Turkiye GDP Growth Preview: Slowdown Will Continue in Q2

Bottom Line: Turkish Statistical Institute (TUIK) will announce Q2 GDP growth on September 1 and we expect that Turkish economy will expand around 1.7% -2.0% YoY backed by private consumption despite early indicators demonstrate a lower acceleration rate in domestic demand amid tightening financial conditions and high infation. Private sector investment growth is unlikely to stand high due to diminished business confidence and political turbulence after arrest of Istanbul mayor and opposition’s presidential candidate Ekrem Imamoglu late March. Q2 growth rate could even hit below expectations due to the weight of high interest rates, sluggish demand from abroad due to the tariff-related drag on global activity, political tensions and adverse geopolitical developments.

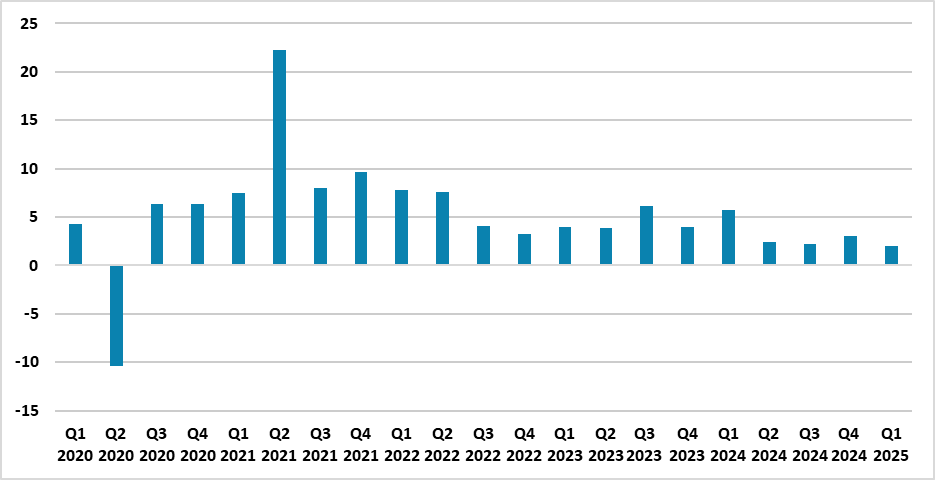

Figure 1: GDP (%, YoY), Q1 2020 – Q1 2025

Source: Continuum Economics

After Turkish economy expanded by 2.0% YoY in Q1 supported by household consumption and robust investments, GDP will likely grow by around 1.7%-2.0% in Q2 backed by private consumption despite early indicators demonstrate a lower acceleration rate amid tightening financial conditions. High inflation and high interest rates are expected to continue weighing on real consumer demand. We think subdued external demand due to the tariff-related drag on global activity will also impact GDP growth negatively in Q2. (Note: Q2 GDP growth figures will be announced by TUIK on September 1).

On sectoral front, manufacturing output slightly fell in Q2 since businesses struggled to manage the prolonged period of high rates and eroded competitiveness. Private sector investment growth is unlikely to stand high due to diminished business confidence after arrest of Istanbul mayor Imamoglu late March. (Note: The pace in investments decelerated in Q1 as investments surged by 2.1% YoY in Q1 after expanding by a strong 6.1% YoY in Q4 last year). As noted, Q2 manufacturing sector faced a downturn, with the Purchasing Managers' Index (PMI) showed a contraction and a decline in industrial employment. The manufacturing sector PMI, which has been in contractionary territory since April 2024, remained so in July 2025 with another dive to 45.9 from 46.7 a month ago.

One major development in Q2 was the arrest of opposition’s presidential candidate Imamoglu, who got detained due to fraud allegations on March 19, which caused Turkish stocks and the TRY plummeted significantly in Q2. Turkish economy remained under pressure due to political risks which risked the disinflationary process in Q2.

We feel tight policies will continue to suppress domestic demand the rest of 2025 bringing annual growth to 2.8%. We foresee growth will remain under pressure in H2 due to high interest rates, contractionary fiscal actions and additional macro prudential policies to fight against the elevated inflation coupled with adverse global outlook. Additionally, the continuation of Russia-Ukraine war will be an important risk factor.

A drop in the inflation rate and rate cuts could boost confidence, which moderately started in Q3, and ignite growth to rise back toward potential of 3.5%-4% after 2026. We feel there is still a downside risk that growth can be lower than expected, particularly considering all tightening measures in place. As mentioned, H2 2025 growth will be likely be higher than H1 supported by positive impacts of the rate cuts and increasing business confidence assuming no dramatic impact from weaker external demand.