FOMC Preview for December 10: A close call for a 25bps easing

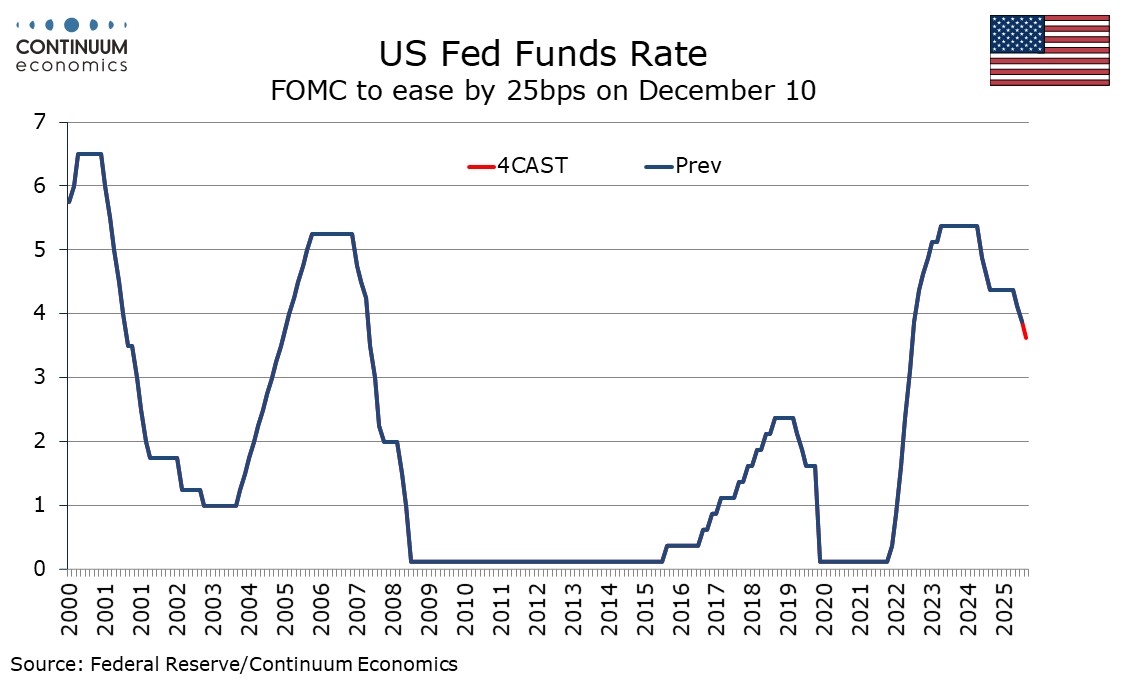

The FOMC meets on December 10 in what looks sure to be a hotly debated decision, though a 25bps easing in the Fed Funds target range to 3.50-3.75% looks likely, justified by labor market risks. However, at least two hawkish dissents for unchanged policy are likely. The meeting will deliver updated dots, though we expect changes from those in September to be modest.

After the last meeting on October 29 Chairman Powell stated that there were strongly differing views on December and that easing was far from sure. Whatever the decision, the vote is unlikely to be unanimous. If the Fed eases by 25bps as we expect, we would expect dissents for unchanged policy from Kansas City Fed’s Schmid, who dissented against October’s ease, as well as St Louis Fed’s Musalem. Chicago Fed’s Goolsbee and Governor Barr are also possible hawkish dissents, but we feel they will go along with Powell’s decision. Governor Miran is likely to deliver a dovish dissent, calling again for a 50bps easing. If policy is left unchanged Governors Waller and Bowman would be likely to dissent for a 25bps easing. We suspect most others would back Powell’s decision.

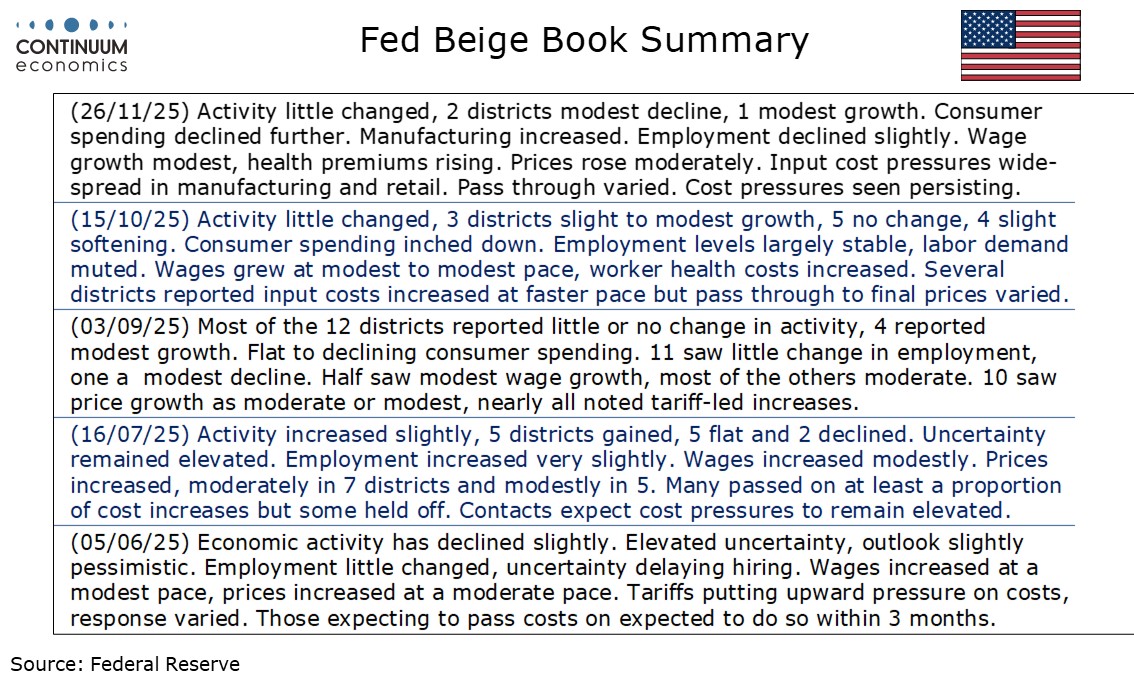

Easings at the last two meetings have been justified by labor market risks. Absence of October and November non-farm payroll data, after a relatively resilient September increase of 119k, may be used by some as arguments for a pause. Initial claims remain low, even if a fall in the latest week is likely to reflect seasonal adjustment difficulties in the Thanksgiving week. However we have seen suggestions that November payrolls slipped from ADP and Revelio, and it may be particularly important to the Fed that its latest Beige Book reported that employment declined slightly. It is a close call, but we believe that labor market risks will tip the balance to easing. If easing is delivered however, we would expect Powell at the press conference to signal that policy is now at an appropriate level, and that sufficient insurance against labor market weakness has been taken.

If the Fed decides to remain on hold, Powell may hint that easing is possible in Q1 once the data picture is clearer. However several at the meeting, including some non-voters, will argue that persistent above target inflation justifies keeping rates on hold, with the full pass through from tariffs probably not yet seen and risk that tariff-led inflation could become sustained, something that the doves do not expect to happen. The lift to goods inflation from tariffs, while noticeable, has been less than many feared, but there are differences of opinion at the Fed on whether underlying inflation, led by services, is moving towards the 2.0% target.

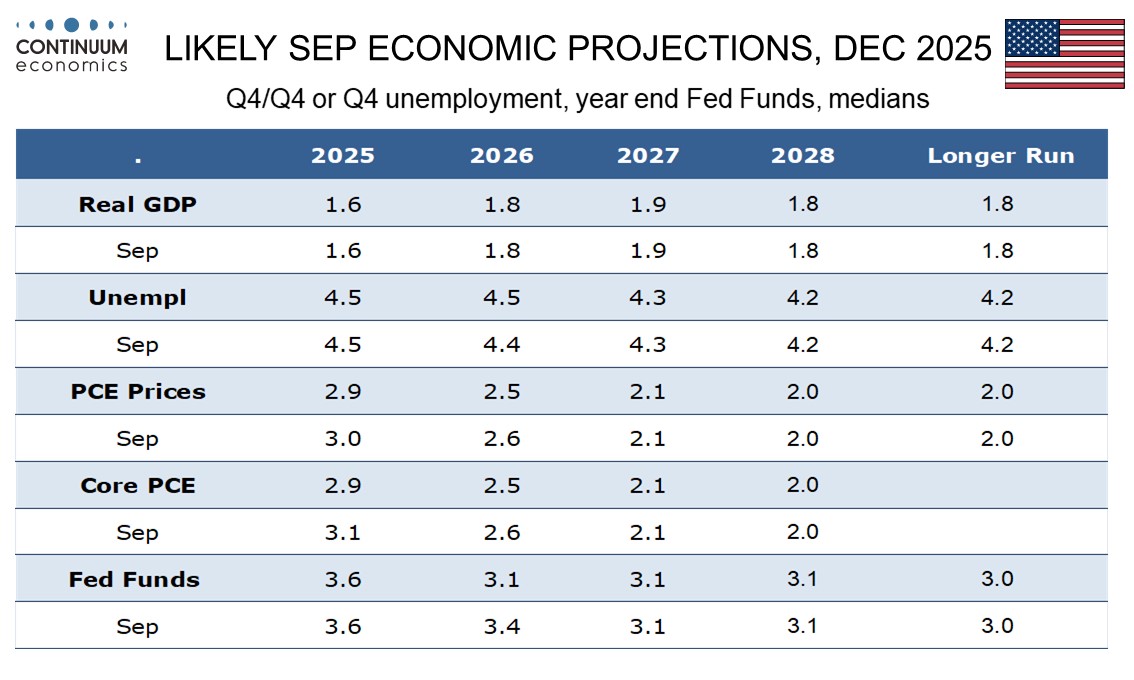

This meeting will see the dots updated. It is not out of the question that the 2025 dot could diverge from the decision, given the hawkish leaning of some non-voting district presidents, though we expect the 2025 dots to back the 25bps easing. Only one dot has to shift to move the 2026 median to 3.125% from 3.375%. We expect 2027 and 2028 will remain at 3.125% and the long run median dot at 3.0%. We do not expect much change in GDP forecasts with expected weakness in Q4 weighing against an upward revision to Q2 and positive expectations for Q3, though unemployment for 2026 may be nudged marginally higher. Recent data suggests the median core PCE price forecast for 2025 will be revised lower, we expect to 2.9% from 3.1%, and 2026 may see a marginal downward adjustment from 2.6%. That recent price data has not been quite as strong as feared is another factor boosting the case for easing in what remains a close call.