Russian Federation

View:

January 06, 2026

Markets 2026

January 6, 2026 9:58 AM UTC

• For financial markets, the muddle through for global economics and policy provides support for risk assets, combined with solid earnings prospects from some of the magnificent 7. However, U.S. equities are once again significantly overvalued and we look for a 5-10% correction in 2026, b

January 05, 2026

Venezuela: Oil and Geopolitics

January 5, 2026 12:02 PM UTC

· Venezuela’s oil production will likely take years to increase substantively due to poor infrastructure, the need for substantive investment, and a lack of democratic political stability. In terms of geopolitics, operations in Venezuela reinforce the Trump administration’s pivot

December 23, 2025

Trump’s Peace Framework as a Path to a Late 2026 Settlement?

December 23, 2025 1:48 PM UTC

Bottom Line: With Russia maintaining its long-held demands in Ukraine and negotiations intensifying around President Trump’s latest peace proposal, our baseline view is that this framework will serve as the primary catalyst for a settlement. We anticipate a Russia-friendly peace deal (70% probabil

December 22, 2025

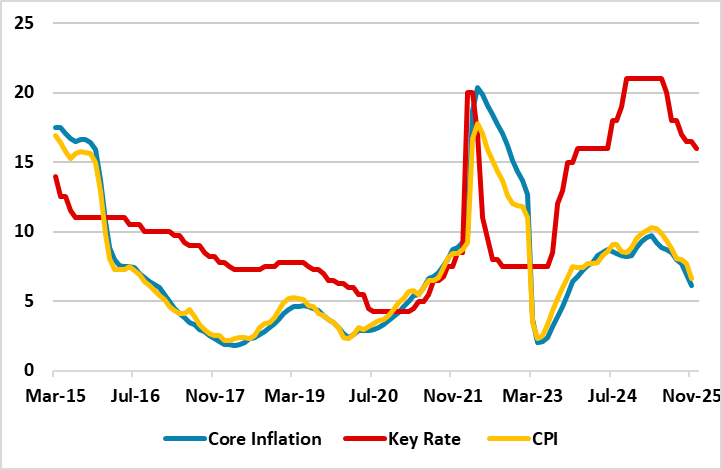

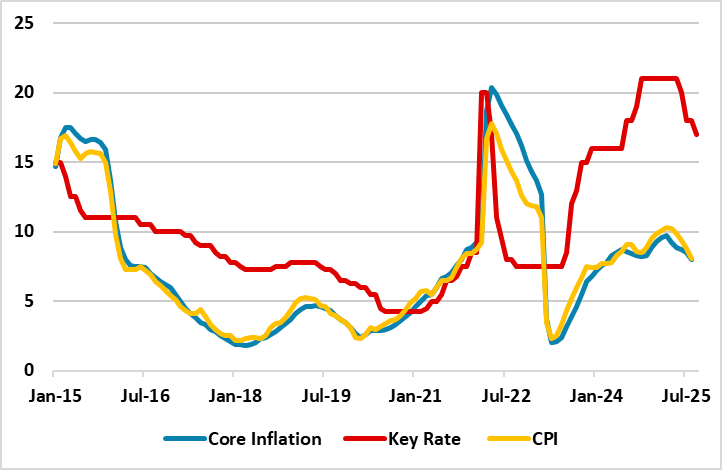

Russia’s Inflation is Expected to Continue to Soften in December

December 22, 2025 2:11 PM UTC

Bottom Line: After edging down to 6.6% in November, we expect Russian inflation to continue its decreasing pattern in December owing to lagged impacts of previous aggressive monetary tightening and relative resilience of RUB. December inflation figures will be announced on December 29, and we forese

December 19, 2025

Easing Cycle Continues: CBR Reduced Key Rate to 16% on December 19

December 19, 2025 11:09 AM UTC

Bottom Line: As expected, Central Bank of Russia (CBR) reduced the key rate by 50 bps to 16% during the MPC on December 19 since the pace of the fall in inflation accelerated in November. CBR said in its written statement that monetary policy will remain tight for a long period, and further decision

December 18, 2025

EM FX Outlook: High Real Yields Still Help

December 18, 2025 12:14 PM UTC

• EM currency 2026 prospects come against a backdrop of a further but slower USD depreciation against DM currencies, but inflation differentials, domestic central bank policy and politics also matter. We forecast the Mexican Peso (MXN) will likely be more volatile, as President Donald Tru

December 17, 2025

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 16, 2025

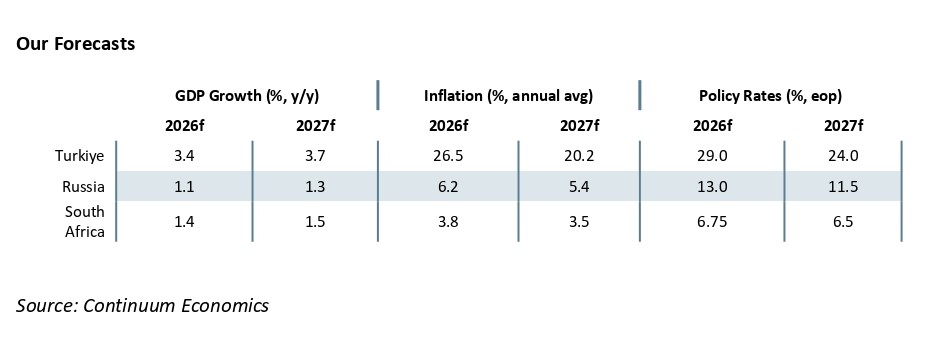

EMEA Outlook: Uncertainties Give Mixed Signals

December 16, 2025 7:00 AM UTC

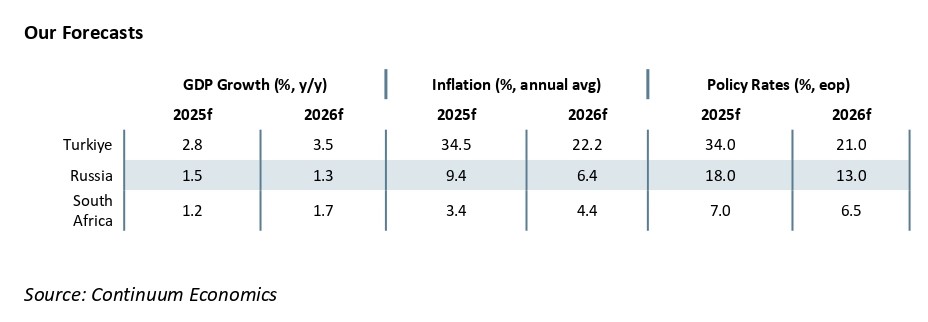

· In South Africa, we foresee average headline inflation will stand at 3.8% and 3.5% in 2026 and 2027, respectively. Upside risks to inflation remain such as, utility costs, and supply chain destructions. We see growth to be 1.4% and 1.5% in 2026 and 2027, respectively. Risks to the growth

December 11, 2025

Exceeding Expectations: Russia Inflation Eased Fast to 6.6% y/y in November

December 11, 2025 8:15 AM UTC

Bottom Line: Russian inflation continued its decreasing pattern in November and edged down to 6.6% owing to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB despite food and services prices continued to surge in November. We think the inflation will continue

December 09, 2025

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 14, 2025

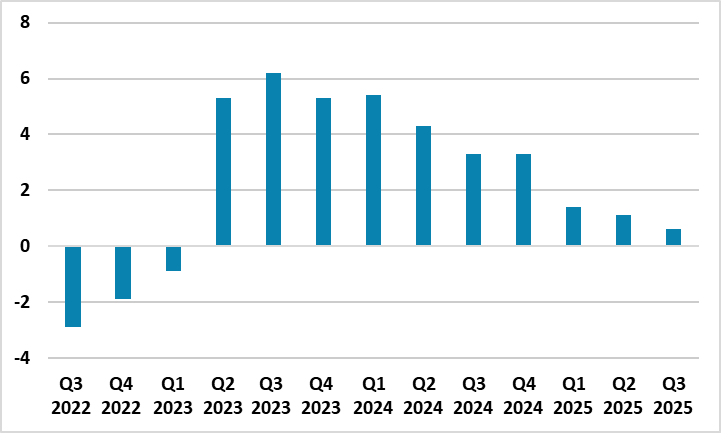

Slowest Rate of Growth for Russia Since Q1 2023: 0.6% y/y in Q3 2025

November 14, 2025 6:06 PM UTC

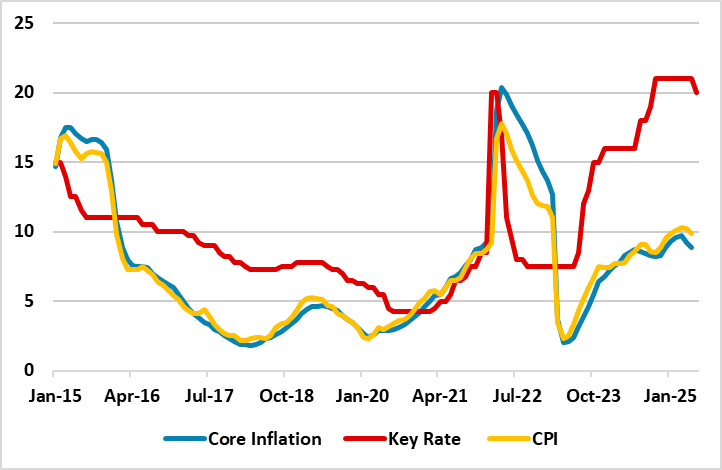

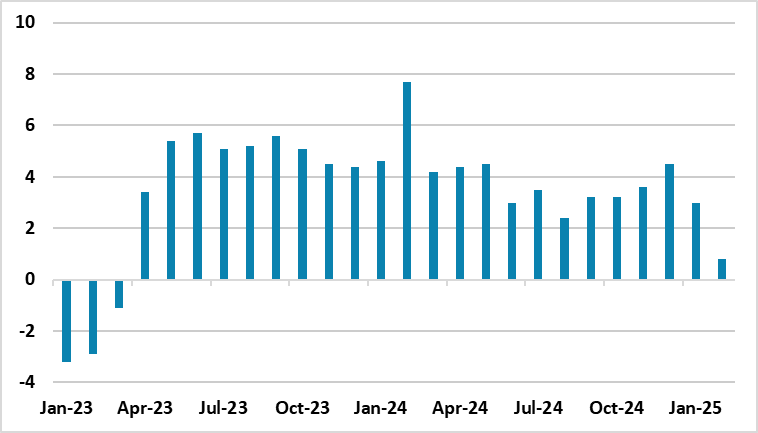

Bottom Line: According to Ministry of Economic Development’s preliminary figures, Russia's GDP expanded by a moderate 0.6% y/y in Q3, marking the slowest rate of growth since Q1 2023 showing the economic slowdown in Russia is more evident now. We think Central Bank of Russia’s (CBR) previous agg

Russia’s Inflation Softened to 7.7% y/y in October

November 14, 2025 5:00 PM UTC

Bottom Line: As expected, Russian inflation continued its decreasing pattern in October and edged down to 7.7% thanks to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB particularly after July. Despite fall in inflation; we think the inflation will continue

November 06, 2025

Russia’s Inflation is Expected to Continue to Soften in October Likely Hitting Below 8.0% y/y

November 6, 2025 2:39 PM UTC

Bottom Line: We expect Russian inflation to continue its decreasing pattern in October thanks to lagged impacts of previous aggressive monetary tightening coupled with softening food prices and decreasing core inflation. October inflation figures will be announced on November 14, and we foresee Yr/Y

October 24, 2025

Unexpectedly, CBR Reduced Key Rate to 16.5% on October 24

October 24, 2025 4:53 PM UTC

Bottom Line: Despite we expected Central Bank of Russia (CBR) to hold the policy rate constant at 17% during the next MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine stepped up hitting oil refineries in Russia; CBR de

October 16, 2025

Preview: CBR will Likely Hold the Key Rate Stable at 17% on October 24

October 16, 2025 1:09 PM UTC

Bottom Line: We expect Central Bank of Russia (CBR) to hold the policy rate constant at 17% during the next MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine stepped up hitting oil refineries in Russia; which could also

October 10, 2025

Russia’s Inflation Softened to 17-Month Low in September

October 10, 2025 7:02 PM UTC

Bottom Line: Russian inflation continued its decreasing pattern in September, and hit the lowest in 17-months after with 7.98% y/y, particularly thanks to lagged impacts of previous aggressive monetary. According to Rosstat’s announcement on October 10, core inflation eased to 7.7% y/y from 8% y/y

October 02, 2025

Russia’s Growth Continues to Lose Steam

October 2, 2025 11:17 AM UTC

Bottom Line: According to a recent announcement by the Ministry of Economic Development, Russia's GDP expanded by a moderate 0.4% YoY in August, meeting the same pace in the previous month, driven by manufacturing, retail trade and agriculture activities. According to the announcement, the growth in

October 01, 2025

Russia’s Inflation is Expected to Continue to Soften in September

October 1, 2025 1:35 PM UTC

Bottom Line: We expect Russian inflation to continue its decreasing pattern in September, after hitting the softest rate since April of 2024 with 8.1% YoY in August, particularly thanks to lagged impacts of previous aggressive monetary tightening coupled with softening services and food prices. Sep

September 26, 2025

War in Ukraine: No Light Yet at the End of the Tunnel

September 26, 2025 12:34 PM UTC

Bottom Line: Despite expectations from the 80th United Nations General Assembly (UNGA) held in New York were high, it did not yield a solution to the war in Ukraine, but an escalation between the U.S. and Russia. The claims by president Trump as he shifted his position on the war, saying for the f

September 23, 2025

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

September 22, 2025

EMEA Outlooks Stay Mixed into 2026: Domestic and Global Uncertainties

September 22, 2025 6:58 AM UTC

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.2% in 2025 and 2026, respectively, despite upside risks to inflation such as swings in food prices, supply chain destructions including energy shortages and port inefficiencies and global uncertainties. We see

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 12, 2025

CBR Reduced its Key Rate to 17% as Inflation Softened, but Warned Inflation is Still High

September 12, 2025 3:48 PM UTC

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 100 bps to 17% on September 12 taking into account that inflation continued to slow down in Q3 but still warned inflation remains high. CBR stated in its written statement it will maintain monetary conditions as tight

September 10, 2025

August 18, 2025

Trump-Putin Summit: No Ceasefire Agreement, Possible Concessions Discussed

August 18, 2025 12:29 PM UTC

Bottom Line: U.S. President Trump and Russian President Putin met in Alaska on August 15 to discuss the fate of war in Ukraine. The meeting lasted three hours, but did not yield an immediate ceasefire agreement as we expected. After the meeting, Trump and Putin both signaled what could happen next i

August 14, 2025

Russian Economy is Slowing: GDP Growth Continued to Lose Steam in Q2 2025

August 14, 2025 9:23 AM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) figures, Russia's GDP expanded by 1.1% YoY in Q2, the slowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, investments, higher wages and fiscal stimulus. We think Central Bank of R

August 13, 2025

Deceleration in Inflation Resumes in Russia: 8.8% YoY in July

August 13, 2025 7:28 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data on August 13, inflation stood at 8.8% YoY in July after hitting 9.4% YoY in June, ignited by higher non-food and services prices. Despite inflation eased for a fourth straight month, we foresee inflation will continue to st

July 25, 2025

CBR Reduced its Key Rate to 18% as Inflation Softens

July 25, 2025 11:41 AM UTC

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 200 bps to 18% on July 25 taking into account that inflation slowed to 9.4% in June from 9.9% in May; MoM price growth marked the lowest hike after August 2024; and the inflation expectations declined to 13% in June fro

July 16, 2025

CBR will Likely Cut its Key Rate to 19% on July 25

July 16, 2025 4:32 PM UTC

Bottom Line: After Central Bank of Russia (CBR) reduced its key interest rate by 100 basis points to 20% on June 6, citing continued easing in inflationary pressures, including core inflation, we foresee that the rate will be further reduced to 19% on July 25 taking into account that inflation slowe

July 11, 2025

Deceleration in Inflation, Albeit Gradual, Continued in June: 9.4% YoY

July 11, 2025 4:48 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 9.4% YoY in June after hitting 9.9% YoY in May, partly due to favorable base impacts, recent RUB strengthening and falling oil prices. We think the recent tariffs hike for electricity, gas, heating and w

July 02, 2025

Russia GDP Growth Continues to Lose Steam

July 2, 2025 6:43 PM UTC

Bottom Line: According to Ministry of Economic Development figures, Russia's GDP expanded by 1.2% YoY in May following a 1.9% rise the previous month, which marked one of the lowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, higher wages and fiscal

June 26, 2025

Ukraine War Update: War Continuing Probability is Now at 70%

June 26, 2025 11:06 AM UTC

Bottom Line: Our baseline scenario (70%) is based on the war continuing after talks fail since president Putin insists on his peace terms. President Trump is reluctant to threaten or implement of secondary tariffs on Russia oil buyers, that would really pressure president Putin. The U.S. financing o

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

June 14, 2025

Russian GDP Growth Loses Steam in Q1

June 14, 2025 8:54 AM UTC

Bottom Line: Russia's GDP expanded by 1.4% YoY in Q1, the slowest pace of growth since the economy resumed expansion in Q2 2023 driven by military spending, higher wages and fiscal stimulus. The softening of growth figures demonstrates monetary tightening, sanctions, supply side constraints and hi

June 12, 2025

Inflation in Russia Continued to Moderately Decelerate in May: 9.9% YoY

June 12, 2025 7:43 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 9.9% YoY in May after hitting 10.2% in April, the softest in four months. Despite CPI remained above the Central Bank of Russia’s (CBR) midterm target of 4%, the deceleration was remarkable as prices i

June 06, 2025

Surprising Move: CBR Reduced Key Rate to 20% from 21%

June 6, 2025 1:10 PM UTC

Bottom Line: Despite predictions were centered around no change, Central Bank of Russia (CBR) cut policy rate on June 6 for the first time after September 2022 citing easing in inflationary pressures, including core inflation. CBR indicated in its written statement that CBR will maintain monetary co

June 02, 2025

May 16, 2025

Sticky Inflation in Russia Hits 10.2% YoY in April

May 16, 2025 8:36 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 10.2% YoY in April after hitting 10.3% in March, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending, and lab

May 12, 2025

Optimistic CBR Publishes Summary of Key Rate Decision on May 12

May 12, 2025 5:24 PM UTC

Bottom Line: Central Bank of Russia (CBR) published the summary of the key rate decision on May 12, showing CBR’s views on economic developments. CBR highlighted in its report that “The current inflationary pressures eased in Q1, whereas food and services prices were still rising at a fast pa

April 28, 2025

The Hope for A Peace Deal in Ukraine Seems No Close

April 28, 2025 12:55 PM UTC

Bottom Line: We have lowered a Russia-friendly peace deal following a cease-fire to 50% probability but have increased the alternative scenario of war continues to 50% probability in Ukraine as negotiations to end the war in Ukraine continue slowly. In the former scenario, we envisage Russia will co

April 25, 2025

CBR Continues to Keep Key Rate Constant at 21% Despite Surging Inflation

April 25, 2025 1:56 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) held the policy rate stable on April 25 for the fourth consecutive time to combat price pressures. CBR indicated in its written statement that CBR will maintain monetary conditions as tight as necessary to return inflation to the target

April 12, 2025

Soaring Inflation Hits Two-Year High in March with 10.3% YoY

April 12, 2025 10:16 AM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation ticked up to 10.3% YoY in March after hitting 10.1% in February, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending,

April 07, 2025

EMEA Economies Will Be Tested Amid U.S. Tariff Heat

April 7, 2025 5:29 PM UTC

Bottom Line: The impacts of U.S. additional tariffs announced on April 2 could likely have multifaceted impacts over EMEA countries. Relatively-low 10% tariffs could open new doors for Turkiye to capture a higher global market share if it can act quickly on trade diversification. We foresee the coun

April 04, 2025

Russia GDP Growth Loses Steam in the First Two Months of 2025

April 4, 2025 9:14 AM UTC

Bottom Line: According to the figures announced by the Ministry of Economic Development on April 3, Russia's GDP expanded by 0.8% YoY in February following a 3% YoY increase in January driven by military spending, higher wages and fiscal stimulus. The softening of growth figures demonstrates monet

April 01, 2025

The Hope for A Peace Deal in Ukraine is Tested

April 1, 2025 9:55 AM UTC

Bottom Line: As negotiations to end the war in Ukraine continue, we foresee a Russia-friendly peace deal (70% probability) in Ukraine could be sealed in 9-12 months following a cease-fire under current circumstances. In this scenario, we envisage Russia will continue to annex areas in and around fo