Argentina: Economy Continues to Shrink

Argentina’s economy contracted by 0.3% in June (m/m), according to INDEC’s monthly activity indicator and, in quarterly terms, it will accumulate three consecutive quarter of contraction. Despite an 80% annual rise in agricultural activity due to base effects, other sectors like construction and industry saw significant drops. The fiscal consolidation plan is driving the recession, but it's deemed necessary to correct macroeconomic imbalances. Despite an improving trade balance, challenges remain in reserve accumulation, and lifting capital controls is unlikely before the second half of 2025.

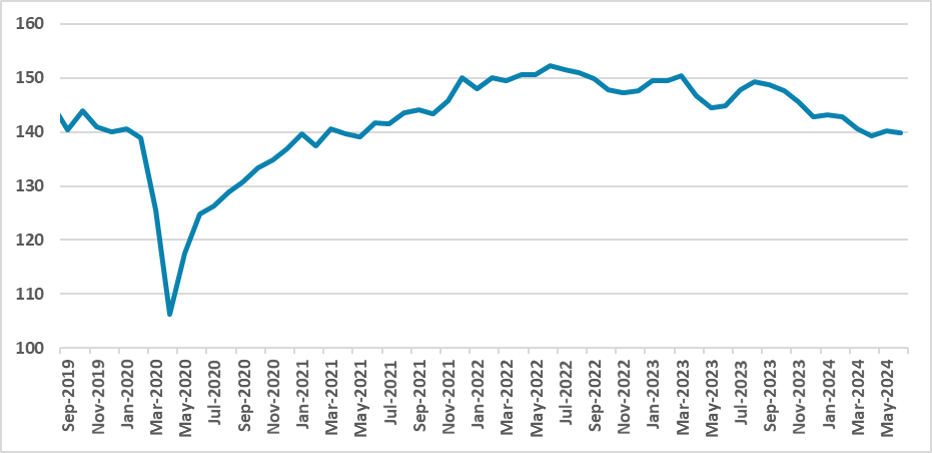

Figure 1: Argentina’s Monthly Activity Index (Seasonally Adjusted)

Source: INDEC

The Argentina Statistics Institute (INDEC) has released its monthly estimate of economic activity for June, completing the three months of Q2. The data shows that economic activity dropped by 0.3% (m/m) in June. In quarterly terms, INDEC estimates that the Argentine economy shrank by around 1.7% during Q2, marking three consecutive quarters of contraction. In the first half of the year alone, Argentina’s economy has contracted by 3.2%.

On an annual basis, only agricultural activities are showing positive signs, as agriculture and hunting activities grew by 80% year-over-year. However, this increase is largely due to base effects, as the agriculture sector faced an enormous drought that severely limited production capacity in 2023. Construction dropped by 23.6%, industry by 20.4%, and retail trade by 18.6%, all compared to June 2023. Overall, Argentina's economy declined by 6.8% year-over-year.

However, this is all part of the ambitious plan of the Milei’s administration, which seeks to correct the many macroeconomic imbalances of the Argentine economy. The significant fiscal consolidation, amounting to around 4% of GDP, is having important multiplicative effects on the economy, leading to this recession. However, that is the price that must be paid to correct the fiscal deficit and close the central bank’s "printing machine." The question that arises now is how long the economy will continue to shrink and whether there will be a rebound in the second half of the year. We still believe that the damage will be quite significant and that the recovery will be somewhat slow.

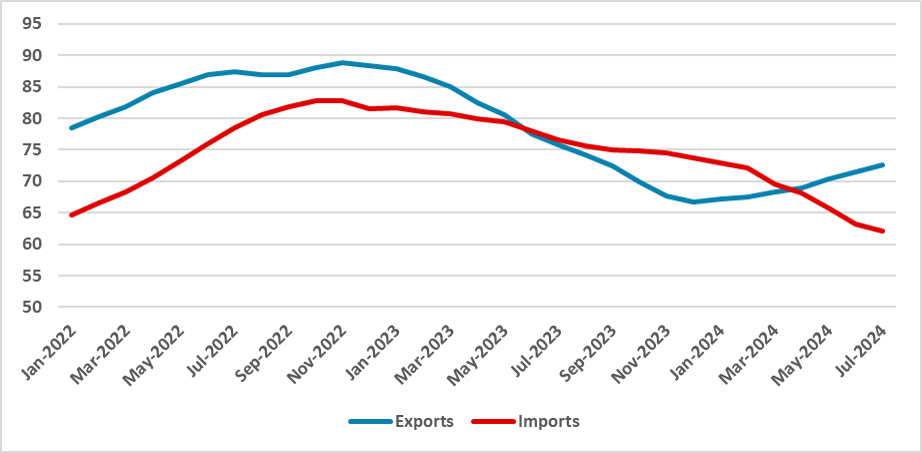

Figure 2: Argentina’s Imports and Exports (USD Bln)

Source: INDEC

On another front, this adjustment significantly reduces internal demand and, as a consequence, reduces imports. With agricultural exports finally recovering from the 2023 crisis, Argentina's trade balance is improving, and we estimate this trend will continue over the second half. However, despite this, the central bank is still facing difficulties in accumulating reserves, which remain at inadequate levels (around USD 27 billion). In recent press conferences, members of the government stated that all debt payments in foreign currencies are guaranteed for the next 12 months. We believe that lifting capital controls is still a distant prospect, and Argentina will likely need to negotiate a new deal with the IMF to manage its foreign reserves. The lifting of capital controls will likely have to wait at least until the second half of 2025.