Strong Consumption Continues to Drive Turkiye's GDP Growth

Bottom Line: Turkish economy expanded by 3.2% YoY in 2024 backed by strong private consumption and robust investments, despite the weight of high interest rates. After Q2 2023, Q4 2024 marked the highest quarterly reading with 1.7% QoQ surge, which stemmed from turnaround in private consumption that turned positive in Q4 after negative readings in Q2 and Q3. Public consumption also positively contributed to the GDP growth in 2024, with a 1.6% YoY hike. We feel anti-inflation measures, commercial boycotts following the arrest of mayor of Istanbul, Ekrem Imamoglu, and global uncertainties could moderately dent consumption and growth in Q2, despite we don’t foresee major declines.

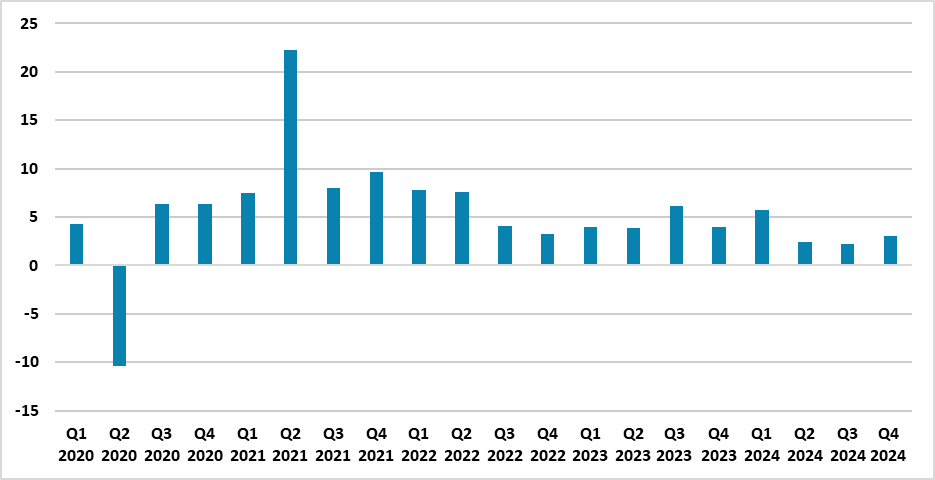

Figure 1: GDP (%, YoY), Q1 2020 – Q4 2024

Source: Continuum Economics

Turkish economy expanded by 3.0% YoY in Q4 2024, -after growing by 2.4% YoY in Q2 and 2.2% YoY in Q3-, driven particularly by private consumption and robust investments. The full-year growth hit 3.2% YoY in 2024.

After Q2 2023, Q4 2024 marked the highest quarterly reading with 1.7% QoQ surge, which stemmed from turnaround in private consumption that turned positive in Q4 following negative readings in Q2 and Q3. Public consumption also positively contributed to the GDP growth in 2024 with a 1.6% YoY hike.

Turkish Statistical Institute’s data revealed that households’ final consumption surged by 3.9% YoY in Q4, accelerating from 2.6% in Q3. For the full-year, the increase in household consumption was 3.7%. Investment appetite also strengthened with 6.1% YoY in Q4, against the 0.1% decline in Q3.

Despite the key interest rate remains high at 42.5% amid tight monetary policies, Q4 data demonstrated that domestic demand ignited by consumption recovered in Q4, as private consumption reached a record high level following drops in early H2. Central Bank of Turkiye (CBRT) also confirmed in its written statement on March 6 that domestic demand was above projections in Q4, while it is currently cruising around disinflationary levels, according to CBRT.

It is worth noting that we envisage consumption trajectory, particularly in Q2, could be moderately negatively impacted by opposition calls for mass commercial boycotts following the arrest of Istanbul mayor Ekrem Imamoglu. (Note: The opposition called for a boycott of goods and services from companies with perceived ties to the government on April 2, including a halt to all shopping activities for one day, was partially effective in cutting the consumption on mentioned day).

Taking into account that we expect CBRT will continue its cutting cycle the rest of 2025 and likely reduce the end-year key rate to 30%, we foresee a continued recovery in GDP growth in 2025 is probable and private consumption will play the leading role with the investments. We feel anti-inflation measures, commercial boycotts following the arrest of Imamoglu and global uncertainties could partly dent consumption and growth in Q2, despite we don’t foresee major declines.