Surprising Move: CBRT Increased the Key Rate to 46%

Bottom Line: Central Bank of Turkiye (CBRT) surprisingly hiked the policy rate from 42.5% to 46% during the MPC on April 17 after three consecutive interest rate cuts, mainly due to global uncertainties and domestic inflationary risks. CBRT highlighted in its written statement that the possibility of persistent inflationary pressures has become more evident due to heightened uncertainties reflected in global market volatility while domestic inflation expectations and pricing behavior continue to pose risks to the disinflation outlook. We foresee CBRT will likely continue its cutting cycle during the next monetary policy meeting scheduled for June 19 if global tensions will defuse and domestic inflation will continue to soften.

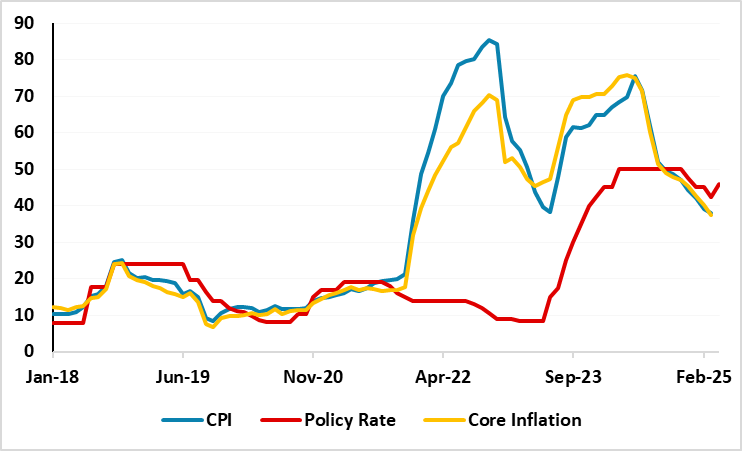

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – April 2025

Source: Continuum Economics

Despite the deceleration trend in inflation continued in March with 38.1% y/y supported by moderate slowdown in domestic demand and relative TRY stability, CBRT decided to hike the policy rate from 42.5% to 46% on April 17 after three consecutive interest rate cuts, particularly due to global uncertainties and domestic inflationary risks. (Note: MoM inflation rose by 2.46% in March, higher than 2.27% MoM print the previous month. Core inflation rose by 1.5% MoM, bringing the annual rate down to 37.4%, which has been supported by the relatively stable foreign exchange basket and the positive outlook for PPI). The rate decision was taken amid global market turmoil due to ongoing tariffs war between China and the U.S.

CBRT highlighted in its written statement on April 17 that the core goods inflation is expected to rise slightly in April because of recent financial market developments, and services inflation is projected to remain stable. CBRT also emphasized that the inflation expectations and pricing behavior continue to pose risks to the disinflation outlook, along with the potential impact of rising global protectionism through channels such as global economic activity, commodity prices, and capital flows.

In addition to key rate, CBRT lifted its overnight lending rate to 49% from 46%, and raised the overnight borrowing rate from 41% to 44.5%.

Taking into account that the CBRT recently raised the year-end inflation forecast to 24% from 21%, we continue to envisage upside risks emanating from the stickiness of services inflation, inflation expectations, deteriorated pricing behavior, and adverse geopolitical impacts will likely lead average inflation to stand at 31.9% in 2025. A faster pace of TRY depreciation is also likely the rest of 2025 particularly given the high uncertainty governing global trade policies, which can moderately reignite inflation in the upcoming months coupled with the adverse impacts of Imamoglu protests in March over TRY.

Under current circumstances, we feel CBRT shall maintain its tight monetary conditions until a sustained decline in inflation is achieved, and will have to proceed carefully on interest-rate adjustments given inflation expectations, pricing behavior and unpredictable outlook for the global economy continue to pose risks to the disinflation process. We foresee CBRT will likely continue its cutting cycle during the next monetary policy meeting scheduled for June 19 if global tensions will defuse and domestic inflation will continue to soften.