Argentina: June CPI and Cleaning the Central Bank Balance

Argentina's CPI rose by 4.6% in June, up from 4.1% in May, missing market expectations of 5.1%. The Y/Y CPI fell to 271%. Housing items saw the highest increase at 14.2%, while core CPI growth slowed to 3.0%. Inflation may stabilize around 4.0% monthly. The Central Bank of Argentina's policies are mixed, maintaining a 2.0% monthly devaluation rate. Fiscal adjustments are causing a recession, and further devaluation might be needed, affecting inflation.

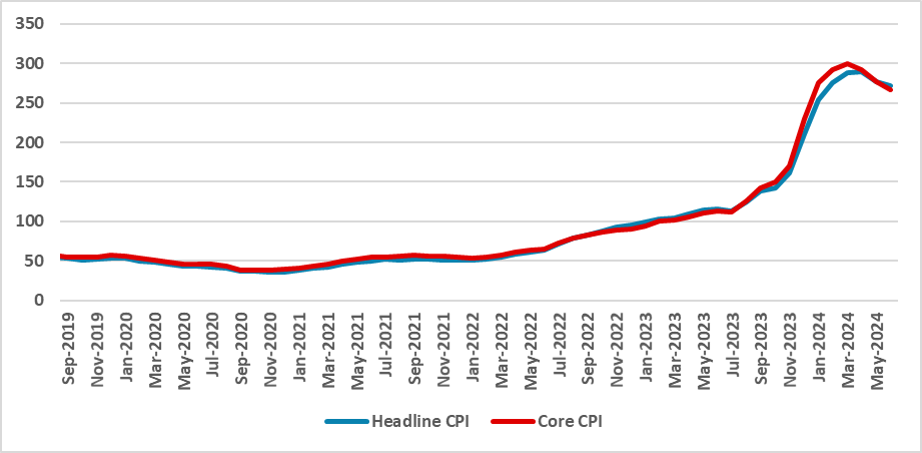

Figure 1: Argentina CPI (Y/Y, %)

Source: INDEC

Argentina’s National Statistics Institute (INDEC) has released the CPI data for June. After seeing six consecutive drops in the m/m CPI, the CPI index grew by 4.6% (m/m) in June, up from 4.1% in May. Therefore, the Y/Y CPI dropped to 271% from 276% in May. The data came slightly below market expectations, which were anticipating a 5.1% growth in the CPI in June. The biggest rise came from the Housing items, which grew by 14.2% in the month, reflecting repressed tariffs on electricity and gas. Food and Beverages CPI grew by 4.0%, similar to the Transport group (+3.9%). The good news came from the core CPI, which continued to slow down, growing 3.0% during June.

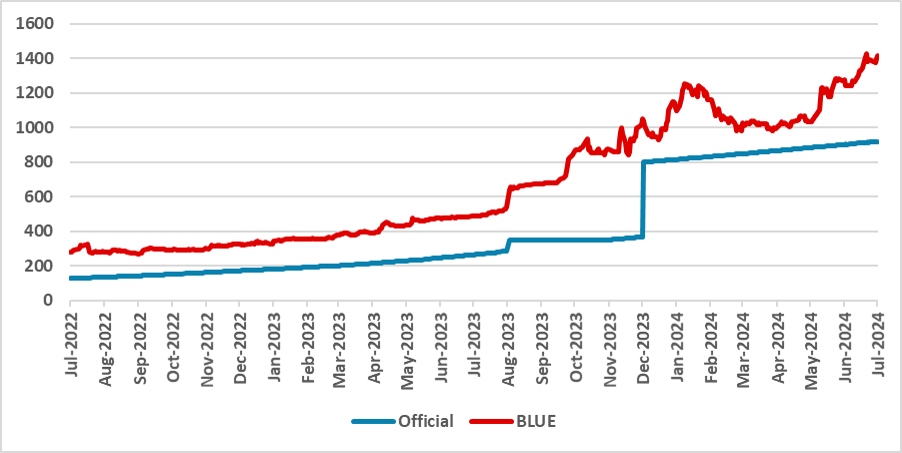

Figure 2: ARS/USD

Source: Refinitiv

Contrary to the predictions by the Central Bank of Argentina (BCAR), inflation seems like it will stabilize this year around the 4.0% monthly mark. At the moment, the BCAR is maintaining a 2.0% per month devaluation rate, meaning the official exchange rate is actually appreciating in real terms. One of the notable developments in June is that the gap between the official Pesos and the BLUE (parallel) exchange rate started to widen again. If the BCAR is seriously considering unifying the multiple exchange rate regimes, they will eventually need to apply another significant devaluation, which will again prompt a new rise in monthly inflation rates.

On another front, the coordination between monetary and fiscal policy seems to be mixed. On one side, the government is trying to implement shock fiscal adjustments, which are clearly having effects in terms of economic recession. On the other side, the BCAR is not applying a contractionary monetary policy but is rather focusing on cleaning the Central Bank balance sheet. In recent years, the central bank issued fresh Pesos to finance government debt and sterilized those Pesos with BCAR bonds, which were then refinanced through new emissions or new bonds. The strategy now is that no new emissions will be needed to finance government debt and, therefore, the focus has switched to cleaning the BCAR balance sheet. BCAR aims to apply monetary policy through Treasury-issued bonds, which will be used to finance government needs, thus cleaning the BCAR's liabilities. With a policy rate of 40%, monetary policy is still far from restrictive, and it is believed that at some point the BCAR will likely need to adjust it upwards.