DM Central Banks

View:

January 05, 2026

January 02, 2026

Bessent: New Fed Inflation Range and Dropping Dots?

January 2, 2026 11:30 AM UTC

U.S. Treasury Secretary Bessent over the Christmas period suggested that the Fed should shift to targeting an inflation range and drop the quarterly dots. What impact would this have? Such a change would give the Fed more flexibility on the margin, but not significant. This could make communicat

December 30, 2025

U.S. Consumption Vulnerable to Asset Market Hit

December 30, 2025 8:42 AM UTC

Overall, we see consumption growth prospects as being modest for 2026, as low to middle income households still struggle with the cost of living crisis. Additionally, the slowdown in immigration is causing less overall employment gains and in turn less absolute increase in real income and consumptio

December 23, 2025

U.S. Q3 GDP: Better Than Expected, But

December 23, 2025 1:54 PM UTC

Q3 GDP came in better than expected due to a big net export contribution to growth. Gross domestic purchases at 2.7% were more in line with expectations, with mixed performance in key expenditure sectors. We see growth slowing in Q4, with net exports unlikely to repeat the Q3 outcome and consume

December 22, 2025

December 19, 2025

EZ HICP Preview (Jan 7): Is Services Inflation Problematic?

December 19, 2025 11:10 AM UTC

HICP inflation has been range bound for the last 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. But we see the headline rate falling out of that range in December to 1.9%, this preceding what may be a short-lived fall toward 1.5% in H1 2026. Som

Western Europe Outlook: Underlying Price Pressures Ebbing

December 19, 2025 9:34 AM UTC

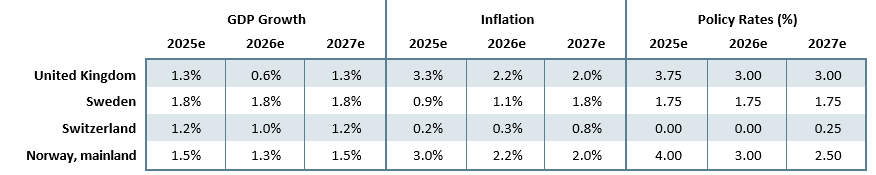

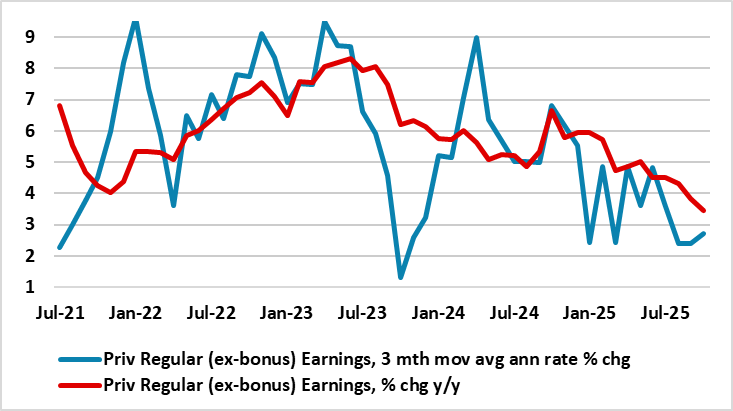

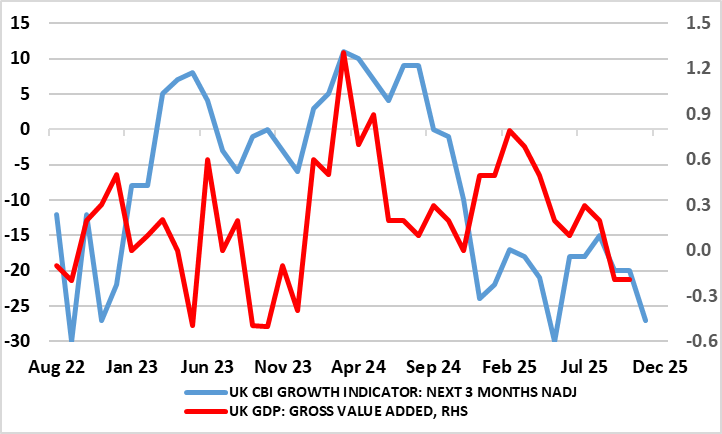

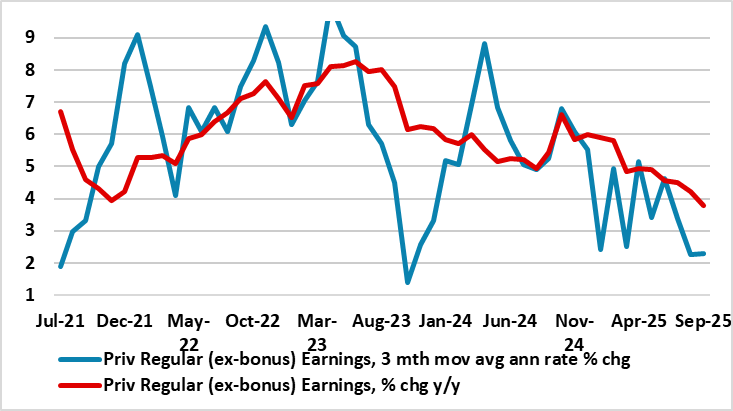

· In the UK, we have upgraded 2025 GDP growth by 0.1 ppt to 1.3%, but pared back that for next year by a two notches to a very sub-par 0.6%. We think the weak(er) labor market will accentuate somewhat refreshed disinflation allowing the BoE to ease further in 2026 by around 75 bp to 3.0

Japan Outlook: Putting One Foot in Front

December 19, 2025 7:15 AM UTC

· Private consumption growth is hindered by negative real wage in Q3 2025 yet Japan continues to demonstrate the structural change in both higher business price/wage setting and consumer behavior. Early signs for 2026 spring wage negotiation are upbeat and should see wage growth at

December 18, 2025

ECB Review: On Hold Message to Convert to Easing on Disinflation

December 18, 2025 3:09 PM UTC

· The ECB increased its 2026 GDP and inflation forecast and appears happy with current policy rate levels. However, still tight financial conditions, plus easing wage growth, point to disinflation and growth disappointment. We see this switch the ECB from an on hold message to easin

DM FX Outlook: Scope for USD decline against JPY, AUD and NOK

December 18, 2025 2:31 PM UTC

· Bottom Line: We expect some modest USD losses across the board over the next couple of years, but there is much more scope for losses against the JPY, AUD and NOK than the other G10 currencies, as yield spreads have moved dramatically in favour of these currencies, and the currencies

U.S. November CPI - Is the tariff impact fading?

December 18, 2025 2:10 PM UTC

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month ov

BoE Review (Dec 18): Splits More Entrenched?

December 18, 2025 12:41 PM UTC

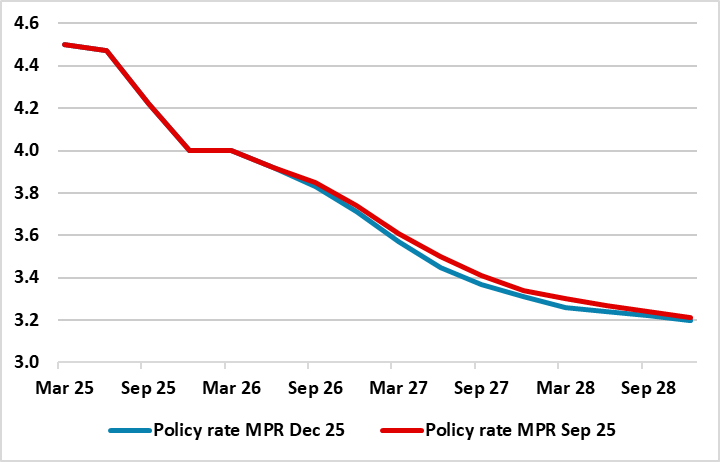

That the BoE delivered a sixth 25 bp rate cut (to an almost three-year low of 3.75%) was hardly in doubt. But we were surprised that amid the recent run of weak data, that there were (again) four dissents with Governor Bailey switching sides. Notably, in a clear combative overtone, at least some

Norges Bank Review: Still Far Too Cautious Despite Clear Output Gap

December 18, 2025 9:40 AM UTC

As expected, no change in policy and little shift in rhetoric and/or outlook was the message from the Norges Bank’s latest verdict. After two 25 bp cuts this year (to 4.0%), this month saw a second successive unchanged verdict with the policy outlook also retained (Figure 1). This was consistent

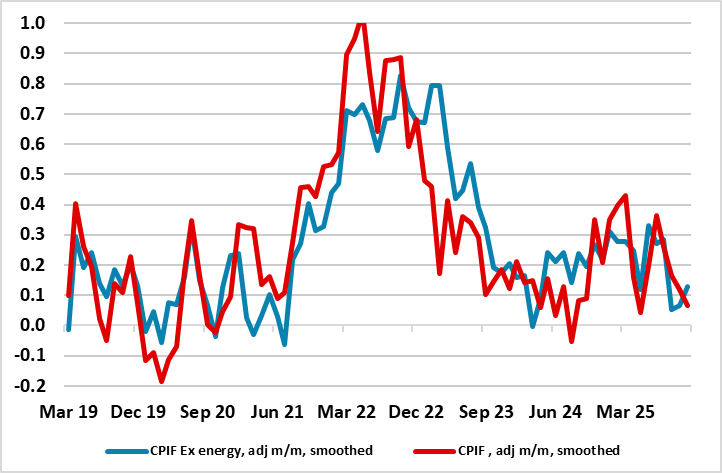

Sweden Riksbank Review: On Hold and For Some Time Ahead?

December 18, 2025 8:54 AM UTC

As widely anticipated, the Riksbank kept policy on hold with the key rate left (again) at 1.75%. It does seem as if the Riksbank Board is (very) pleased with the data flow since its last and very probably final rate cut on Sep 23. GDP saw a strong and unexpected Q3 showing of over 1% q/q while p

December 17, 2025

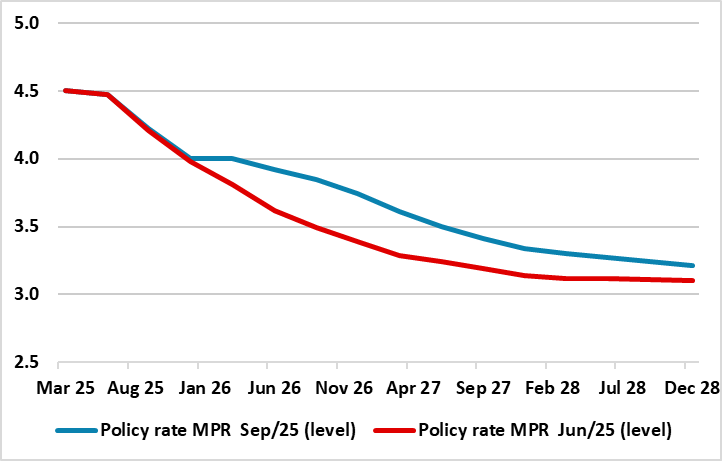

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

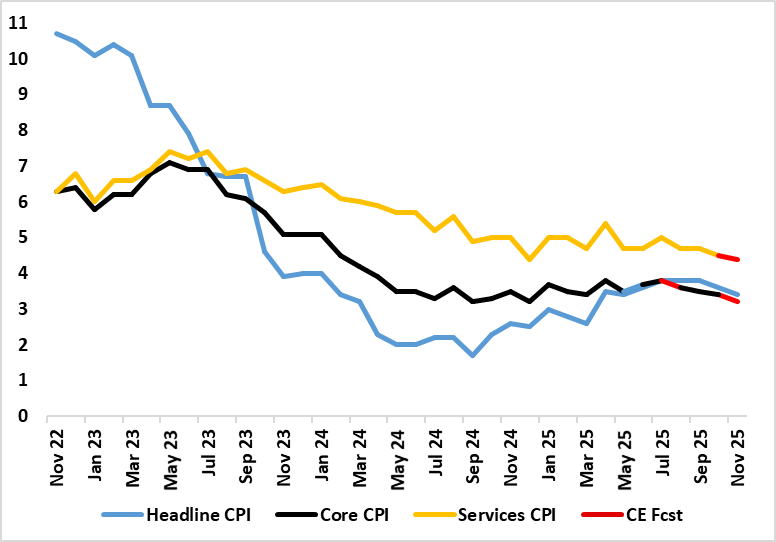

UK CPI Review: Down More Than Expected from Likely Peak?

December 17, 2025 7:38 AM UTC

A clear downside surprise adds to the wealth of data suggesting a reining of price and cost pressures. This November result makes it more likely that the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus by 0.2 pp

December 16, 2025

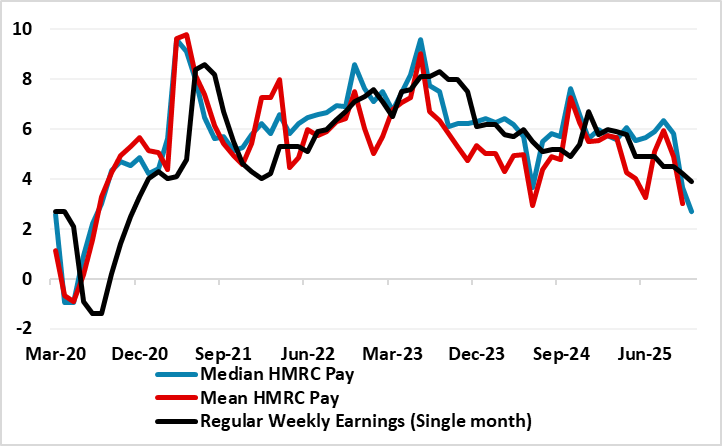

UK Labor Market: Job Losses Weighing Even More Clearly on Wages

December 16, 2025 8:06 AM UTC

Adding to the array if weak activity updates of late, there are increasing signs that the labor market is haemorrhaging jobs more clearly and broadly with fresh and deeper falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down alm

December 15, 2025

Canada November CPI - Underlying trend has slowed

December 15, 2025 1:48 PM UTC

November Canadian CPI at 2.2% has held steady at October’s pace, and is slightly weaker than expected. The Bank of Canada’s core are are on balance weaker, with CPI-Median and CPI-Trim falling to 2.8% from 3.0%, though CPI-Common (less important to the BoC) edged up to 2.8% from 2.7%.

December 12, 2025

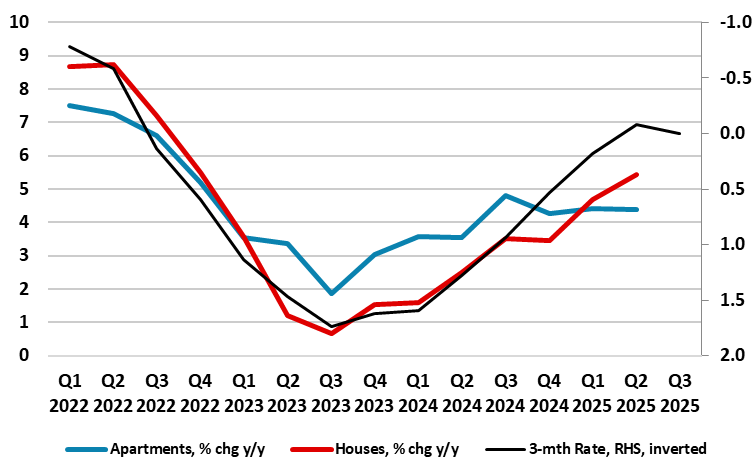

U.S. Outlook: Consumers Vulnerable, but Recession Unlikely

December 12, 2025 4:38 PM UTC

• US GDP growth is likely to look solid in Q3 2025 supported by resilient consumer spending, but with slowing employment growth and resilient inflation weighing on real disposable income that will be difficult to sustain. However, while consumers look vulnerable, business investment looks h

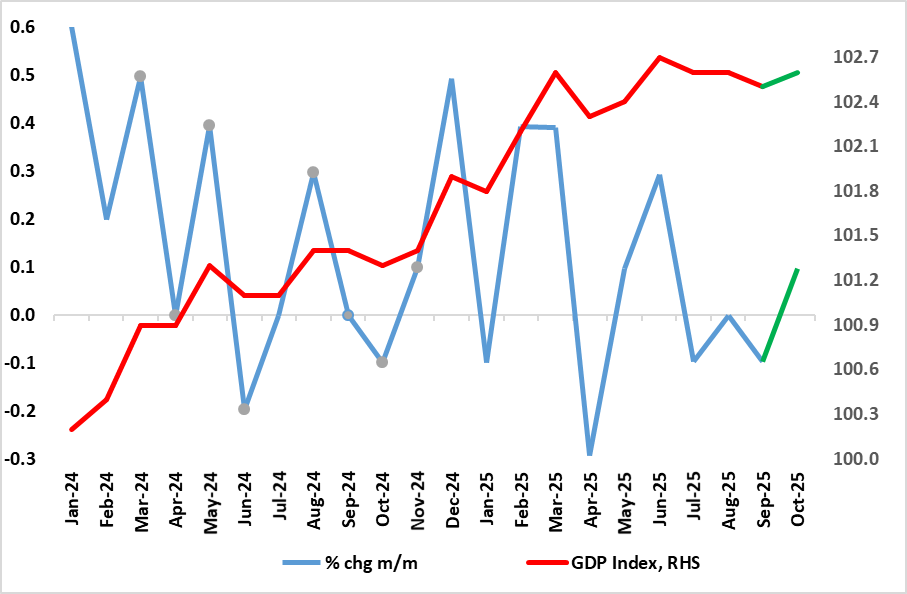

UK GDP Review: Underlying and Headline Economy Negative, Fragile and Listless

December 12, 2025 7:47 AM UTC

As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months (Figure 1), and where the unexpected further 0.

December 11, 2025

Eurozone Outlook: Running to Keep Fiscally Still?

December 11, 2025 10:09 AM UTC

· Amid what may still be tightening financial conditions and likely protracted trade uncertainty, we retain our below consensus activity forecast for 2026 but see a fiscally driven pick-up into 2027. However, the picture this year appears to be slightly better but the economy has actual

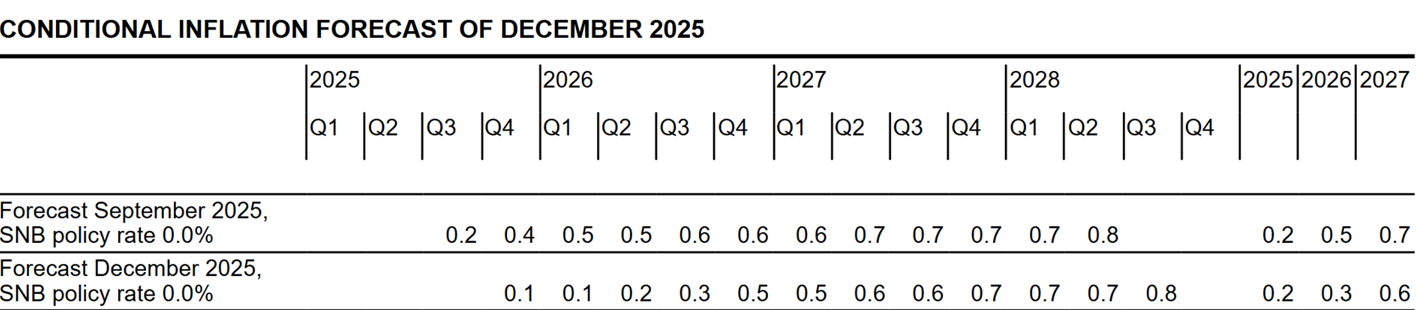

Swiss SNB Review: Preserving Ammunition

December 11, 2025 9:39 AM UTC

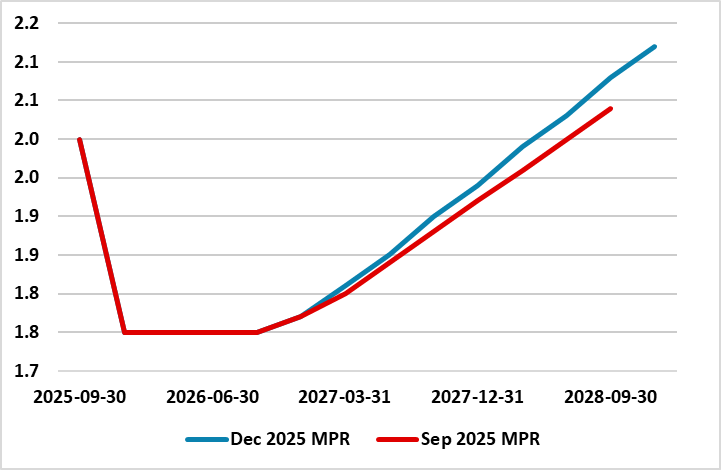

Although the tone of the economic outlook was a little perkier, the latest SNB analysis saw no real change. Policy was unchanged, as widely expected, with little shift in the forecast fir either growth or inflation. Overall it sees medium-term inflation at 0.6% (Figure 1), this despite a gloomy

December 10, 2025

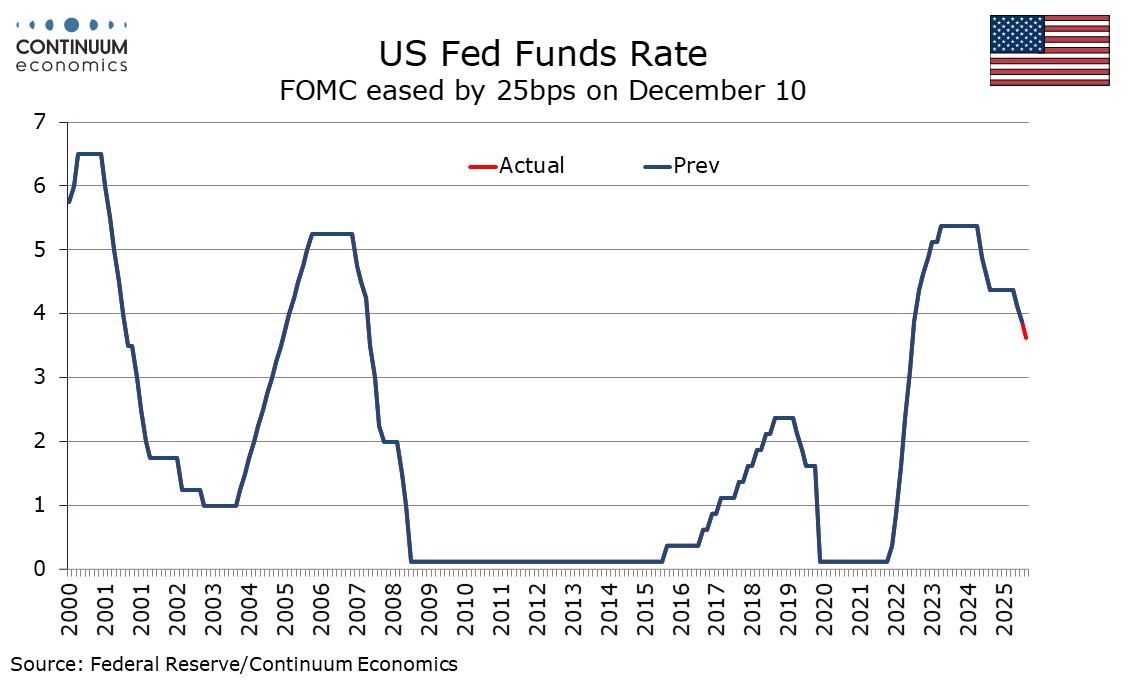

Fed: Slower 2026 Easing

December 10, 2025 8:34 PM UTC

Powell in the press conference made clear that the Fed is now in a wait and see mood, with policy rates entering a broad measure of neutral policy rates. This means further weakening in labor demand and then consumption would be required to prompt an early 2026 cut. We are less upbeat than the Fed

FOMC eases by 25bps, dots unchanged from September

December 10, 2025 7:21 PM UTC

The FOMC has eased by 25bps as expected to a 3.50-3.75% Fed Funds target range, with two hawkish dissents for no change from Schmid (who dissented in October) and Goolsbee, while Miran again dissented for a steeper 50bps ease. The dots are unchanged from September, implying one 25bps ease in both 20

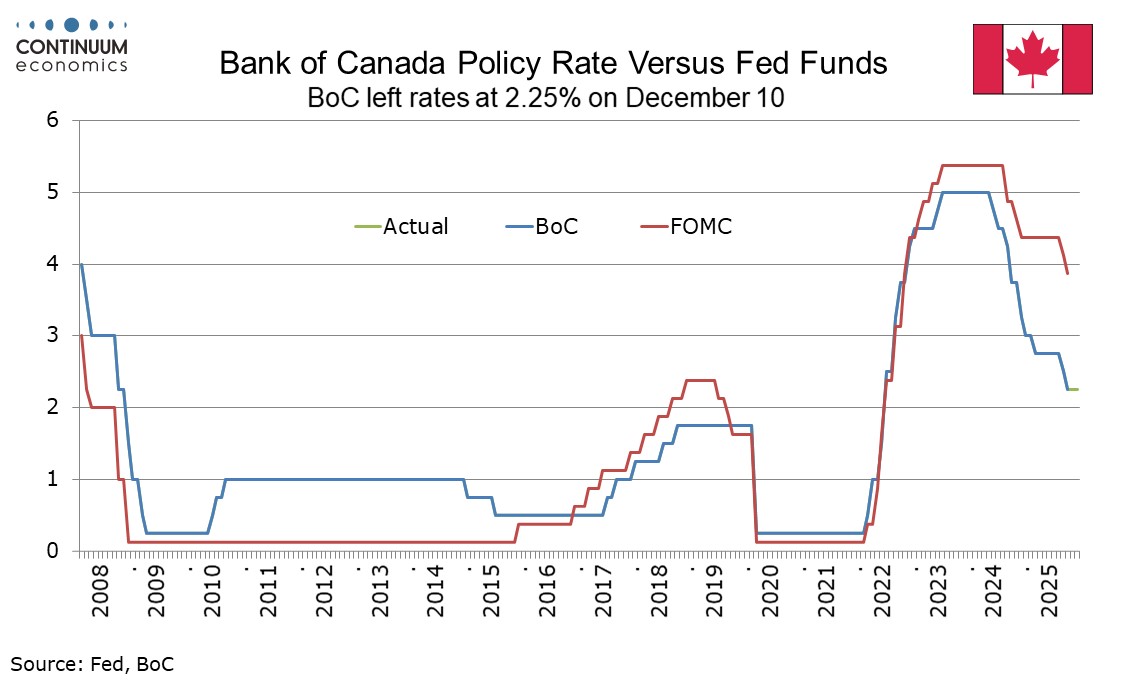

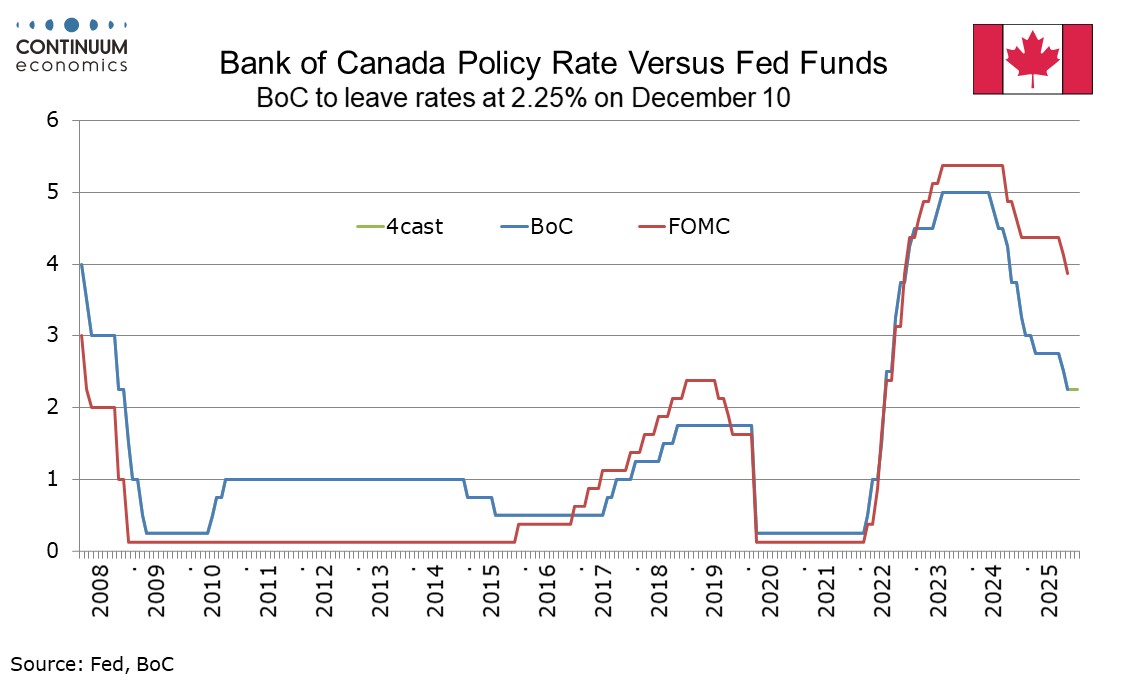

Bank of Canada - Rate Level Still Appropriate Despite Stronger Data

December 10, 2025 4:21 PM UTC

Since the Bank of Canada eased rates to 2.25% in October and stated that policy was now at an appropriate level, Canada has delivered stronger than expected data on GDP and employment. The data has not been dismissed, but the BoC view that policy is at an appropriate level persists after today’s m

Norges Bank Preview (Dec 18): Still Far Too Cautious

December 10, 2025 9:17 AM UTC

No change in policy and little shift in rhetoric was the message from the Norges Bank’s latest verdict. After what was to some a surprise (and seemingly far from a formality) move in September, in which the Norges Bank cut is policy rate by a further 25 bp to 4.0%, we see no change at the loomin

December 09, 2025

BoE Preview (Dec 18): How Big a Split?

December 9, 2025 11:29 AM UTC

That the BoE will deliver a fifth 25 bp rate cut (to 3.75%) on Dec 18 is almost certain, even after a Budget that did not accentuate current emerging demand weakness. The question is whether the MPC vote will be as close as the 5:4 split seen last month but with Governor Bailey switching sides.

ECB Preview (Dec 18): Still in Good Place – or Even Better?

December 9, 2025 7:52 AM UTC

A fourth successive stable policy decision will be the almost inevitable outcome of the ECB Council meeting verdict on Dec 18, with the discount rate left at 2.0%. The likely unanimous vote will mask splits about whether policy has troughed or not, this mainly a result of differences within the Co

December 08, 2025

Sweden Riksbank Preview (Dec 18): Policy to be Unchanged and little Move in Projections?

December 8, 2025 1:18 PM UTC

As we anticipated in our review, the Riksbank Board will be very pleased with the data flow since its last and very probably final rate cut on Sep 23 (to 1.75%). GDP saw a strong and unexpected Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confir

UK CPI Preview (Dec 17): Down Further from Likely Peak?

December 8, 2025 9:43 AM UTC

It does seem as if the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus to 3.6%, the looming November numbers may show a same-sized fall to 3.4%, a six-month low. We see the core rate seen also dropping 0.2 ppt b

December 05, 2025

FOMC Preview for December 10: A close call for a 25bps easing

December 5, 2025 4:09 PM UTC

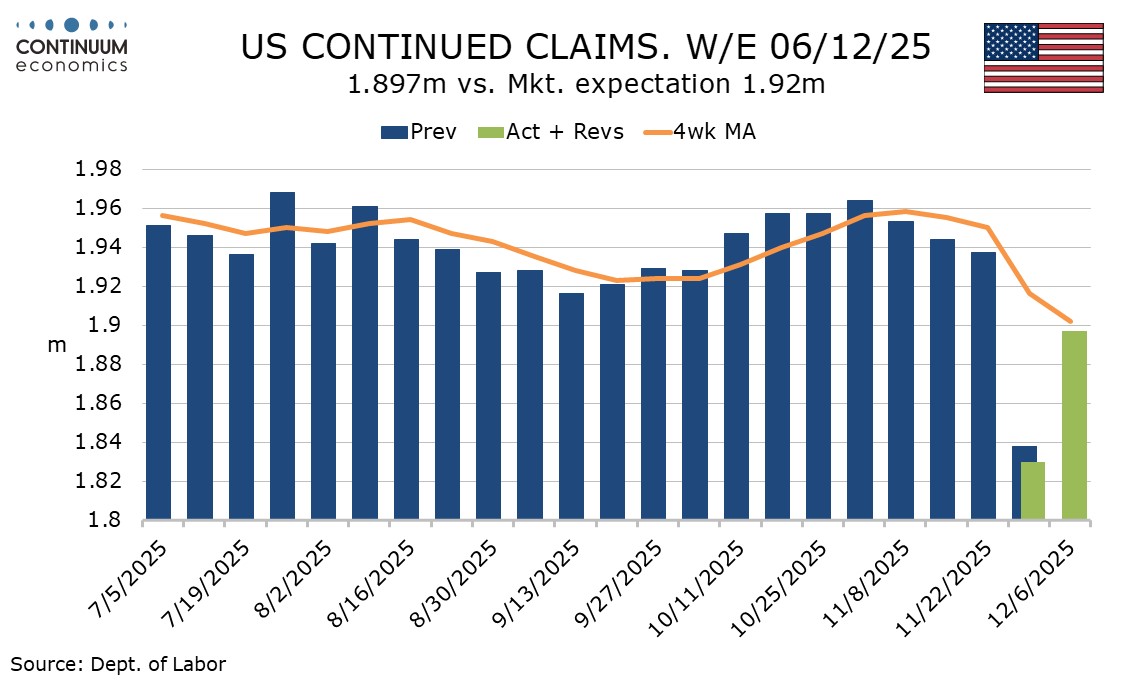

The FOMC meets on December 10 in what looks sure to be a hotly debated decision, though a 25bps easing in the Fed Funds target range to 3.50-3.75% looks likely, justified by labor market risks. However, at least two hawkish dissents for unchanged policy are likely. The meeting will deliver updated d

Bank of Canada Preview for December 10: Stronger data reinforces case for a pause

December 5, 2025 2:31 PM UTC

The Bank of Canada looks highly likely to leave rates at 2.25% when it meets on December 10. After easing in both September and October, the BoC after its October move stated rates were now at about the right level if the economy evolved in line with its expectations. With Q3 GDP and November employ

Canada November Employment - Third straight strong rise, unemployment lowest since July 2024

December 5, 2025 2:00 PM UTC

Canada’s November employment report has surprised on the upside for a third straight month, rising by 53.6k, and this time with a sharp fall in unemployment to 6.5% from 6.9%. While the Bank of Canada is unlikely to be thinking about tightening yet, the data adds to hopes generated by a 2.6% annua

December 04, 2025

UK GDP Preview (Dec 12): Underlying Economy Fragile and Listless

December 4, 2025 9:55 AM UTC

As we have underlined, GDP has hardly moved since March and this is un likely to change with the October GDP release. Indeed, it has fallen in two of the last three months (Figure 1), albeit where some recovery should be in store for the current quarter as the September numbers were hit (temporari

SNB Preview (Dec 11). Still Staying at Zero – And For Some Time?

December 4, 2025 8:10 AM UTC

Along with just about everyone, we see unchanged SNB policy when it gives it next quarterly assessment on Dec 11. It is likely to retain what were modest growth outlook for this and next year and still see inflation nearer zero than the 2% upper target (figure 1). But this will be enough to just