Turkish Inflation Continued to Decelerate in January

Bottom line: Turkish Statistical Institute (TUIK) announced on February 3 that consumer price index (CPI) softened to 42.1% y/y in January with education, health, and housing prices leading the rise in the index. We think lagged impacts of previous tightening, relative Turkish lira (TRY) stability, and less-than expected hike in minimum wage helped relieving the price pressure, despite the deceleration pace is slower-than-expected.

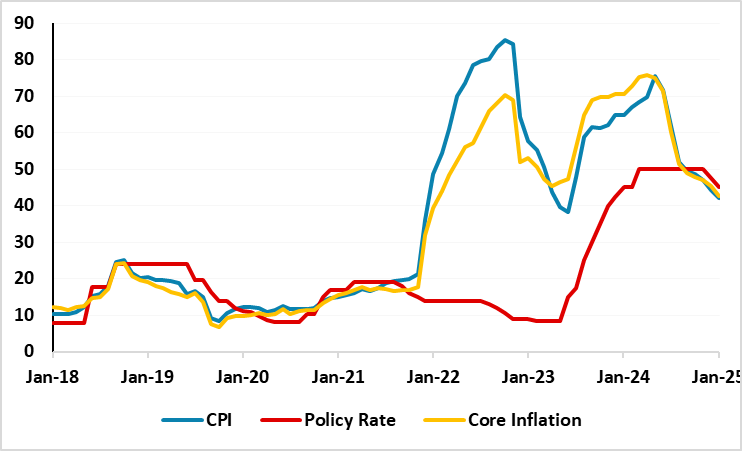

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – January 2025

Source: Continuum Economics

The deceleration trend in inflation continues in Turkiye despite the pace is slower-than-expected. CPI cooled off to 42.1% y/y in January from 44.4% in December with education, health, and housing prices leading the rise in the index. MoM inflation rose by 5.03% in January as monthly inflation stood above expectations considering MoM inflation was a mere 1% in December.

Core inflation (CPI-C) recorded a 5.6% MoM increase, scaling up to 42.7% on an annual basis supported partly by the relatively slow-moving FX basket. (Note: PPI stood at 3.1% MoM, demonstrating a drop to 27.2% on same month of the previous year basis).

When annual rate of changes (%) in the CPI’s main groups are examined in January, transportation with 23.1% was the main group with the lowest annual increase while education recorded the highest annual increase with 99.9%. It is worth mentioning that housing (68.9%), and health (55%) also recorded remarkable YoY increases and drove inflation.

We think lagged impacts of previous monetary tightening, relative TRY stability, and less-than expected hike in minimum wage helped relieving the price pressure. 30% administered rise in the minimum wage for 2025 was lower than workers had requested, which will likely continue to support the deceleration in the inflation.

Despite Central Bank of Turkiye (CBRT) cited in its written statement following the MPC meeting on January 23 that that core goods inflation remains relatively low, and domestic demand standing at disinflationary levels coupled with improving inflation expectations and pricing behaviour, we continue to feel deteriorated pricing behaviour, the stickiness of services inflation, and adverse geopolitical impacts will likely lead to average headline inflation to stand at 31.9% in 2025. (Note: CBRT predicts YoY inflation will fall to 21% by the end of 2025, though some Turkish businesses and households doubt it will come down that quickly. The government envisages the rate will drop even more in that period, to 17.5%).

It appears the inflation expectations of consumers and companies continued to improve in January, a survey by the Central Bank showed on January 28. The 12-month ahead inflation expectations of households declined from 63.1% percent in the December survey to 58.8 percent in the January survey.

Speaking about the inflation figures, Treasury and Finance Minister Mehmet Simsek said on January 30 that four main issues will be decisive in disinflation in 2025. "First, the delayed effect of monetary policy on inflation will be seen more clearly over time. Second, the decrease in the ratio of the budget deficit to national income in 2025 will create a negative fiscal effect. Third, to the extent that budget opportunities allow, we will determine the managed and directed prices in line with the inflation target. Fourth, we will support disinflation not only with demand-side policies but also with supply-side measures in many areas such as food, housing and energy," he explained.

As CPI softens ignited by previous tightening and relative TRY stability underpinning the inflation relief, we foresee decelerating trend will continue to dominate the inflation outlook in 2025, but the extent of the decline will be determined by TRY volatility, new administrative price and tax adjustments. We think CBRT will have to proceed carefully on interest-rate adjustments given domestic inflationary risks and unpredictable outlook for the global economy.