Easing Cycle Continues: CBRT Reduced the Key Rate to 40.5% on September 11

Bottom Line: As we expected, Central Bank of Republic of Turkiye (CBRT) reduced the policy rate by 250 bps to 40.5% during the MPC meeting on September 11 taking moderate fall in inflation and relative TRY stability into account. CBRT highlighted in its written statement that recent data indicate demand conditions are at disinflationary levels while inflation expectations, pricing behaviour, and global developments continue to pose risks to the disinflation process. Our end year key rate prediction stands at 36.0% for the-end of 2025 as CBRT will likely continue its easing cycle cautiously in Q4 due to risks.

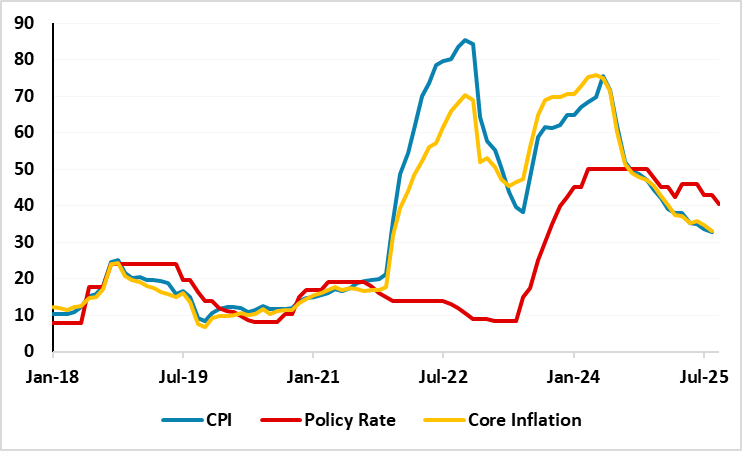

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – September 2025

Source: Continuum Economics

The deceleration trend in inflation, which continued in August with 32.9% y/y supported by lagged impacts of previous monetary tightening and tighter fiscal measures, left with some room of choice for the CBRT on September 11, and CBRT used this opportunity to cut the rates by 250 bps to 40.5% taking the moderate fall in inflation and relative TRY stability into consideration. (Note: CPI cooled off to 32.9% y/y August from 33.5% in July, marking the lowest rate since November 2021 while education, housing and food prices lead the rise in the index). This is second rate cut in a row after July 2025. The MPC committee also lowered the overnight lending rate and the overnight borrowing rate by 250 basis points each to 43.5% and 39%, respectively.

In its written statement on September 11, CBRT emphasized that "The underlying trend of inflation slowed down in August and recent data indicate that demand conditions are at disinflationary levels." The bank added that food prices and service items with high inertia are exerting upward pressure on inflation while inflation expectations, pricing behavior, and global developments continue to pose risks to the disinflation process.

According to the CBRT’s statement, MPC committee will make its policy decisions so as to create the monetary and financial conditions necessary to reach the 5% inflation target in the medium term.

We continue to think that CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis given domestic inflationary risks and unpredictable outlook for the global economy. We expect the inflation slowdown to continue the rest of the year but with a slower pace in Q4 as the extent of the decline will be determined by food inflation, energy prices, TRY volatility, and global developments. We envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation becomes stickier requiring high interest to remain for some time. Despite the CBRT predicts inflation will soften to 24% at the end of 2025, the road will be very bumpy. Our end year key rate prediction stands at 36.0% for the-end of 2025 as CBRT will likely continue its easing cycle cautiously in Q4 due to risks.