Argentina CPI Review: Monthly Inflation Drops to One Digit

Argentina's April CPI dropped to 8.8% after six months above 10%, with Y/Y CPI at 289%. Key rises included housing (+36%) and communication (+14.2%). Javier Milei's program and fiscal adjustments have reduced monetary emissions to zero, easing inflation. The Central Bank cut the policy rate to 40%. CPI is expected to decelerate, potentially reaching 5% monthly inflation in the coming months.

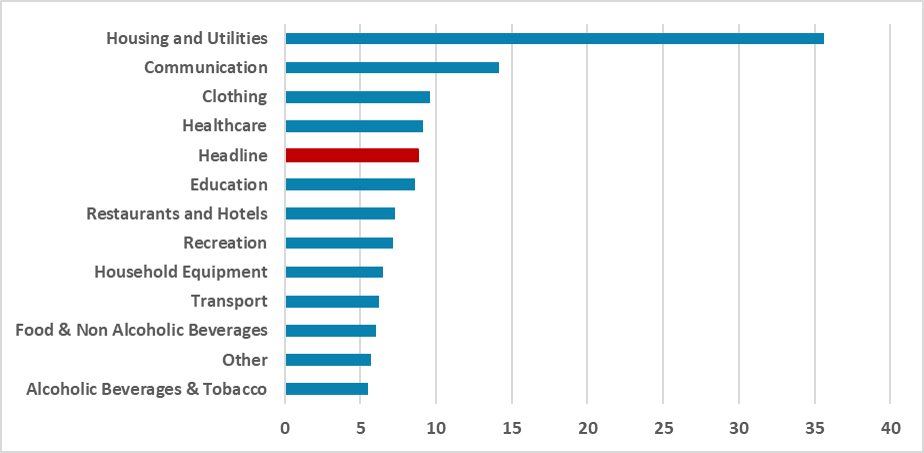

Figure 1: Argentina CPI (%, m/m)

Source: INDEC

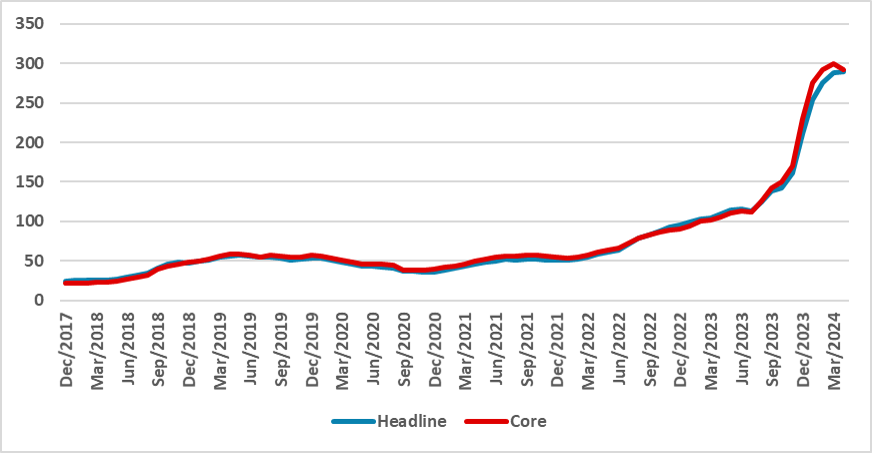

The Argentina National Institute of Statistics has released the CPI data for April. After six months of inflation above the 10% mark, the monthly CPI has dropped to 8.8% (m/m). Consequently, the Y/Y CPI has risen to 289%, remaining more or less stable from March (287%). Accounting only for 2024, the CPI has accumulated a 64% growth. Core CPI growth was even lower, registering a 6.3% (m/m) increase for the month.

Figure 2: Argentina CPI (%, y/y)

Source: INDEC

The biggest rise of the month occurred in housing due to the increase in regulated tariffs for water and electricity. The new policy is reducing general subsidies. Therefore, this group registered a 36% rise for the month. Communication costs also rose significantly (+14.2%) as communication companies continue to pass the cost increases to the final consumer. It is important to note that the government opted to postpone the re-introduction of taxes on gasoline in an attempt to reduce April inflation. It is yet unclear when the government will reinstate them.

Most of the drop in inflation is related to the shock plan instituted by Javier Milei's program. Recent data indicates that consumption is shrinking, which diminishes demand pressures. With the fiscal adjustment, the government has been able to reduce monetary emission to zero, which also helps diminish inflationary pressures.In terms of monetary policy, it is clear that the government is opting to first clean the Central Bank's balance sheets. Over the years, Argentina opted to use BCAR instruments for savings, but the aim of the Central Bank is for most of those savings to go toward financing the government.

Additionally, the BCAR cut the policy rate to 40%, which in real terms puts the rate in negative territory.At the moment, the government's fiscal anchor is working as planned. Monetary emissions have been reduced to zero, and the resulting contraction is helping demand to put inflation down. The pace of exchange rate devaluation has also stabilized, contributing to less pass-through. We anticipate that the CPI is likely to continue decelerating in the coming months, probably reaching the 5% monthly inflation mark, which was more or less the number registered in the first year of Fernández’s administration.y, but if inflation numbers fall and Argentine Reserves are rebuilt, the future could be brighter.