Russian Federation

View:

October 02, 2025

Russia’s Growth Continues to Lose Steam

October 2, 2025 11:17 AM UTC

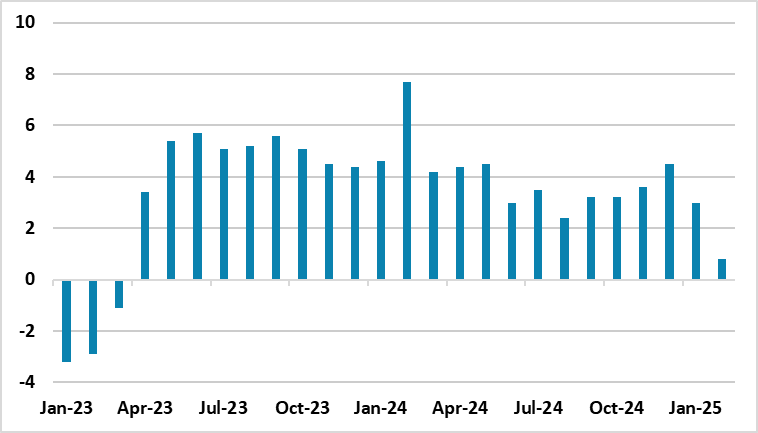

Bottom Line: According to a recent announcement by the Ministry of Economic Development, Russia's GDP expanded by a moderate 0.4% YoY in August, meeting the same pace in the previous month, driven by manufacturing, retail trade and agriculture activities. According to the announcement, the growth in

October 01, 2025

Russia’s Inflation is Expected to Continue to Soften in September

October 1, 2025 1:35 PM UTC

Bottom Line: We expect Russian inflation to continue its decreasing pattern in September, after hitting the softest rate since April of 2024 with 8.1% YoY in August, particularly thanks to lagged impacts of previous aggressive monetary tightening coupled with softening services and food prices. Sep

September 26, 2025

War in Ukraine: No Light Yet at the End of the Tunnel

September 26, 2025 12:34 PM UTC

Bottom Line: Despite expectations from the 80th United Nations General Assembly (UNGA) held in New York were high, it did not yield a solution to the war in Ukraine, but an escalation between the U.S. and Russia. The claims by president Trump as he shifted his position on the war, saying for the f

September 23, 2025

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

September 22, 2025

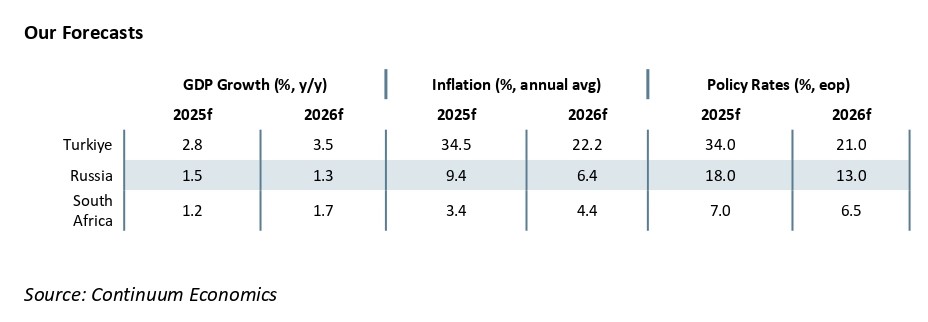

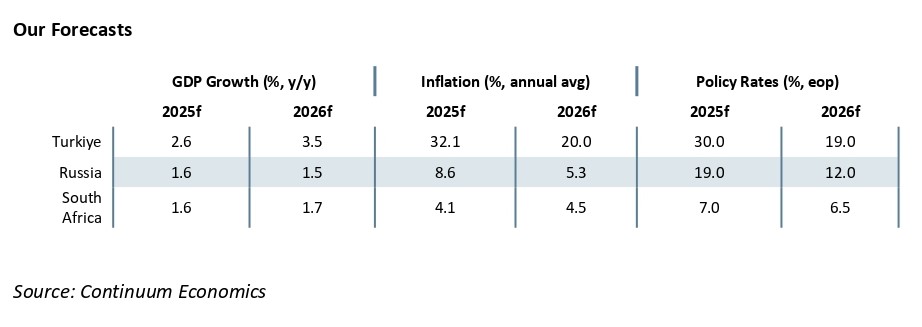

EMEA Outlooks Stay Mixed into 2026: Domestic and Global Uncertainties

September 22, 2025 6:58 AM UTC

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.2% in 2025 and 2026, respectively, despite upside risks to inflation such as swings in food prices, supply chain destructions including energy shortages and port inefficiencies and global uncertainties. We see

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 12, 2025

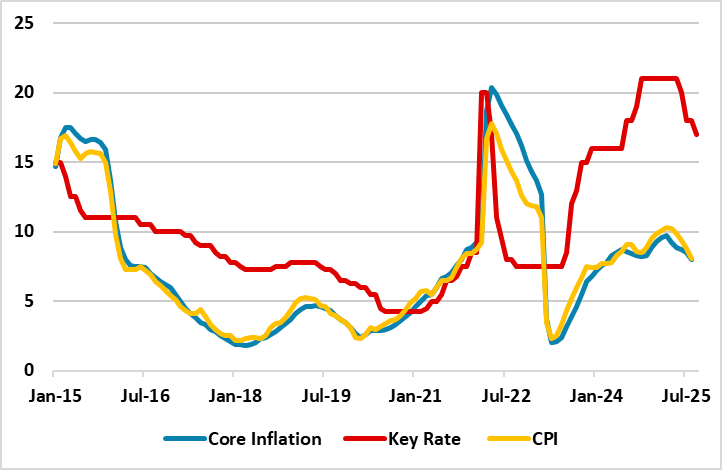

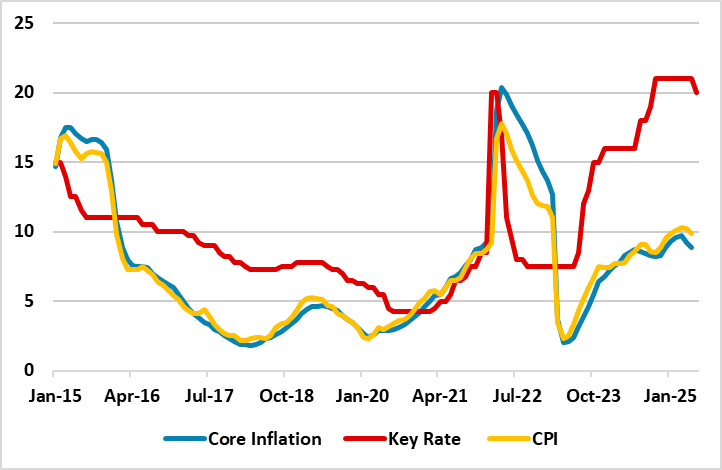

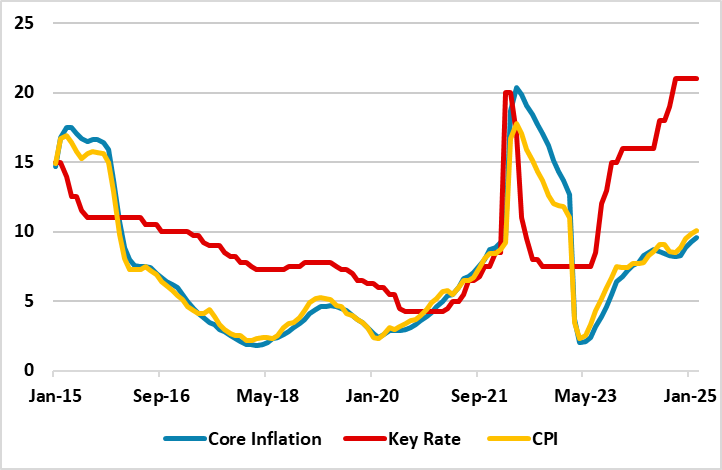

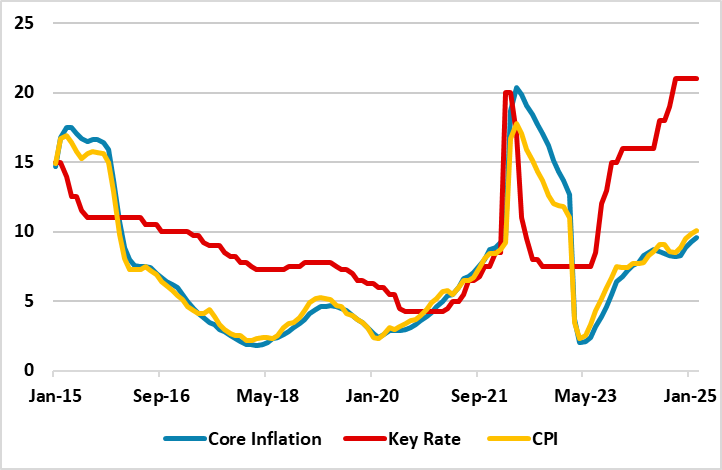

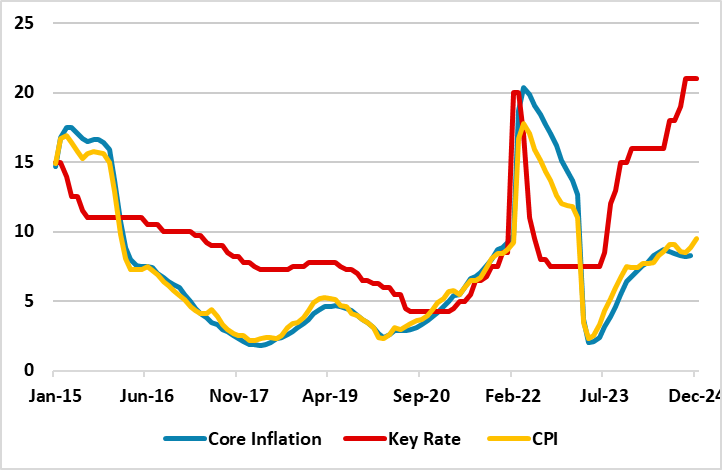

CBR Reduced its Key Rate to 17% as Inflation Softened, but Warned Inflation is Still High

September 12, 2025 3:48 PM UTC

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 100 bps to 17% on September 12 taking into account that inflation continued to slow down in Q3 but still warned inflation remains high. CBR stated in its written statement it will maintain monetary conditions as tight

September 10, 2025

August 18, 2025

Trump-Putin Summit: No Ceasefire Agreement, Possible Concessions Discussed

August 18, 2025 12:29 PM UTC

Bottom Line: U.S. President Trump and Russian President Putin met in Alaska on August 15 to discuss the fate of war in Ukraine. The meeting lasted three hours, but did not yield an immediate ceasefire agreement as we expected. After the meeting, Trump and Putin both signaled what could happen next i

August 14, 2025

Russian Economy is Slowing: GDP Growth Continued to Lose Steam in Q2 2025

August 14, 2025 9:23 AM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) figures, Russia's GDP expanded by 1.1% YoY in Q2, the slowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, investments, higher wages and fiscal stimulus. We think Central Bank of R

August 13, 2025

Deceleration in Inflation Resumes in Russia: 8.8% YoY in July

August 13, 2025 7:28 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data on August 13, inflation stood at 8.8% YoY in July after hitting 9.4% YoY in June, ignited by higher non-food and services prices. Despite inflation eased for a fourth straight month, we foresee inflation will continue to st

July 25, 2025

CBR Reduced its Key Rate to 18% as Inflation Softens

July 25, 2025 11:41 AM UTC

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 200 bps to 18% on July 25 taking into account that inflation slowed to 9.4% in June from 9.9% in May; MoM price growth marked the lowest hike after August 2024; and the inflation expectations declined to 13% in June fro

July 16, 2025

CBR will Likely Cut its Key Rate to 19% on July 25

July 16, 2025 4:32 PM UTC

Bottom Line: After Central Bank of Russia (CBR) reduced its key interest rate by 100 basis points to 20% on June 6, citing continued easing in inflationary pressures, including core inflation, we foresee that the rate will be further reduced to 19% on July 25 taking into account that inflation slowe

July 11, 2025

Deceleration in Inflation, Albeit Gradual, Continued in June: 9.4% YoY

July 11, 2025 4:48 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 9.4% YoY in June after hitting 9.9% YoY in May, partly due to favorable base impacts, recent RUB strengthening and falling oil prices. We think the recent tariffs hike for electricity, gas, heating and w

July 02, 2025

Russia GDP Growth Continues to Lose Steam

July 2, 2025 6:43 PM UTC

Bottom Line: According to Ministry of Economic Development figures, Russia's GDP expanded by 1.2% YoY in May following a 1.9% rise the previous month, which marked one of the lowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, higher wages and fiscal

June 26, 2025

Ukraine War Update: War Continuing Probability is Now at 70%

June 26, 2025 11:06 AM UTC

Bottom Line: Our baseline scenario (70%) is based on the war continuing after talks fail since president Putin insists on his peace terms. President Trump is reluctant to threaten or implement of secondary tariffs on Russia oil buyers, that would really pressure president Putin. The U.S. financing o

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

June 14, 2025

Russian GDP Growth Loses Steam in Q1

June 14, 2025 8:54 AM UTC

Bottom Line: Russia's GDP expanded by 1.4% YoY in Q1, the slowest pace of growth since the economy resumed expansion in Q2 2023 driven by military spending, higher wages and fiscal stimulus. The softening of growth figures demonstrates monetary tightening, sanctions, supply side constraints and hi

June 12, 2025

Inflation in Russia Continued to Moderately Decelerate in May: 9.9% YoY

June 12, 2025 7:43 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 9.9% YoY in May after hitting 10.2% in April, the softest in four months. Despite CPI remained above the Central Bank of Russia’s (CBR) midterm target of 4%, the deceleration was remarkable as prices i

June 06, 2025

Surprising Move: CBR Reduced Key Rate to 20% from 21%

June 6, 2025 1:10 PM UTC

Bottom Line: Despite predictions were centered around no change, Central Bank of Russia (CBR) cut policy rate on June 6 for the first time after September 2022 citing easing in inflationary pressures, including core inflation. CBR indicated in its written statement that CBR will maintain monetary co

June 02, 2025

May 16, 2025

Sticky Inflation in Russia Hits 10.2% YoY in April

May 16, 2025 8:36 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 10.2% YoY in April after hitting 10.3% in March, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending, and lab

May 12, 2025

Optimistic CBR Publishes Summary of Key Rate Decision on May 12

May 12, 2025 5:24 PM UTC

Bottom Line: Central Bank of Russia (CBR) published the summary of the key rate decision on May 12, showing CBR’s views on economic developments. CBR highlighted in its report that “The current inflationary pressures eased in Q1, whereas food and services prices were still rising at a fast pa

April 28, 2025

The Hope for A Peace Deal in Ukraine Seems No Close

April 28, 2025 12:55 PM UTC

Bottom Line: We have lowered a Russia-friendly peace deal following a cease-fire to 50% probability but have increased the alternative scenario of war continues to 50% probability in Ukraine as negotiations to end the war in Ukraine continue slowly. In the former scenario, we envisage Russia will co

April 25, 2025

CBR Continues to Keep Key Rate Constant at 21% Despite Surging Inflation

April 25, 2025 1:56 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) held the policy rate stable on April 25 for the fourth consecutive time to combat price pressures. CBR indicated in its written statement that CBR will maintain monetary conditions as tight as necessary to return inflation to the target

April 12, 2025

Soaring Inflation Hits Two-Year High in March with 10.3% YoY

April 12, 2025 10:16 AM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation ticked up to 10.3% YoY in March after hitting 10.1% in February, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending,

April 07, 2025

EMEA Economies Will Be Tested Amid U.S. Tariff Heat

April 7, 2025 5:29 PM UTC

Bottom Line: The impacts of U.S. additional tariffs announced on April 2 could likely have multifaceted impacts over EMEA countries. Relatively-low 10% tariffs could open new doors for Turkiye to capture a higher global market share if it can act quickly on trade diversification. We foresee the coun

April 04, 2025

Russia GDP Growth Loses Steam in the First Two Months of 2025

April 4, 2025 9:14 AM UTC

Bottom Line: According to the figures announced by the Ministry of Economic Development on April 3, Russia's GDP expanded by 0.8% YoY in February following a 3% YoY increase in January driven by military spending, higher wages and fiscal stimulus. The softening of growth figures demonstrates monet

April 01, 2025

The Hope for A Peace Deal in Ukraine is Tested

April 1, 2025 9:55 AM UTC

Bottom Line: As negotiations to end the war in Ukraine continue, we foresee a Russia-friendly peace deal (70% probability) in Ukraine could be sealed in 9-12 months following a cease-fire under current circumstances. In this scenario, we envisage Russia will continue to annex areas in and around fo

March 27, 2025

March 26, 2025

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

March 25, 2025

EMEA Outlook: Mixed Prospects Due to Global Uncertainties and Domestic Dynamics

March 25, 2025 7:00 AM UTC

· In South Africa, we foresee average headline inflation will stand at 4.1% and 4.5% in 2025 and 2026, respectively, despite there are upside risks to inflation such as remaining power cuts (loadshedding), tariff hikes by Eskom, spike in food and housing prices, and global uncertainties. We

March 21, 2025

As Expected, CBR Kept Key Rate Constant at 21% on March 21

March 21, 2025 3:40 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) kept the policy rate constant on March 21 for the third consecutive time to combat price pressures. CBR signaled that it is unlikely that further tightening is needed for disinflation, and stated that current inflationary pressures have decr

March 13, 2025

Inflation in Russia Hits Two-Year High in February: 10.1% YoY

March 13, 2025 10:10 AM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation ticked up to 10.1% YoY in February after hitting 9.9% in January, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending,

March 03, 2025

February 25, 2025

Negotiations to End Ukraine War Started: What is Next?

February 25, 2025 2:33 PM UTC

Bottom Line: Russia and the U.S. have started negotiations to end the war in Ukraine. We continue to foresee a Russia-friendly peace deal in Ukraine sealed in 6-12 months following a cease-fire. We envisage Russia will continue to annex areas in and around four Ukrainian oblasts that it occupied,

February 17, 2025

Stubborn Inflation Continues to Stay Elevated in the First Month of 2025

February 17, 2025 9:33 AM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation ticked up to 9.9% YoY in January after hitting 9.5% in December, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending,

February 14, 2025

CBR Held Key Rate Constant at 21% on February 14

February 14, 2025 12:24 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) kept the policy rate constant on February 14 for the second consecutive time supported by the recent RUB strengthening while the inflation remains elevated. CBR said in its statement on February 14 that current inflationary pressures remain

February 13, 2025

Negotiations to End Ukraine War to Start Soon

February 13, 2025 3:03 PM UTC

Bottom Line: As we envisaged, U.S. president Trump and Russian president Putin talked over the phone on February 12 to discuss the war in Ukraine. According to sources, Trump and Putin agreed to have their teams start negotiations immediately. Under current circumstances, we foresee a Russia-friendl

Europe’s Ukraine Political Fallout and Market Hopes

February 13, 2025 12:33 PM UTC

European politicians are surprised and angry at the U.S. stance on a peace deal for Ukraine and less military support for Europe, but eventually they will have to accept the new reality. Europe is too divided to provide security guarantees to Ukraine on its own. A further increase and acceleration

February 07, 2025

Russian Economy Grew by 4.1% YoY in 2024

February 7, 2025 7:22 PM UTC

Bottom Line: According to the figures announced by the Russian State Statistics Service (Rosstat) on February 7, Russia's GDP expanded by 4.1% YoY in 2024 driven by strong military spending, higher wages and fiscal stimulus. We envisage growth to hit 1.6% in 2025, which is significantly less than

February 06, 2025

CBR Will Likely Hold Key Rate Constant at 21% on February 14

February 6, 2025 10:05 AM UTC

Bottom Line: After Central Bank of Russia (CBR) held the key rate stable at 21% on December 20 despite expectations were centered around a rate hike, we now foresee that the rate will be kept constant on February 14 taking into account that January will likely bring a little inflation relief support

January 27, 2025

Trump-Putin Meeting in Horizon, Date Still Unknown

January 27, 2025 7:01 PM UTC

Bottom Line: After Trump took the office as of January 20, we feel Ukraine war is not a priority in Trump’s agenda since he is most focused on his priorities of immigration and tariffs. We think Trump and Putin will likely meet in spring to discuss tha war in Ukraine and energy prices, and Ukraine

January 15, 2025

Stubborn Inflation Jumped to Record High at Year-End Amid Ruble Woes

January 15, 2025 7:18 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data released on January 15, inflation ticked up to 9.5% YoY in December after hitting 8.9% in November, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices,

January 13, 2025

Cyberattacks and AI Misinformation: Market and Economic Fallout

January 13, 2025 8:10 AM UTC

A major cyberattack is a tail risk, while a huge AI misinformation crisis is a modest crisis in our view. Russia/China and Iran are less likely to launch a state sponsored cyberattack for geopolitical reasons and also uncertainty over president elect Donald Trump’s response. A huge AI mis

December 30, 2024

December 29, 2024

Russian Economy Grew by 3.6% YoY in November

December 29, 2024 9:57 AM UTC

Bottom Line: According to the preliminary figures announced by the Ministry of Economic Development, Russia's GDP expanded by 3.6% YoY in November driven by strong military spending while monetary tightening, sanctions, and higher price pressures remain restrictive. We envisage growth to hit 1.6%

December 24, 2024

December Outlook Webinar on Jan 7: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 24, 2024 8:30 AM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats