Argentina: CPI grows 20.6% in January

Argentina's CPI surged in January, marking a 20.6% increase (m/m), the highest globally. Annual figures show a staggering 254% rise. The rise was influenced by the exchange rate devaluation and the release of controlled prices. Only in April we will probably see a CPI cleaned from this noises. The government aims to stabilize inflation via fiscal measures and reduced monetary emissions. Nevertheless, challenges persist amid negative interest rates and currency devaluation.

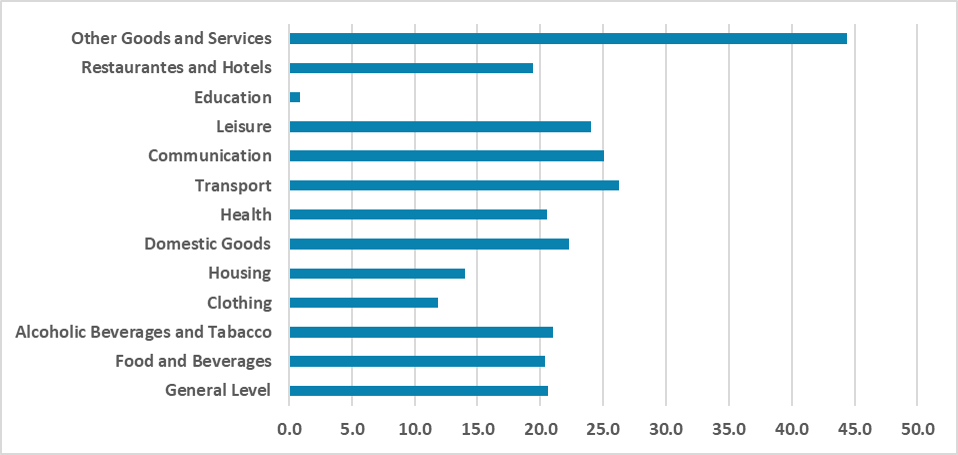

Figure 1: Argentina’s CPI by Groups (m/m, %)

Source: INDEC

The Argentine National Statistics Institute (INDEC) has released the CPI numbers for January. The data has shown a strong increase in the index, with the CPI growing by 20.6% (m/m) in the month. With this number, Argentina is the country that saw the highest inflation in January. In annual terms, the Y/Y CPI has grown to 254%. The biggest rise occurred in the other goods and services group, growing 44.4% (m/m), while Education grew only 0.4% (m/m). However, due to seasonal reasons, Education CPI usually spikes in February and March due to the readjustment of school monthly quotas; it is very possible that in February Education prices will grow above the 20% level.

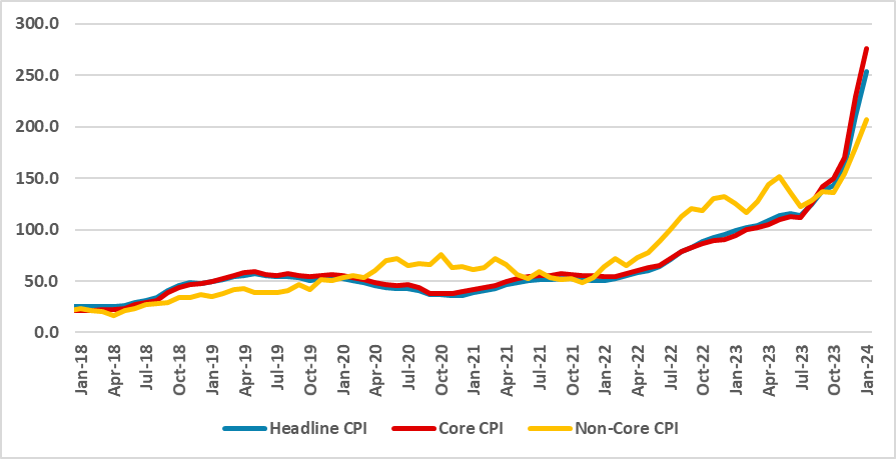

Figure 2: Argentina’s CPI (Y/Y, %)

Source: INDEC

Most of the increase seen in Argentine prices can be related to two effects. First, several prices were being held artificially by the last government, and when the new cabinet assumed office, they released those prices, meaning an adjustment for the general level of prices. The second one is related to the massive devaluation of the Argentine Peso, which almost doubled in December. As the pass-through is quite high in Argentina, prices are still catching up with this devaluation.

The question now will be how long this adjustment will continue. The plan for the Argentine government is to hope that the fiscal adjustment and the cessation of new monetary emissions will be able to bring inflation down once this readjustment ends. Considering that several public prices will be readjusted in February, it is fair to say that the first “clean” CPI numbers will come out only in April. However, the recent rise in the numbers will increase inertia, and in case wages respond, expectations could continue to move inflation up, making it tougher to lower it.

Additionally, the main policy rate (BADLAR) stands at an effective rate of 180%, meaning it is fairly negative. The government is trying a new strategy by transferring short-term Central Bank papers to Treasury ones, trying to resume government financing through domestic debt. The negative rates mean it is less attractive for domestic saving, and the promise of dollarization only weakens the ARN further. The road to disinflation and some changes in the interest rate policy are likely to be seen to keep rates on real positive terrain.10.