Switzerland

View:

September 26, 2025

September 25, 2025

SNB Review: Staying at Zero – For Some Time?

September 25, 2025 8:03 AM UTC

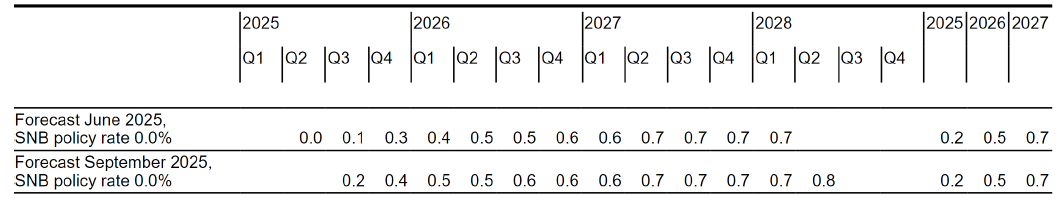

Very much as expected, both in deed and word, the SNB kept the policy rate at zero this month having cut by 25 bp back in June in June. Indeed, markets priced out what was previously seen as a good chance of rates turning negative, even against a backdrop of the punitive tariff scheme the Swiss econ

September 23, 2025

DM FX Outlook: USD steadies but vulnerable to equity correction

September 23, 2025 2:48 PM UTC

· Bottom Line: The USD has continued to edge lower against the EUR in the last quarter as market expectations of Fed easing have increased following clear weakening in U.S. employment growth. But at this stage the data doesn’t indicate we are heading for recession, and this suggests w

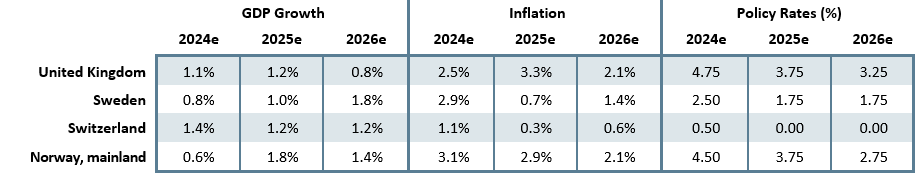

Western Europe Outlook: Policy Divergences

September 23, 2025 9:54 AM UTC

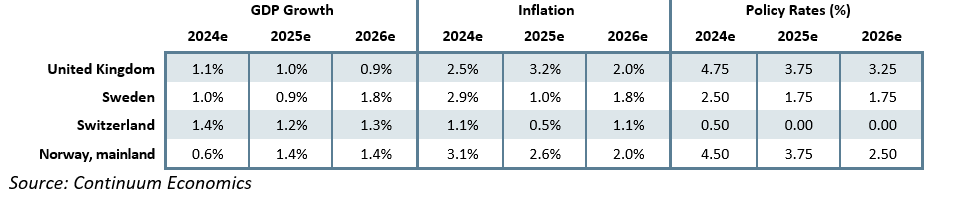

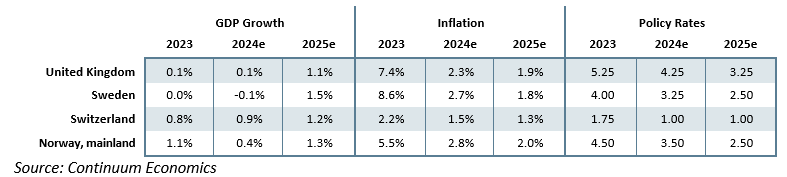

· In the UK, we have upgraded 2025 growth by 0.2 ppt back to 1.0%, but pared back that for next year by a notch to a sub-par 0.8%. We think this will refresh somewhat stalled disinflation allowing the BoE to ease further into H1 by around 75 bp.

· Sweden has seen a clear e

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

September 17, 2025

SNB Preview (Sep 25). Staying at Zero Amid Credit Cross Currents?

September 17, 2025 9:01 AM UTC

Having the SNB cut the policy rate by 25 bp back to zero in June, as widely expected, we see no further change for the time being, and with little likelihood of any move at the quarterly assessment due later this month (Sep 25). Indeed, despite barely positive inflation, markets have priced out wh

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

DM FX Outlook: USD uncertainty increases as Trump changes the rules

June 24, 2025 7:05 AM UTC

· Bottom Line: After making initial gains after the election, the USD has followed a similar path to the first Trump presidency, falling back steadily this year as optimism on the economy has faded, with the introduction of tariffs contributing to more negative sentiment. Much as in the

June 23, 2025

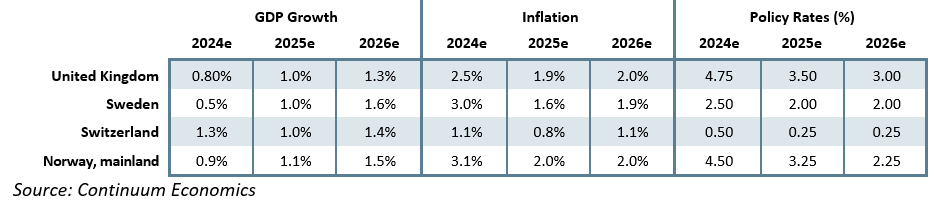

Western Europe Outlook: The First Shall be Last…

June 23, 2025 7:46 AM UTC

· In the UK, we have upgraded 2025 growth by 0.3 ppt back to 1.0%. But this is purely a result of the Q1 front-loading and instead masks what we think will be essentially a flat GDP profile into 2026. The BoE will likely ease further in H2 by at least 50 bp and maybe faster and then i

June 19, 2025

SNB: Cut to Zero, But Negative Rates an Option

June 19, 2025 8:00 AM UTC

The SNB would probably prefer to consolidate the effects of previous rate cuts, but the low inflation forecast and downside risk to inflation means that a cut to -0.25% is feasible at the September or December meetings. The SNB will also hope that the threat of negative rates restrains the CHF s

June 11, 2025

SNB Preview (Jun 19): Toying With Being Negative?

June 11, 2025 9:23 AM UTC

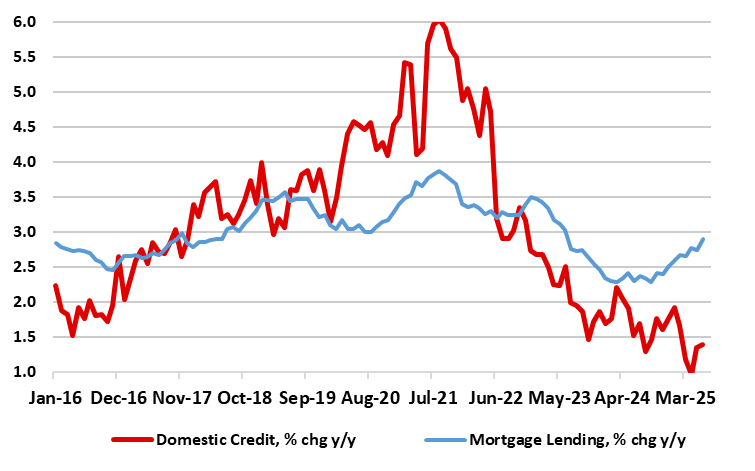

A further 25 bp cut (to zero) in the SNB policy rate on Jun 19 now looks almost certain. Weak(er) business surveys suggest that the tariff threat is both tangible and growing and this is before key Swiss pharmaceutical exports come under fire. Meanwhile, there is the strong currency where FX int

May 14, 2025

Europe Portfolio Leverage Over Trump

May 14, 2025 9:05 AM UTC

The U.S. will likely introduce a 25% tariff on pharmaceuticals, which will increase pressure on the EU and other European countries (e.g. Switzerland) and also delay serious negotiations close to the 90 day reciprocal tariff deadline on July 9, adding to pressure on Europe by deliberately prolonging

May 07, 2025

Switzerland: A Triple Disinflationary Threat?

May 7, 2025 1:30 PM UTC

A further 25 bp cut (to zero) in the SNB policy rate on June 19 now looks almost certain. Weak(er) business surveys suggest that the tariff threat is both tangible and growing. Meanwhile, there is the strong currency where FX intervention on aby major scale could provoke US retaliation against a

March 27, 2025

March 26, 2025

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

March 25, 2025

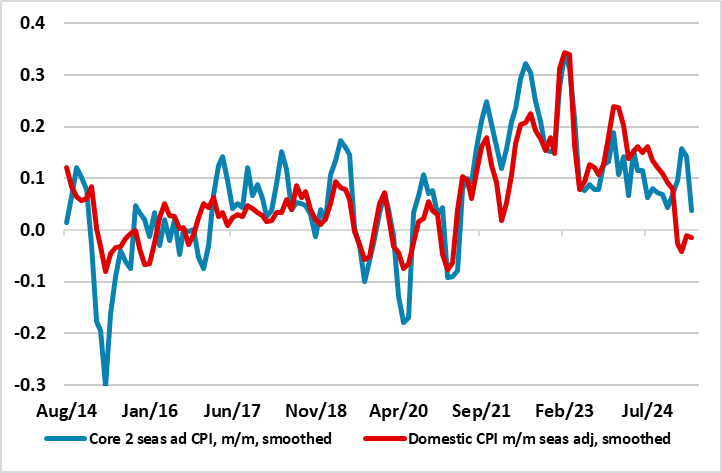

Western Europe Outlook: Price Pressures - Puzzling or Possibly Persistent!

March 25, 2025 10:47 AM UTC

· In the UK, we continue to retain our below-consensus GDP picture for this year, with growth actually downgraded and with downside risks that may actually be both increasing and materializing. The BoE will likely ease further through 2025 by at least 75 bp and maybe faster and into 202

DM FX Outlook: USD under pressure as Trump policies disappoint

March 25, 2025 8:51 AM UTC

· Bottom Line: The market had expected the Trump presidency to see further fiscal expansion and consequent tight Fed policy and high US yields. But the combination of less tax cuts than previously expected and more aggressive tariff increases have led to reduced expectations for US grow

March 20, 2025

SNB: 25 bp Cut Likely To Last

March 20, 2025 9:26 AM UTC

Bottom Line: With inflation forecasts stable, and given a reasonable economic outlook, it would be a good time to pause or stop the SNB easing cycle. However, if the U.S. trade tariffs have a bigger adverse effect than expected or the CHF surges, then the SNB may want the option to ease again later

March 11, 2025

SNB Preview (Mar 20): A Final Cut?

March 11, 2025 11:45 AM UTC

Having very much delivered relatively rapid easing worth some 125 bp in the last year, we see a further SNB rate cut of 25 bp at this month’s quarterly assessment taking the policy rate to 0.25%, the lowest since Sep 2022, ie when the Board moved away from negative rates. A return to negative ra

February 19, 2025

U.S. 25% Tariff for Cars, Pharma and Semiconductors?

February 19, 2025 1:40 PM UTC

· Tariff reality in the spring and summer will likely be both tariff threats to negotiate trade deals and permanently higher tariffs in certain products and reciprocally to raise revenue for the U.S. government – along Peter Navarro guidance to Trump. The macro effects of this cou

December 30, 2024

December 24, 2024

December Outlook Webinar on Jan 7: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 24, 2024 8:30 AM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 20, 2024

DM FX Outlook: USD to edge lower despite high yields

December 20, 2024 8:28 AM UTC

· Bottom Line: Recent strong US data has bolstered the USD, with the Trump election victory also supportive due to expectations of tax cuts and tariffs which are seen leading to less Fed easing than previously expected. While we still see the USD weakening through 2025 as Fed easing red

December 19, 2024

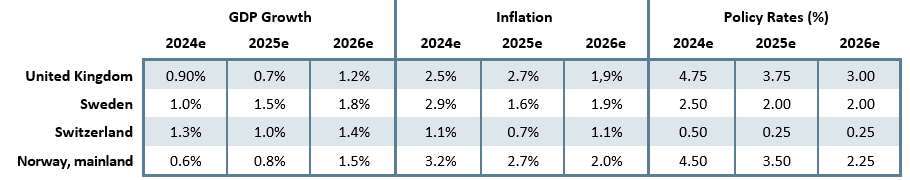

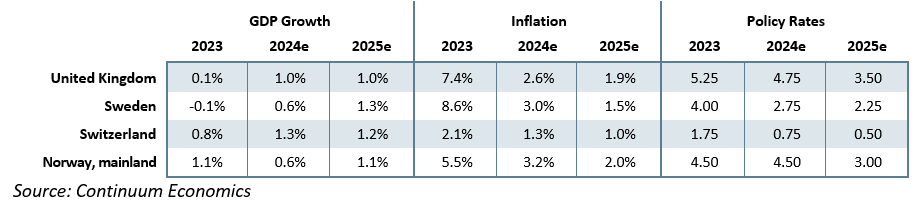

Western Europe Outlook: Divergent Policy Thinking

December 19, 2024 2:12 PM UTC

· In the UK, perhaps the main story in our outlook is that we retain our below-consensus GDP picture for next year, with growth of 1.0% and with downside risks. The BoE will likely ease further through 2025 by at least 100 bp and maybe faster and beyond.

· As for Sweden, d

Outlook Overview: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 19, 2024 9:25 AM UTC

· The U.S. economy momentum remains reasonable before President elect Trump’s policies impact in 2025 and 2026. While high uncertainty exists on the scale and timing of policies, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 18, 2024

Jan 7 Outlook Webinar: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 18, 2024 1:23 PM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 12, 2024

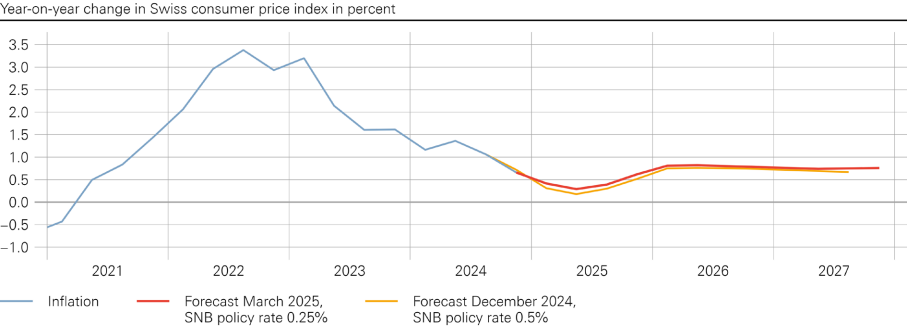

SNB Review: Easing Bias Toned Down?

December 12, 2024 9:21 AM UTC

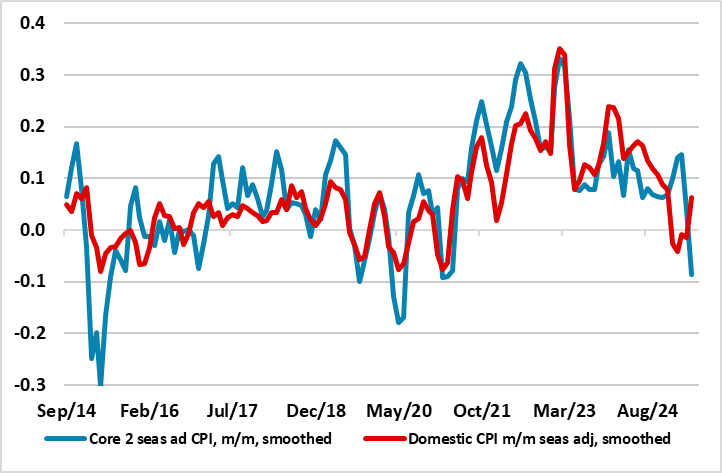

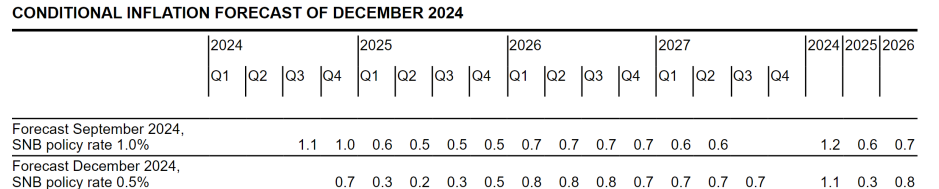

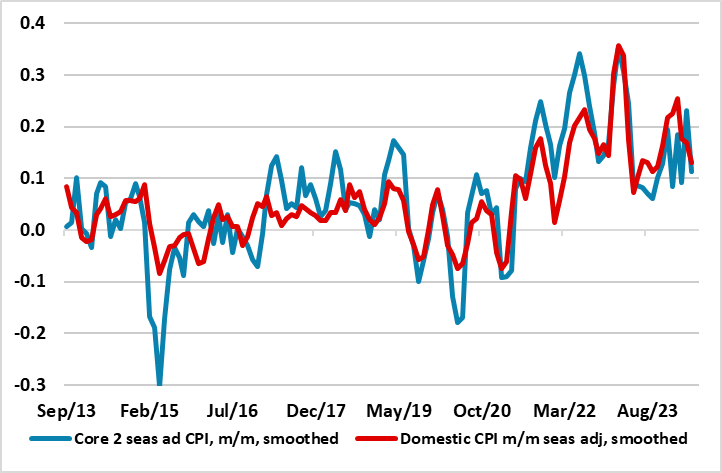

In what seems to be ever-clearer policy front-loading, the SNB cut its policy rate by 50 bp (to 0.5%), thereby accentuating an easing cycle that had delivered three 25 bp moves since March. Possibly, this larger, but far from unexpected, reduction was driven by a fresh assessment that the inflatio

December 03, 2024

SNB Preview (Dec 12): How Much Further Easing?

December 3, 2024 1:54 PM UTC

Whatever the SNB does this month is likely to be merely a further staging post in an easing cycle that has to date delivered three 25 bp moves since March, ie taking the policy rate to 1.0%. More likely the SNB will again cut by 25 bp this month, but amid downside real economy risks and inflation

September 27, 2024

September 26, 2024

Western Europe Outlook: Gradualism vs Reality

September 26, 2024 10:45 AM UTC

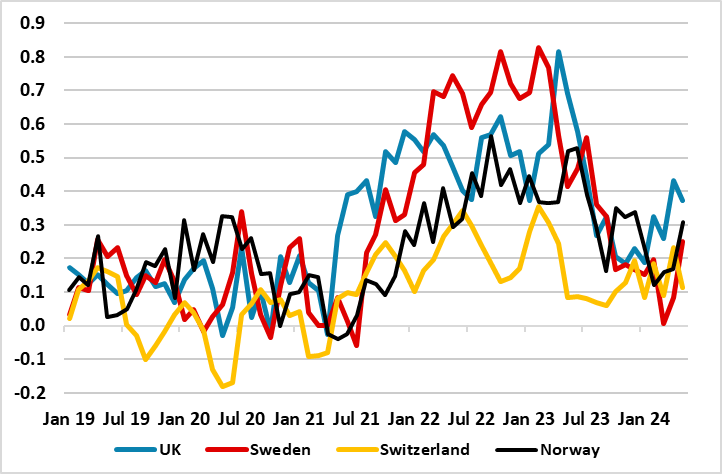

· In the UK, while headline GDP numbers look firmer, the real economy backdrop and outlook remains no better than mixed. This should improve a disinflation process driven mainly by friendlier supply conditions. The BoE will likely ease in Q4 and continue doing so through 2025 (we look

SNB Review: More Cuts on the Way

September 26, 2024 8:24 AM UTC

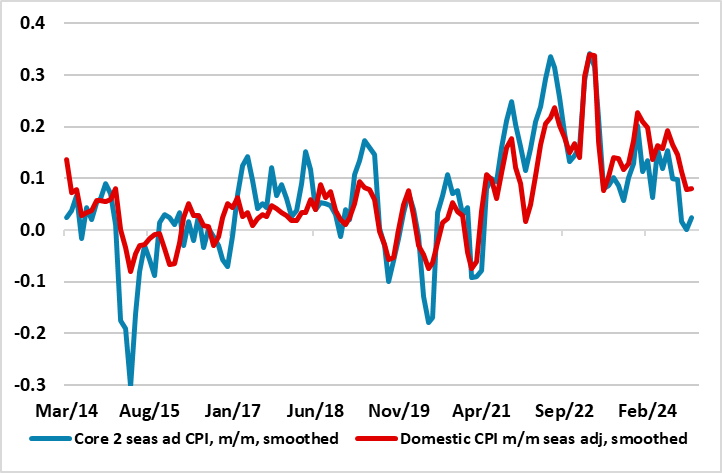

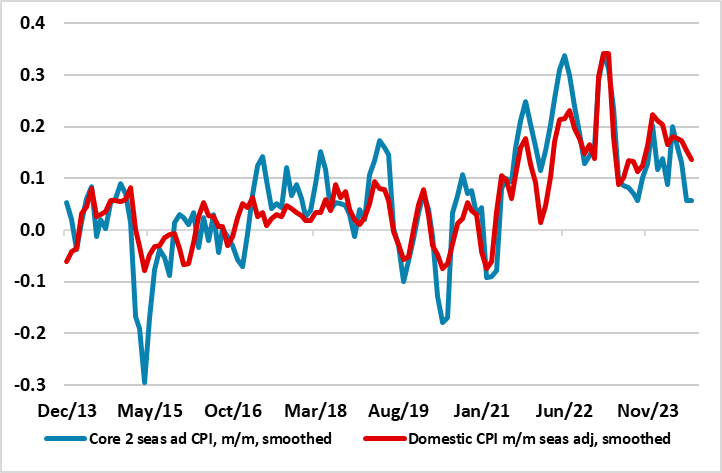

Very much as expected, the SNB today repeated the 25 bp policy rate cut that it had made twice since March. This took the policy rate to 1.0% and reflected an even clearer below-target inflation picture in both recent actual numbers and the updated outlook (Figure 1). This flagged further easing

September 25, 2024

Outlook Overview: Rate Cuts But How Far?

September 25, 2024 7:30 AM UTC

· The U.S. economy is slowing, with the critical question being whether this is a soft or harder landing. Our broad analysis leaves us inclined to the soft landing view into 2025, though we shall watch real sector data closely over the next 3-6 months to check the trajectory. Else

DM FX Outlook: USD Set for 2025 Decline

September 25, 2024 7:11 AM UTC

· Bottom Line: The USD has reached the end of year targets of 1.12 for EUR/USD and 140 for USD/JPY that we forecast in June, when it was trading at 1.07 and 159 respectively. From here, we still favour the USD downside through both the rest of the year and 2025, as the Fed continues to

September 19, 2024

SNB Preview (Sep 26): Another Cut All But Certain But How Large an Inflation Target Undershoot

September 19, 2024 1:54 PM UTC

Along with market thinking, we see the SNB next Thursday repeating the 25 bp policy rate cut that it has now made twice since March. This would take the policy rate to 1.0% and where the very clear below-target inflation picture in both recent actual numbers and the outlook flagged by the SNB in J

September 15, 2024

Sep 27 Outlook Webinar: Rate Cuts But How Far?

September 15, 2024 10:30 AM UTC

Uncertainty about whether the U.S. economy will have a soft or hard landing is growing as the market approaches Q4. This is shaping the debate regarding the scale of easing through the remainder of 2024 and 2025 by the Fed. European easing is underway, but how much further will central ba

June 26, 2024

June 25, 2024

Outlook Overview: Cyclical and Structural Forces

June 25, 2024 10:15 AM UTC

• The global economy is showing signs of healing, as inflation comes back towards targets and growth recovers momentum in some economies. Nevertheless, the cyclical headwind of lagged monetary tightening remains in DM countries, and will likely be one of the forces slowing the U.S. economy

June 24, 2024

Western Europe Outlook: Easing Cycles Diverge?

June 24, 2024 7:48 AM UTC

· · In the UK, while downside economic risks may have dissipated, the real economy backdrop and outlook is still no better than mixed. This should accentuate a disinflation process hitherto driven mainly by friendlier supply conditions. The BoE will likely ease in Q3 and

DM FX Outlook: Politics rears its head

June 24, 2024 7:42 AM UTC

· Bottom Line: The USD strength in Q2 on the back of a less dovish view of the Fed is unlikely to extend over the rest of the year. The JPY remains exceptionally cheap and has potential to recover sharply if risk appetite weakens. A slower JPY recovery is likely if lower inflation leads

June 20, 2024

SNB: 25bps Cut and Next Cut in September

June 20, 2024 8:34 AM UTC

The SNB cut by 25bps to try and stop inflation undershooting. We look for a further 25bps cut in September, as the new inflation forecasts remains too far below target for SNB comfort. CHF strength will also not ebb quickly given the prospect of prolonged French political uncertainty.

June 12, 2024

SNB Preview (Jun 20): Another Cut Likely but How Large an Inflation Target Undershoot

June 12, 2024 9:26 AM UTC

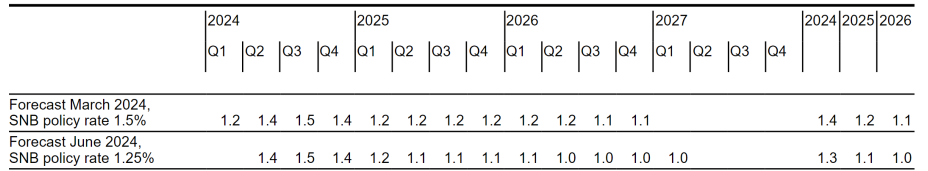

Along with market thinking, we see the SNB on June 20 repeating the 25 bp policy rate cut that it surprised many with three months ago. This would take the policy rate to 1.25% and where the very clear below-target inflation picture in both recent actual numbers and the outlook flagged by the SNB

April 03, 2024

March 27, 2024

March 25, 2024

March 22, 2024

Western Europe Outlook: Easing Cycle Underway?

March 22, 2024 11:26 AM UTC

· In the UK, downside economic risks may have dissipated but the tighter monetary stance has far from fully bitten. This accentuates and/or prolongs an already weak domestic backdrop into 2025 that will complement friendlier supply conditions in easing inflation. The BoE will likely e

March 21, 2024

Switzerland: SNB Surprise with 25bps Rate Cut

March 21, 2024 9:01 AM UTC

The SNB became the first DM central bank to cut rates with a 25bps reduction to 1.50%, which reflects an even larger forecast inflation undershoot and to counterbalance the strong Swiss Franc (CHF). The inflation forecasts for 2024 and 2025 were significantly lowered even with the new 1.50% policy