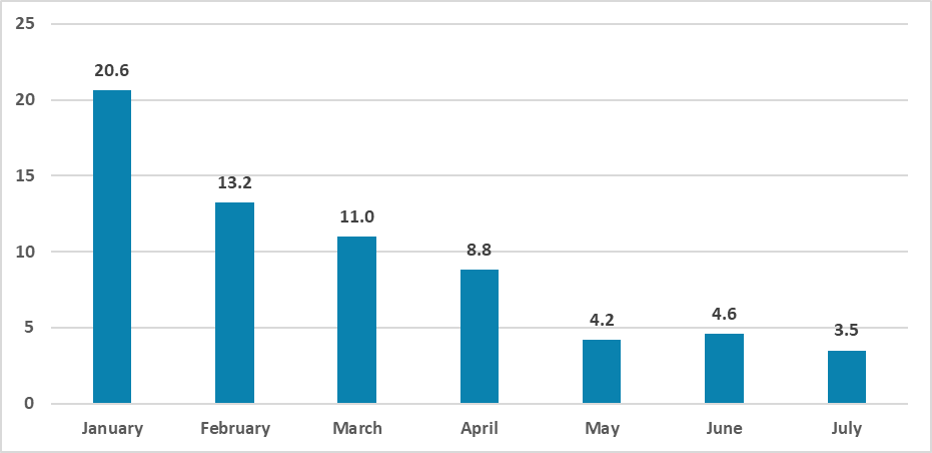

Argentina CPI Preview: Inflation Continues to Slowdown

On July 14 Argentina National Statistics Institute (INDEC) will release CPI data for July. Argentina's fiscal adjustment and zero ARS emissions strategy have eased inflation, reducing CPI growth from 20% in January to 3.5% in July. However, the crawling peg exchange rate policy and lack of international reserves pose risks. Continued recession may be necessary to sustain current policies, but improvement is expected in 2025 with the full operation of the Vaca Muerta field. Dollarization remains a distant possibility.

Figure 1: Argentina CPI (%, m/m)

Source: INDEC and Continuum Economics

On July 14, Argentina National Institute of Statistic will release the CPI figures for July. It is fair to say that Argentina's strategy to address most of its macroeconomic imbalances is working more or less according to plan. The shock plan included a strong fiscal adjustment, which has put the economy into a recession, causing demand to shrink. Additionally, as the monetary financing of the deficit stops and the printing of Argentine Pesos in the local markets decreases, inflationary pressures have eased. Of course, there is still some inertia from the adjustment of the exchange rate, but Argentina has made significant progress, reducing the 20% (m/m) growth in the CPI in January to 3.5% in July, which is our forecast.

The government has now shifted to a strategy of zero emission of ARS Pesos, which will have additional contractionary effects but could help control inflation. So far, controlling the growth of the monetary base has been used as a monetary instrument rather than the policy rate. However, there are still risks. The government is relying on a crawling peg of the exchange rate, allowing it to depreciate by 2% per month, which means a real appreciation. The gap between the official and Blue (Parallel) exchange rates is around 35%, which means that if the government attempts to equalize the two, a new round of inflationary pressures could be generated.

Clearly, the strategy of zero ARS emissions will not be sustainable over time unless the recession continues. The government will likely need to continue achieving a primary surplus to avoid the monetary financing of the debt. We believe Argentina's inflation will continue to hover around 3.0% monthly until the end of the year. Unifying the multiple exchange rates in the country will require a better level of international reserves, which the Central Bank is currently short of. We believe conditions will improve slightly next year once the “Vaca Muerta” field becomes fully operational, allowing the government to accumulate foreign reserves. By mid-2025, unification of the multiple exchange rate regimes could be possible, though there is a risk that inflation may temporarily increase. We still believe that the promise of dollarization remains a distant prospect.