Turkiye Inflation Preview: CPI is Expected to Slightly Increase in April

Bottom line: After easing to 38.1% annually in March, we expect consumer price index (CPI) will slightly surge to 38.2%-38.3% YoY in April. Despite tight monetary policy and moderately falling demand helped relieving the price pressure in Q1, April inflation will likely stand at higher-than-expected due to TRY losing value particularly after Istanbul mayor Ekrem Imamoglu’s arrest late March. We continue to foresee domestic uncertainties, deteriorated pricing behaviour, the stickiness of services inflation, and adverse geopolitical impacts will likely lead to average headline inflation to stand at 31.9% in 2025. April print will be announced on May 5.

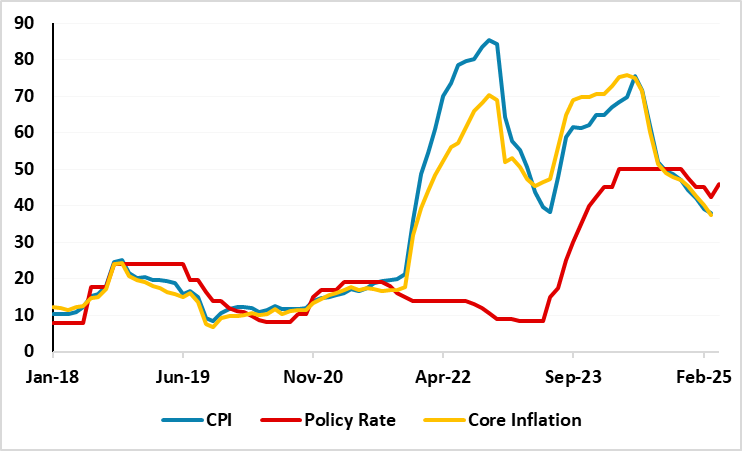

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – April 2025

Source: Continuum Economics

The deceleration trend in inflation continued in Turkiye in March and inflation stood below forecasts as the inflation rate softened for ten consecutive months, marking its lowest level since December 2022. CPI cooled off to 38.1% y/y March from 39.1% in February with food, education and housing prices leading the rise in the index.

We expect consumer price index (CPI) will slightly surge to 38.2%-38.3% YoY in April. (Note: April print will be announced on May 5). Despite tight monetary policy and moderately falling demand helped relieving the price pressure in Q1, April inflation will likely stand at higher-than-expected due to TRY losing value particularly after mayor of Istanbul Ekrem Imamoglu’s arrest late March.

Reacting to market fluctuations, Central Bank of Turkiye (CBRT) hiked the policy rate from 42.5% to 46% during the MPC on April 17 after three consecutive interest rate cuts, mainly due to global uncertainties and domestic inflationary risks, citing in part a slight rise in inflation expectations after a sell-off in the TRY and other assets in April following the detention of Ekrem Imamoglu. (Note: In addition to key rate, CBRT lifted its overnight lending rate to 49% from 46%, and raised the overnight borrowing rate from 41% to 44.5% on April 17).

It appears the inflation expectations of consumers and companies also continued to improve in April, a survey by the CBRT showed on April 11. The 12-month ahead inflation expectations of the real sector increased 0.6 points to 41.7% in April while inflation expectations remained steady at 59.3% in 12 months for households. Remaining hopeful, Treasury and Finance Minister Mehmet Simsek said “(…) although there was a slight increase in expectations compared to the previous month, a significant improvement was still observed on an annual basis.”

Under current circumstances, we continue to envisage domestic uncertainties, deteriorated pricing behaviour, the stickiness of services inflation, and adverse geopolitical impacts will likely lead to average headline inflation to stand at 31.9% in 2025.

Despite inflation softened in Q1 thanks to tightened monetary policy and relative TRY stability underpinning the inflation relief, we foresee domestic developments and global uncertainties will be important determinants for the inflation trajectory in H2. We still think the road to bringing inflation back down to single-digit levels will be very bumpy, and the inflation getting there before 2027 remains very unlikely.