Outlook Overview: Rate Cuts But How Far?

· The U.S. economy is slowing, with the critical question being whether this is a soft or harder landing. Our broad analysis leaves us inclined to the soft landing view into 2025, though we shall watch real sector data closely over the next 3-6 months to check the trajectory. Elsewhere, European growth should recover into 2025 from a weak 2024, but be modest rather than a strong recovery. Finally, we forecast that China growth is set to slow to 4% in 2025, as a slowdown in consumption adds to the drag from the residential property sector. This all means growth worries, before a modest recovery into H2 2025.

· For DM central banks this means reducing the degree of policy restriction consistently, given that inflation is heading back to or close to target in most countries. The Fed will likely ease to a 3.00-3.25% Fed Funds rate by end 2025, with a further 125bps also delivered by the ECB. In contrast, the BOJ wants to normalize further and we see a further 75bps of hikes by mid-2025.

· For EM central banks, the Fed easing and a soft USD landscape allows scope to reduce interest rates, where domestic inflation is heading towards target. Mexico, India, Indonesia and South Africa will likely ease, but by less than the Fed given less their own central bank policy assessments and in most cases less of an economic slowdown than the U.S. Meanwhile, Turkey and Russia are dependent on domestic inflation trajectories and Brazil is doing a mini tightening cycle but will likely resume cuts in 2025. China will likely cut the 7-day reverse repo rate by a further 20bps by end 2025 after the Sep 24 cut (here) given economic and inflation weaknesses, but is unlikely to go to ultra-low interest rates or use QE due to opposition from China’s authorities.

· On the political front, the outcome of the U.S. presidential election is key and the race is currently too close to call. If Kamala Harris is elected, then it would likely herald a broad continuation of existing policies. If Donald Trump is elected, then we feel his key priority would be immigration (where he could threaten Mexico) and renewing the lapsing parts of the 2017 tax cuts. However, 2025 could also see Trump stopping funding to Ukraine to force a negotiation between Ukraine and Russia to end the war. Trade threats against China in 2025 would also likely come from Trump, but we feel a trade war is more likely in 2026. Elsewhere, a wider Middle East war is unlikely, though Israel/Iran and Hezbollah could exchange more missile strikes. An end to the military phase in Gaza could be seen in 2025, but progress to a two state solution will likely be very slow.

· For financial markets, the DM easing cycle has been largely discounted in the money market curves, but 2yr government bond yields can still come down as the actual easing arrives and stability becomes factored in for policy rates in 2026. 10yr U.S. yields will likely be choppy and consolidative for the next 15 months, thus we see modest yield curve steepening. For equity markets, the U.S. will likely be at risk to the downside in the next 3-6 months, as the soft vs hard landing debate will linger and 2025 corporate earnings get cut. We favor outperformance by the UK and EM Asia ex China by end 2025.

· Risks to our views: DM countries could see stronger lagged effects on the economy from the 2022-23 monetary tightening that could mean a stalled recovery in the EZ/UK or more of a slowdown in the U.S. economy. The Fed could then cut to 2.00% (here). Separately, in China the impact of the residential construction decline/consumer slowdown could be stronger than expected in economic and financial instability terms and cause a harder landing around 3% growth for China (here) This would negatively affect EM economies (Figure 1).

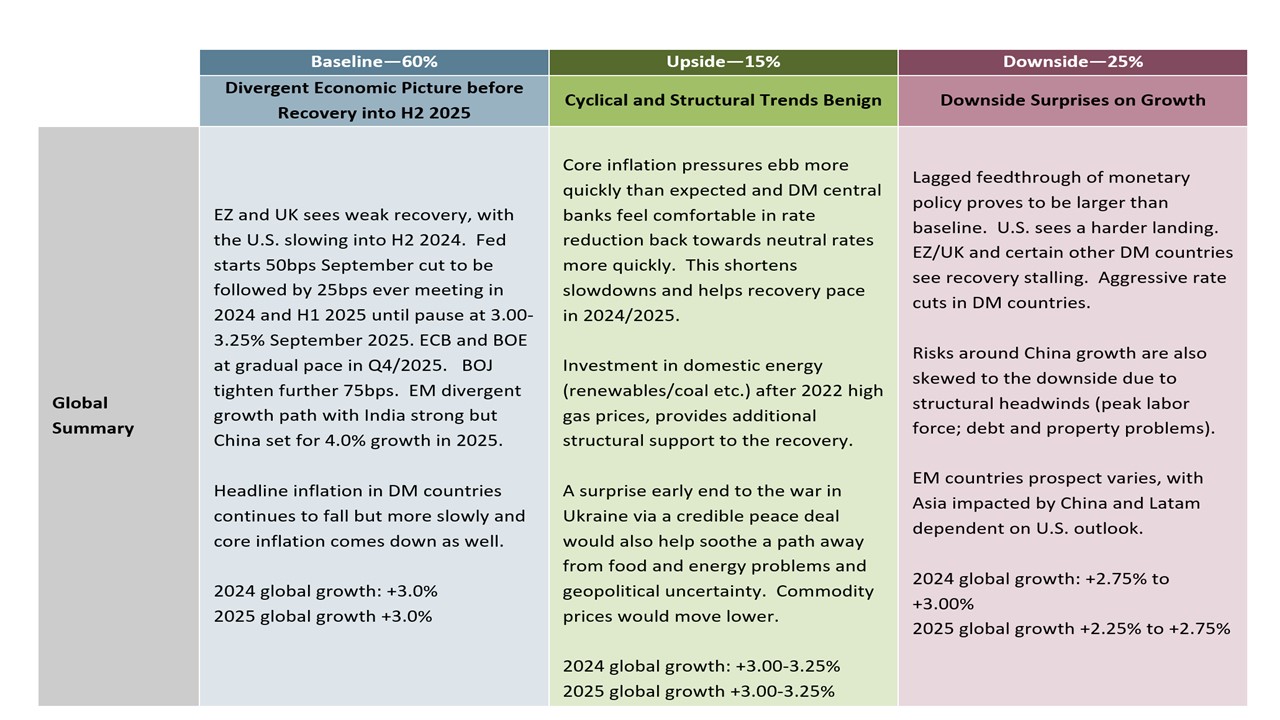

Figure 1: Economic Scenarios

Source: Continuum Economics

Market Implications

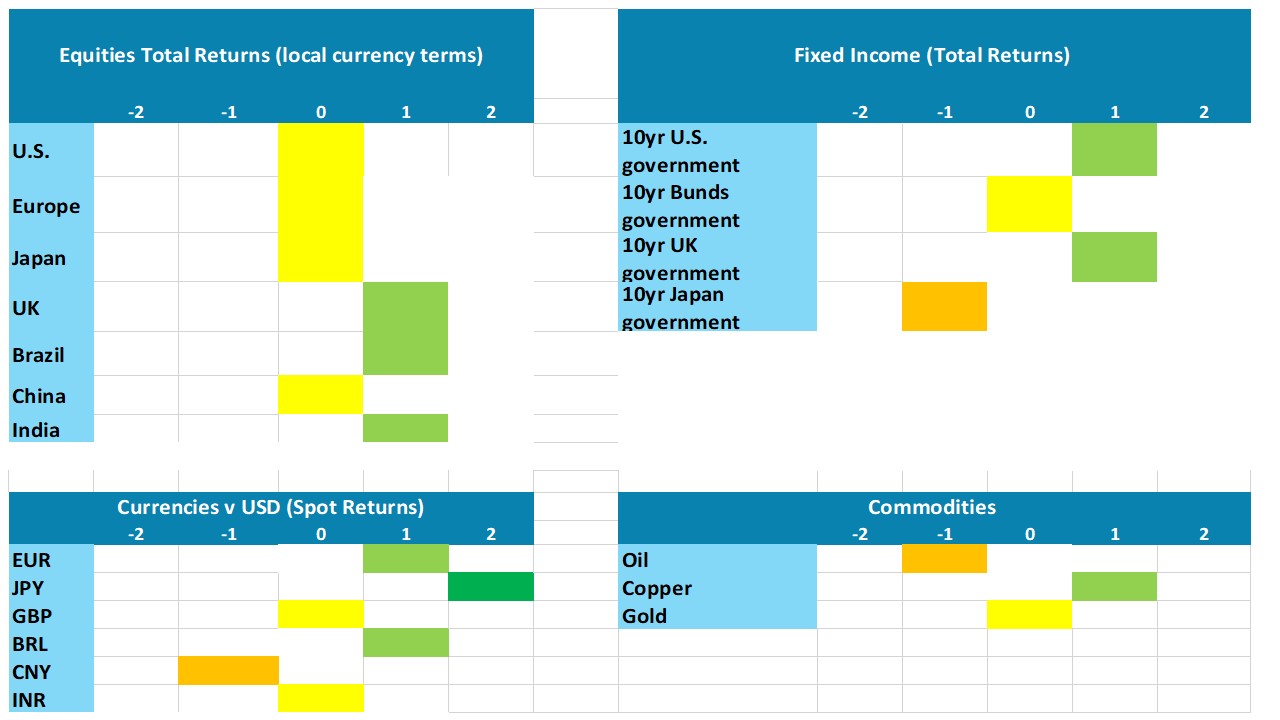

Figure 2: Asset Allocation for the next 15 Months

Source: Continuum Economics Note: Asset views in absolute total returns from levels on September 24 2024 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

· Government Bonds. 10yr U.S. yields will likely be choppy in the next 15 months. U.S. Treasury yields will likely rise 20bps in H1 2025, as some temporary fiscal stress is likely under either president and a high risk exists of a U.S. rating downgrade. Then cumulative Fed easing will help 10yr yields come back down. 10yr JGB yield can move consistently higher to 1.40-45% due to BOJ rate hikes prompting a parallel yield curve shift.

· Equities. The U.S. equity market is benefitting from the Fed taking out insurance to increase the chances of a soft landing. Even so, the U.S. equity market will likely still be at risk to the downside in the next 3-6 months, as the soft vs hard landing debate will linger and 2025 corporate earnings get cut. Proposal on corporate tax will likely not be implemented by either presidential candidate, as Congress will likely be split and restricting corporate tax changes. We favor outperformance by the UK and EM Asia ex China by end 2025.

· FX. The USD downtrend will extend, as the reduction in high U.S. interest rate will sap the USD – especially given the starting point of a still high USD. We see scope to 1.20 EUR/USD and 125 USD/JPY by end 2025. EM currencies will be more divergent depending on inflation and interest rate differentials, though we see scope for a Brazilian Real recovery. China authorities will likely favor a weak Chinese Yuan to support growth via exports.

· Commodities. Oil prices face a tug of war between soft demand and OPEC+ production cuts. OPEC+ will likely reduce the scale of production cuts in 2025, and thus we have cut our end 2025 WTI forecast to USD68. Copper prices have been depressed by China pessimism, but should recover by end 2025 on restrained new supply prospects.

Figure 3: Key Events

| October 6, 2024 | Brazil Municipal Elections | All Brazilian municipalities will hold elections to decide the mayors of the municipalities and the members of the local assemblies. |

| November 5, 2024 | U.S. Elections | For Presidency, the contest between Vice President Kamala Harris and former President Donald Trump looks too close to call. Following a strong performance in the September 10 debate, Harris has a marginal lead in the polls but the electoral college looks very close, with Pennsylvania the most likely tipping point state. The contests for Congress will also be close but Republicans look likely to regain control of the Senate, where the Democrats are defending more vulnerable seats, but dysfunctional Republican leadership in the House suggests the Democrats will be able to regain control there. The contest for the House is however a closer call than that for the Senate. |

| September 27, 2025 | Australia General Election | All 153 seats in the House of Representative and at least 40 seats in the senate will be contested. Prime minister Anthony Albanese will be seeking for a second term re-election, facing Peter Dutton Liberal party and National Coalition’s challenge. |

| October 20, 2025 | Canada Federal Election | Canada’s election looks likely to deliver a Conservative majority government, led by Pierre Poilievre, ending the tenure of Liberal Prime Minister Justin Trudeau that has persisted since 2015. A business friendly-government would be seen, but plans to balance the budget while cutting taxes may be difficult to combine. We would expect little change from the current fiscal stance of modest budget deficits, and no major changes in the Canadian economic outlook. |

| October 26, 2025 | German Federal Election | The next German federal election must be held on or before 26 October 2025 with the opposition CDU currently commanding a clear opinion poll lead and with the far-right also polling well. The risk is that with the current coalition looking ever more fragile a shift in government could occur even earlier. |

| October 31, 2025 | Japan General Election | All 465 seats in the House of Representative will be up for election. A new prime minister and cabinet will also be elected. The governing Liberal Democrat Party (LDP) has been mostly in control post war, and we envisage this will not change. |

Source: Continuum Economics