Argentina CPI Review: Monthly Inflation Drops to 2.7%

Argentina's October CPI rose by 2.7%, hitting a three-year low and reducing the Y/Y inflation to 192%. Milei’s fiscal shock plan aims to curb inflation, with anticipated tariff adjustments potentially keeping inflation near 3% monthly in the next month. With inflation dropping Argentine government will likely reduce the crawling-peg rate to 1%, and with the BLUE exchange rate and the official rate converging, in around 8 months Argentina may began lifting capital controls.

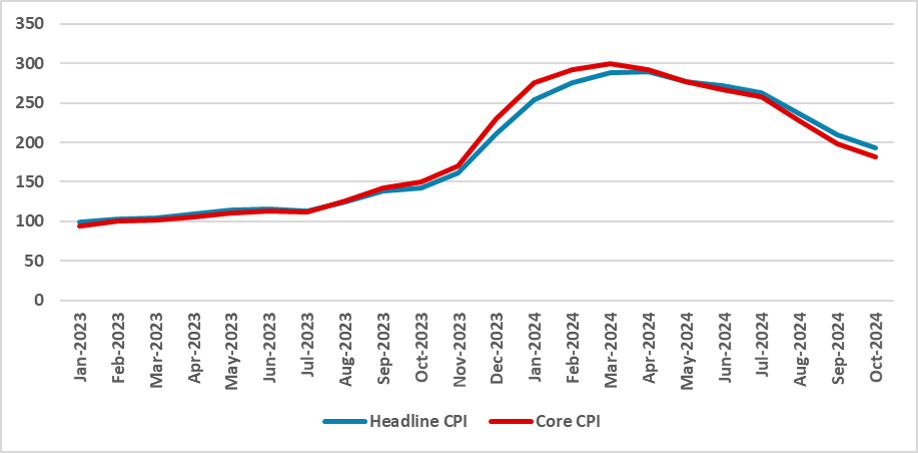

Figure 1: Argentina’s CPI (Y/Y, %)

Source: INDEC

Argentina's National Statistics Institute (INDEC) has released the CPI figures for October. The data show that the CPI increased by 2.7%, the lowest rate in three years, breaking the 3.0% floor. Consequently, the Y/Y CPI dropped to 192% from 209% in September. The Food and Beverages CPI grew by only 1.2%, the lowest rate since the pre-pandemic period, accumulating a 183% increase in annual terms. The largest rise in October's CPI came from the Housing group which rose by 5.4% in the month, reflecting higher electricity tariffs. Core CPI grew slightly above the headline rate at 2.9%, accumulating a 181% increase on annual terms.

The CPI is clearly showing a downward trend as a result of Milei’s shock plan to control inflation, which leans on substantial fiscal consolidation despite the drop in economic activity. We believe there are still some tariffs to be adjusted by year-end, which will keep monthly inflation near 3.0% in the coming months. Once these tariffs are readjusted, we foresee monthly inflation moving downward to around the 2.0% level, which accumulating for 12 months means an annual inflation of around 26%.

The Argentine government has stated that if inflation continues to fall, they intend to change the pace of the crawling peg to a 1% devaluation rather than the current 2% rate. With the gap between the BLUE (parallel exchange rate) and the official exchange rate narrowing, we believe that in approximately 8 months, both rates will converge, allowing the government to unify the multiple exchange rate regimes and cautiously begin lifting capital controls. This would help avoid a major devaluation like the one seen in December 2023. We still see any plan of dollarization of the Argentine economy as very unlikely. It remains to be seen whether the government will reduce the policy rate, which remains fixed at 40%.