Argentina CPI Review: Inflation Eases in February to 13%, but it Still a Long Road

The February CPI release by Argentina's INDEC shows a slight ease in inflation to 13.8% (m/m), yet on an annual basis, it has soared to 276%, hitting a record high since the 1980s. Major increases were noted in Transport (21%), Food and Beverages (11%), and Housing (20%). While indicating initial improvement, addressing macroeconomic imbalances remains a substantial challenge. The stabilization of the black market rate offers hope, but successful implementation of fiscal and monetary policies is crucial for long-term stability..

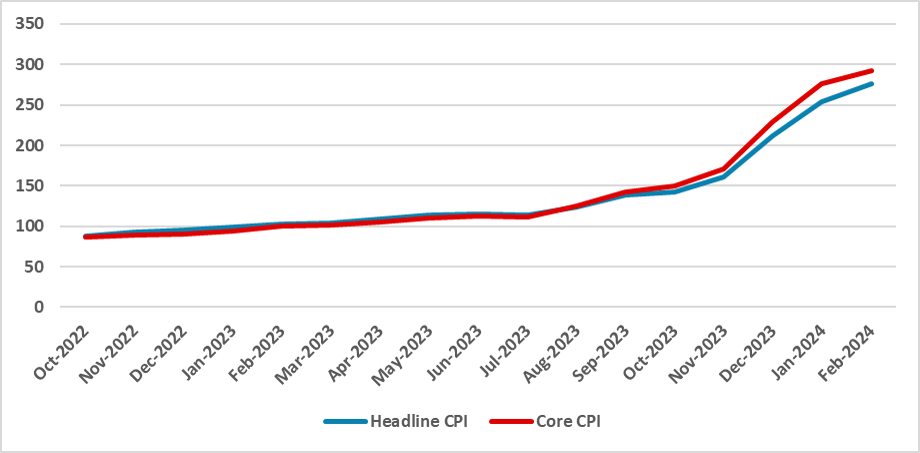

Figure 1: Argentina’s CPI (%, Y/Y)

Source: INDEC

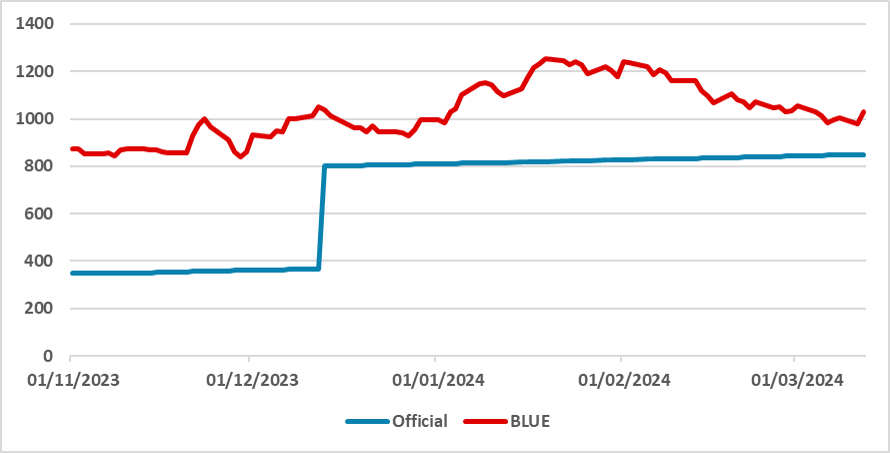

The Argentine Statistics Institute (INDEC) has released the CPI numbers for February. After registering inflation above 20% (m/m) for two consecutive months, Argentine CPI has eased to 13.8% (m/m) in February. On an annual basis, Y/Y CPI has climbed to 276%, a record high since the years of hyperinflation in the 1980s. The biggest rise occurred in the Transport Group, which rose by 21%, due to adjustments in fuels and public transport fares. Food and Beverages grew by 11%, improving from the 20% registered in January. Housing also rose by 20% due to the liberalization of rent contracts, which now can be readjusted freely between renters and property owners. Although this is a first sign of improvement, there is a long road for Argentina to solve its macroeconomic imbalance. A big chunk of the recent inflation was mostly due to the strong devaluation of the official peso, almost equalling it to the black market rate. The good news is that the black market rate (BLUE) has shown some stability in February, and although prices tend to continue to be readjusted and causing some inflation in the short term, most of these adjustments are likely to be completed in the first half of the year, and a strong drop in the inflation rate could be seen in the second half, at least below the 10% m/m margin. One worrying sign is related to the monetary adjustment.

Figure 2: ARS/USD

Source: Refinitiv

Source: Refinitiv

Most of the strategy to rebalance the Argentine economy relies on allowing the official exchange rate to be sufficiently close to the black market one and implementing a strong fiscal adjustment capable of reducing the deficit to zero. In this situation, there would be no need for the Central Bank of Argentina to emit new pesos to finance it. However, a contractionary monetary policy should also be applied and at the moment, with the policy rate set at 100%, it is fairly negative. The truth is that the government aims to reduce financial markets' reliance on BCAR papers and thus is applying a reduced policy rate to somehow force investors to buy treasury papers rather than BCAR ones, cleaning in this manner the BCAR market. It remains to be seen whether this strategy will be successful and if once it is achieved, BCAR will raise rates.