Argentina: CPI at 4.0% in July

Argentina's July CPI rose 4.0%, the lowest since January 2022, yet still above the 2% crawling peg, suggesting real exchange rate appreciation. Year-over-year CPI fell to 263% from 271% in June, with further declines anticipated. Despite some inflation reduction under Milei, price distortions and regulated prices persist. Economic recovery may be delayed until 2025, with ongoing fiscal adjustments and reliance on a new bond scheme to manage debt. 2024 CPI is forecasted at 120% year-over-year.

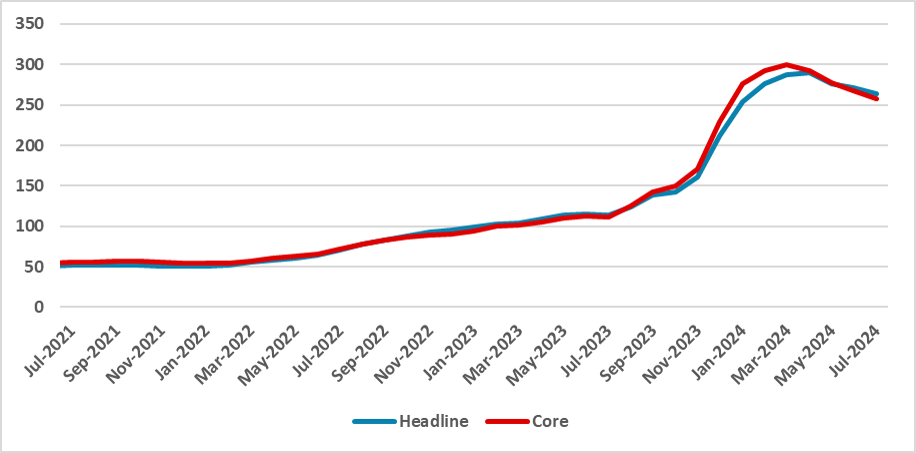

Figure 1: Argentina’s CPI (%, Y/Y)

Source: INDEC

The Argentine National Statistics Institute has released the CPI data for July. The figures show that Argentina's CPI increased by 4.0% in July, in line with market expectations according to Bloomberg and slightly higher than our forecast (3.5%). This is the lowest figure since January 2022. Core CPI came in slightly lower than the headline figure, at 3.8% (m/m). The figures are still somewhat higher than the crawling peg of 2%, which could indicate that the real exchange rate is actually appreciating. Year-over-year CPI has fallen to 263% from 271% in June, and this index will likely continue to fall during the second half of the year.

Most of the rise was driven by restaurants and hotels, which have some seasonal components related to winter vacations. Core goods rose by 3.1% during the month, while core services increased by 6%. There are still some regulated prices that need to be updated with past inflation, and we see this as one of the reasons for inflation not falling further in the upcoming months. However, the government seems to be timing these adjustments to calibrate their inflationary effects.

Since the beginning of Milei’s government, inflation has fallen, but relative price distortions from regulated prices continue to be a problem. Additionally, inertia does not dissipate as quickly as one might expect, even though the decline in economic activity contributes to it. There is still a lot of ground to cover to resolve Argentina's macroeconomic imbalances. The BCAR still needs to accumulate enough foreign reserves, and the monetary strategy of zero Pesos emissions is not sustainable indefinitely; some transition in the monetary front will eventually be needed.

It seems that the so-called economic recovery from the shock plan will need to wait until 2025. Until then, the government plans to continue with a fiscal adjustment compatible with a zero fiscal deficit, and the new scheme of government bonds is expected to help roll over the internal debt, while the external debt will depend on some renewal of the deal with the IMF. We are now forecasting that 2024 CPI will end at 120% year-over-year – 204% Y/Y average – which represents some improvement from the previous year.