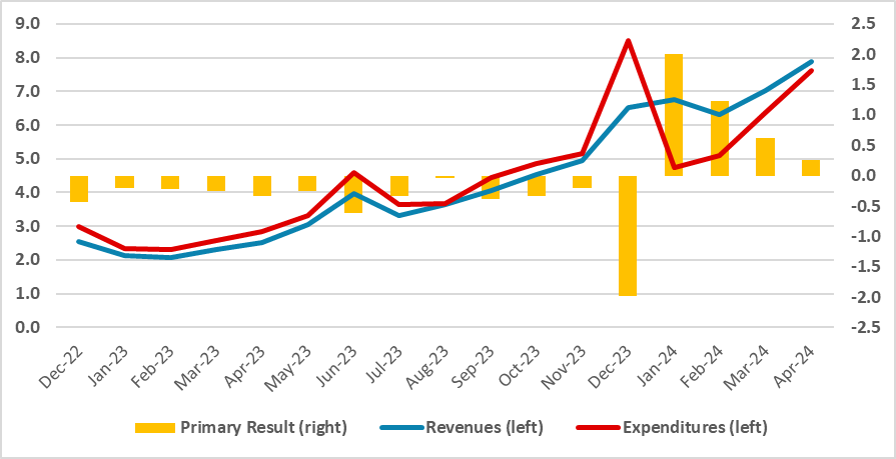

Argentina: Fourth Consecutive Month of Primary Surplus but It is Reducing

Argentina has delivered the fourth consecutive months of primary surplus. Most of this surplus comes from cutting the consumption of goods and services by the national administration and mainly by the pace of revenues growth which surpassed the growth of expenditures. However, the surpluses are reducing and we believe the government will start to register deficts in the second half of the year. With inflation reducing and GDP contracting, we believe Argentina will not deliver the promised 2% of the GDP primary surplus.

Figure 1: Argentina Monthly Primary Revenues, Expenditure and Primary Surplus (ARS Billions)

Source: Secretaria de Hacienda

Argentina has registered the fourth consecutive month of primary surplus. However, it is important to remember that most of this fiscal adjustment is related on controlling expenditures growth below inflation growth. As revenues growth will likely correspond to the growth of nominal GDP, which in turn is similar to inflation, revenues grew much higher than expenditure, warranting this better result of the primary surplus.

However, it is important to note that most of the reduction came on the drop of Goods and Services Consumption and Capital from the National Administration. Wages and Pensions, which are the core of Argentina expenditures, continued to grow moderately. In terms of pensions the government is trying to negotiate with the Congress some changes in the formula the payments are made, but due to resistance in the Congress it will likely not be approved.

The reduction of primary surplus in April shows the difficult for the government to actually continue to register primary surpluses without measures to grow revenues by heightening taxes or a significant reduction on the pensions bill. Still the good news is that in case new primary deficits occur, the strategy for the government to finance it will be the usual emissions of debt. The strategy of the Central Bank of Argentina of lowering their policy rate is to induce the Argentina savers to buy local government bonds to finance the roll-over of the current debt and the eventual primary deficits. In the past it was done through the monetary emissions which obviously has inflationary effects.

The future of the promise of the current government to register primary surplus will likely depend also on growth. With inflation slowing and the GDP contracting, revenues will also grow at a lower rate. Argentina will likely start to register primary deficits in the second half which will make things difficult for the government to deliver the promised 2% of the GDP primary surplus. We see Argentina registering around 0.5%-1% of the GDP primary deficit.