ASIA

View:

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 20, 2025

Commodities Outlook: Policy Realignment

June 20, 2025 9:30 AM UTC

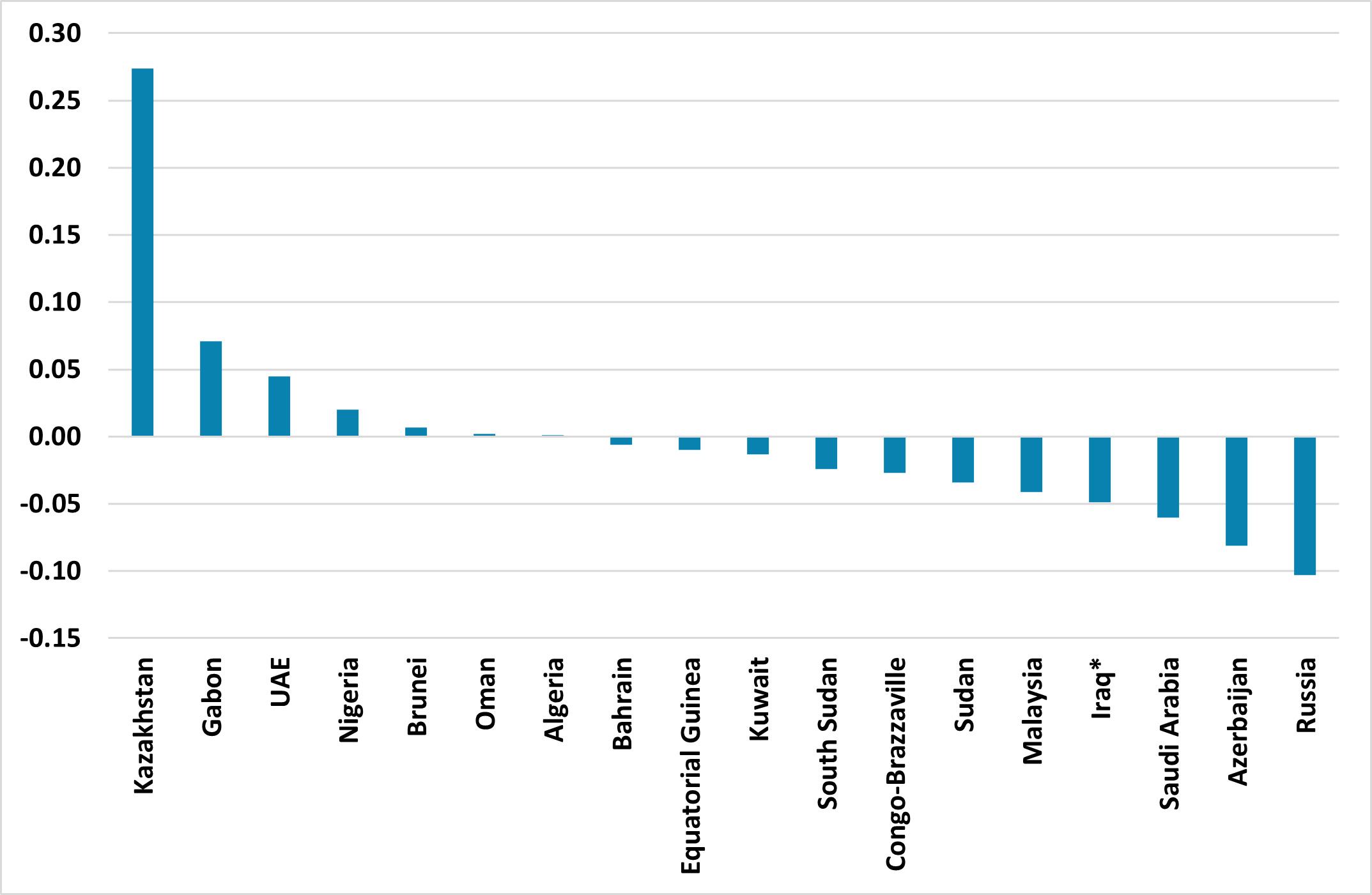

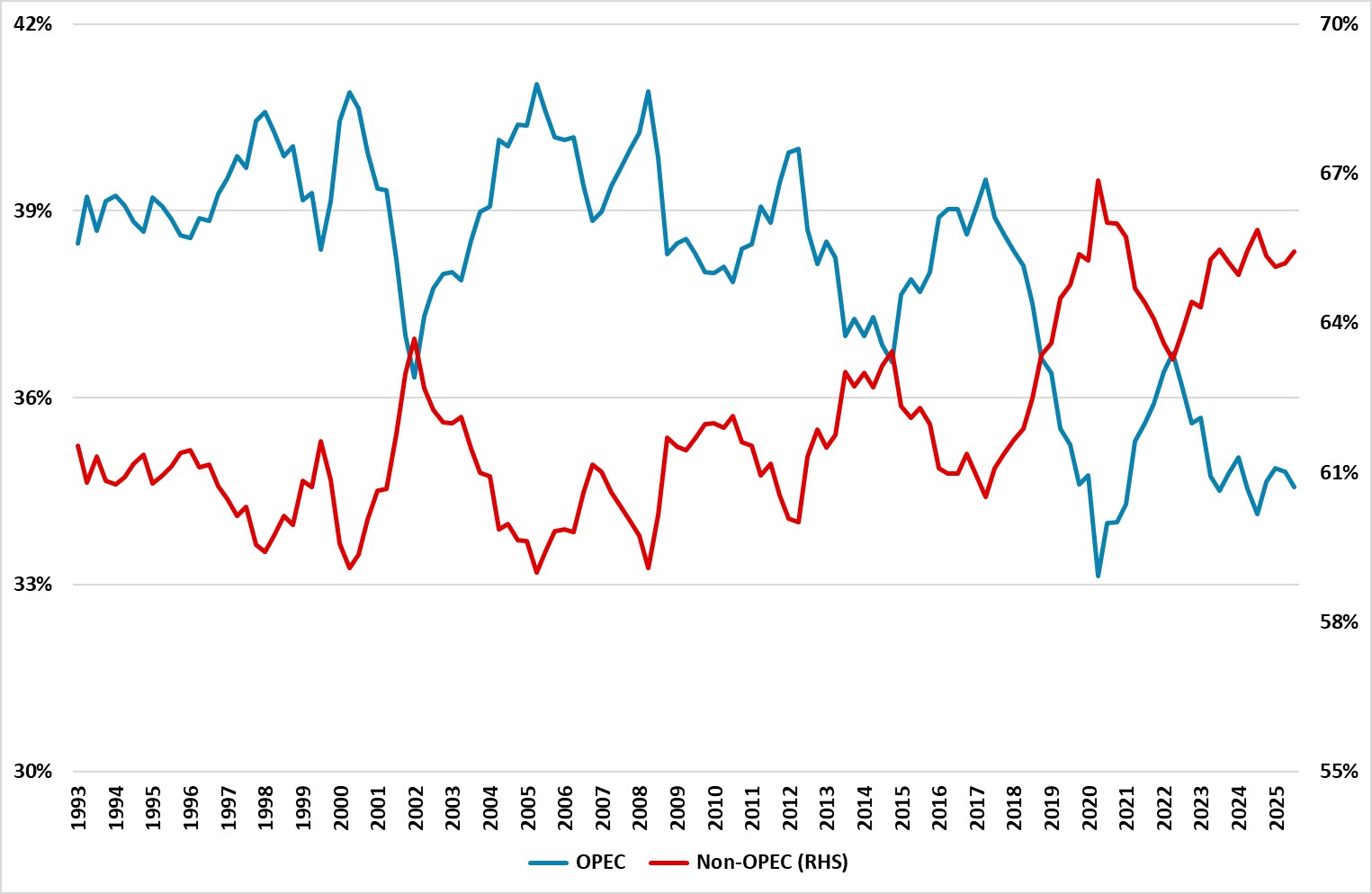

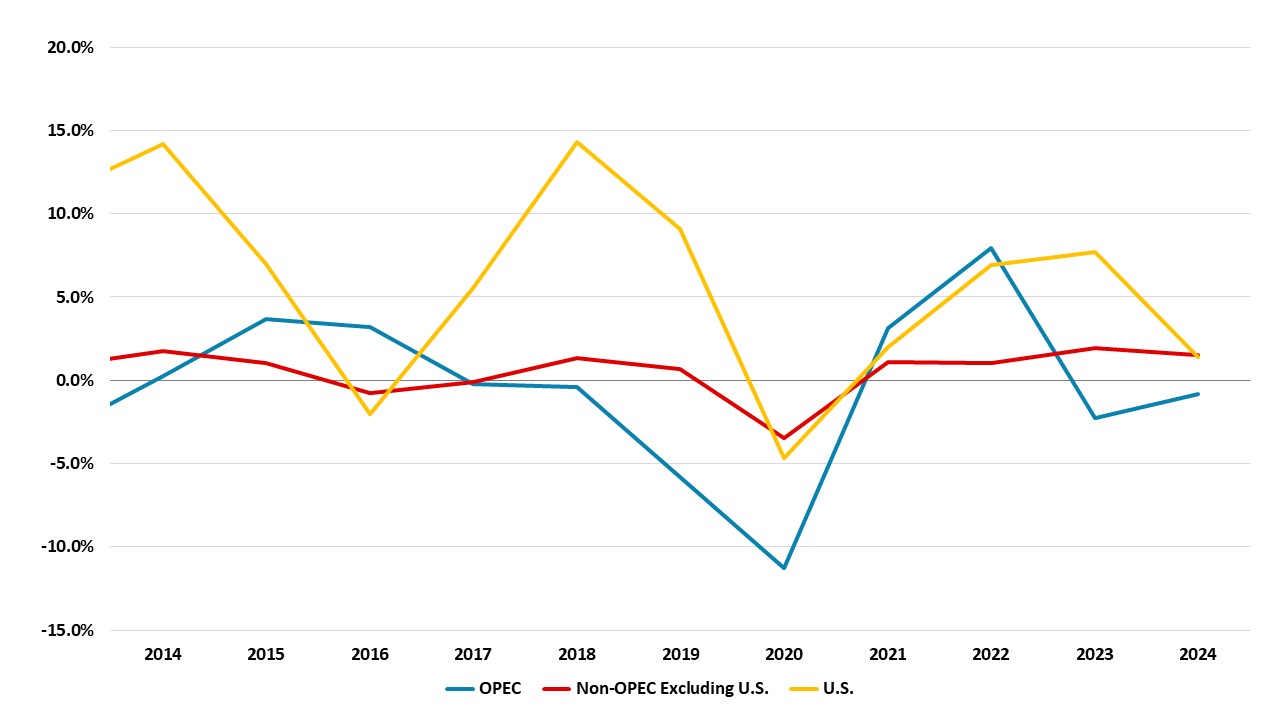

In Q2 2025, eight OPEC+ countries pledged a faster oil supply hike, motivated by market share losses, internal frictions, and geopolitical shifts. However, actual output has fallen short due to overproduction offsets, domestic consumption, and capacity limits. Further gradual increases are expected,

March 27, 2025

March 26, 2025

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

March 24, 2025

Commodities Outlook: Shifting Dynamics

March 24, 2025 11:00 AM UTC

The oil market faces mixed forces, including geopolitical pressures, demand concerns, and supply shifts. OPEC+ plans production hikes, driven by stricter U.S. sanctions on Iran and Russia and President Trump’s push for more supply. However, global demand prospects, especially in the U.S. and China

February 03, 2025

January 13, 2025

Cyberattacks and AI Misinformation: Market and Economic Fallout

January 13, 2025 8:10 AM UTC

A major cyberattack is a tail risk, while a huge AI misinformation crisis is a modest crisis in our view. Russia/China and Iran are less likely to launch a state sponsored cyberattack for geopolitical reasons and also uncertainty over president elect Donald Trump’s response. A huge AI mis

January 06, 2025

Markets 2025: A Tale of Two Halves

January 6, 2025 8:10 AM UTC

· For financial markets, 2025 will likely be a game of two halves. US exceptionalism will likely drive US equities to extend outperformance in H1, while the USD rises further as tariffs (threats and actual) escalate. However, 10yr U.S. Treasury yields will likely push higher in H2, which can

December 30, 2024

December 24, 2024

December Outlook Webinar on Jan 7: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 24, 2024 8:30 AM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 20, 2024

December 19, 2024

Outlook Overview: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 19, 2024 9:25 AM UTC

· The U.S. economy momentum remains reasonable before President elect Trump’s policies impact in 2025 and 2026. While high uncertainty exists on the scale and timing of policies, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 18, 2024

Jan 7 Outlook Webinar: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 18, 2024 1:23 PM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

Commodities Outlook: Strategic Caution

December 18, 2024 11:00 AM UTC

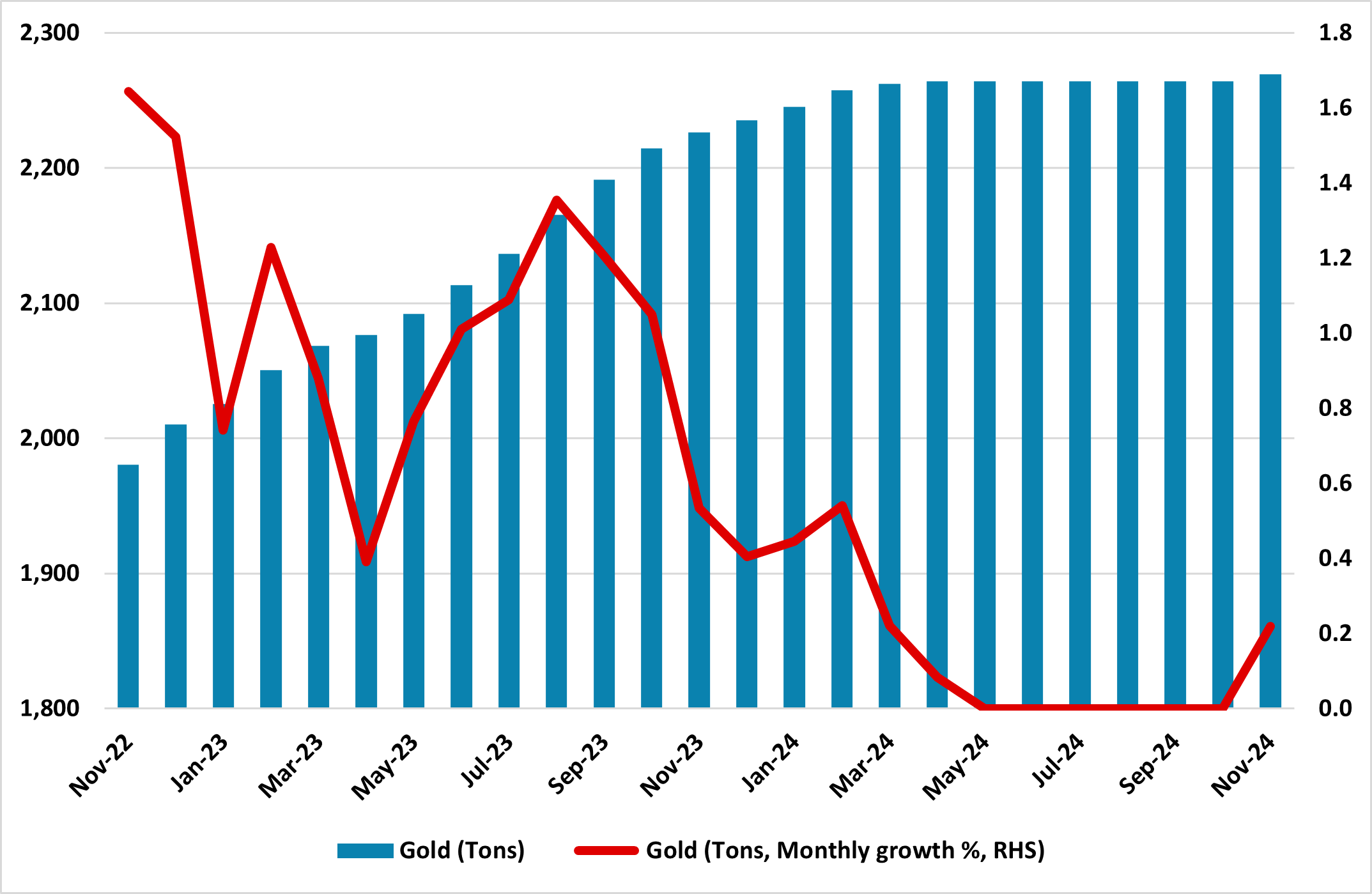

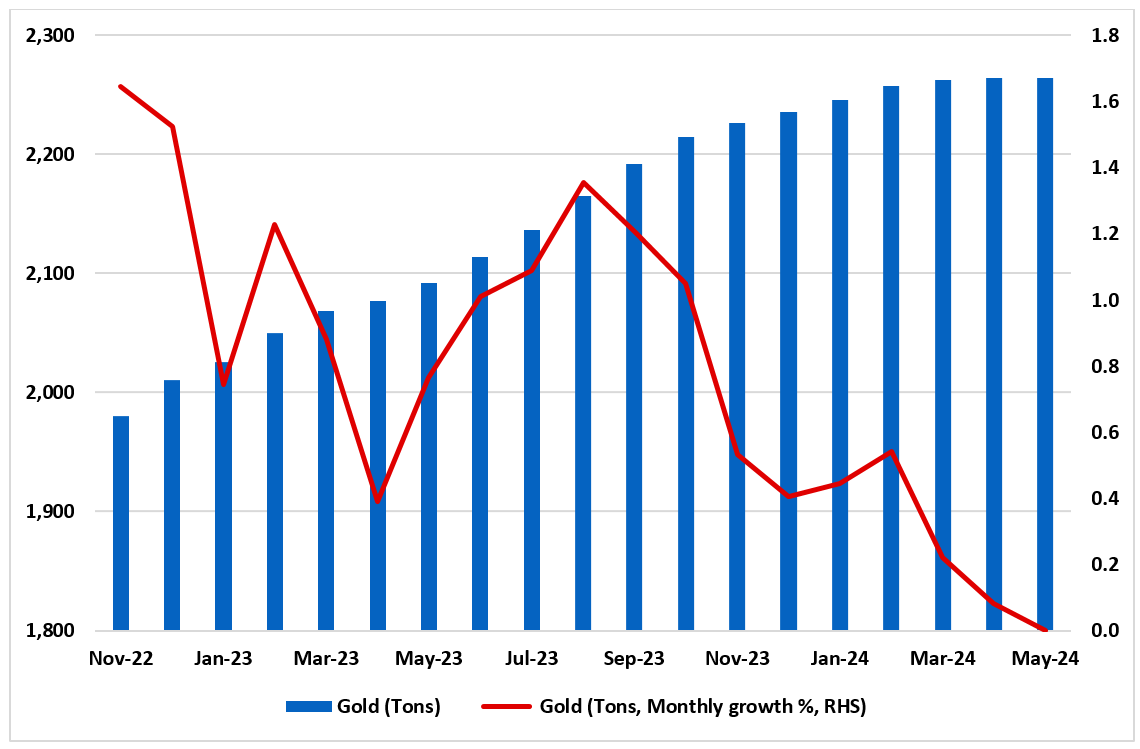

The oil supply outlook depends on OPEC+ policies, with the reversal of the voluntary 2.2 million b/d cuts being officially delayed until April 2025. However, we expect the progressive rollover of these barrels into the market to be further postponed at least until the third quarter of 2025, as the c

October 02, 2024

Markets: Rate Cuts or Geopolitics?

October 2, 2024 9:36 AM UTC

Israel will likely counteract Iran, which will prompt a further missile attack by Iran. However, our bias remains that Israel main aim is to have a buffer zone in southern Lebanon up to the Latani river and not fight a prolonged war with Iran. This limits the economic fallout globally and on oil

September 27, 2024

September 25, 2024

Outlook Overview: Rate Cuts But How Far?

September 25, 2024 7:30 AM UTC

· The U.S. economy is slowing, with the critical question being whether this is a soft or harder landing. Our broad analysis leaves us inclined to the soft landing view into 2025, though we shall watch real sector data closely over the next 3-6 months to check the trajectory. Else

September 23, 2024

Commodities Outlook: Fragile Foundations

September 23, 2024 9:30 AM UTC

Oil prices in the short to medium term will be shaped by demand in China and the U.S. In particular, we expect weak data in China to continue weighting on oil prices in Q4 2024, with limited upside risks from supply-side developments. In 2025, demand growth will likely remain slow in the first half,

September 15, 2024

September 27 Outlook Webinar: Rate Cuts But How Far?

September 15, 2024 11:17 AM UTC

Uncertainty about whether the U.S. economy will have a soft or hard landing is growing as the market approaches Q4. This is shaping the debate regarding the scale of easing through the remainder of 2024 and 2025 by the Fed. European easing is underway, but how much further will central ba

Sep 27 Outlook Webinar: Rate Cuts But How Far?

September 15, 2024 10:30 AM UTC

Uncertainty about whether the U.S. economy will have a soft or hard landing is growing as the market approaches Q4. This is shaping the debate regarding the scale of easing through the remainder of 2024 and 2025 by the Fed. European easing is underway, but how much further will central ba

July 23, 2024

The Aussie Chapter 5: Kiwi, a tale of two cities

July 23, 2024 12:00 AM UTC

In "The Aussie", we will look into the "well-known "correlation among the Aussie and well-known benchmark to give our readers a closer look towards factors that have been affecting the movement of the Australian Dollar. In Chapter 4, we will look into the performance of the Aussie relative to the Ki

June 26, 2024

June 25, 2024

Outlook Overview: Cyclical and Structural Forces

June 25, 2024 10:15 AM UTC

• The global economy is showing signs of healing, as inflation comes back towards targets and growth recovers momentum in some economies. Nevertheless, the cyclical headwind of lagged monetary tightening remains in DM countries, and will likely be one of the forces slowing the U.S. economy

June 20, 2024

Commodities Outlook: Fundamentals Kick In

June 20, 2024 10:00 AM UTC

West Texas Intermediate (WTI) is projected to end 2024 at USD82. We anticipate that the voluntary cuts introduced in November 2023 will likely be reversed during H1 2025 and not in Q4 2024, as initially communicated by OPEC+. The scenario is built on our expectation that demand will not increase suf

May 21, 2024

The Aussie Chapter 4: Chinese Proxy

May 21, 2024 12:00 AM UTC

In "The Aussie", we will look into the "well-known "correlation among the Aussie and well-known benchmark to give our readers a closer look towards factors that have been affecting the movement of the Australian Dollar. In Chapter 4, we will look into the performance of the Aussie relative to the Ch

May 14, 2024

The Aussie Chapter 3: Risk

May 14, 2024 12:00 AM UTC

In "The Aussie", we will look into the "well-known "correlation among the Aussie and well-known benchmark to give our readers a closer look towards factors that have been affecting the movement of the Australian Dollar. In Chapter 3, we will look into the performance of the Aussie against major equi

April 26, 2024

Headwinds To Long-term Global Growth

April 26, 2024 9:30 AM UTC

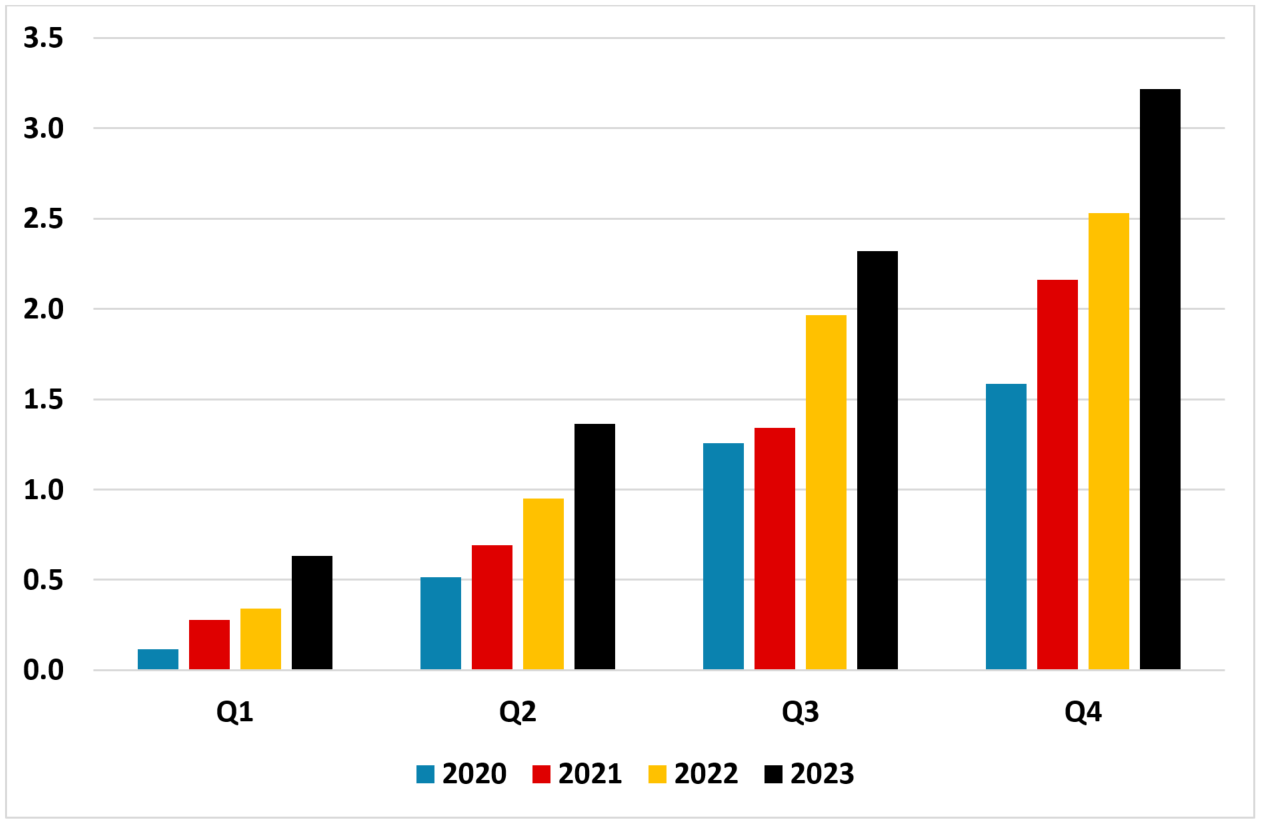

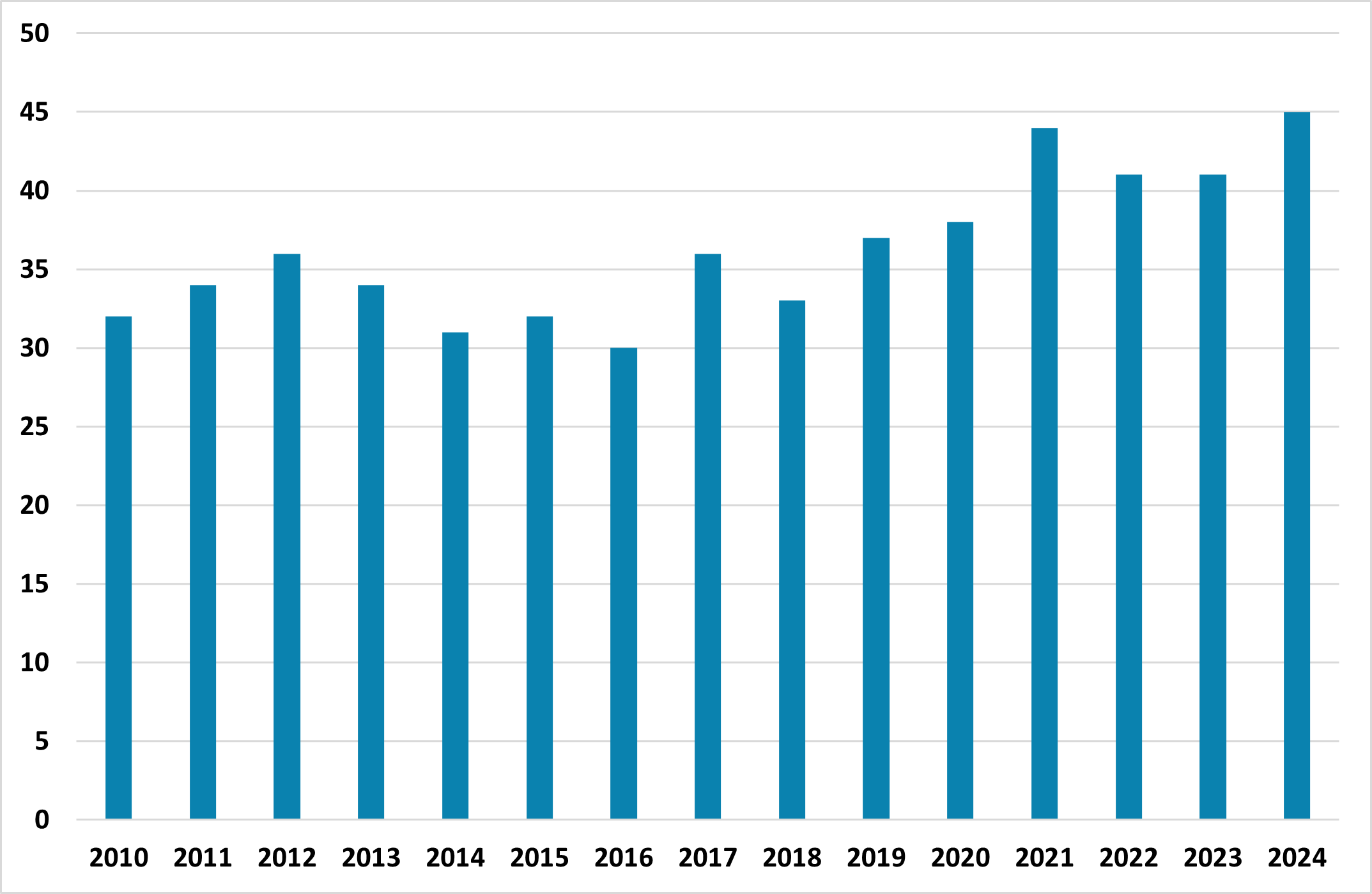

Bottom line: While much focus is on the cyclical economic position to determine 2024 monetary policy prospects, the 2025-28 structural growth trajectory differs to the pre 2020 GDP trajectory for major economies. While global fragmentation has a role to play, aging populations are already having a

April 17, 2024

Markets: Fed Rather Than Middle East Worries

April 17, 2024 12:34 PM UTC

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers

April 03, 2024

April 02, 2024

Asset Allocation: Pausing for Breath

April 2, 2024 9:00 AM UTC

Into Q2, data and policy (actual and perceived) will dominate DM markets. The ECB will likely take the spotlight with a 25bps cut on June 7, as the Fed face a better growth/more fiscal policy expansion and a tighter labor market than the EZ but also with a better productivity backdrop and outlook to

March 27, 2024

March 25, 2024

March 11, 2024

The Aussie Chapter 2: Commodities

March 11, 2024 12:00 AM UTC

In "The Aussie", we will look into the "well-known "correlation among the Aussie and well-known benchmark to give our readers a closer look towards factors that have been affecting the movement of the Australian Dollar. In Chapter 2, we will look into the performance of the Aussie against commoditie

February 26, 2024

The Aussie Chapter 1: Interest Rate and Yields

February 26, 2024 4:27 AM UTC

The Australian Dollar ,"Aussie", has been referred as the commodity currency, risk currency, proxy Yuan by market participants who see correlation between the corresponding benchmark and the Aussie. While they all have sounded reasons to support their perspective, the level of correlation seems to b

January 15, 2024

Taiwan: DPP Weaker than 2020

January 15, 2024 8:49 AM UTC

The DPP have won the Taiwan presidential election. However, the DPP has lost its majority in parliament, while the 3rd party (Taiwan People Party (TPP) are signalling they will not form a coalition with (Kuomintang) KTT. This will restrain the DPP. However, China will still likely show its dis

January 09, 2024

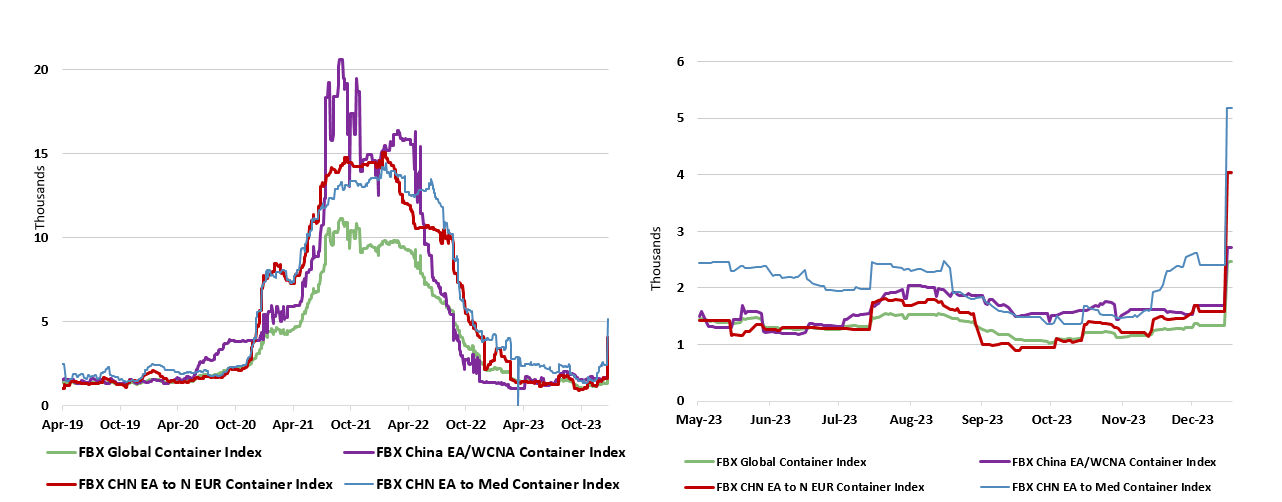

Shipping Freight Cost Jump and Inflation – Some Perspectives

January 9, 2024 2:24 PM UTC

Bottom Line: The attacks on Red Sea shipping have already triggered a marked rise in freight costs, and more broadly than just for the Red Sea route. Thus has led to some worries about the possible fresh upside risks to what have recently been sharply falling CPI inflation rates. These worries a

January 03, 2024

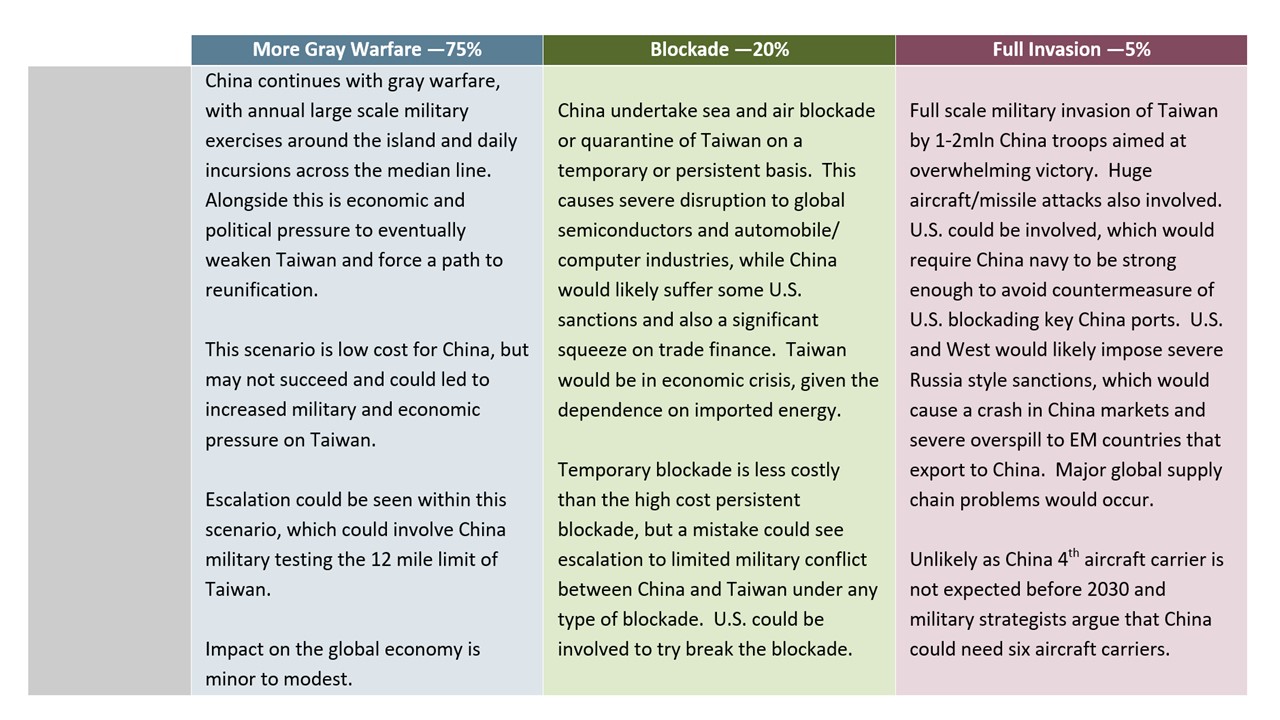

Taiwan: Gray Warfare After A Mixed Election

January 3, 2024 11:02 AM UTC

Bottom line: After the January 2024 Taiwan presidential election, the baseline (75% Figure 1) is for is for a continuation/esculation of the gray warfare before the new president takes power on May 20 and afterwards. This can gradual increase the pressure on Taiwan to move towards a political soluti

AI and Technology Impact on Growth and Inflation

January 3, 2024 10:30 AM UTC

Bottom Line: The full benefits of the latest AI wave will likely not kick in until the late 2020/early 2030’s.However, 5G over the last couple of years has been enabling more connectivity via the Internet of Things and allowing more big data analysis, including AI tools and algorithms. In the 2hal

December 19, 2023

December 15, 2023

RBA: Late to the 2024 Rate Cut Party

December 15, 2023 3:30 PM UTC

We see the RBA staying on holding in H1 2024, even if the Fed and other central banks cut interest rates. The Australian inflation picture means that the RBA has to stay higher for longer. However, with CPI eventually falling further, we do see the 1st 25bps cut from the RBA in Q3 2024.

Commodities Outlook: Economic Forces at Play

December 15, 2023 11:21 AM UTC

• Oil prices in 2024 hinge on OPEC's production policies and global economic growth. We expect the agreed-upon 2.2 million bpd voluntary cuts to be implemented in Q1 2024, most of them extending into Q2 due to weak global growth. With Saudi Arabia supporting the cuts, we assign a 60% likeli