Surprising Move by the CBR: 50 Bps Interest Rate Cut Despite Inflationary Risks

Bottom Line: Despite we expected the Central Bank of Russia (CBR) to hold the policy rate at 16% during the MPC on February 13 and anticipated a cautious stance as the Bank monitors inflationary risks, including the VAT hike in 2026, utility tariff increases, and elevated inflation expectations; the CBR reduced the policy rate by 50 bps likely to stimulate the economy as it comes under increasing strain from high borrowing costs. Our year-end target for the 2026 key rate remains 13%. High real yields will be necessary to manage stubborn inflation, which is currently fueled by massive military spending and labor shortages and we anticipate these inflationary headwinds will persist for the duration of the war in Ukraine.

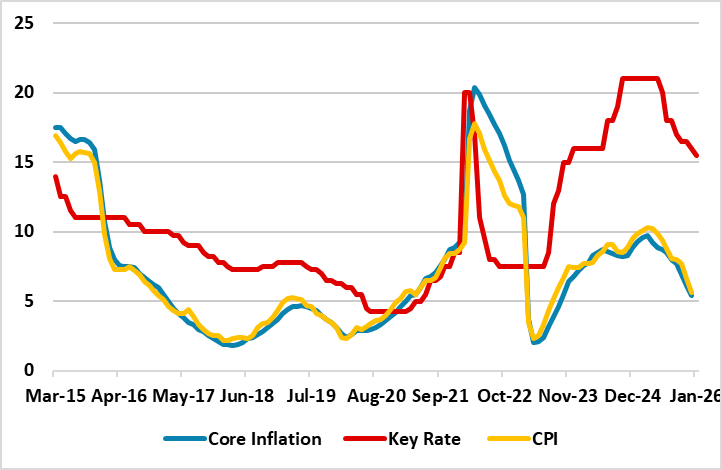

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – February 2026

Source: Continuum Economics

Following the Central Bank of Russia’s 50 bps cut to 16% on December 19—precipitated by an accelerated disinflationary trend in Q4—we expected the Bank to hold the policy rate constant during the MPC on February 13 due to mounting inflationary risks, notably the VAT hike from 20% to 22% for 2026, utility tariff increases, and elevated inflation expectations.

First, heightened inflation expectations remain a primary concern for policymakers, alongside robust lending activity and uneven price dynamics. Business inflation expectations surged in January to their highest level since 2022, while household expectations remained elevated at a one-year high of 13.7%.

Furthermore, despite the CBR attributes the expected January inflation spike to temporary factors like VAT and administered prices, we doubt that these impacts will be confined solely to the month of January. (Note: January inflation data is set for publication later this afternoon, February 13).

Despite mentioned risks, CBR reduced the policy rate by 50 bps to 15.5% likely to stimulate the economy as it comes under increasing strain from high borrowing costs, which was an interesting move. CBR noted in its written statement that it will assess the need for a further key rate cut at its upcoming meetings depending on the sustainability of the inflation slowdown and the dynamics of inflation expectations. CBR added that "The baseline scenario assumes the average key rate to be in the range from 13.5% to 14.5% per annum in 2026."

According to the CBR’s forecast, annual inflation is projected to decline to 4.0–5.0% in 2026, with underlying inflation expected to hit the 4% target by the second half of the year. (Note: Our projection for average headline inflation in 2026 remains at 6.2%). We believe achieving 4.0-5.0% target band in 2026 will be challenging since the disinflationary process will take longer than the CBR anticipates due to the persistent impact of sanctions, the adverse effects of the VAT hike, continued high levels of military spending and tightening labor market conditions. Consequently, we expect monetary policy to remain restrictive for an extended period.

We think the CBR have to be cautious and should proceed with moderate rate cuts provided the inflation trajectory improves and inflation expectations begin to converge toward the Bank’s forecasts. Our year-end target for the 2026 key rate remains 13%. High real yields will be necessary to manage stubborn inflation and we anticipate these inflationary headwinds will persist for the duration of the war in Ukraine.