Inflation Falls More Than Expectations in December: 44.4% YoY

Bottom line: Inflation fell more than expected to 44.4% annually in November supported by benign food prices and relative TRY stability. We envisage that inflation will continue to decelerate in Q1 2025 by moderate slowdown in domestic demand and credit growth, and will likely be helped by lower-than-expected 30% hike in minimum wage in early January. As we highlighted in December outlook, we think upside risks emanating from the stickiness of services inflation, deteriorated pricing behavior, and adverse geopolitical impacts lead our average inflation forecasts to stand at 31.9% and 20% in 2025 and 2026, respectively, while the Central Bank of Turkiye (CBRT) expects inflation to fall to 21% by end-2025.

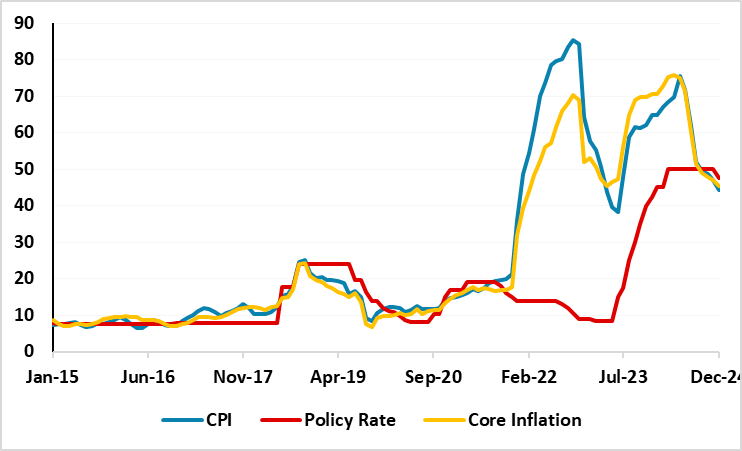

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2024

Source: Continuum Economics

As we expected, the deceleration trend in inflation continued in December supported by moderate slowdown in domestic demand and relative TRY stability; posting the seventh consecutive decline since June 2024 and almost matching the CBRT’s recently updated year-end prediction. CPI cooled off to 44.4% y/y in December from 47.1% in November as inflation figures came out better than expected.

MoM inflation rose by 1.03% in December as monthly inflation stood below expectations while forecasts in surveys ranged between 1.4% and 1.8%. Core inflation (CPI-C) recorded a 1.1% MoM increase, scaling up to 45.3% on an annual basis, supported by the relatively slow-moving FX basket and increasingly benign PPI outlook. (Note: PPI stood at 0.4% MoM, demonstrating a drop to 28.5% YoY from the month prior).

When annual rate of changes (%) in the CPI’s main groups are examined in December, transportation with 25.9% was the main group with the lowest annual increase while education recorded the highest annual increase with 91.6%. It is worth mentioning that housing (69%), hotels, cafes and restaurants (57.1%) also recorded remarkable YoY increases.

The December inflation print came days after the announcement of the minimum wage increase for 2025. We feel inflation trajectory will likely be helped by lower-than-expected 30% hike in minimum wage in early January, which brought net monthly pay to 22,104 TRY (USD 627).

Commenting on the inflation print, Treasury and Finance Minister Mehmet Simsek highlighted that "In December, inflation was 1%, the lowest level in the last 19 months. Annual inflation fell to 44.4%, 2.4 ppt above the Central Bank's forecast range," and added that "We expect inflation to be realized in line with our target in 2025 with the increasing support of fiscal policy, the decline in the rigidity in services inflation and the improvement in expectations."

As CPI continued to soften in December ignited by lagged impacts of aggressive tightening, benign food prices, slowdown in credit growth and relative TRY stability underpinning the inflation relief, we envisage that inflation will continue to decelerate in Q1 2025.

As we highlighted in December outlook, we think upside risks emanating from the stickiness of services inflation, deteriorated pricing behaviour, and adverse geopolitical impacts lead our average inflation forecasts to stand at 31.9% and 20% in 2025 and 2026, respectively, while the CBRT expects inflation to fall to 21% by end-2025. We envisage the inflation outlook in 2025 will be shaped by administrative prices, TRY volatility and tax adjustments.