Argentina CPI Review: Small Improvements Amid the Uncertainty

The INDEC's March CPI data reveals an 11.0% increase, down from February's 13.2%. Annually, Argentine CPI rose by 287% (Y/Y), with core CPI below 10%. Despite past shocks, we foresee continued monthly CPI slowdown. Argentina focuses on fiscal measures and on stabilize the exchange rate to accumulate reserves. A challenging adjustment looms, yet a brighter future is possible if inflation decreases and reserves are replenished.

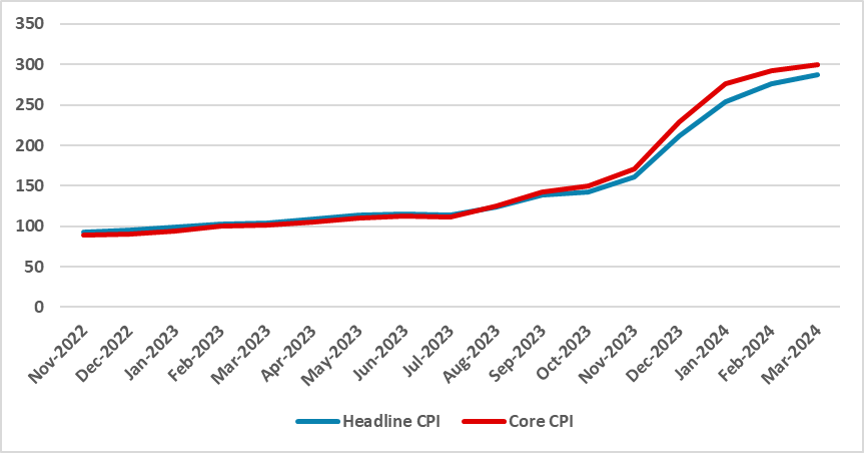

Figure 1: Argentina’s CPI

Source: INDECThe Argentine Statistics Institute (INDEC) has released the CPI data for March. The data shows that the CPI increased by 11.0% during March, decelerating from February when it registered 13.2%. On an annual basis, the Argentine CPI has increased by 287% (Y/Y). Core CPI came in below the 10% mark, which could be seen as a positive sign, growing by 9.4% and accumulating a 300% (Y/Y) increase on an annual basis. Although inertia from the December shock, when most prices were de-frozen, and the strong devaluation of the official Argentine Peso promoted by the government, will continue to be present, we believe the Argentine CPI will continue to slow down below the 10% monthly growth in the next months.

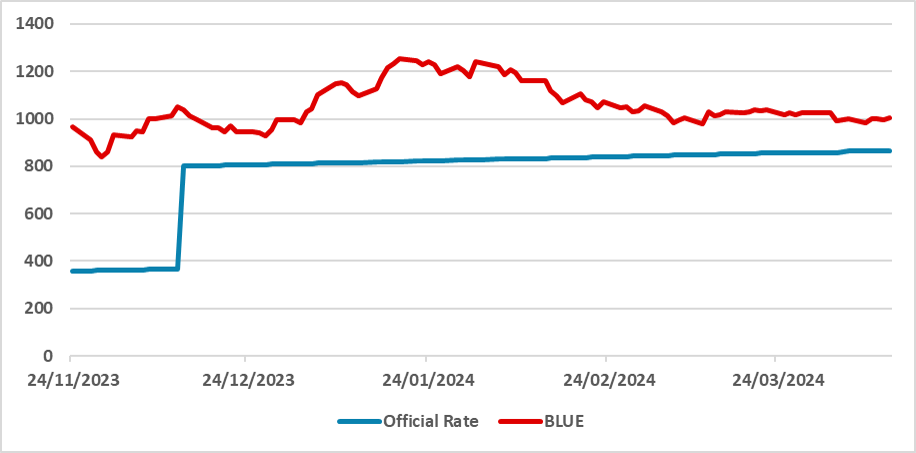

Figure 2: Argentina Exchange Rate (ARS/USD)

Source: RefinitivMost of Argentina's strategy to tackle its macroeconomic imbalances is currently focused on fiscal measures. The government was unable to pass an ambitious reform program in Congress and is banking on a painful adjustment, consolidating around 6% of the GDP by cutting expenditures while maintaining a competitive exchange rate, which would benefit exporters and penalize importers. This would help the Central Bank accumulate reserves. So far, BCAR activity is focused on transitioning people from BCAR bonds to Federal bonds, thus avoiding monetary emissions to finance the fiscal deficit. Given the past situation, it seems this will be enough to bring inflation back towards more sustainable levels, and so far, the BCAR has been able to accumulate reserves in the first months of the year, which will please the IMF technical team.

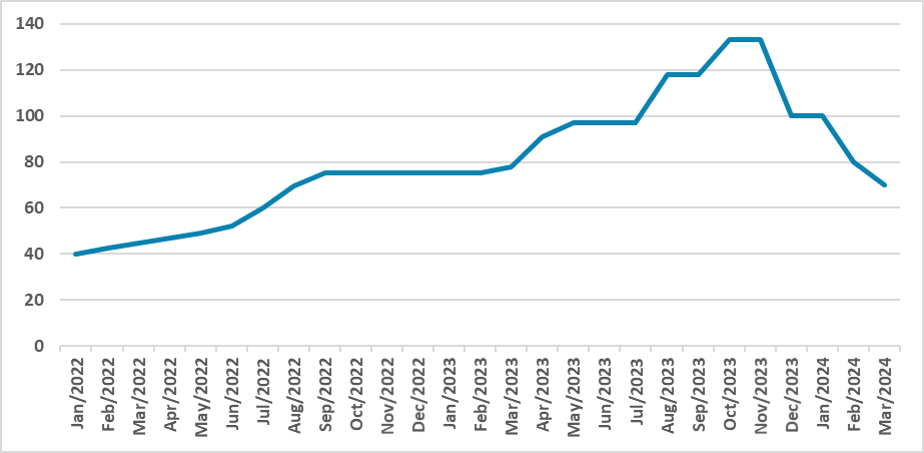

Figure 3: Argentina’s Policy Rate (%)

Source: BCAR

The Argentine Peso is also performing better. Since the last strong devaluation, the BCAR has maintained its crawling pegging policy, keeping the real exchange rate stable. The gap between the BLUE (black market rate) and the official exchange rate is now below 10%, and the BLUE has even shown some appreciation. The government has relaxed access to US Dollars, which will have marginal effects on the economy. Due to this drop in monthly inflation, the BCAR has reduced its policy rate to 70%, keeping it in negative real terrain. Therefore, most of the Argentine government's hopes to solve its macroeconomic imbalances rely on maintaining a competitive exchange rate and fiscal adjustment, with monetary policy playing a side role. This first year will be painful and contractionary, but if inflation numbers fall and Argentine Reserves are rebuilt, the future could be brighter.