Argentina: Agriculture Drives Growth in May

The Argentine economy showed a 1.3% growth in May, driven mainly by the recovering agricultural sector, which is 100% higher than last year. However, other sectors like manufacturing and construction continue to lag. Despite the growth, economic recovery is uncertain due to fiscal adjustments, exchange rate devaluation, and ongoing financial instability. Due to multiple uncertainties, we continue to see the Argentine economy contracting by 4.0% this year. We believe the recovery will be only partial in 2025, with a growth of 1.4%.

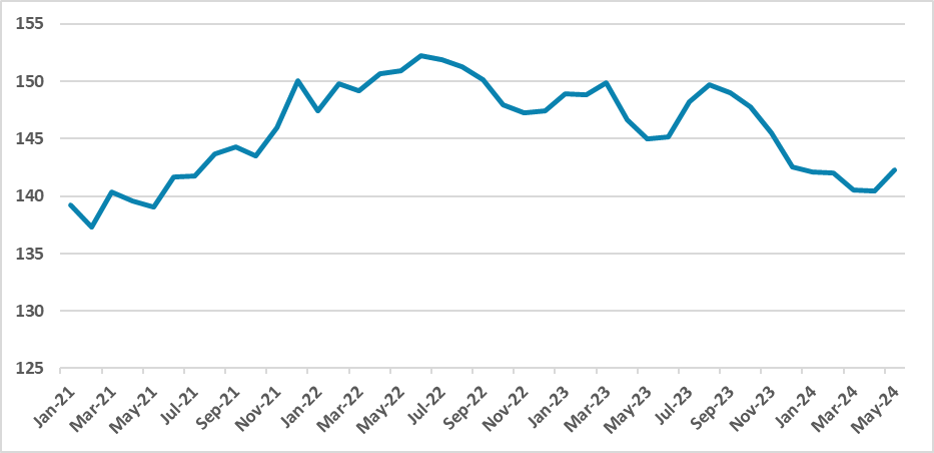

Figure 1: Monthly Economic Activity Index (Seasonally, Adjusted, 2004 =100)

Source: INDEC

The Argentine National Statistics Institute (INDEC) has released its monthly indicator of economic activity for May. For the first time in eight months, the index hasn’t fallen compared to the previous month. Data shows that the index rose by 1.3% during the month. However, when one examines the data closely, it is clear that the main driver of this growth was the agricultural sector. In 2023, Argentina’s rural sector suffered from severe droughts, which limited the production capacity of this sector. This year, the sector is only recovering the ground lost last year. The agricultural activity index is now 100% higher than in the same month last year.

All other sectors are still lagging behind when compared to May 2023, with the exception of mining, agriculture, and electricity. Manufacturing is 14% lower, construction is 22% lower, trade is 11.2% lower, and financial activities are 8.2% lower.

The expected recovery of the Argentine economy is yet to be seen. The factors driving agricultural growth are mainly due to the base effect, although a more favorable exchange rate could be prompting the recovery in production. However, the level of fiscal adjustment and the devaluation of the official exchange rate are clearly taking their toll on economic activity. It is still difficult to see any sector recovering from the shock, and most of the recovery could be delayed until the second half of the year. Additionally, it is very likely that the Argentine economy will only recover partially from the recession, with its level of economic activity still lagging behind what we saw in September 2023.

To this mix, we add the rising uncertainty around the framework to access foreign currency (cepo). The government clearly wants to unify the multiple exchange rate regimes. However, the gap between the BLUE (parallel) quotation and the official one is around 50%, and applying a new devaluation will revive inflationary pressures. The government announced an intervention in the currency market, trying to reduce the level of the BLUE, but so far it has had limited impact. Additionally, the government will try to renew its deal with the IMF to access fresh reserves, with the outcome of this deal still uncertain.

Due to multiple uncertainties, we continue to see the Argentine economy contracting by 4.0% this year. We believe the recovery will be only partial in 2025, with a growth of 1.4%.