India

View:

October 02, 2025

RBI Holds Rates, Balances Growth Optimism with Global Risks

October 2, 2025 6:09 AM UTC

The RBI held the repo rate at 5.5% in its October review, keeping policy neutral after 100 bps of cuts earlier this year. Inflation was sharply revised down to 2.6% in FY26, while growth was upgraded to 6.8%, reflecting resilient domestic demand. The decision reflects a strategy of stability—pausi

October 01, 2025

AI/Humanoid Robots and Disinflation?

October 1, 2025 9:40 AM UTC

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year

September 30, 2025

Trump Tariffs: China, Mexico and Semiconductors

September 30, 2025 8:00 AM UTC

· Our baseline (60% probability) remains that a U.S./China trade deal will be agreed in Q4/Q1 2026 and it is possible though unlikely that this could be announced at the Trump/Xi meeting at the October 31 APEC summit – China requests that the U.S. changes policy on Taiwan could slo

September 29, 2025

RBI Likely to Hold Rates, Watchful of Tariffs and Festive Demand

September 29, 2025 6:57 AM UTC

The RBI is expected to keep the repo rate unchanged at 5.5% in its October review, pausing after three consecutive cuts earlier this year. With inflation undershooting and GST rationalisation set to push CPI lower, policymakers see little need for immediate action. The central bank will instead wait

September 26, 2025

September 25, 2025

September 23, 2025

Asia/Pacific (ex-China/Japan) Outlook: Balancing Moderation with Resilience

September 23, 2025 11:22 AM UTC

· Asia’s growth trajectory in 2026 reflects regional resilience under strain. Investment-led economies like India and Malaysia are sustaining momentum via infrastructure push, public capex, and digital industrial policy, while Indonesia’s outlook is clouded by fiscal recalibration a

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

Equities Outlook: Correction Then Up In 2026

September 23, 2025 7:15 AM UTC

• The U.S. equity market’s bullishness reflects good corporate earnings reality, buybacks and the AI story. However, we feel that the U.S. economy can deteriorate still further in the coming months, as the lagged effects of tariffs boost inflation and restrain spending/hurt corporate ea

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 08, 2025

New GST Slabs to Boost Demand as India Faces 50% US Tariffs

September 8, 2025 6:45 AM UTC

India’s landmark GST 2.0 reform, effective 22 September 2025, simplifies slabs to 5% and 18%, with a 40% rate for sin goods. By easing prices on essentials and mid-market products, the move aims to boost demand and partially offset the drag from US tariffs of 50% on Indian exports. While household

Modi in China: Eurasian Diplomacy Meets US Tariff Tensions

September 8, 2025 6:02 AM UTC

Prime Minister Modi’s visit to Tianjin for the SCO Summit underscored India’s pursuit of strategic autonomy—engaging China and Russia while reaffirming ties with the US. Publicly, India backed Eurasian financial and connectivity initiatives, while tactically reopening dialogue with Beijing. Fo

September 04, 2025

September 02, 2025

India GDP Review: Public Spending and Services Lift India’s Growth to Five-Quarter High

September 2, 2025 6:45 AM UTC

India’s economy grew 7.8% y/y in Q1 FY25, beating expectations. Strong gains in construction, services, and agriculture underpinned the recovery, while private consumption and investment remained subdued. However, sustaining momentum in FY26 will hinge on broad-based demand and improving global co

September 01, 2025

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 29, 2025

India GDP Preview: Q1FY26 Growth - Services Surge, Industry Slows: India’s Uneven Q1 Recovery

August 29, 2025 4:49 AM UTC

India’s economy likely grew 6.6% yr/yr in Q1 FY26, down from 7.4% in the previous quarter, as weak private investment and soft industrial output offset robust government spending. Growth was buoyed by strong public capex and resilient services, while manufacturing lagged. Full-year GDP is forecast

August 25, 2025

Tariffs and Tensions: India–US Trade Talks Stalled as Relations Sour

August 25, 2025 6:25 AM UTC

India–US relations have entered a tense phase after Washington doubled tariffs on Indian exports to 50%, the steepest duties applied to any US trading partner. The move, tied to India’s record Russian oil imports, has derailed trade talks scheduled for late August. With USD 87bn in exports at ri

August 13, 2025

India CPI Review: Headline inflation drops sharply on account of food prices

August 13, 2025 7:38 AM UTC

India’s retail inflation fell to 1.55% yr/yr in July 2025, its lowest since 2017 and below the RBI’s 2–6% target band for the first time in over six years. The drop was driven by a sharp contraction in food prices, even as edible oil and fruit inflation remained elevated. With inflation well b

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

August 06, 2025

No Rush to Ease: RBI Flags External Risks, Holds Policy Steady

August 6, 2025 4:39 PM UTC

The RBI held the policy rate at 5.5% in its August 2025 meeting, opting for a strategic pause after front-loading 100bps of cuts earlier this year. While inflation has dropped sharply, global trade risks and sticky core prices argue against further easing for now. The central bank’s neutral stance

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

Tariffs and Tensions: India Holds Its Ground Amid US Pressure

August 4, 2025 5:17 AM UTC

India has responded firmly to US tariff escalation, defending its strategic autonomy on Russian oil and domestic market protections. The economic hit is manageable, but the geopolitical signal is clear: India won’t yield under pressure. Talks will continue, but New Delhi won’t trade core interes

RBI to Hold in August as Policy Cycle Enters Pause Phase

August 4, 2025 4:00 AM UTC

The upcoming RBI August meeting is not about action, but observation. With macro indicators largely aligned and risks tilting toward caution, a rate hold by the RBI is expected. Inflation remains subdued, but growth is resilient—requiring no immediate policy move

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

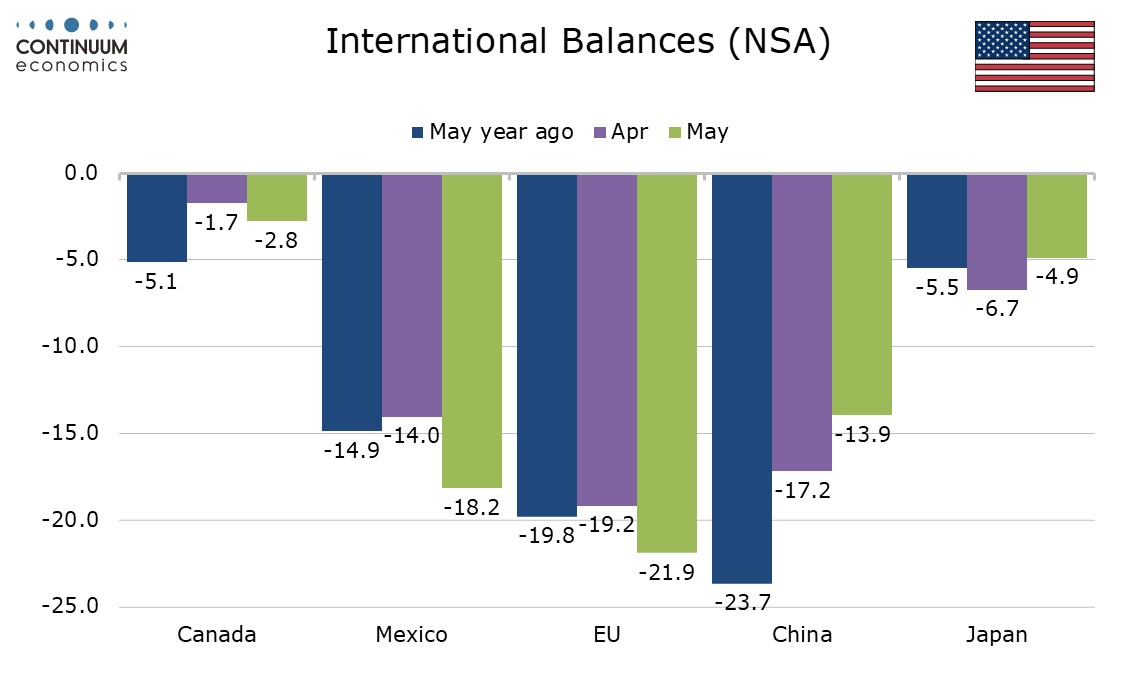

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

The India–UK Free Trade Agreement: Big Win or Big Gamble?

July 28, 2025 4:37 AM UTC

India and the UK have signed a landmark Free Trade Agreement aimed at doubling bilateral trade by 2030. The deal grants India near-total duty-free access for its goods, boosts prospects for agriculture, textiles, and services, and safeguards sensitive sectors. It also signals New Delhi’s evolving

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

No Deal Yet: India–US Trade Talks Stretch Beyond August Deadline

July 24, 2025 5:42 AM UTC

India and the US have made progress in negotiations for an interim trade deal, but key sticking points—particularly around agriculture and autos—remain unresolved ahead of the August 1 deadline for new US tariffs. President Trump’s tariff-first strategy has pushed India to seek partial relief,

July 23, 2025

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

July 15, 2025

Solid Buffers, Soft Spots: India’s Debt Metrics in Focus

July 15, 2025 12:00 PM UTC

India’s fiscal metrics for FY26 show strong early gains, with a sharply lower deficit and robust revenue support from RBI dividends and capital spending. Externally, the country’s debt levels have risen but remain manageable, backed by healthy reserves and a low debt-to-GDP ratio. However, short

India CPI Review: CPI at 2.1%: Increased Headroom for One More Cut

July 15, 2025 4:33 AM UTC

India’s retail inflation dropped to a six-year low of 2.82% in May, driven by easing food prices and supported by favourable base effects. While disinflation continues to create monetary space, RBI's next rate cut will be data driven.

July 14, 2025

Tariffs: Seeking a Trigger for the TACO Trade

July 14, 2025 4:28 PM UTC

It has been fairly clear for some time that 10% represented a likely floor for the eventual Trump tariff regime. However, expectations that Trump would not be willing to go dramatically above that are being tested. A rate in the mid-teens still looks the most likely outcome, as the economic damage t

July 11, 2025

Negotiating the Fine Print: India’s Calculated Stance in US Tariff Talks

July 11, 2025 7:29 AM UTC

India and US continue to negotiate a favourable deal with August 1 as a firm deadline. India will remain unwilling to compromise on key sectors such as agriculture and dairy but concessions for auto sector are likely. However, no deal will be signed without certain benefits for Indian exporters as w

July 03, 2025

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

July 01, 2025

Trump Tariffs: Poker Face?

July 1, 2025 12:55 PM UTC

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be fol

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Asia/Pacific (ex-China/Japan) Outlook: Slower Trade, Softer Inflation, and Looser Policy

June 24, 2025 9:24 AM UTC

· Asia’s growth profile in 2025 reflects a region navigating structural transition amid external strain. Investment-led economies like India are benefitting from infrastructure spending, industrial policy momentum, and political continuity. In contrast, trade-reliant markets such as V

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

June 23, 2025

Iran: Measured Next Steps?

June 23, 2025 3:17 PM UTC

A measured or modest Iran retaliation could be used by the U.S. to seek a path back towards negotiation. Israel would likely want to continue to degrade Iran nuclear and military facilities, but the U.S. could eventually pressure Israel to stop. This is our baseline, though the military attac

June 13, 2025

India CPI Review: CPI at 2.82%: Disinflation Deepens, But Risks Linger

June 13, 2025 7:18 AM UTC

India’s retail inflation dropped to a six-year low of 2.82% in May, driven by easing food prices and supported by favourable base effects. While disinflation continues to create monetary space, RBI's next rate cut will be data driven.

June 12, 2025

Trump Tariffs: China and July 9 Reciprocal Deadline

June 12, 2025 7:17 AM UTC

We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tariff to 15-20% imposed by the U.S., most likely agreed in Q4 2025 and to be implemented in 2026. However, a 35% probability exist of no deal and this could eventually mean higher tariffs (Fig

June 05, 2025

June 02, 2025

India GDP Review: Growth Outpaces Expectations as Q4 GDP Hits Four-Quarter High

June 2, 2025 11:56 AM UTC

India’s economy grew 7.4% y/y in Q4 FY25, beating expectations and capping full-year growth at 6.5%. Strong gains in construction, services, and agriculture underpinned the recovery, while private consumption and investment strengthened. However, sustaining momentum in FY26 will hinge on broad-bas

Trump’s 50% Steel And Aluminum: Negotiating Leverage?

June 2, 2025 7:42 AM UTC

• President Donald Trump increase in steel and aluminum tariffs from 25% to 50% is not just about boosting the steel and aluminum industry. It also a demonstration that Trump remains in control of tariffs and can aggressively change tariffs to increase negotiating leverage. It is a mess

May 29, 2025

Court Stops Trump Reciprocal and Fentanyl Tariff

May 29, 2025 7:18 AM UTC

• The Trump administration will likely follow a multi-track response by appealing the judgement but also fast-tracking section 232 product tariffs for pharmaceuticals and semiconductors. The administration could also consider section 301 or 122 tariffs (the latter 15% for 150 days against c