Turkiye’s Inflation Slightly Eased to 32.9% YoY in August... But, Monthly Inflation is Still Over 2.0%

Bottom line: Turkish Statistical Institute (TUIK) announced on September 3 that the inflation slightly softened to 32.9% y/y in August from 33.5% y/y in July driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. August figure came in slightly above expectations mainly due to food prices affected by frost and drought. Despite moderate fall, monthly inflation stood at 2.04%, which is above forecasts, infirming the success of the ongoing disinflationary program. Despite hot-growth in the economy, upside-tilted inflationary risks and adverse global developments, we foresee that Central Bank of Turkiye (CBRT) will keep trimming interest rates on September 11 but with a slower pace due to limited fall in inflation in Q3.

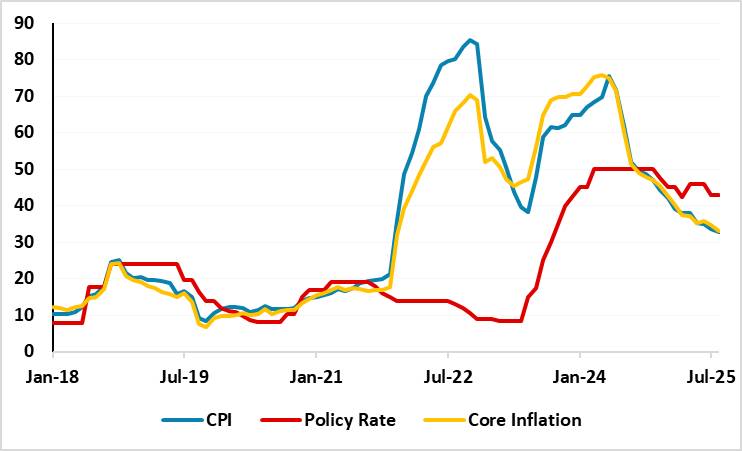

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – August 2025

Source: Continuum Economics

The deceleration trend in inflation moderately continued in Turkiye in August, and inflation rate softened for fifteen consecutive months. CPI cooled off to 32.9% y/y August from 33.5% in July, marking the lowest rate since November 2021 while education, housing and food prices lead the rise in the index. MoM inflation rose by 2.04% in August, which is above forecasts, infirming the success of the ongoing disinflationary program. We think lagged impacts of the tightening cycle and tighter fiscal stance helped relieve the price pressure in August.

Education prices recorded the highest annual increase with 60.9% YoY followed by housing prices were up by 53.3% YoY. Prices rose at a slower pace across a number of categories, such as footwear and clothing, which came in at 9.5% YoY in August.

Core inflation surged by 1.7% MoM, bringing the annual rate down to 33.0%. PPI picked up pace in August with the monthly PPI rising to 2.5% in August from 1.7% in July. The annual PPI rate climbed to 25.2% from 24.2%, TUIK data showed.

Commenting on the figures, Treasury and Finance Minister Mehmet Simsek said that “The food group, impacted by frost and drought, saw price increases well above the long-term average, contributing 0.7 points to monthly inflation. The drop in core goods and services inflation persisted in August.” Separately, Vice President Cevdet Yılmaz explained on X that the August figure came in slightly above expectations due to food prices affected by frost and drought, which contributed about one-third to the monthly inflation. "The annual inflation rate is developing on a path consistent with the Central Bank's forecast range of 25-29% at the end of 2025," Yilmaz noted.

As Yilmaz highlighted, we also expect the slowdown to continue the rest of the year but with a slower pace in Q4 as the extent of the decline will be determined by food inflation, energy prices, TRY volatility, and global developments. We envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation becomes stickier requiring high interest to remain for some time.

Despite the CBRT predicts inflation will soften to 24% at the end of 2025, the road will be very bumpy due to risks. Despite hot-growth in the economy, upside-tilted inflationary risks and adverse global developments, we think CBRT will likely continue its rate cuts on September 11 but with a slower pace due to limited fall in inflation in Q3 coupled with heightened adverse global developments.