Turkey

View:

September 11, 2025

Easing Cycle Continues: CBRT Reduced the Key Rate to 40.5% on September 11

September 11, 2025 5:17 PM UTC

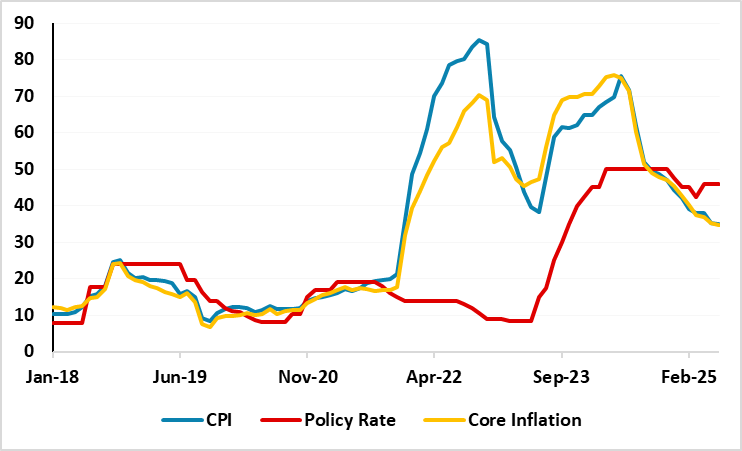

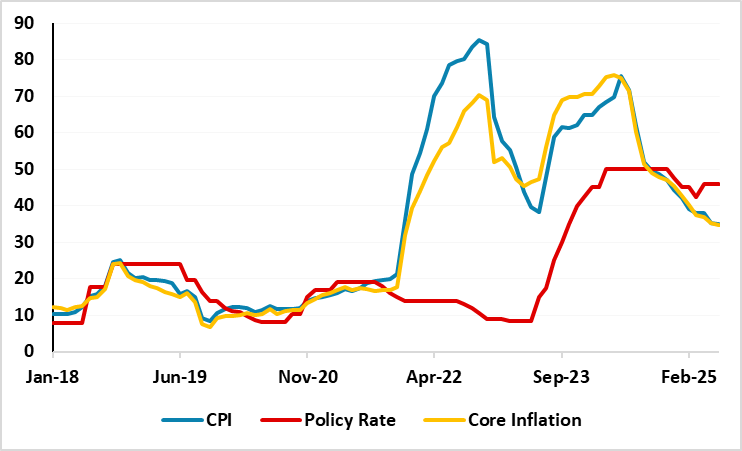

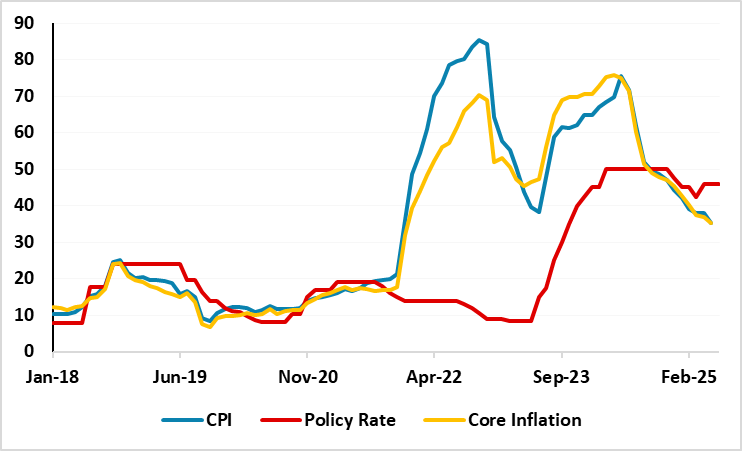

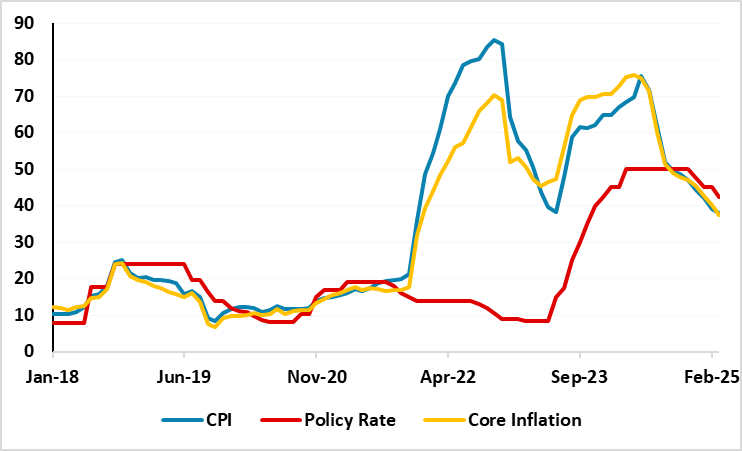

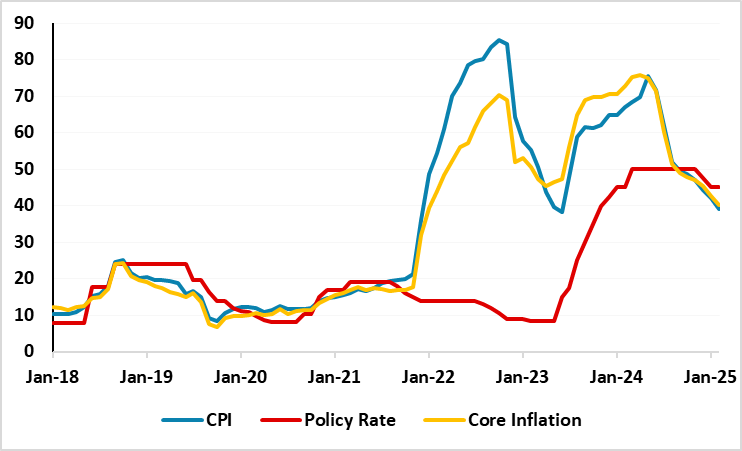

Bottom Line: As we expected, Central Bank of Republic of Turkiye (CBRT) reduced the policy rate by 250 bps to 40.5% during the MPC meeting on September 11 taking moderate fall in inflation and relative TRY stability into account. CBRT highlighted in its written statement that recent data indicate de

September 09, 2025

September 03, 2025

Turkiye’s Inflation Slightly Eased to 32.9% YoY in August... But, Monthly Inflation is Still Over 2.0%

September 3, 2025 4:11 PM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on September 3 that the inflation slightly softened to 32.9% y/y in August from 33.5% y/y in July driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. August figure came in slightly above

September 01, 2025

Hitting Beyond Expectations thanks to Construction Activities: Turkiye’s GDP Growth Rebounded Strong in Q2

September 1, 2025 10:55 AM UTC

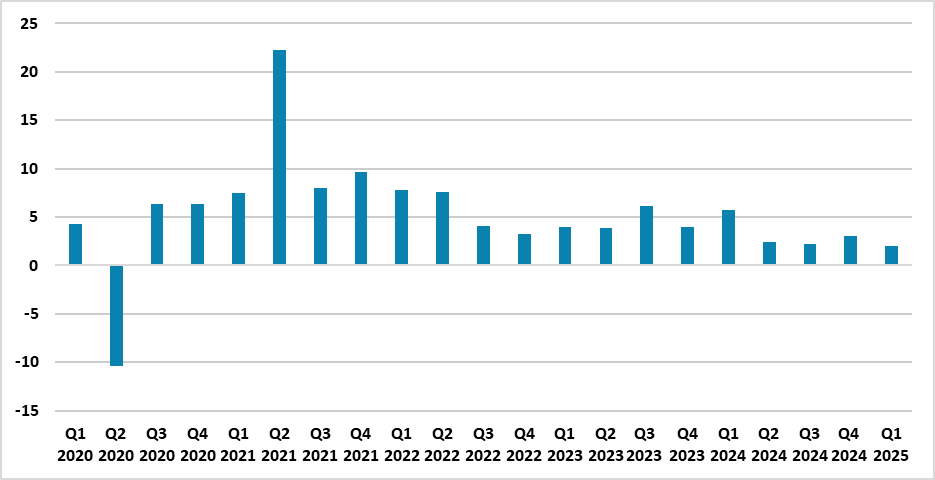

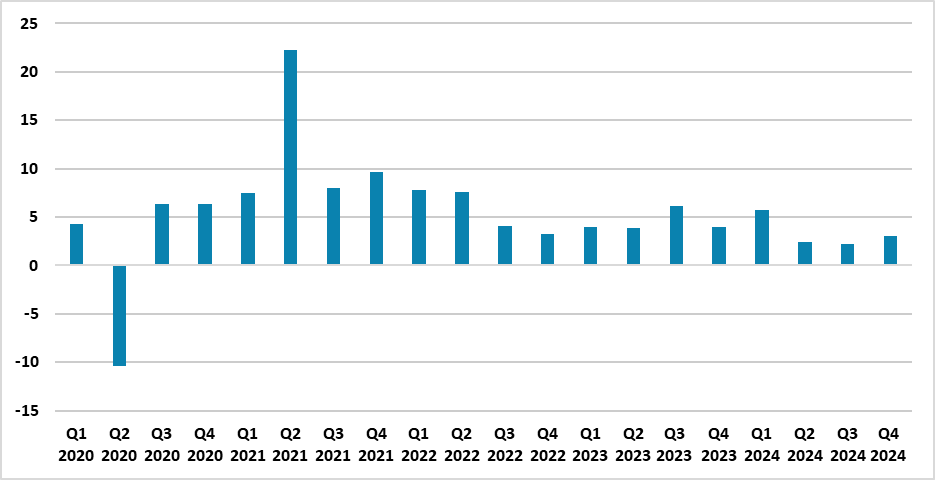

Bottom Line: According to Turkish Statistical Institute’s (TUIK) announcement on September 1, Turkish economy increased by a strong 4.8% YoY despite political turbulence after arrest of Istanbul mayor and opposition’s presidential candidate Ekrem Imamoglu in Q2, prolonged monetary tightening eff

August 26, 2025

Turkiye GDP Growth Preview: Slowdown Will Continue in Q2

August 26, 2025 5:14 PM UTC

Bottom Line: Turkish Statistical Institute (TUIK) will announce Q2 GDP growth on September 1 and we expect that Turkish economy will expand around 1.7% -2.0% YoY backed by private consumption despite early indicators demonstrate a lower acceleration rate in domestic demand amid tightening financial

August 14, 2025

CBRT Kept Its End-Year Inflation Forecast at 24%, and Announced Its New Interim Targets

August 14, 2025 4:01 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released its third quarterly inflation report of the year on August 14, and kept its inflation forecast constant at 24% for 2025, 16% by the end of 2026 and 9% by end-2027. CBRT governor Karahan said the regulator decided to separate the targets from its i

July 30, 2025

Turkiye Inflation will Slightly Soften in July: Tax Adjustments and Gas Price Hike in July Will Limit the Fall

July 30, 2025 8:35 AM UTC

Bottom line: After easing to 35.1% annually in June, we expect Turkiye’s consumer price index (CPI) will continue to soften moderately in July to 34.1%-34.3% as tax adjustments and energy price hikes in July will limit the downward trend. Despite tight monetary policy and moderately falling dema

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

Easing Cycle Restarts: CBRT Reduced the Key Rate to 43% on July 24

July 24, 2025 2:15 PM UTC

Bottom Line: As we expected, Central Bank of Republic of Turkiye (CBRT) reduced the policy rate by 300 bps to 43% during the MPC meeting on July 24 taking the deceleration trend in inflation and relative TRY stability in June into account. CBRT highlighted in its written statement that the underly

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

July 15, 2025

Turkiye MPC Preview: CBRT will Likely Restart its Easing Cycle on July 24

July 15, 2025 12:09 PM UTC

Bottom Line: After Central Bank of Turkiye (CBRT) held its key policy rate stable at 46% on June 19, we believe CBRT will likely reduce the policy rate by 150-250 bps during the MPC meeting scheduled for July 24 considering the deceleration trend in inflation in June beat forecasts and reinforced ex

July 07, 2025

New Probes into Turkiye’s Opposition Party

July 7, 2025 10:34 AM UTC

Bottom Line: After mayor of Istanbul Ekrem Imamoglu got arrested on March 23, political tension remains high in Turkiye, particularly after the Republican People’s Party (CHP) Adana mayor Zeydan Karalar, Antalya mayor Muhittin Bocek and Adiyaman mayor Abdurrahman Tutdere were detained on July 5 fo

July 03, 2025

Turkiye’s Inflation Slightly Eased to 35.1% YoY in June

July 3, 2025 1:00 PM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on July 3 that the inflation softened to 35.1% y/y in June from 35.4% y/y in May driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. Despite moderate fall, inflationary risks remain tilte

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

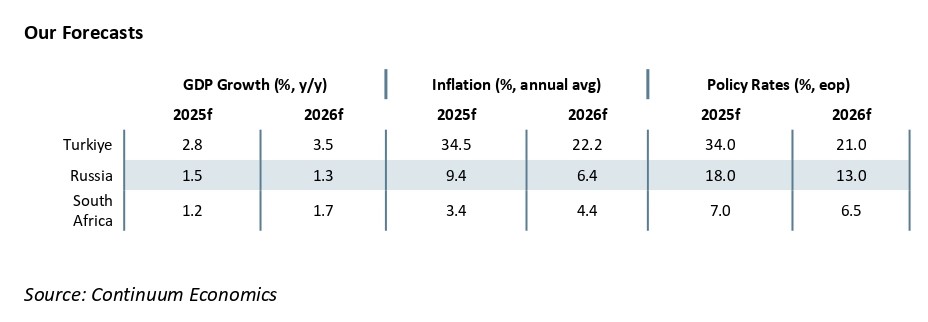

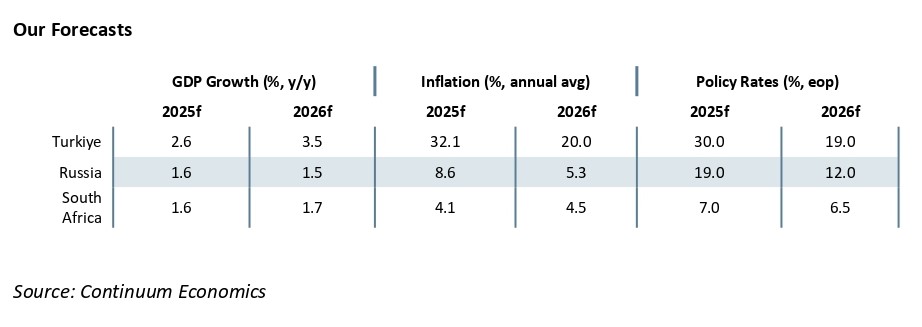

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

June 19, 2025

Hawkish Stance Maintained: CBRT Held the Key Rate Stable at 46% Despite Softening Inflation

June 19, 2025 7:49 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) held the policy rate unchanged at 46% during the MPC on June 19 despite inflation continues to ease. CBRT highlighted in its written statement that the tight monetary stance will be maintained until price stability is achieved via a sustained decline in in

June 03, 2025

Turkiye’s Inflation Eased to the Lowest Since November 2021 with 35.4% YoY in May

June 3, 2025 8:21 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on June 3 that the inflation softened to 35.4% y/y in April from 37.9% y/y in April. We think monetary tightening, fiscal measures and suppressed wages helped relieve the price pressure. Despite this, inflationary risks remain tilted to th

May 30, 2025

Hitting Below Expectations: Turkish GDP Grew by 2.0% YoY in Q1

May 30, 2025 12:38 PM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced on May 30 that Turkish economy expanded by 2.0% in Q1 2025 backed by private consumption. The growth rate hit below expectations due to the weight of high interest rates, sluggish demand abroad causing weakening exports and adverse geopolit

May 23, 2025

Turkiye Inflation Report: CBRT Keeps Its End-Year Inflation Forecast at 24%

May 23, 2025 6:28 AM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released its second quarterly inflation report of the year on May 22, and kept its inflation forecast constant for 2025 at 24%. CBRT governor Karahan signalled to maintain a tight stance until a permanent decline in inflation is sustained and price stabili

May 05, 2025

Annual Inflation Slightly Decreased in April Despite MoM Hit 3.0% Due to High FX Pass Through

May 5, 2025 10:15 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on May 5 that the inflation softened to 37.9% y/y in April from 38.1% y/y in March. We think monetary tightening and suppressed wages helped relieve the price pressure despite hikes in electricity and natural gas prices in April, and curre

April 30, 2025

Turkiye Inflation Preview: CPI is Expected to Slightly Increase in April

April 30, 2025 4:47 PM UTC

Bottom line: After easing to 38.1% annually in March, we expect consumer price index (CPI) will slightly surge to 38.2%-38.3% YoY in April. Despite tight monetary policy and moderately falling demand helped relieving the price pressure in Q1, April inflation will likely stand at higher-than-expect

April 17, 2025

Surprising Move: CBRT Increased the Key Rate to 46%

April 17, 2025 12:32 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) surprisingly hiked the policy rate from 42.5% to 46% during the MPC on April 17 after three consecutive interest rate cuts, mainly due to global uncertainties and domestic inflationary risks. CBRT highlighted in its written statement that the possibility o

April 11, 2025

Strong Consumption Continues to Drive Turkiye's GDP Growth

April 11, 2025 11:14 AM UTC

Bottom Line: Turkish economy expanded by 3.2% YoY in 2024 backed by strong private consumption and robust investments, despite the weight of high interest rates. After Q2 2023, Q4 2024 marked the highest quarterly reading with 1.7% QoQ surge, which stemmed from turnaround in private consumption that

April 07, 2025

EMEA Economies Will Be Tested Amid U.S. Tariff Heat

April 7, 2025 5:29 PM UTC

Bottom Line: The impacts of U.S. additional tariffs announced on April 2 could likely have multifaceted impacts over EMEA countries. Relatively-low 10% tariffs could open new doors for Turkiye to capture a higher global market share if it can act quickly on trade diversification. We foresee the coun

April 03, 2025

Turkiye’s Inflation Slightly Decreased in March

April 3, 2025 6:48 PM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on April 3 that the inflation softened to 38.1% y/y in March from 39.1% y/y in February. We think favourable base effect, lagged impacts of previous tightening, relative Turkish lira (TRY) stability until March 20 and suppressed wages cont

March 28, 2025

Turkish Economy Remains under Pressure after Mayor of Istanbul Arrest

March 28, 2025 11:06 AM UTC

Bottom Line: After mayor of Istanbul, Ekrem Imamoglu, arrested on March 23 due to fraud allegations, nationwide protests continue in Turkiye and Turkish economy remains under pressure despite a recent recovery after Treasury and Finance Minister Simsek vowed to restore stability, and Central Bank of

March 27, 2025

March 26, 2025

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

EMFX Outlook: Divergence versus the USD

March 26, 2025 9:16 AM UTC

EM currencies will be helped by the ongoing USD downtrend against DM currencies, but prospects also depend on relative inflation differentials versus the USD and starting point in terms of valuations. The Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR) should all make modest s

March 25, 2025

EMEA Outlook: Mixed Prospects Due to Global Uncertainties and Domestic Dynamics

March 25, 2025 7:00 AM UTC

· In South Africa, we foresee average headline inflation will stand at 4.1% and 4.5% in 2025 and 2026, respectively, despite there are upside risks to inflation such as remaining power cuts (loadshedding), tariff hikes by Eskom, spike in food and housing prices, and global uncertainties. We

March 06, 2025

Third Straight Cut: CBRT Reduced the Key Rate to 42.5%

March 6, 2025 12:08 PM UTC

Bottom Line: After inflation softened more-than-expectations to 39.1% in February, the lowest in 20 months, the easing cycle continued on March 6 as Central Bank of Turkiye (CBRT) reduced the policy rate by 250 bps to 42.5%. The decision was supported by domestic demand remaining at disinflationary

March 03, 2025

Turkiye’s Inflation Decelerated More Than Expectations in February, Now Below 40% YoY

March 3, 2025 11:14 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on March 3 that the inflation softened to 39.1% y/y in February from 42.1% y/y in January. We think lagged impacts of previous tightening, relative Turkish lira (TRY) stability, and less-than-expected hike in minimum wage in January contin

February 28, 2025

As Predicted, Turkiye's 2024 GDP Growth Hit 3.2% YoY

February 28, 2025 12:03 PM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced on February 28 that Turkish economy expanded by 3.0% in Q4 2024, and 3.2% YoY in full-year 2024, backed by accelerated private consumption and robust investments, despite the weight of high interest rates.

February 10, 2025

CBRT Increased Its End-Year Inflation Forecast from 21% to 24%

February 10, 2025 3:08 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released its first quarterly inflation report of the year on February 7, and revised its inflation forecast for 2025. CBRT now projects that inflation will stand at 24% at the end of 2025, 12% next year and 8% in 2027. CBRT governor Karahan said the revisi

February 03, 2025

Turkish Inflation Continued to Decelerate in January

February 3, 2025 8:19 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on February 3 that consumer price index (CPI) softened to 42.1% y/y in January with education, health, and housing prices leading the rise in the index. We think lagged impacts of previous tightening, relative Turkish lira (TRY) stability,

January 29, 2025

Turkiye Inflation Preview: CPI is Expected to Continue Decelerating in January

January 29, 2025 1:24 PM UTC

Bottom line: After easing to 44.4% annually in December, we expect consumer price index (CPI) to cool further down to 41-42% y/y in January, which will be announced on February 3. We think lagged impacts of monetary tightening, relative Turkish lira (TRY) stability, and less-than expected hike in

January 23, 2025

As Expected, CBRT Continued its Easing Cycle on January 23

January 23, 2025 12:06 PM UTC

Bottom Line: After Central Bank of Turkiye (CBRT) lowered its key policy rate to 47.5% on December 26, the easing cycle continued on January 23 as CBRT reduced the policy rate by 250 bps to 45% backed by the deceleration trend in inflation continued in December, monthly inflation stood below expecta

January 16, 2025

Turkiye MPC Preview: CBRT will Likely Continue its Easing Cycle on January 23

January 16, 2025 3:09 PM UTC

Bottom Line: After Central Bank of Turkiye (CBRT) lowered its key policy rate by 250 bps to 47.5% on December 26, we believe the rate cuts will continue during the MPC meeting scheduled for January 23. CBRT will likely reduce the policy rate by 250 bps to 45% as the deceleration trend in inflation c

January 13, 2025

Cyberattacks and AI Misinformation: Market and Economic Fallout

January 13, 2025 8:10 AM UTC

A major cyberattack is a tail risk, while a huge AI misinformation crisis is a modest crisis in our view. Russia/China and Iran are less likely to launch a state sponsored cyberattack for geopolitical reasons and also uncertainty over president elect Donald Trump’s response. A huge AI mis

January 10, 2025

Unemployment Rate Hits 8.6% in November in Turkiye

January 10, 2025 4:38 PM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) figures announced on January 10, the unemployment rate declined to 8.6% in November from 8.7% in October. The number of jobless dropped 84,000 from October to 3.07 million in November, the data showed. As unemployment rate continue

January 08, 2025

2025 will be Key for CBRT

January 8, 2025 3:06 PM UTC

Bottom Line: After Central Bank of Turkiye (CBRT) lowered its key policy rate by 250 bps to 47.5% on December 26, which was the first rate cut in around two years, we believe the rate cuts will continue in 2025 following inflation fighting drive in 2024 while our end year key rate prediction remains

January 03, 2025

Inflation Falls More Than Expectations in December: 44.4% YoY

January 3, 2025 11:34 AM UTC

Bottom line: Inflation fell more than expected to 44.4% annually in November supported by benign food prices and relative TRY stability. We envisage that inflation will continue to decelerate in Q1 2025 by moderate slowdown in domestic demand and credit growth, and will likely be helped by lower-t

December 30, 2024

December 26, 2024

First Cut Since 2023: CBRT Lowered Key Rate to 47.5%

December 26, 2024 3:14 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) lowered its key policy rate by 250 bps to 47.5% on December 26 which was the first rate cut in around two years, but said it would remain cautious about future cuts. In its press release, CBRT cited a flat underlying trend of inflation in November and sugg

December 24, 2024

December Outlook Webinar on Jan 7: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 24, 2024 8:30 AM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats