Scenario Analysis

View:

September 23, 2025

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

March 27, 2025

March 26, 2025

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

March 25, 2025

DM Rates Outlook: Policy Divergence

March 25, 2025 9:30 AM UTC

• 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias. 10yr U.S. Treasury yields can be helped by this easing and see a move down through 2025. However, the budget deficit will likely be 6.5-7.0%

January 13, 2025

Cyberattacks and AI Misinformation: Market and Economic Fallout

January 13, 2025 8:10 AM UTC

A major cyberattack is a tail risk, while a huge AI misinformation crisis is a modest crisis in our view. Russia/China and Iran are less likely to launch a state sponsored cyberattack for geopolitical reasons and also uncertainty over president elect Donald Trump’s response. A huge AI mis

January 06, 2025

Markets 2025: A Tale of Two Halves

January 6, 2025 8:10 AM UTC

· For financial markets, 2025 will likely be a game of two halves. US exceptionalism will likely drive US equities to extend outperformance in H1, while the USD rises further as tariffs (threats and actual) escalate. However, 10yr U.S. Treasury yields will likely push higher in H2, which can

December 30, 2024

December 24, 2024

December Outlook Webinar on Jan 7: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 24, 2024 8:30 AM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 20, 2024

December 19, 2024

DM Rates Outlook: Policy and Spread Divergence

December 19, 2024 12:07 PM UTC

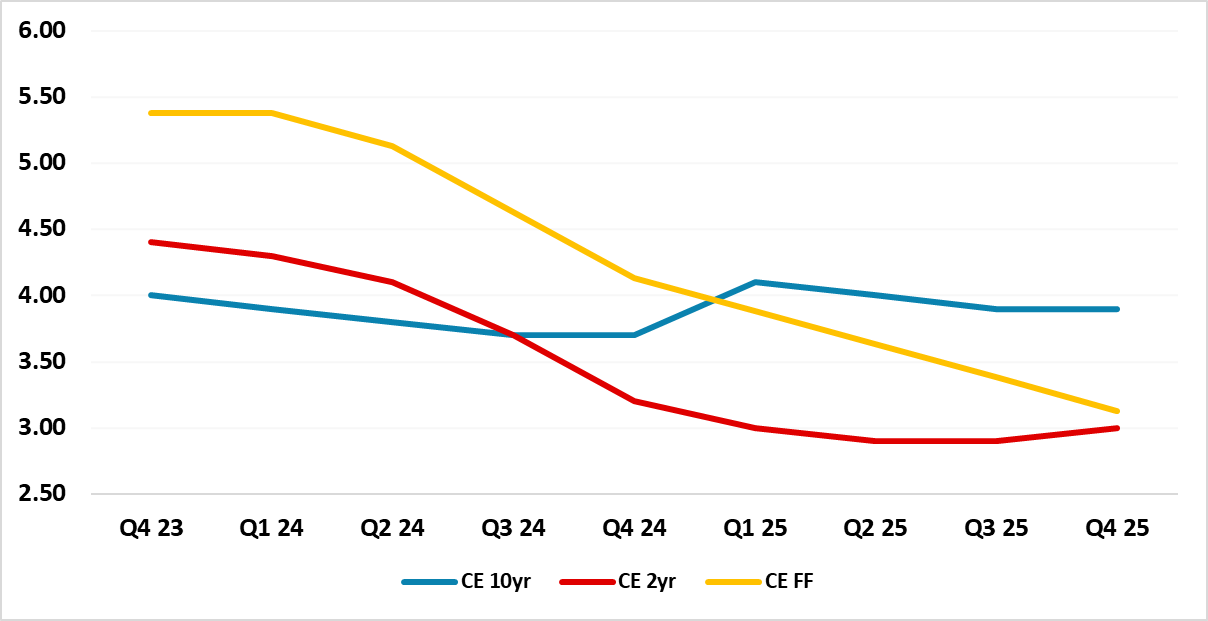

• 2yr U.S. Treasury yields can decline initially as the Fed finishes easing (Figure 1), but as the sense grows that the rate cut cycle is stopping, we see the 2yr swinging to a small premium versus the Fed Funds rate – as the market debates the risks of a future tightening cycle. For 10y

Outlook Overview: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 19, 2024 9:25 AM UTC

· The U.S. economy momentum remains reasonable before President elect Trump’s policies impact in 2025 and 2026. While high uncertainty exists on the scale and timing of policies, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 18, 2024

Jan 7 Outlook Webinar: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 18, 2024 1:23 PM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

October 02, 2024

Markets: Rate Cuts or Geopolitics?

October 2, 2024 9:36 AM UTC

Israel will likely counteract Iran, which will prompt a further missile attack by Iran. However, our bias remains that Israel main aim is to have a buffer zone in southern Lebanon up to the Latani river and not fight a prolonged war with Iran. This limits the economic fallout globally and on oil

September 25, 2024

Outlook Overview: Rate Cuts But How Far?

September 25, 2024 7:30 AM UTC

· The U.S. economy is slowing, with the critical question being whether this is a soft or harder landing. Our broad analysis leaves us inclined to the soft landing view into 2025, though we shall watch real sector data closely over the next 3-6 months to check the trajectory. Else

September 24, 2024

DM Rates Outlook: Rate Cuts Arrive Except Japan

September 24, 2024 9:00 AM UTC

• For U.S. Treasuries, we see 2yr yields coming down further on our baseline soft landing view, as the Fed moves consistently to a 3.00-3.25% Fed Funds rate. However, with considerable Fed easing already discounted, 2yr yield decline should be modest and 2yr yields should bottom mid-2025. 1

September 15, 2024

Sep 27 Outlook Webinar: Rate Cuts But How Far?

September 15, 2024 10:30 AM UTC

Uncertainty about whether the U.S. economy will have a soft or hard landing is growing as the market approaches Q4. This is shaping the debate regarding the scale of easing through the remainder of 2024 and 2025 by the Fed. European easing is underway, but how much further will central ba

July 12, 2024

EZ and UK Government Bonds: Decoupling From the U.S.?

July 12, 2024 9:37 AM UTC

Different economic and inflation dynamics, plus no constraint from trade weighted exchange rates, means that the ECB and BOE can cut irrespective of the Fed in the coming quarters. This can see 2yr yields decline, though less so in Germany where a 2.5% ECB depo rate is already discounted. 10yr y

June 25, 2024

Outlook Overview: Cyclical and Structural Forces

June 25, 2024 10:15 AM UTC

• The global economy is showing signs of healing, as inflation comes back towards targets and growth recovers momentum in some economies. Nevertheless, the cyclical headwind of lagged monetary tightening remains in DM countries, and will likely be one of the forces slowing the U.S. economy

June 24, 2024

DM Rates Outlook: Rate Cuts Arrive Except Japan

June 24, 2024 8:45 AM UTC

• For U.S. Treasuries we see a steady easing process from the Fed from September, which can allow 2yr yields to fall consistently. However, the decline in H2 2024 will be slower at the long-end from traditional yield curve steepening pressures and then we see fiscal stress in H1 2025 unde

March 25, 2024

March 22, 2024

November 29, 2023

Brazil: The 0% Deficit Tale is About to be Forgotten

November 29, 2023 7:47 PM UTC

Despite Finance Minister Fernando Haddad's initial vision of achieving a 0% deficit by 2024 through the New Fiscal Framework, current projections reveal an unattainable target due to limited revenue growth. Expenditures, fueled by investments and social transfers, persistently rise, and factors like

November 24, 2023

LatAm: Long Term Growth Differences

November 24, 2023 11:52 AM UTC

In Latin America, distinctive long-term growth patterns are emerging. Brazil faces challenges of an aging population and constrained capital growth, aiming to return to pre-pandemic growth at 1.7%. Mexico anticipates growth through nearshoring, intensifying existing industries for a 2% long-term pro

March 21, 2023

War in Ukraine: Turning to Stalemate

March 21, 2023 2:58 PM UTC

Russia’s failure to gather sufficient forces for a spring major offensive in Ukraine is an indication that attacks into Ukraine may have reached culmination without the realization of a significant offensive. An increasing fiscal burden on Russia and absence of meaningful support from China along