Argentina CPI Review: 4.2% only in August

Argentina’s CPI rose 4.2% in August, surpassing market expectations, with Y/Y inflation falling to 236% from 260%. Public service tariff adjustments, particularly in Transport and Housing, were key inflation drivers. Food prices increased 3.5%, while goods CPI grew 3.2%, suggesting a slowing inflation trend. Import tax cuts and a stabilized exchange rate gap between the official and the parallel rate may further ease price pressures. Inflation is expected to decline to 3% monthly, but exchange rate liberalization remains distant due to reserve constraints and potential peso devaluation.

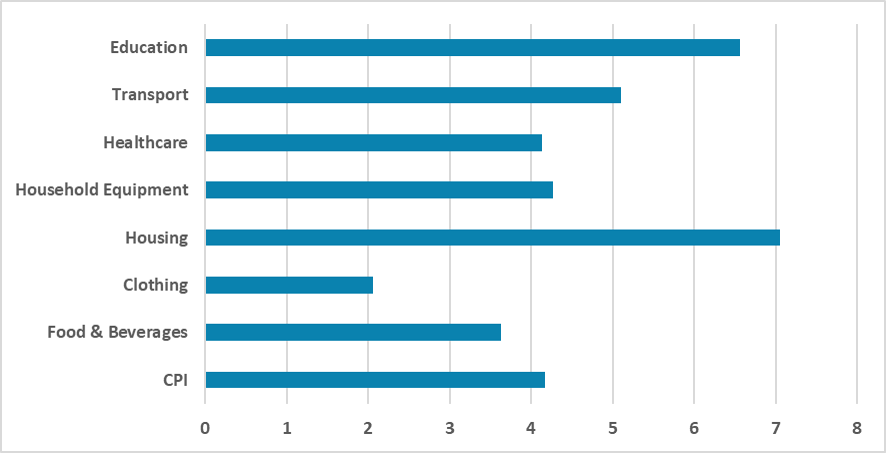

Figure 1: Argentina’s August CPI (m/m, %)

Source: INDEC

The Argentina National Statistics Institute (INDEC) has released the CPI data for August. The data shows that Argentina’s CPI grew 4.2% (m/m), exceeding market expectations (3.9% according to Bloomberg) and government forecasts (4.0%). Consequently, Y/Y inflation fell to 236% from 260% in July, marking four consecutive months of decline, though it remains at a stratospheric level.

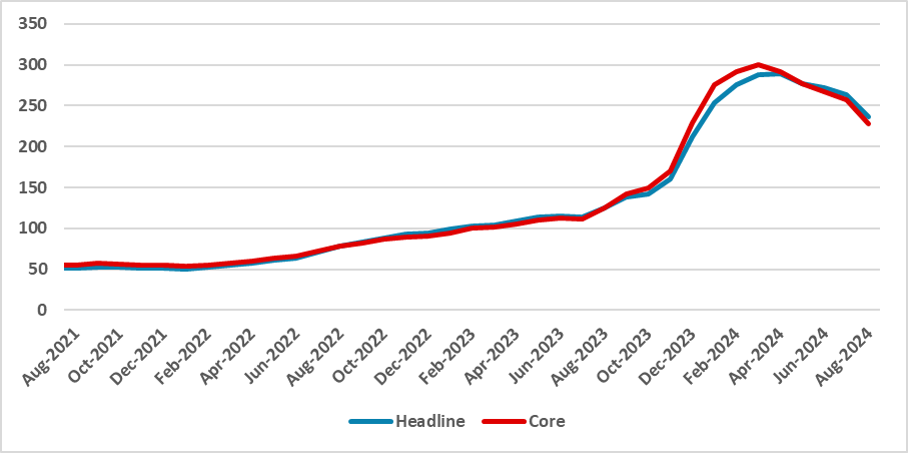

Figure 2: Argentina’s CPI (Y/Y, %)

Source: INDEC

The primary driver of inflation in August was the adjustment of public service tariffs, which impacted both the Transport and Housing groups. The government has been timing these tariff adjustments to maintain the viability of public services while moderating their impact on inflation. Food inflation rose 3.5%, while goods CPI increased by 3.2%, suggesting a slight tendency for inflation to decelerate. The rise in education costs was due to seasonal adjustments in course fees.

There are some key takeaways from this data. Achieving a 2.0% monthly inflation rate, which aligns with the crawling-peg rate of devaluation for the official exchange rate, remains difficult, and whether the government will reach this target is still uncertain. However, there is another perspective to consider. The economy is undergoing a realignment of relative prices, and as the increase of public tariffs approaches yearly inflation, the need to further increase those prices will be restricted. Additionally, a reduction in import taxes (Impuesto País) is expected to place downward pressure on goods prices in September. Moreover, there has been positive news regarding the exchange rate, with the gap between the official exchange rate and the BLUE (parallel) market rate stabilizing around 30%. Indeed, the BLUE has appreciated recently, in response to foreign exchange interventions by the Central Bank of Argentina.

We believe inflation is likely to decline toward 3.0% monthly in the coming months, which could be viewed positively. Liberalizing the exchange rate, which remains a government goal, still appears distant, as it requires a larger level of reserves and an expected 30% devaluation of the Argentine peso. The government is probably betting that local interventions will stabilize the BLUE rate, and that the crawling-peg regime will help narrow the gap, so that when the time comes to unify both rates, the gap will be small enough to avoid a major devaluation.