Argentina: Activity is Shrinking but that is the Price to Stabilize

The INDEC data for February reveals a 0.2% economic shrinkage, signalling a 5.1% drop since August 2023, potentially leading to a Q1 2024 recession. High inflation and fiscal adjustments are primary causes. Some foresee 0% April inflation due to price realignment and stable ARS. Despite low reserves, March saw a significant trade surplus, yet the BCAR cut again the policy rate relinquishing the use of monetary policy to lower inflation.

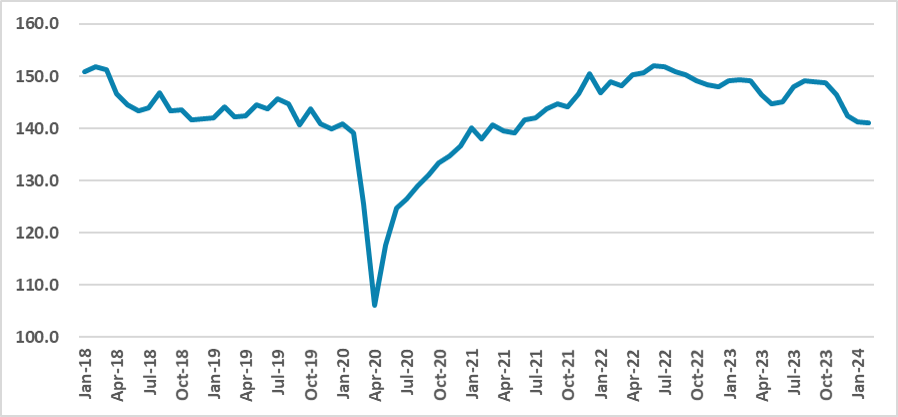

Figure 1: Argentina Activity Index (2014=100, Seasonally Adjusted)

Source: INDEC

The Argentina National Institute of Statistics (INDEC) has released the data for its monthly activity index (IMAE) for February. The data indicate that economic activity continued to shrink, dropping 0.2% (m/m) in February. Since August 2023, the index has accumulated a 5.1% drop, which will likely translate to a technical recession in the first quarter of 2024. The combination of high inflation and a strong fiscal adjustment promoted by Milei’s government is likely the main factor contributing to this recession. However, this is the painful medicine needed to stabilize the Argentine economy.Some consultancies are already pointing to 0% inflation in April as a result of the realignment of prices, the stabilization of the ARS which has been fairly stable after the strong devaluations, and the strong fiscal adjustment which is helping the BCAR to cease the monetary financing of the Argentine government.

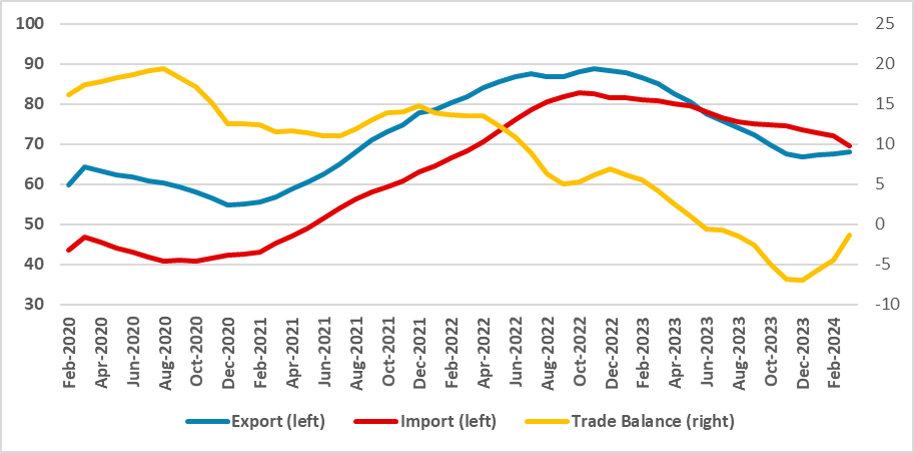

Figure 2: Argentina Trade Balance (USD Bn, 12 months sum)

Source: INDEC

External accounts will be better this year. March has registered the biggest trade surplus of the last 5 years, registering a USD 2 Bn surplus. Again, this could be seen as the effect of restricted import demand and an improvement in exports as the agricultural sector starts to recover from the severe droughts seen last year. However, the level of reserves is still pretty low. Due to the high level of external debt which is still on hold, indicating that years of a surplus on the current account are needed for reserves to come back to a healthy level, likely around 80-90 Bn, at the moment it is still at around USD 30 Bn.

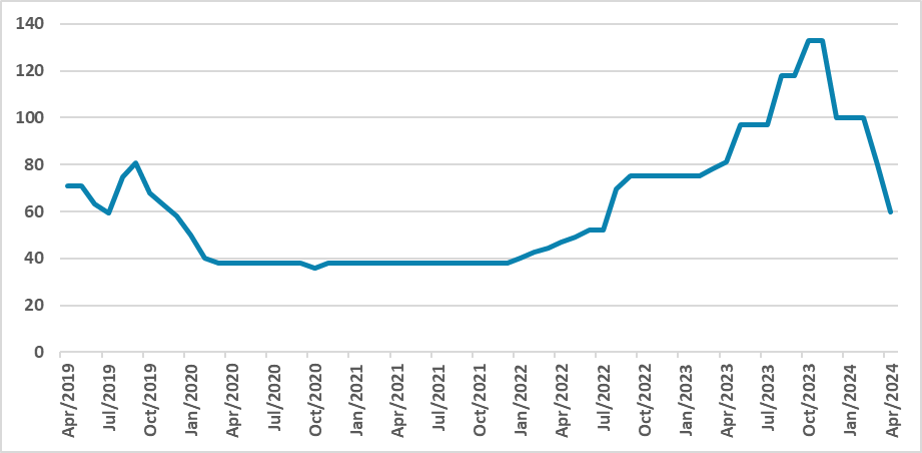

Figure 3: Policy Rate (%)

Source: BCAR

However, the BCAR is reluctant to keep interest rates on real positive terrain. In another decision, the BCAR has dropped the monetary policy to 60% per year, which would be equivalent to an 82% effective rate. However, what the BCAR is focusing on is rather cleaning its balance sheet and incentivizing internal investors to migrate to Treasury bonds rather than BCAR ones. This would allow the government to refinance its own debt without the aid of new monetary emissions. At the moment, the BCAR is abdicating monetary policy to put inflation down, betting that keeping an attractive exchange rate will stabilize the currency and that the strong fiscal adjustment will be capable of putting inflation down.