Outlook Overview: Cyclical and Structural Forces

• The global economy is showing signs of healing, as inflation comes back towards targets and growth recovers momentum in some economies. Nevertheless, the cyclical headwind of lagged monetary tightening remains in DM countries, and will likely be one of the forces slowing the U.S. economy from robust to soft growth in H2 2024. The recoveries in Europe will also be restrained in 2024 by tight money/slow credit growth.

• This all argues for the scale of DM restrictive policy should be reduced and Europe’s central banks have mostly started on this journey. The ECB will likely cut a further 50bps in the remainder of 2024 and a further 100bps in 2025. We see the Fed easing in September followed by two further cuts in Q4 and an additional 100bps of Fed easing in 2025. As well as the cyclical picture, structural forces are also having an impact on growth and inflation. While the disinflation impact from Tech/AI is well understood, the continued easing of supply chains pressures still also adds to disinflation. Structural divergence does exist however in labor markets, where the situation is better in the EZ than the U.S. due to a better labor market supply response in the EZ. This makes us more confident of the ECB getting back to neutral rates compared to the U.S. Meanwhile, BOJ interest rate normalization will likely stall by Q4, as Japanese consumers reject higher inflation and stop a wage/price cycle.

• China looks likely to get close to the 5% real GDP growth target for 2024, but will likely slow to 4% in 2025 due to the cyclical headwinds of the ongoing residential investment problems; shift of some supply chains out of China, and sluggish private sector investment/employment and income growth. Structural headwinds of large debt overhang, population aging and slow productivity are also biting. Fiscal and monetary policy support from China authorities will likely remain targeted and insufficient to sustain growth or lift inflation from low levels.

• Other major EM countries growth patterns vary but most are close to trend growth except South Africa. Inflation in most major EM countries has come back towards target (excluding Turkey/Argentina and Russia), but the last part of convergence is taking time in Brazil/Mexico/India and South Africa, which means either slow easing in Latam or delayed rate cuts in India and South Africa. The recent South Africa, Mexico and India elections have also created some surprises, which we discuss in the individual chapters. A key EM structural issue is government debt/GDP trajectories, which is causing an economically damaging real yield premia in South Africa and Brazil.

• November U.S. presidential and congressional elections remain a close call, but will likely impact the U.S. and global economies into 2025. We see fiscal stress in the U.S. in H1 2025 under either Joe Biden or Donald Trump (here). Otherwise it is a question of how key policies would diverge under the alternative of Joe Biden or Donald Trump, with the economy and markets implicitly geared to the status quo under Joe Biden policies. If Trump were elected, he would like put political priority on reducing immigration and making the 2017 tax cuts permanent in 2025. Trump could also curtail Ukraine funding and split western support, which may lead to a probable Russia-friendly peace deal with current territories, likely in 2025.

• For asset allocation, we favor the short-end of government bond curves where not enough easing is discounted in the next 2 years in the U.S. or UK. U.S. equities face a choppy sideways environment, as high valuation means that earnings need to catch up with the market. The UK equity market is favored in DM over the next 18 months (stable government post-election and cheap valuations) and India in EM (nominal GDP growth and infrastructure/manufacturing momentum remain post-election). In FX, we see lower U.S. rates being discounted and causing a modest decline in the USD versus DM currencies. EM currencies are more divergent due to differing starting points and also divergent inflation trajectories versus trading partners.

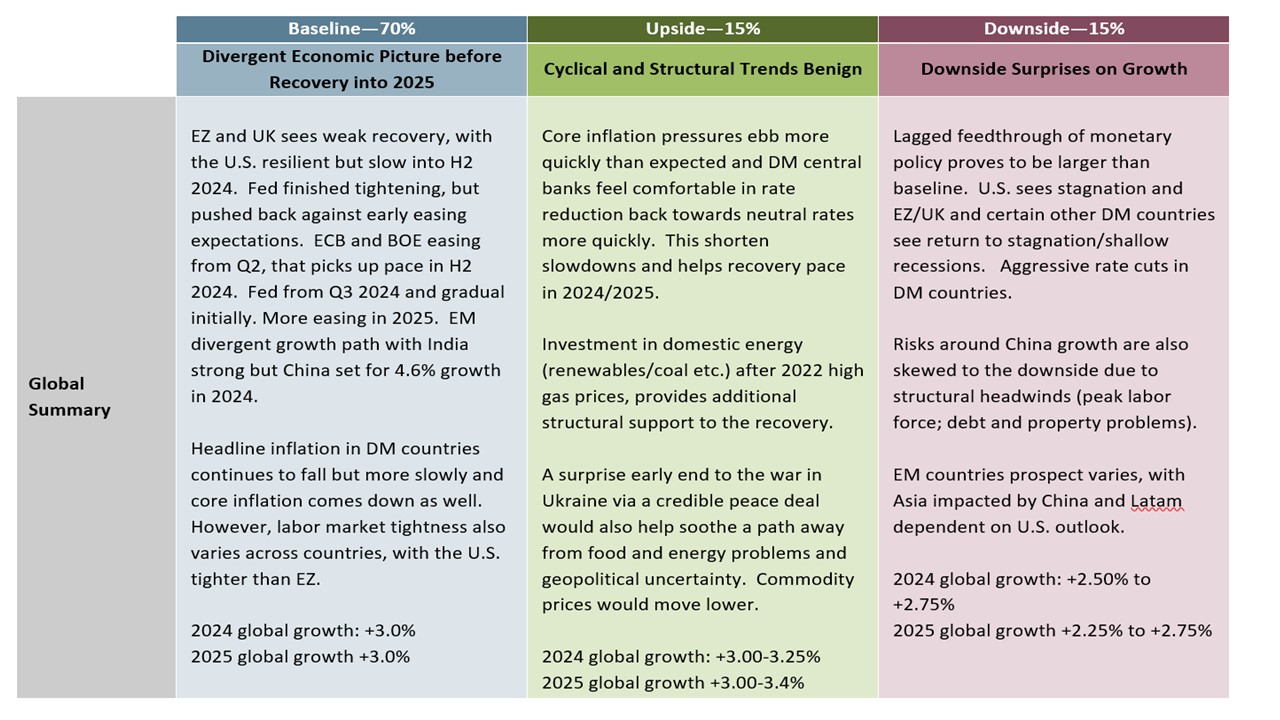

• Risks to our views: DM countries could see stronger lagged effects on the economy from the 2022-23 monetary tightening that could mean a stalled recovery in the EZ/UK recession or more of a slowdown in the U.S. economy. Separately, in China the impact of the residential construction decline could be stronger than expected in economic and financial instability terms and cause noticeable downside risks to our baseline China forecast. This may negatively affect EM economies (Figure 1).

Figure 1: Economic Scenarios

Source: Continuum Economics

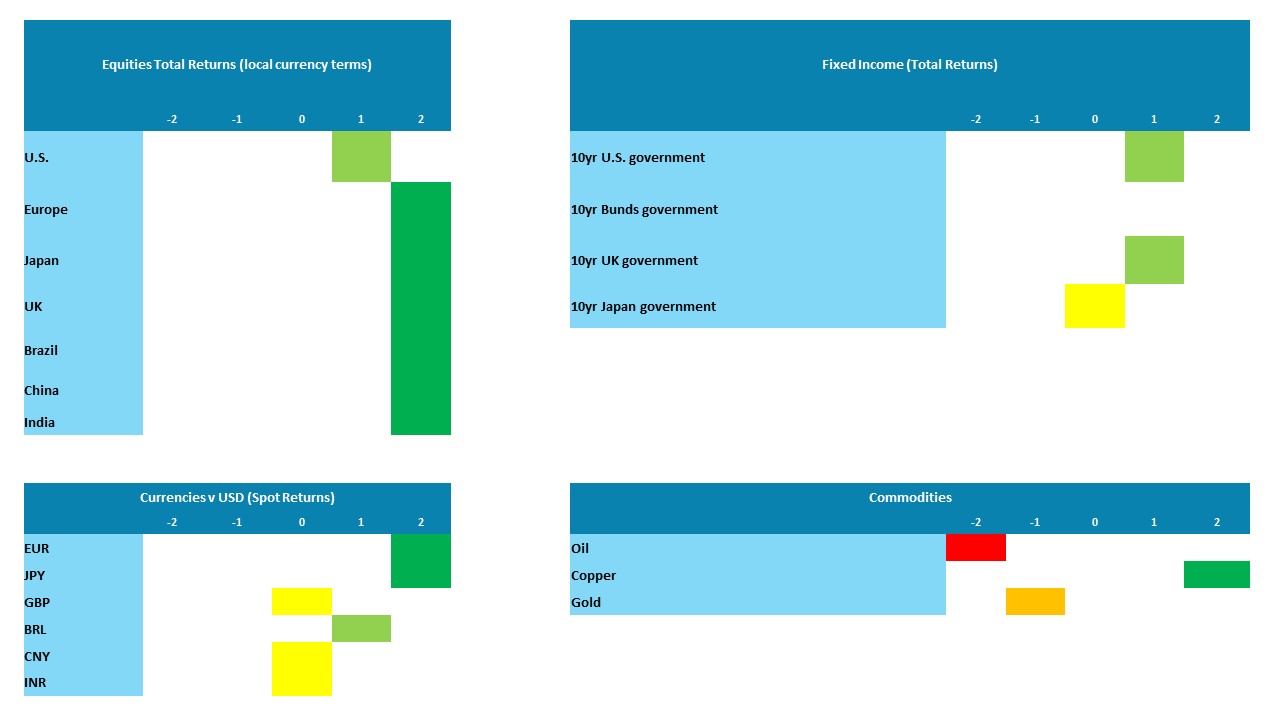

Market Implications

Figure 2: Asset Allocation for the next 18 Months

Source: Continuum Economics Note: Asset views in absolute total returns from levels on June 24 2024 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

• Government Bonds. The U.S. front end is discounting a terminal policy rate of 3.75% in the forthcoming easing cycle, whereas the arrival of actual Fed easing will likely shift expectations to 3%. With the long-end held up by fiscal stress in the U.S., this favors the short-end and a switch to a positive 10-2yr yield curve. EZ and UK will also likely swing to positive yield curve helped by persistent ECB and BOE easing that helps broaden the recovery in 2025.

• Equities. U.S. equities face a choppy sideways environment; as high valuation means that earnings need to catch up with the market. The UK equity markets is favoured in DM over the next 18 months and India in EM. China has 5-10% upside in the next 6 months given undervaluation and the news flow getting less negative, but strategically we are not bullish due to the cyclical and structural headwinds, as mentioned above

• FX. In FX, we see lower U.S. rates being discounted and causing a modest decline in the USD versus DM currencies. On EUR/USD this means 1.12 end 2024 and 1.20 end 2025. We see the JPY as undervalued versus relative bond spreads and at a reset higher will likely be noticeable into 2025. EM currencies are more divergent due to differing starting points and also divergent inflation trajectories versus trading partners. We see CNY losses to 7.40 by end 2024, while feeling that the BRL shakeout has been overdone and carry trades will return to benefit the BRL.

• Commodities. Oil prices will likely soften into 2025, as OPEC+ is keen to reduce voluntary production cuts given financial needs in some countries. With demand growth modest, due to increased switch away from oil in OECD countries, we now see WTI at $72 by end 2025.

Figure 3: Key Events

| July 4, 2024 | UK General Election | Surprising many, PM Sunak called a snap election, much earlier than the autumn date many anticipated. The incumbent Conservatives are far behind in the opinion polls, which suggests that the opposition Labour will win with a handsome majority, albeit finding the fiscal backdrop it will inherit will limit its scope for major policy initiatives at least economically – politically. Labour will try and improve the relationship with the EU and point to policy stability to improve growth potential. |

| July 7, 2024 | French Parliamentary Election (2 round) | After a trouncing for his party in EU parliament elections, President Macron called a surprise parliamentary election, something that has accentuated political uncertainty in France. Amid a two round election with the first vote on June 30, the worry is that the right-wing National Rally or the left-wing Popular Front could win. But after the 2 round of voting, we think it unlikely any party bloc will be able to form a majority. Clause 49.3 allows a minority government to make fiscal policy changes however, but at the risk of a no confidence vote and no further parliamentary elections for 12 months leads to policy paralysis amid already clear fiscal strains. |

| October 6, 2024 | Brazil Municipal Elections | All Brazilian municipalities will hold elections to decide the mayor of the municipality and the members of the local assemblies. |

| November 5, 2024 | U.S. Elections | For Presidency, there will be another contest between President Joe Biden and former President Donald Trump, but the race looks too close to call. Trump is currently ahead in the polls but this may be due more to opinions on Biden than those on Trump. Come the election, negative views towards Trump may become more significant. We foresee the contests for Congress will also be close. Republicans look likely to regain control of the Senate, where the Democrats are defending more vulnerable seats, but dysfunctional Republican leadership in the House gives the Democrats a good chance of regaining control there. Incumbents all appear vulnerable. |

| September 27, 2025 | Australia General Election | All 153 seats in the House of Representative and at least 40 seats in the senate will be contested. Prime minister Anthony Albanese will be seeking for a second term re-election, facing Peter Dutton of liberal and National Coalition’s challenge. |

| October 20, 2025 | Canada Federal Election | Canada’s election looks likely to deliver a Conservative majority government, led by Pierre Poilievre, ending the tenure of Liberal Prime Minister Justin Trudeau that has persisted since 2015. A business friendly-government would be seen, but plans to balance the budget while cutting taxes may be difficult to combine. We would expect little change from the current fiscal stance of modest budget deficits, and no major changes in the Canadian economic outlook. |

| October 26, 2025 | German Federal Election | The next German federal election must be held on or before 26 October 2025 with the opposition CDU is currently commanding a clear opinion poll lead. The risk is that with the current coalition looking ever more fragile a shift in government could occur even earlier. |

| October 31, 2025 | Japan General Election | All 465 seats in the House of Representative will be up for election. A new prime minister and cabinet will also be elected. Currently, the governing Liberal Democratic Party (LDP) are holding 261 seats, 28 seats more than the majority requirement. The next competitor Constitutional Democratic Party of Japan is holding 97 seats and Nippon Ishin no Kai is holding 41 seats. The LDP has been mostly in control post war, and we envisage this will not change. |

Source: Continuum Economics