VAT Hike, Stubborn Food and Services Prices Pushed Russia’s Inflation to 6.0% y/y in January

Bottom Line: After easing to 5.6% y/y in December, Russia’s inflation edged up to 6.0% y/y in January due to VAT hike and stubborn food and services prices, the State Statistics Service (Rosstat) said. Despite Central Bank of Russia (CBR) announced that the inflation forecast for 2026 has been raised to 4.5–5.5%, our 2026 average headline inflation projection stays at 6.2% due to inflationary risks such as utility tariff increases, elevated inflation expectations, the recent VAT hike from 20% to 22%, and oil prices.

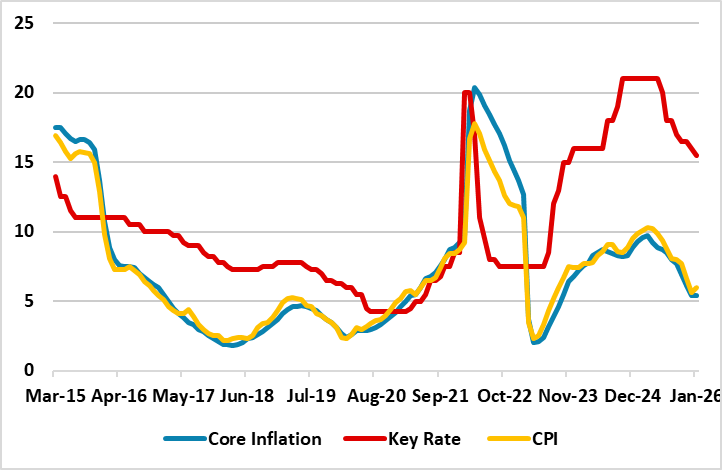

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – February 2026

Source: Continuum Economics

After annual inflation softened to 5.6% in December owing to lagged impacts of previous aggressive monetary tightening and relative resilience of RUB, Russia’s inflation edged up to 6.0% y/y due to VAT hike, stubborn food and services prices, the State Statistics Service (Rosstat) said.

In monthly terms, consumer prices surged by 1.6% in January. Monthly food prices went up by 1.9% while services prices surged by 2.3%. Annual prices of food and services soared by 5.9% and 9.6%, respectively. In the food segment, the price hike was the most notable for cucumbers (+32.7%), tomatoes (+18%), and potatoes (+9.4%) in January.

There are some clear inflationary risks, notably the VAT hike from 20% to 22% for 2026, utility tariff increases, elevated inflation expectations and oil prices. First, heightened inflation expectations remain a primary concern for policymakers, alongside robust lending activity and uneven price dynamics. Business inflation expectations surged in January to their highest level since 2022, while household expectations remained elevated at a one-year high of 13.7%.

Oil prices may create certain risks and speed up inflation if they fail to recover to the levels that the Bank of Russia set in its baseline scenario, the regulator’s Governor Elvira Nabiullina said on February 13. "(…) If oil prices don't recover from current levels to those we included in the baseline scenario this could accelerate inflation through the foreign exchange channel," Nabiullina indicated.

Despite CBR predicts that annual inflation will decline to 4.5–5.5% in 2026 and underlying inflation will reach 4% in H2 2026, we continue to believe reaching this target band will be tough in 2026 since cooling off inflation will take longer than CBR anticipates due to the persistent impacts of sanctions, the adverse effects of the VAT hike, continued high levels of military spending and tightening labor market conditions.

Our 2026 average headline inflation projection stays at 6.2%. We think pro-inflationary risks still prevail over disinflationary ones in the mid-term horizon. Key risks include the potential persistence of inflation expectations, vulnerability of the ruble to external shocks, and volatility in global commodity markets. We believe a peace deal in Ukraine remains the real key to ease pressure on inflation and alleviate demand-supply imbalances in Russia.