminishing state interference in the economy and applying a shock therapy to control inflation. So far, this contraction was expected given the contractionary effects of fiscal consolidation. After the December devaluation, the inflation rate has been dropping consistently and, with the BCAR not increasing the money supply through monetary emissions, the blueprint of the stabilization plan seems clear.

The key to success is how much the Argentines can endure the contractionary effects of Milei’s plan. We still expect the economy to be stagnant in the next quarters, which means poverty will likely continue to increase. So far, several protests have been seen by the opposition, which is trying to block Milei’s deregulation proposals in Congress. It seems that Milei bets that controlling inflation will be enough to compensate for the economic recession. Additionally, unemployment has risen from 5.5% in December to 7.7% in March, which is not good news on the social front.

We believe Argentina will only start recovering from Milei’s shock in the second half and it will take a while to achieve the past level of economic activity. Our growth forecast for this year is a 4.0% contraction with only a relative 1.4% recovery in 2025.