CBRT Increased Its End-Year Inflation Forecast from 21% to 24%

Bottom Line: Central Bank of Turkiye (CBRT) released its first quarterly inflation report of the year on February 7, and revised its inflation forecast for 2025. CBRT now projects that inflation will stand at 24% at the end of 2025, 12% next year and 8% in 2027. CBRT governor Karahan said the revision of the inflation forecast for this year did not signal any easing in Turkiye's monetary policy stance. We think deteriorated pricing behaviour, food and commodity price volatility, the stickiness of services inflation, and adverse geopolitical impacts will likely lead average headline inflation to stand at 31.9% in 2025.

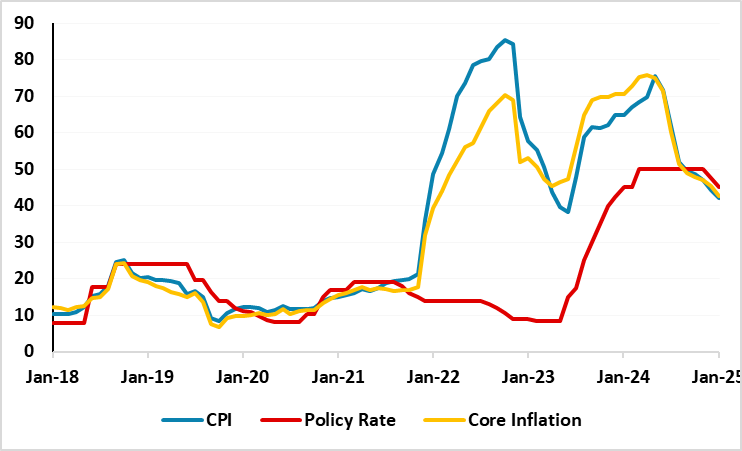

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – January 2025

Source: Continuum Economics

CBRT released the first quarterly inflation report of the year on February 7, and increased its year-end inflation forecast to 24% from 21%. Inflation forecast was set at 12% for 2026, 8% for 2027, and the inflation report mapped out a gradual path toward its medium-term objective of 5% inflation. CBRT governor Karahan highlighted the revision of the inflation forecast for this year did not signal any easing in Turkiye's monetary policy stance.

According to first quarterly inflation report, domestic demand has reached levels that support the decline in inflation trajectory, and the core inflation trend is on a downward path. (Note: The deceleration trend in inflation continued in January and CPI fell to 42.1% y/y from 44.4% in December with education, health, and housing prices leading the rise in the index.) Taking into account that the key concern remains service sector inflation, particularly in housing rentals, the governor also affirmed that January’s monthly increase was primarily driven by higher contract renewal rates." Karahan added at the press conference that "We kept our 2026 forecast unchanged within a context where the probable secondary effects of the revision in our 2025 forecast through expectations will be offset by the tight monetary stance."

Speaking about the course of inflation, Treasury and Finance Minister Mehmet Simsek said on January 30 that four main issues will be decisive in 2025 including delayed effects of monetary policy, the budget deficit to national income, managed and directed prices and supply-side developments particularly in food, housing and energy sectors."

We continue to feel deteriorated pricing behaviour, the stickiness of services inflation, food and commodity price volatility, and adverse geopolitical impacts will likely lead to average headline inflation to stand at 31.9% in 2025. (Note: According to medium term programme for 2025-2027 released in late 2024, the government envisages the inflation rate will drop to 17.5% and 9.7% in 2025 and 2026, respectively.)

As noted, it appears CPI continues to soften thanks to previous monetary tightening and relative TRY stability underpinning the inflation relief, and we foresee decelerating trend will continue to dominate the inflation outlook in 2025, but the extent of the decline will be determined by TRY volatility, new administrative price and tax adjustments.

We think the road to bringing inflation back down to single-digit levels will be very bumpy since the inflation remains sticky, and the inflation falling down to 8% in 2027 is unlikely, as opposed to what CBRT indicated in its first quarterly inflation report.