Sweden

View:

September 15, 2025

Sweden Riksbank Preview (Sep 23): Riksbank To Deliver Final Rate Cut?

September 15, 2025 1:09 PM UTC

Although noting the possible impact of recent both real activity and adjusted CPI data having delivered upside news and surprises, we adhere to our view that a further but final rate cut is looming and probably at the Sep 23 verdict. Indeed, we were disappointed that the Riksbank did not deliver a

August 20, 2025

Sweden Review: Riksbank Still Flagging Final Rate Cut?

August 20, 2025 8:37 AM UTC

Although matching nearly all expectations, we are disappointed that the Riksbank did not deliver a further and probably final 25 bp rate cut this time around, especially given its repeated suggestion of prob a cut later this year. Now, there are three more policy verdicts before year-end and we thin

August 11, 2025

Sweden Preview (Aug 20): Riksbank to Cut for Final Time?

August 11, 2025 12:42 PM UTC

We see the Riksbank delivering a further 25 bp rate cut on Aug 20, taking the policy rate to new cycle low of 1.75%. This would chime with the hints after the last meeting and cut in July of a further move is possible. And with both real activity and CPI data having delivered downside news and s

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

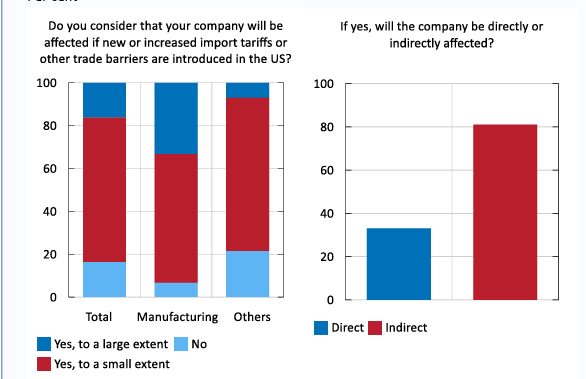

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 23, 2025

Western Europe Outlook: The First Shall be Last…

June 23, 2025 7:46 AM UTC

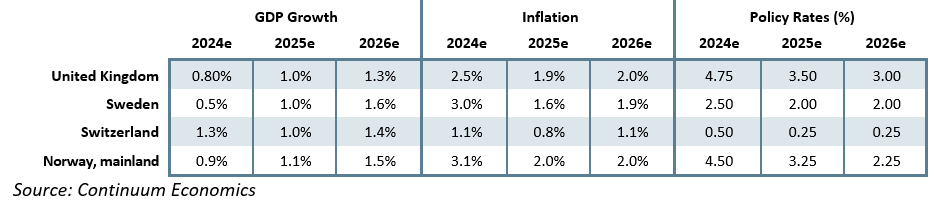

· In the UK, we have upgraded 2025 growth by 0.3 ppt back to 1.0%. But this is purely a result of the Q1 front-loading and instead masks what we think will be essentially a flat GDP profile into 2026. The BoE will likely ease further in H2 by at least 50 bp and maybe faster and then i

June 18, 2025

Sweden: Riksbank Cuts and Flags Possible Further Move?

June 18, 2025 8:26 AM UTC

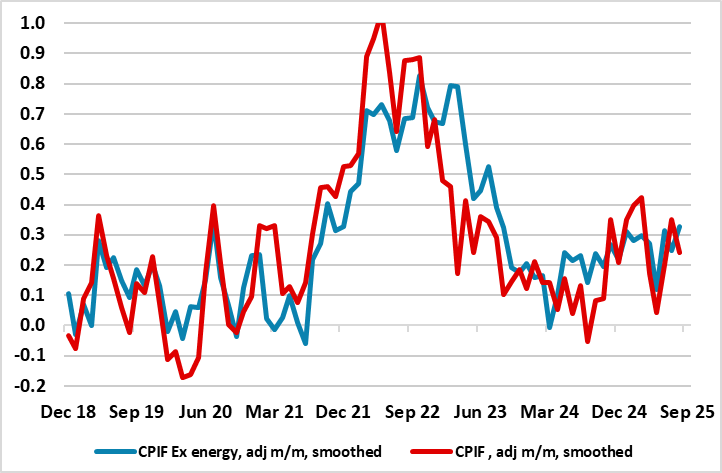

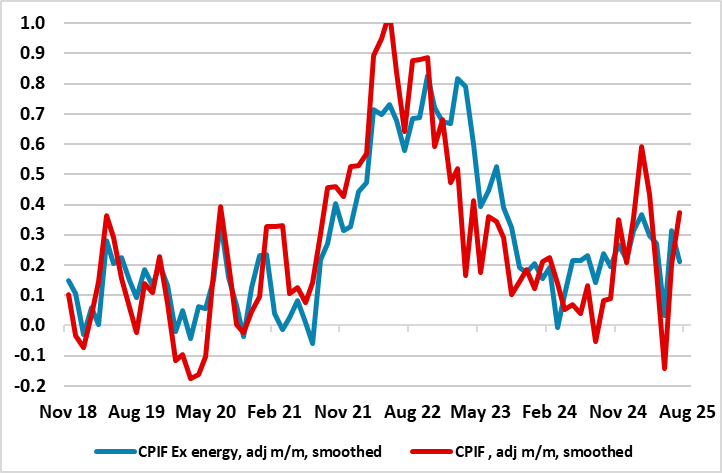

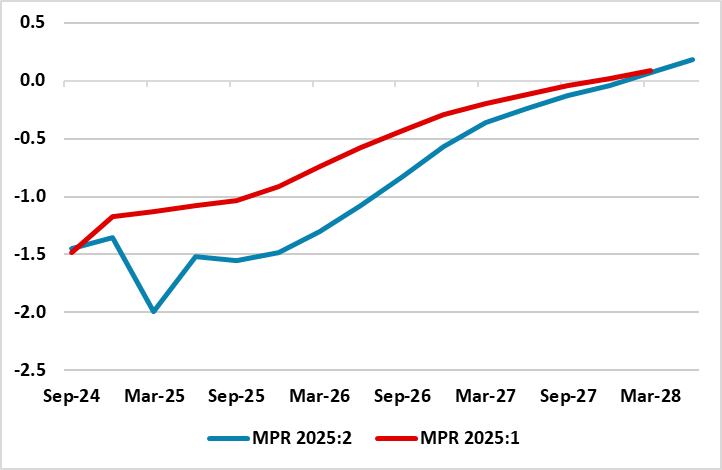

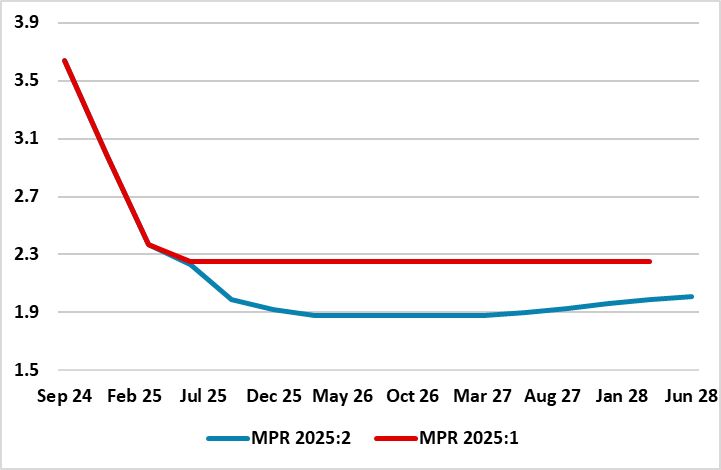

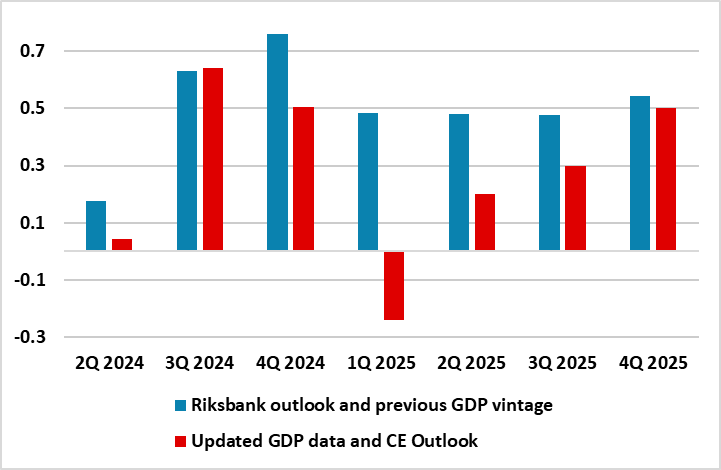

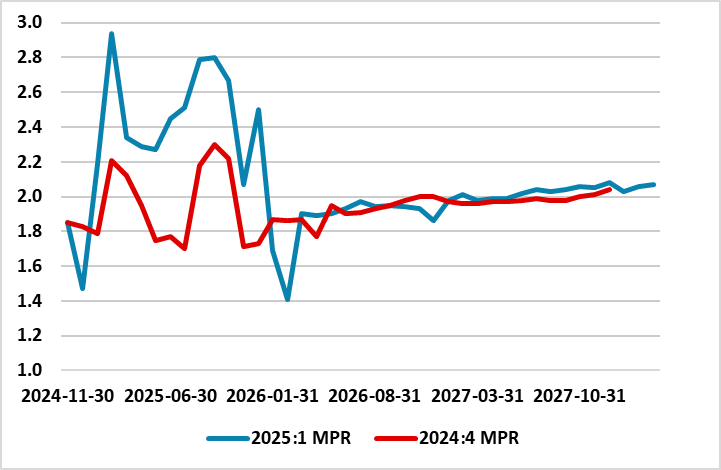

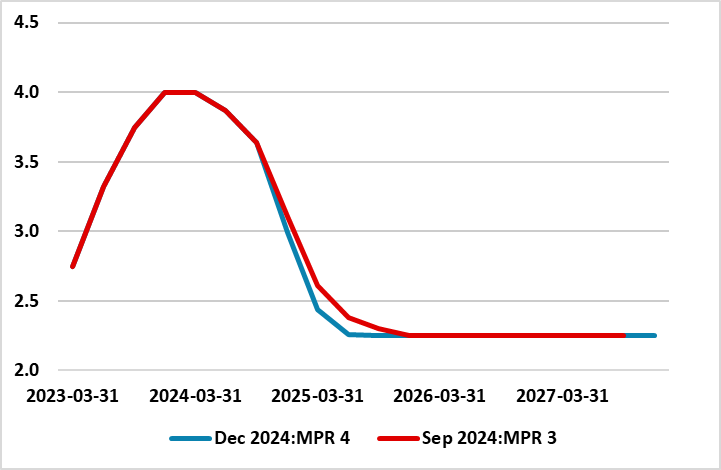

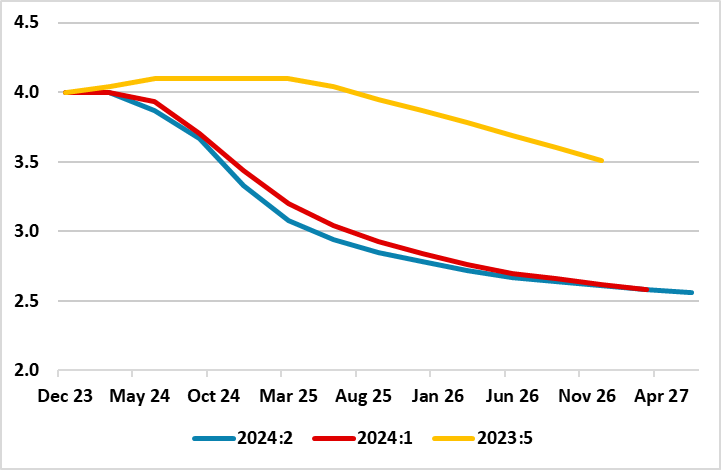

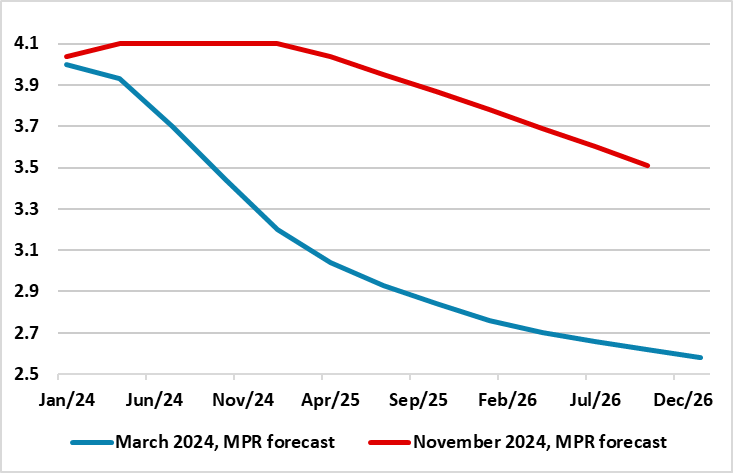

As widely expected, the Riksbank cut its policy rate by a further 25 bp to a new cycle low of 2.0%. Moreover, as we hinted at, the Board even then suggest that a further move is possible (Figure 1). Given that even with substantial paring back of its growth forecast in its updated Monetary Polic

June 10, 2025

Sweden Preview (Jun 18): Riksbank to Cut and Reassess Policy Outlook?

June 10, 2025 10:05 AM UTC

We are even more convinced that the Riksbank will cut further and as soon as the next Board verdict on Jun 18. Moreover, the Board may even then suggest that further moves are possible. This may seem stretched given that the Riksbank has virtually called a halt to the easing cycle, albeit most r

May 30, 2025

Sweden: Riksbank Needs to Revise Output Gap Estimate and Reassess Policy Outlook?

May 30, 2025 11:49 AM UTC

We are even more convinced that the Riksbank will cut further and as soon as the next Board verdict on Jun 18. Moreover, the Board may even then suggest that further moves are possible. This may seem stretched given that the Riksbank has virtually called a halt to the easing cycle, albeit most r

May 08, 2025

Sweden – Riksbank Review: Fresh Easing Hints Confirmed?

May 8, 2025 8:03 AM UTC

The very much expected stable policy decision at this Riksbank verdict was the second in succession but where the Board veered away from its previous assertion that that, with the policy rate now at 2.25%, this may be the end of the easing path. Instead, and amid the stronger currency and softer C

April 29, 2025

Sweden – Riksbank Preview (May 8): Fresh Easing Hints?

April 29, 2025 1:17 PM UTC

A very likely stable policy decision next month would be the second in succession and where the Riksbank has now underscored that, with the policy rate now at 2.25%, this may be the end of the easing path. But amid the stronger currency, with real activity signs having largely disappointed even be

March 27, 2025

March 26, 2025

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

March 25, 2025

Western Europe Outlook: Price Pressures - Puzzling or Possibly Persistent!

March 25, 2025 10:47 AM UTC

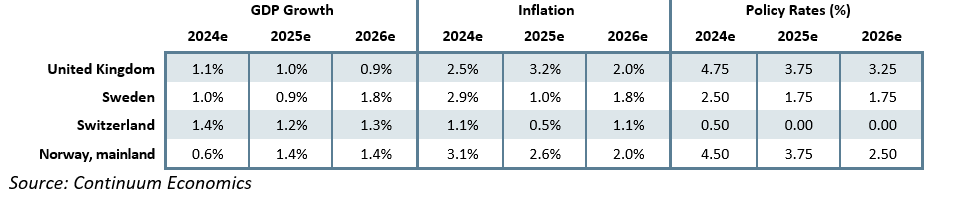

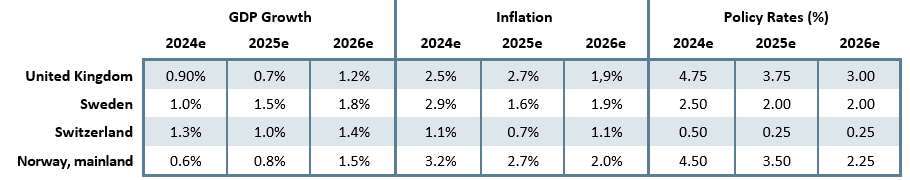

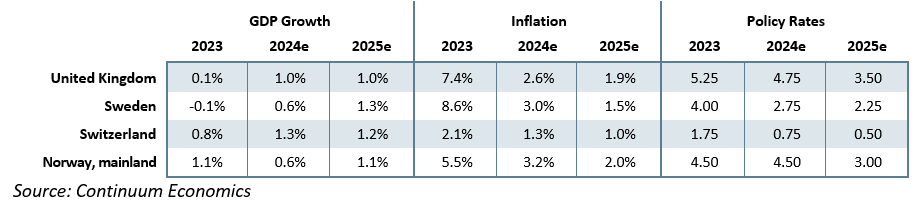

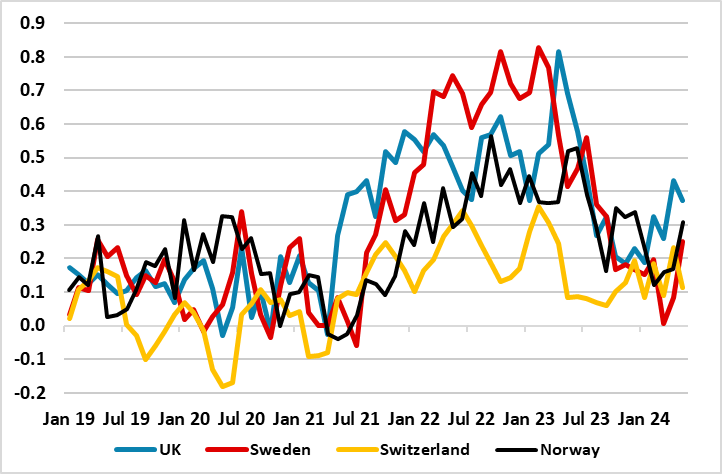

· In the UK, we continue to retain our below-consensus GDP picture for this year, with growth actually downgraded and with downside risks that may actually be both increasing and materializing. The BoE will likely ease further through 2025 by at least 75 bp and maybe faster and into 202

March 20, 2025

Sweden Riksbank Review: Everything Unchanged?

March 20, 2025 9:16 AM UTC

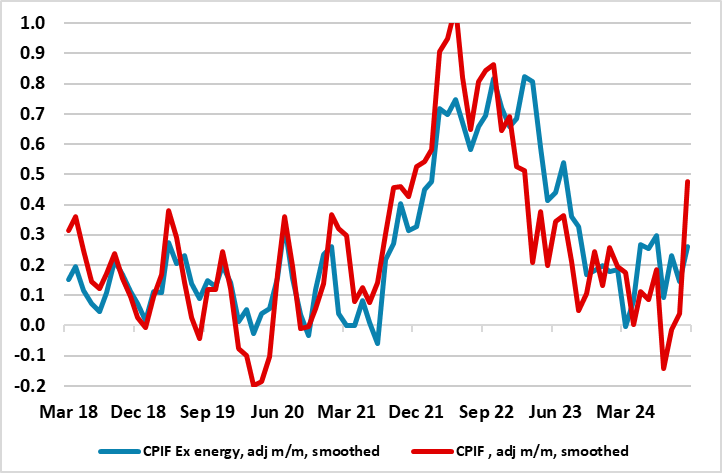

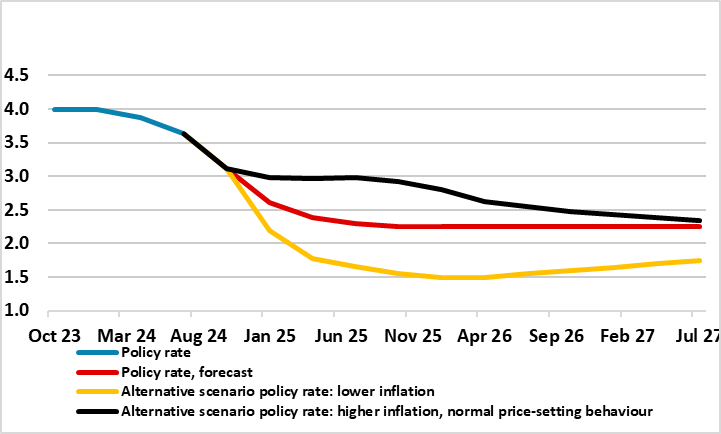

Having delivered in January, the widely-expected sixth successive rate cut, the Riksbank adhered to the assessment made in December that the easing cycle has drawn to an end with the policy rate (down to 2.25%) having dropped 1.75 ppt in eight months. Especially given the recent upside CPI surpris

March 11, 2025

Sweden Riksbank Preview (Mar 20): Time to Pause?

March 11, 2025 10:33 AM UTC

Having delivered in January, the widely-expected sixth successive rate cut, the Riksbank adhered to the assessment made in December that the easing cycle has drawn to an end with the policy rate (down to 2.25%) having dropped 1.75 ppt in eight months. Especially given the recent upside CPI surpris

January 29, 2025

Sweden Riksbank Review: Shifts to Easing Bias?

January 29, 2025 9:33 AM UTC

Having delivered the widely-expected sixth successive rate cut this month, the Riksbank adhered to the assessment made in December that the easing cycle has drawn to an end with the policy rate (now at 2.25%) having dropped 1.75% in eight months. But the Board remains open to further easing; while

January 21, 2025

Sweden Riksbank Preview (Jan 29): Not Yet the End?

January 21, 2025 2:30 PM UTC

Having delivered the widely-expected fifth successive rate cut at the December Riksbank meeting, the Riksbank hinted that the easing cycle is drawing to an end. Indeed, this assertion was supported by a smaller move in December – ie a 25 bp move (to 2.5%) rather than the 50 bp cut seen previousl

December 30, 2024

December 24, 2024

December Outlook Webinar on Jan 7: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 24, 2024 8:30 AM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 20, 2024

December 19, 2024

Western Europe Outlook: Divergent Policy Thinking

December 19, 2024 2:12 PM UTC

· In the UK, perhaps the main story in our outlook is that we retain our below-consensus GDP picture for next year, with growth of 1.0% and with downside risks. The BoE will likely ease further through 2025 by at least 100 bp and maybe faster and beyond.

· As for Sweden, d

Sweden Riksbank Review: Nearing the End?

December 19, 2024 9:47 AM UTC

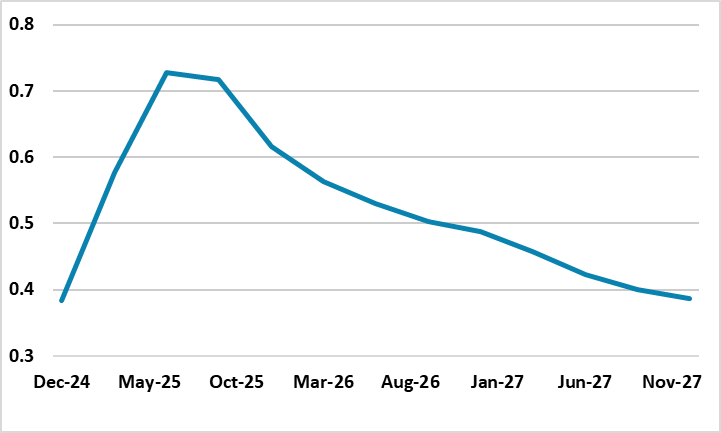

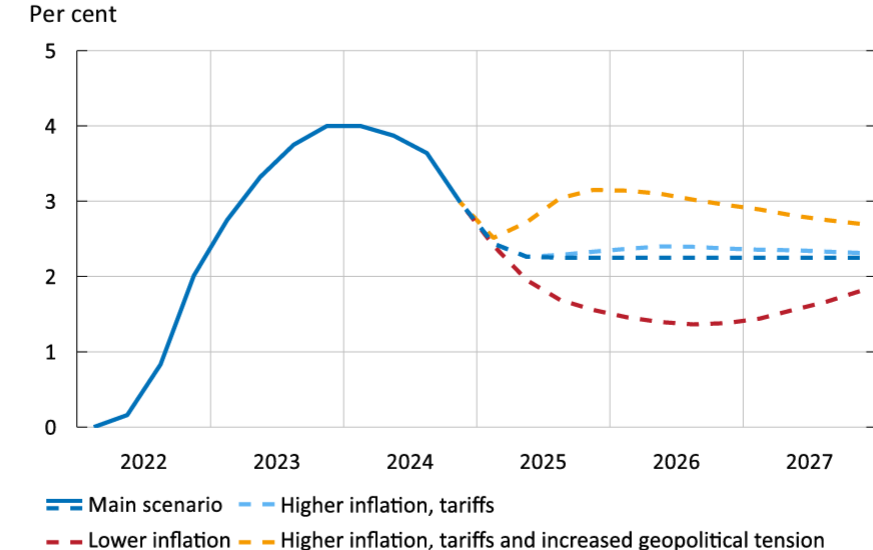

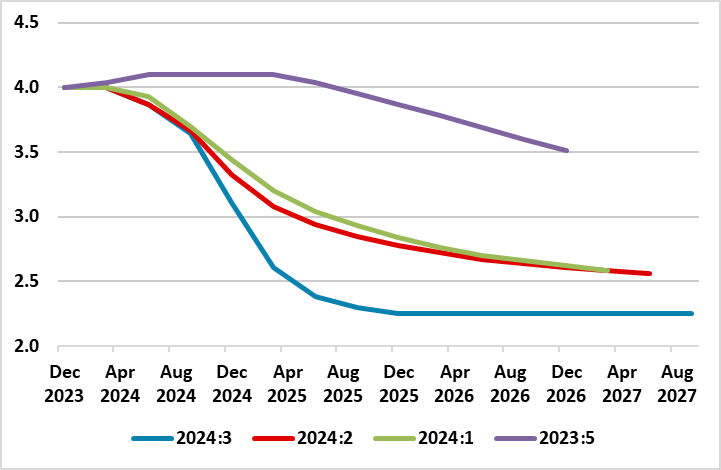

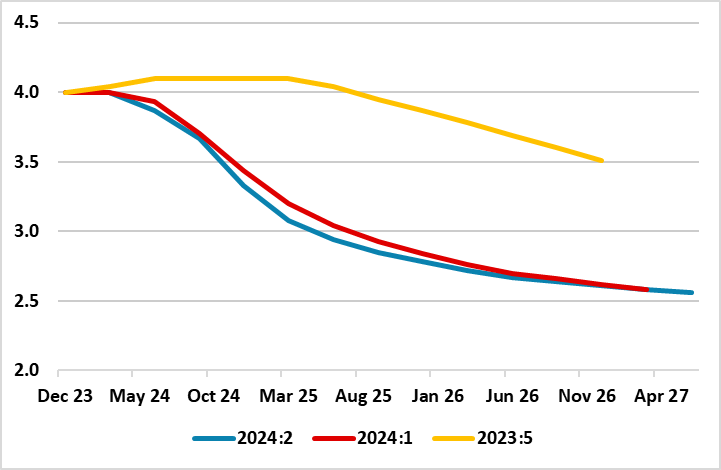

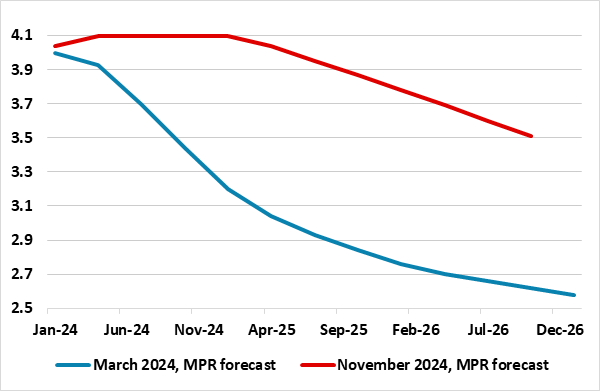

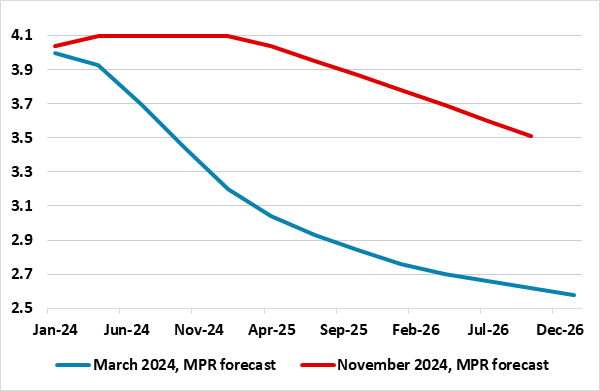

As widely expected, a fifth successive rate cut was seen at this December Riksbank meeting, but back to a 25 bp move rather than the 50 bp cut last time around (to 2.5% vs the 4% peak seen up until last May). But it was the updated projections (Figure 1) that was be the main news, not least given da

Outlook Overview: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 19, 2024 9:25 AM UTC

· The U.S. economy momentum remains reasonable before President elect Trump’s policies impact in 2025 and 2026. While high uncertainty exists on the scale and timing of policies, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 18, 2024

Jan 7 Outlook Webinar: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 18, 2024 1:23 PM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 09, 2024

Sweden Riksbank Preview (Dec 19): Flagging a Little Further Easing?

December 9, 2024 1:12 PM UTC

A fifth successive rate cut is seen at this looming December Riksbank meeting, but rather back to a 25 bp move rather than the 50 bp cut last time around (to 2.75% vs the 4.0% peak seen up until last May). This would fulfil the policy guidance advertised at the September Board meeting. But it will b

November 07, 2024

Sweden Riksbank Review: Faster, But Not (Yet) Any Further?

November 7, 2024 8:50 AM UTC

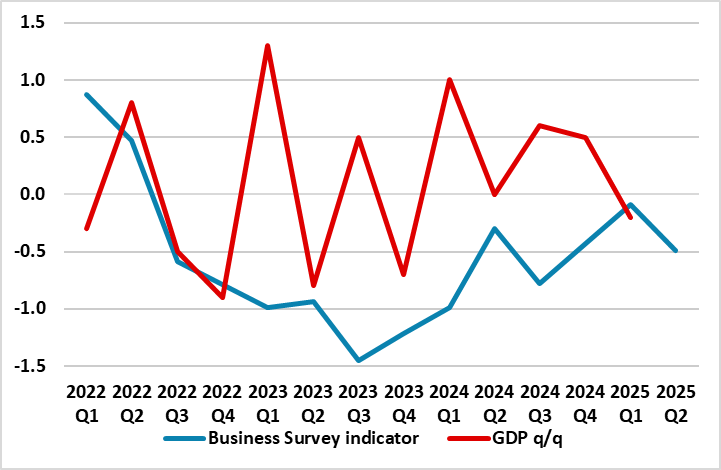

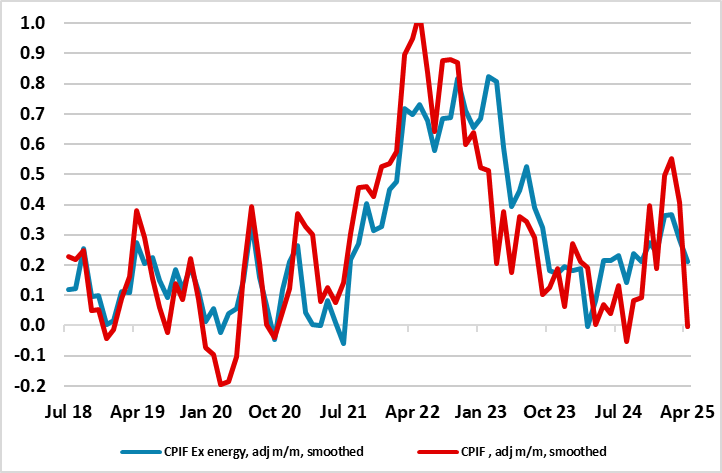

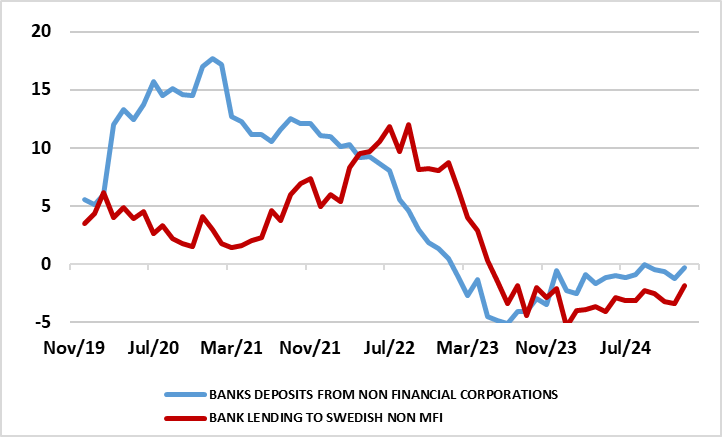

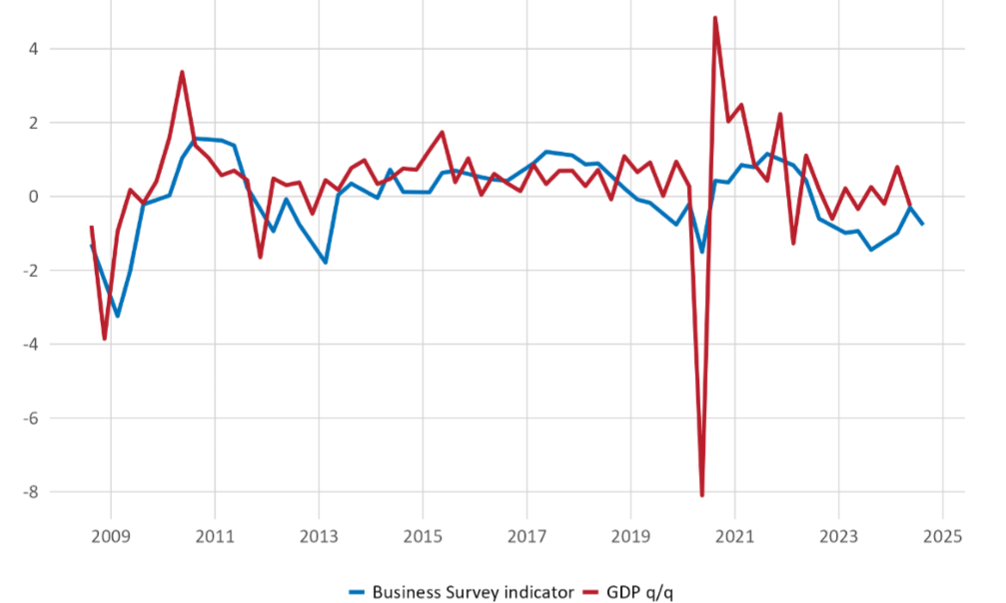

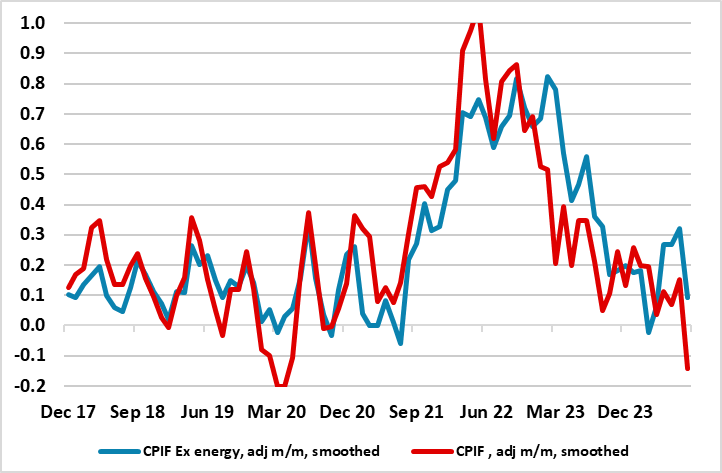

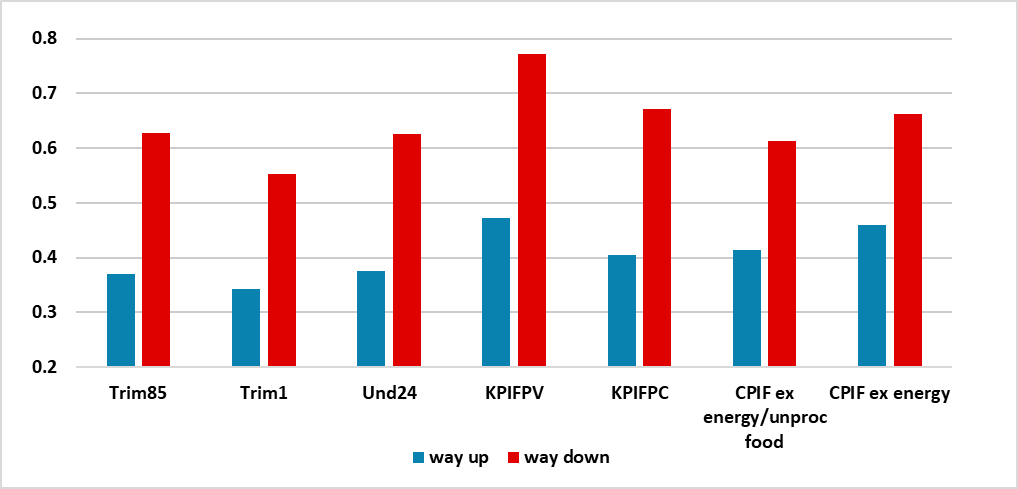

A fourth successive rate cut was widely seen at this Riksbank meeting, but rather than the 25 bp moves seen hitherto, there was the 50 bp move (to 2.75%) that was hinted at as part of the two further cuts advertised at the last (September) meeting. What seems clear is that inflation worries have s

October 29, 2024

Sweden Riksbank Preview (Nov 7): Rate Cuts Driven Increasingly by Weak Economy

October 29, 2024 10:09 AM UTC

A fourth successive 25 bp rate cut (to 3.0%) is widely seen at the looming Riksbank meeting (Nov 7), with the risk that it may even be the 50 bp move that was hinted at as part of the two further cuts advertised at the last (September) meeting. What seems clear is that inflation worries have subsi

October 02, 2024

Markets: Rate Cuts or Geopolitics?

October 2, 2024 9:36 AM UTC

Israel will likely counteract Iran, which will prompt a further missile attack by Iran. However, our bias remains that Israel main aim is to have a buffer zone in southern Lebanon up to the Latani river and not fight a prolonged war with Iran. This limits the economic fallout globally and on oil

September 27, 2024

September 26, 2024

Western Europe Outlook: Gradualism vs Reality

September 26, 2024 10:45 AM UTC

· In the UK, while headline GDP numbers look firmer, the real economy backdrop and outlook remains no better than mixed. This should improve a disinflation process driven mainly by friendlier supply conditions. The BoE will likely ease in Q4 and continue doing so through 2025 (we look

September 25, 2024

Sweden Riksbank Review: Rate Cuts – Faster and a Little Further?

September 25, 2024 8:15 AM UTC

A third successive 25 bp rate cut (to 3.25%) surprised no-one at this month’s Riksbank meeting. More notably, updated forecasts more formally validated both the likelihood and the rationale for the two added cuts by end-year that the Board hinted at after the August easing and which largely are

Outlook Overview: Rate Cuts But How Far?

September 25, 2024 7:30 AM UTC

· The U.S. economy is slowing, with the critical question being whether this is a soft or harder landing. Our broad analysis leaves us inclined to the soft landing view into 2025, though we shall watch real sector data closely over the next 3-6 months to check the trajectory. Else

September 17, 2024

Sweden Riksbank Preview (Sep 25): Rate Cuts – Faster and Further?

September 17, 2024 8:45 AM UTC

A third successive 25 bp rate looms at this month’s Riksbank meeting verdict (Sep 25) to 3.25%. More notably, updated forecasts are likely to more formally validate the rationale for the two added cuts by end-year that the Board hinted at after the August easing and which now seem all but certai

September 15, 2024

Sep 27 Outlook Webinar: Rate Cuts But How Far?

September 15, 2024 10:30 AM UTC

Uncertainty about whether the U.S. economy will have a soft or hard landing is growing as the market approaches Q4. This is shaping the debate regarding the scale of easing through the remainder of 2024 and 2025 by the Fed. European easing is underway, but how much further will central ba

August 20, 2024

Riksbank Deliver 25bps and More to Come

August 20, 2024 7:58 AM UTC

Riksbank appear more concerned about a weak economy, which is causing forward guidance of a faster pace of easing after today’s 25bps cut to 3.50%. We look for 25bps cuts at the September and December meeting and a further 25bps is possible at the November meeting if inflation remains under cont

August 14, 2024

Sweden Riksbank Preview (Aug 20): Still Trying to be Gradual?

August 14, 2024 8:15 AM UTC

Recent data have justified the Riksbank’s increased confidence in the current disinflation process and is highly likely to exercise its easing bias with a second (in three months) 25 bp rate cut (to 3.5%) at the Sep 20 policy verdict. As for future policy, in a Board meeting with no fresh projec

June 27, 2024

Sweden Riksbank Review: Slightly Less Gradual

June 27, 2024 9:29 AM UTC

The Riksbank is more confident in the current disinflation process. While none expected any further cuts at this policy verdict today, especially after the 25 bp rate cut it made last month, the Board updated Monetary Policy Report suggested there may an additional such cut in H2 over and beyond t

June 26, 2024

June 25, 2024

Outlook Overview: Cyclical and Structural Forces

June 25, 2024 10:15 AM UTC

• The global economy is showing signs of healing, as inflation comes back towards targets and growth recovers momentum in some economies. Nevertheless, the cyclical headwind of lagged monetary tightening remains in DM countries, and will likely be one of the forces slowing the U.S. economy

June 24, 2024

Western Europe Outlook: Easing Cycles Diverge?

June 24, 2024 7:48 AM UTC

· · In the UK, while downside economic risks may have dissipated, the real economy backdrop and outlook is still no better than mixed. This should accentuate a disinflation process hitherto driven mainly by friendlier supply conditions. The BoE will likely ease in Q3 and

June 19, 2024

Sweden Riksbank Preview (Jun 27): Doing It Gradually

June 19, 2024 3:24 PM UTC

As much as the 25 bp rate cut it made last month was the clear hint of two further such cuts in H2 this year, this chiming with its policy outlook in the March (Figure 1) Monetary Policy Report (MPR) as well as our own long-standing view. By moving at that early juncture, the Board was both reacti

May 08, 2024

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k

May 01, 2024

Sweden Riksbank Preview (May 8): When, Not If?

May 1, 2024 8:09 AM UTC

It seems to be a question of when, not if as far as policy easing is concerned. Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its last decision

April 03, 2024

April 02, 2024

Asset Allocation: Pausing for Breath

April 2, 2024 9:00 AM UTC

Into Q2, data and policy (actual and perceived) will dominate DM markets. The ECB will likely take the spotlight with a 25bps cut on June 7, as the Fed face a better growth/more fiscal policy expansion and a tighter labor market than the EZ but also with a better productivity backdrop and outlook to

March 27, 2024

Sweden Riksbank Review: Early Easing to Allow Gradual Moves

March 27, 2024 9:58 AM UTC

Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its latest decision, again keeping the policy rate at 4%, and no change to the pace of bond sales,