Data Reviews

View:

January 05, 2026

U.S. December ISM Manufacturing - Weaker on reversal in inventories

January 5, 2026 3:18 PM UTC

December’s ISM manufacturing index of 47.9 is unexpectedly down from 48.2 and the weakest since October 2024, though the details do not suggest much underlying change in the picture, which remains subdued and a little below neutral.

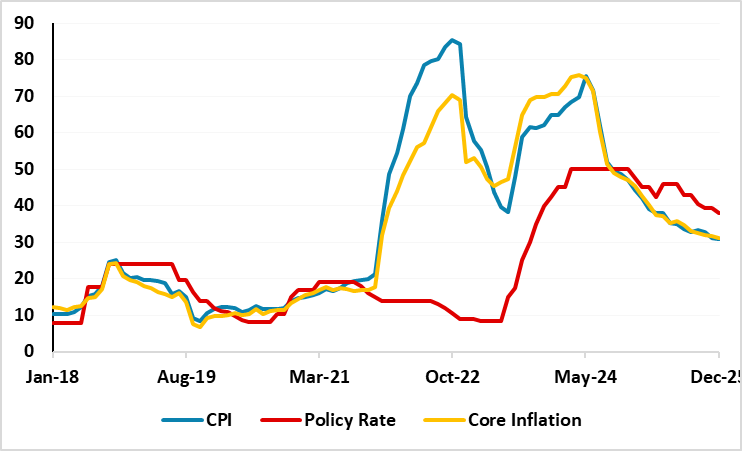

Turkiye Closes the Year with Inflation Easing to 30.9% y/y in December

January 5, 2026 11:25 AM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on January 5, Turkiye’s inflation softened to 30.9% y/y in December backed by the lagged impacts of previous monetary tightening. Food, housing and education drove the inflation in December as education prices recorde

December 19, 2025

December 18, 2025

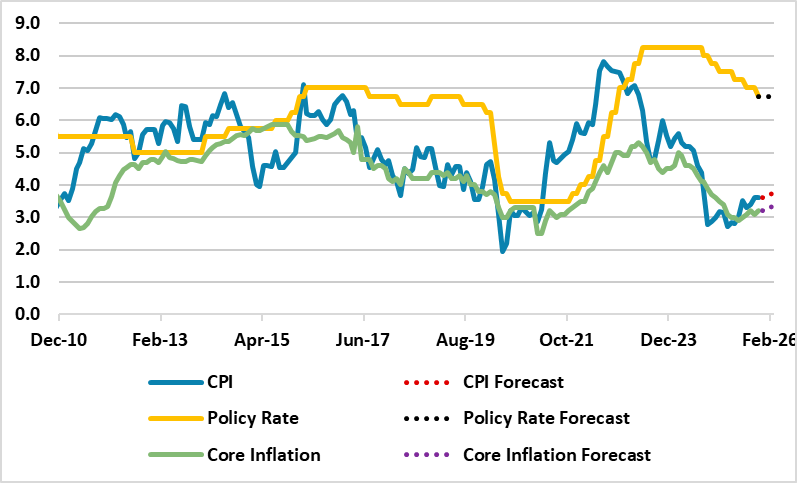

U.S. November CPI - Is the tariff impact fading?

December 18, 2025 2:10 PM UTC

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month ov

December 17, 2025

South Africa Inflation Moderately Softens to 3.5% y/y in November

December 17, 2025 5:08 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on December 17 that annual inflation softened moderately to 3.5% y/y in November from 3.6% the previous month, but food and restaurant prices remained worrisome. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 pe

UK CPI Review: Down More Than Expected from Likely Peak?

December 17, 2025 7:38 AM UTC

A clear downside surprise adds to the wealth of data suggesting a reining of price and cost pressures. This November result makes it more likely that the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus by 0.2 pp

December 16, 2025

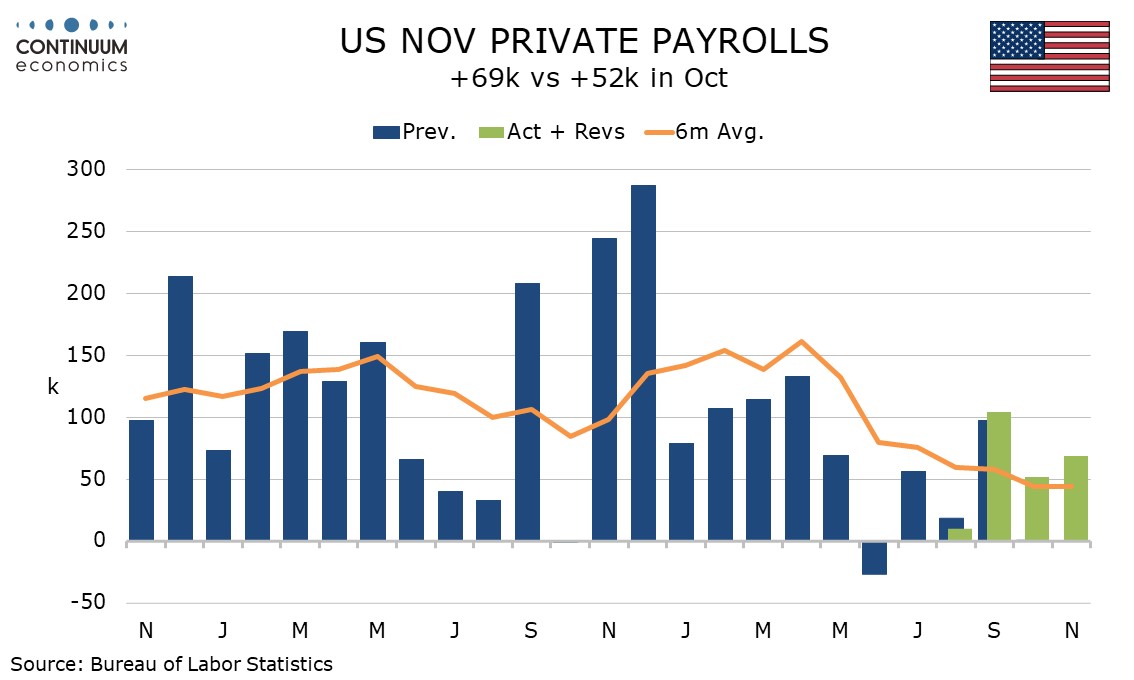

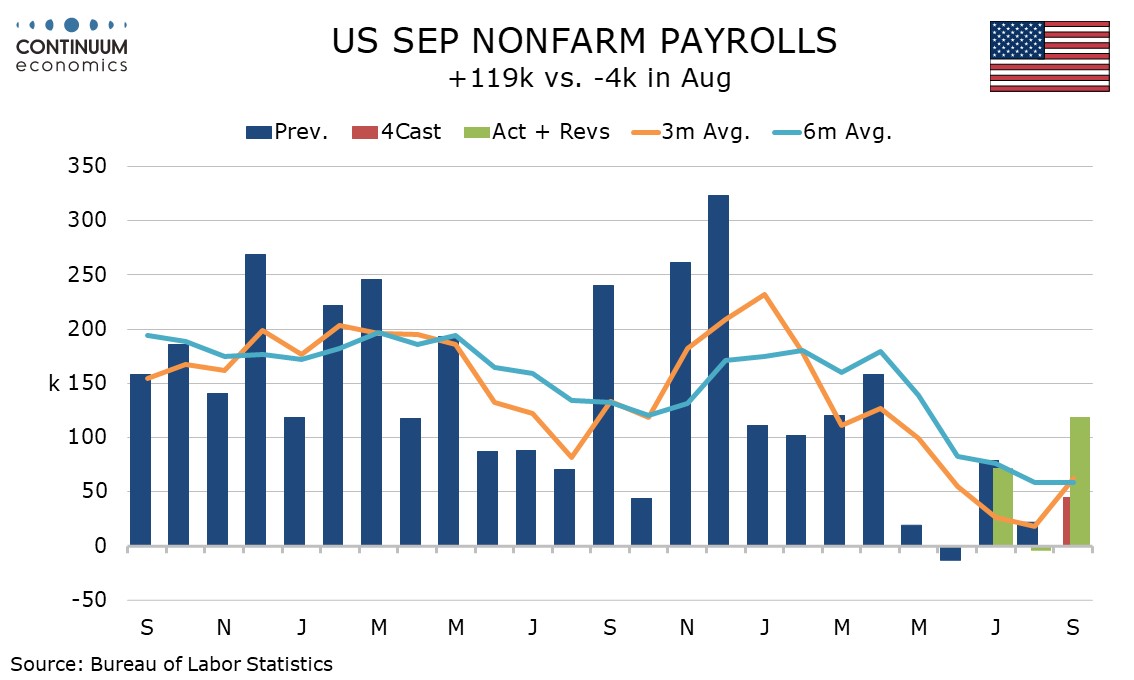

U.S. October and November Employment - Unemployment rising but economy maintains some momentum

December 16, 2025 2:22 PM UTC

November’s non-non-farm payroll at 64k does not fully erase a 105k decline in October but private payrolls at 69k in November and 52k in October maintain moderate growth, though unemployment at 4.6% in November is the highest since September 2021, and average hourly earnings growth is slowing. Oct

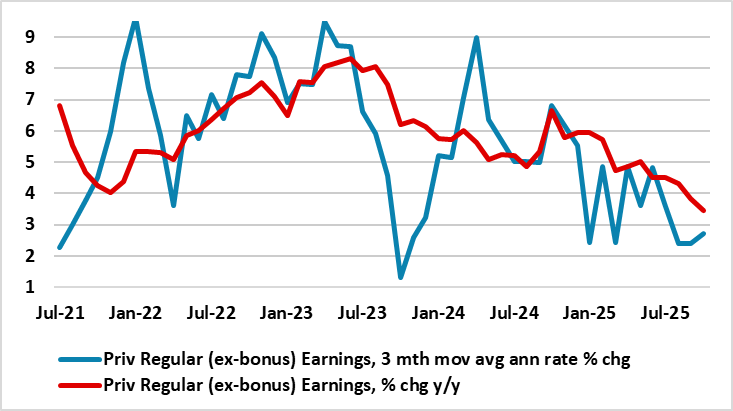

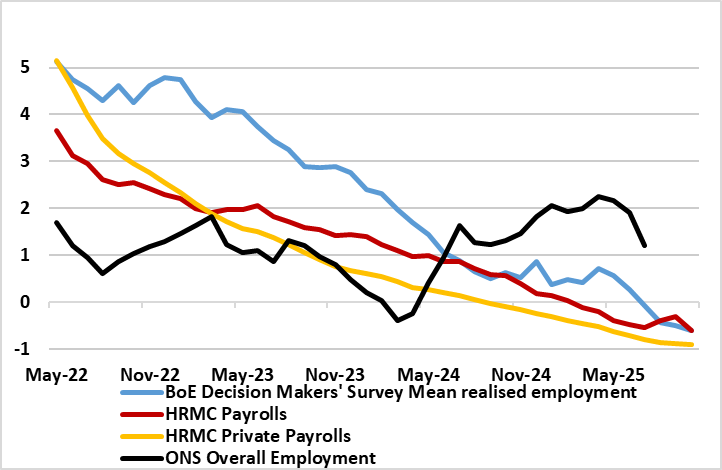

UK Labor Market: Job Losses Weighing Even More Clearly on Wages

December 16, 2025 8:06 AM UTC

Adding to the array if weak activity updates of late, there are increasing signs that the labor market is haemorrhaging jobs more clearly and broadly with fresh and deeper falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down alm

December 15, 2025

U.S. December NAHB Homebuilders Index - Third straight rise

December 15, 2025 3:09 PM UTC

December’s NAHB homebuilders’ index of 39 from 38 has delivered a third straight rise though the latest two gains are marginal, by one point, after a strong five point bounce in October and the level is still quite soft.

U.S. December Empire State Manufacturing Survey - Correction from strong November

December 15, 2025 2:06 PM UTC

December’s Empire State manufacturing index at -3.9 versus 18.7 has corrected from a 12-month high, though remains within this year’s range and the series is volatile. November was well above trend both in 2024 and 2025.

December 12, 2025

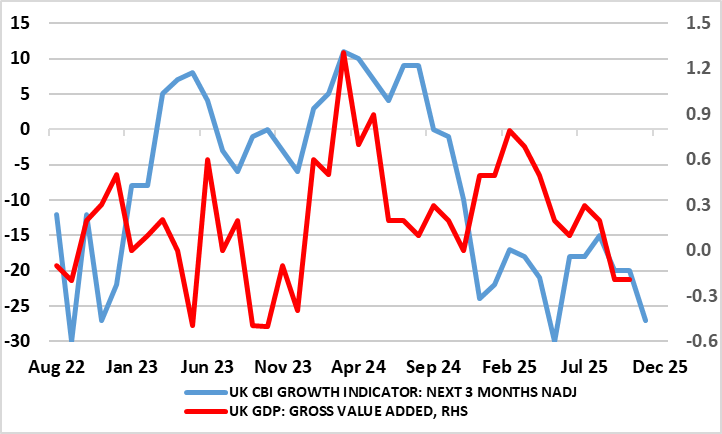

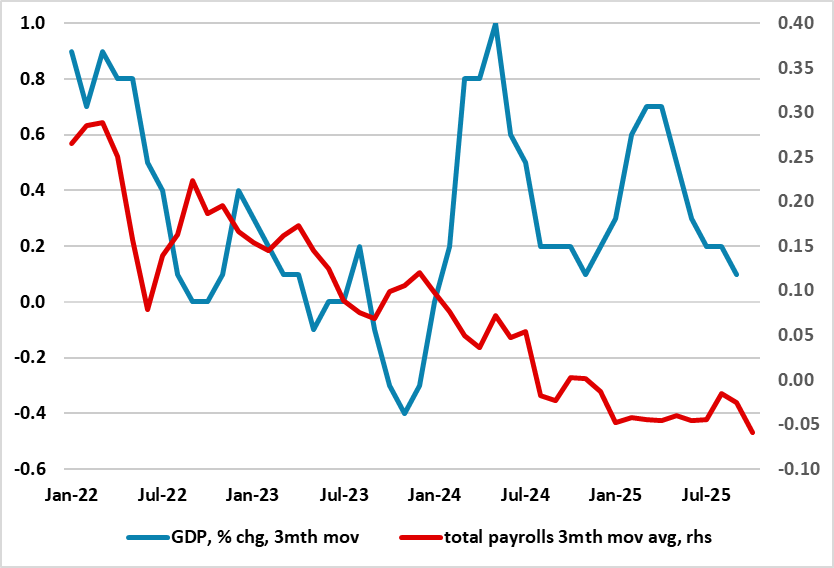

UK GDP Review: Underlying and Headline Economy Negative, Fragile and Listless

December 12, 2025 7:47 AM UTC

As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months (Figure 1), and where the unexpected further 0.

December 11, 2025

U.S. Initial Claims rebound from holiday drop, September trade deficit falls on surge in gold exports

December 11, 2025 2:14 PM UTC

After a sharply below trend outcome last week of 192k (revised from 191k) in a week that included the Thanksgiving holiday and may have seen seasonal adjustment problems, initial claims have rebounded above trend to 236k. The 2-week average is 214k, slightly below the 218k seen two weeks ago and the

Exceeding Expectations: Russia Inflation Eased Fast to 6.6% y/y in November

December 11, 2025 8:15 AM UTC

Bottom Line: Russian inflation continued its decreasing pattern in November and edged down to 6.6% owing to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB despite food and services prices continued to surge in November. We think the inflation will continue

December 09, 2025

U.S. September/October JOLTS report - Mostly a resilient message

December 9, 2025 3:25 PM UTC

The Labor Dep’t has released the JOLTS report on labor turnover for both September and October, with the September data being partial but the October release surveyed as originally planned. The picture is on the strong side of expectations and the pre-shutdown trend.

U.S. November NFIB survey shows significant acceleration in selling prices

December 9, 2025 1:11 PM UTC

The most notable feature of November’s NFIB survey of Small Business Optimism was a sharp rise in the proportion reporting higher selling prices, to 34% from 21%, reaching the highest level since March 2023. Why such as sharp bounce has some this month is difficult to explain but it could be that

December 05, 2025

U.S. September Core PCE Prices consistent with CPI, December Michigan CSI sees inflation expectations fall

December 5, 2025 3:27 PM UTC

September PCE prices at 0.3% overall, 0.2% ex food and energy are in line with expectations with the respective gains before rounding at 0.269% and 0.198%. December’s Michigan CSI has seen inflation expectations easing, which will provide some comfort to the Fed.

Canada November Employment - Third straight strong rise, unemployment lowest since July 2024

December 5, 2025 2:00 PM UTC

Canada’s November employment report has surprised on the upside for a third straight month, rising by 53.6k, and this time with a sharp fall in unemployment to 6.5% from 6.9%. While the Bank of Canada is unlikely to be thinking about tightening yet, the data adds to hopes generated by a 2.6% annua

December 04, 2025

U.S. Initial Claims fell sharply in Thanksgiving week, other labor market signals mixed

December 4, 2025 1:52 PM UTC

Weekly initial claims at 191k from 218k are exceptionally low but there may be some seasonal adjustment issues with Thanksgiving. Unadjusted however initial claims also fell, by 49k to 197k. While this fall in initial claims may be overstated it is the fourth straight decline.

December 03, 2025

U.S. November ISM Services - Rise led by delivery times

December 3, 2025 3:17 PM UTC

November’s ISM services index has marginally extended an October bounce, and at 52.6 from 52.4 is at its highest since February. Details are less impressive but the latest two months suggest the economy is still expanding, if moderately, and worries over tariffs, which may have contributed to a di

U.S. September Industrial Production - Trend marginally positive

December 3, 2025 2:34 PM UTC

September industrial production was in line with expectations with a marginal rise of 0.1%, with manufacturing unchanged. Mining was also unchanged with the rise in industrial production coming from a 1.1% upward correction from a 3.0% August decline in weather-sensitive utilities.

Turkiye’s Inflation Eased to 31.1% y/y in November, Hitting Below Expectations

December 3, 2025 1:40 PM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on December 3, Turkiye’s inflation softened to 31.1% y/y in November backed by moderate unprocessed food prices. We continue to think upside-tilted inflation risks will likely limit the downward trend during the disin

U.S. November ADP Employment leaves trend looking fairly flat

December 3, 2025 1:38 PM UTC

ADP’s November estimate of private sector employment of -32k does not quite reverse a 47k increase in October (revised from 42k) but leaves trend looking fairly flat. The data is consistent with negative signals from weekly ADP employment data released a week ago and also the finding of the latest

December 02, 2025

South African GDP Growth Hit 2.1% y/y in Q3, Marking the Fastest Expansion Since Q3 2022

December 2, 2025 8:03 PM UTC

Bottom Line: Department of Statistics of South Africa (Stats SA) announced Q3 GDP growth on December 2. South African economy grew by 2.1% YoY in Q3, the fastest expansion since Q3 2022. We think that the growth momentum will continue to be supported by low inflation, improved consumer sentiment, fe

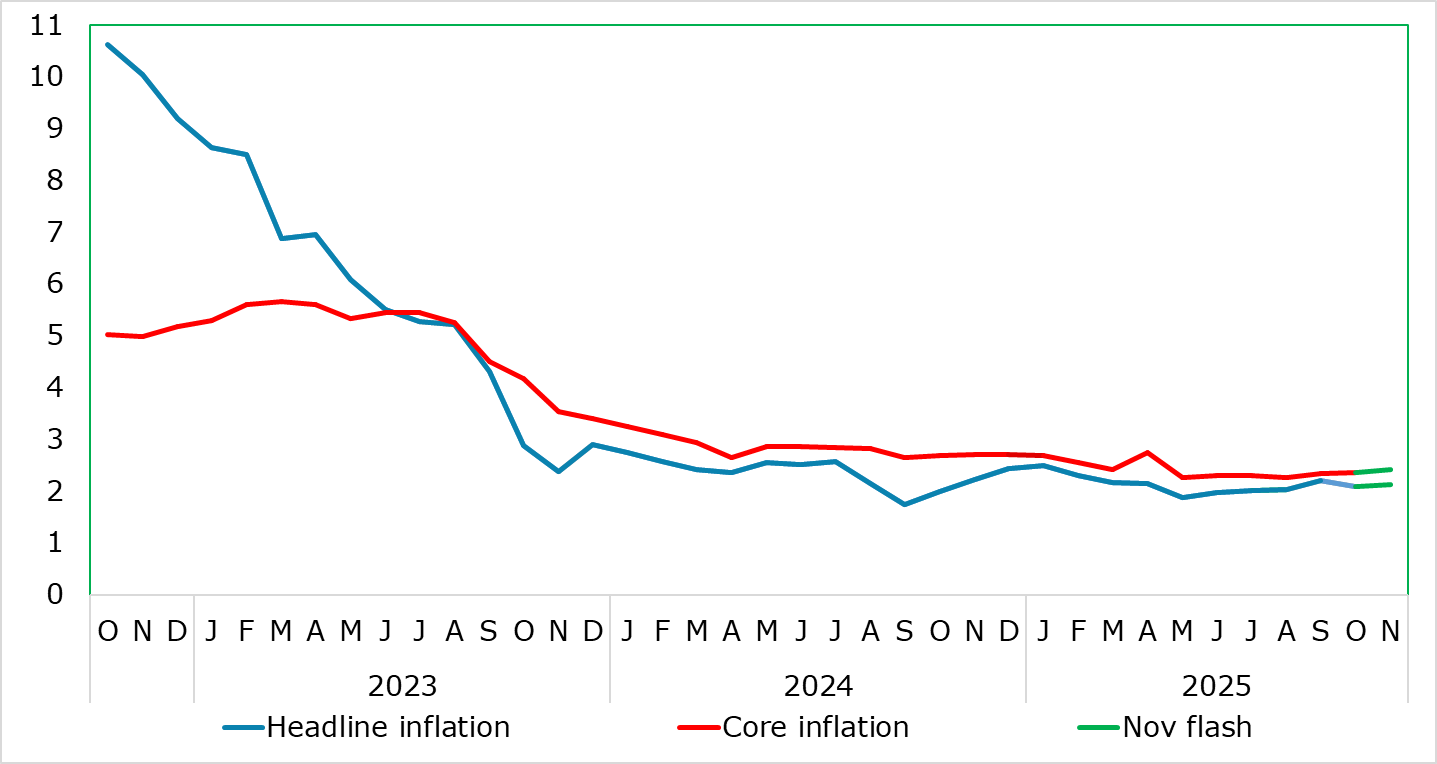

EZ HICP Review: Services Inflation Still Problematic?

December 2, 2025 10:51 AM UTC

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. This reversed in the flash November numbers in what was an outcome a notch above bo

December 01, 2025

U.S. November ISM Manufacturing - Weaker than expected but still in a tight range

December 1, 2025 3:15 PM UTC

November’s ISM manufacturing index of 48.2 from 48.7 is weaker than expected and the signals of most if not all regional surveys, if not dramatically so. The index is the weakest since July but remains in a fairly tight modestly negative range, since moving above neutral in January and February.

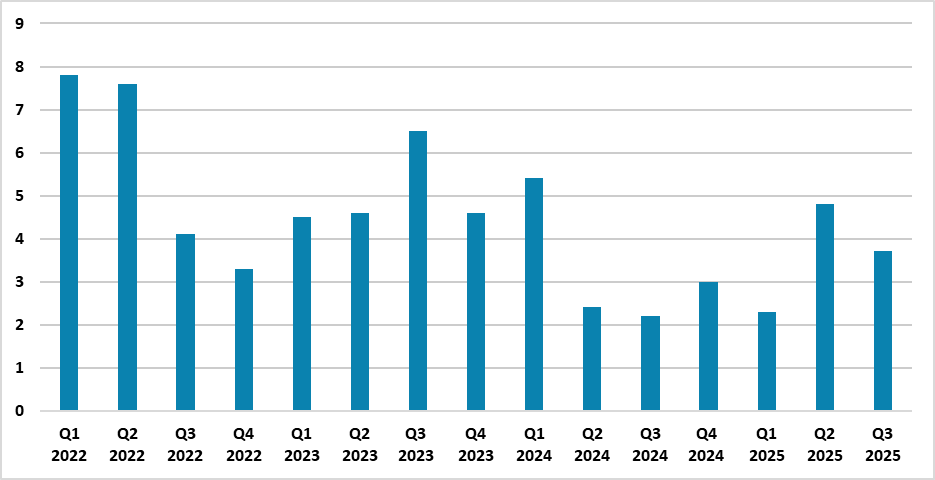

Turkish Economy Expanded by 3.7% in Q3 Backed by Robust HH Consumption and Investments

December 1, 2025 10:41 AM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced GDP growth for Q3 on December 1. Turkish economy grew by 3.7% YoY in Q3 backed by household consumption, investments, and government spending.

November 28, 2025

Canada Q3 GDP rebounds as imports plunge but domestic demand marginally negative

November 28, 2025 2:14 PM UTC

Canada’s 2.6% annualized increase in Q3 GDP is sharply higher than expected though the surprise comes largely from a sharp fall in imports. Domestic demand was almost unchanged with a 0.1% annualized decline. September GDP grew by 0.2% on the month, but the preliminary estimate for October is weak

November 26, 2025

U.S. Initial Claims, September Durable Goods Orders - trends healthy

November 26, 2025 1:59 PM UTC

The latest set of US data is on the strong side of expectations, with initial claims at 216k from 222k the lowest since April. September durable goods orders are on consensus with a 0.5% increase but the ex-transport rise of 0.6% is on the firm side and trend is improving.

November 25, 2025

U.S. November Consumer Confidence slides but October pending home sales stronger

November 25, 2025 3:25 PM UTC

The Conference Board’s Consumer Confidence Index at 88.7 in November from 95.5 in October is the weakest since April when tariff concerns were at their peak. October pending home sales however with a 1.9% increase sustain recent signs of a revival in the housing market as Fed easing resumes.

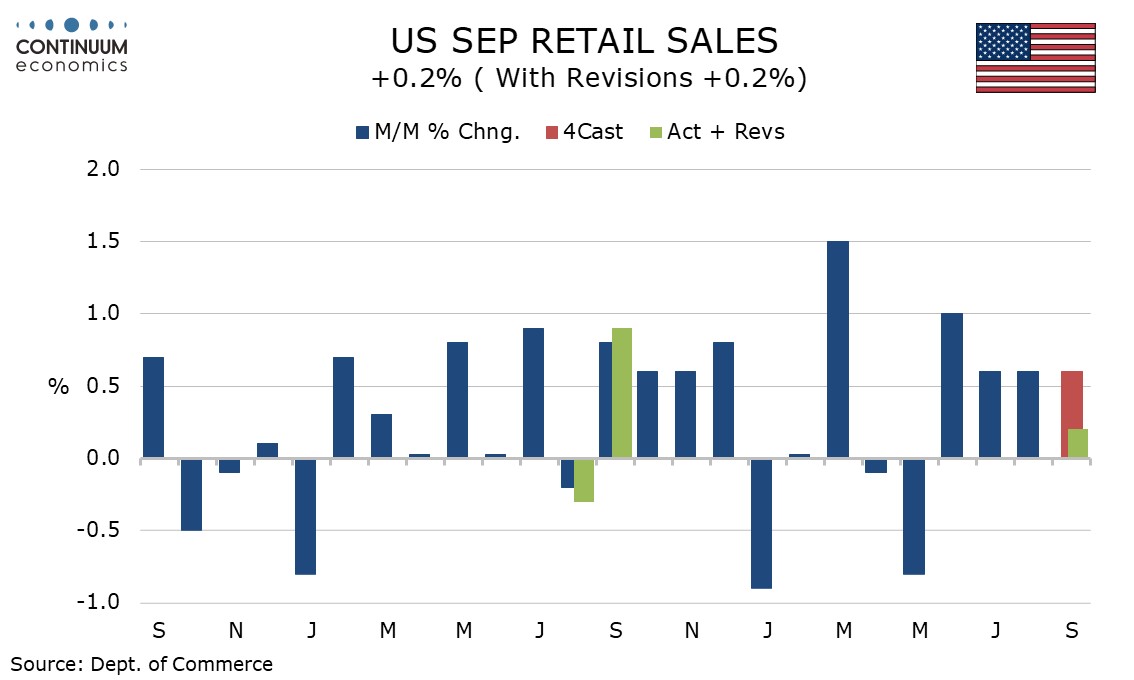

U.S. September Retail Sales lose momentum, PPI strong in goods but weak in services

November 25, 2025 2:08 PM UTC

September retail sales with a rise of 0.2% are weaker than expected and likely to be negative in real terms, given September gains in CPI goods prices, suggesting momentum in consumer spending is starting to fade with employment growth. September’s PPI with a rise of 0.3% overall met expectations

November 21, 2025

U.S. November S&P PMIs - Still healthy

November 21, 2025 3:01 PM UTC

November’s preliminary S and P PMIs both remain at healthy levels, manufacturing modestly slower at 51.9 from 52.5 but still comfortably positive, while services have unexpectedly seen a modest increase to 55.0 from 54.8. The composite increased to 54.8 from 54.6.

November 20, 2025

U.S. October Existing Home Sales - Starting to gain momentum

November 20, 2025 3:16 PM UTC

A 1.2% rise in October existing home sales is in line with other private sector surveys (NAHB, MBA and pending home sales) suggesting some revival in the housing market as the Fed resumes easing. With the scale of future easing uncertain the housing sector outlook is too.

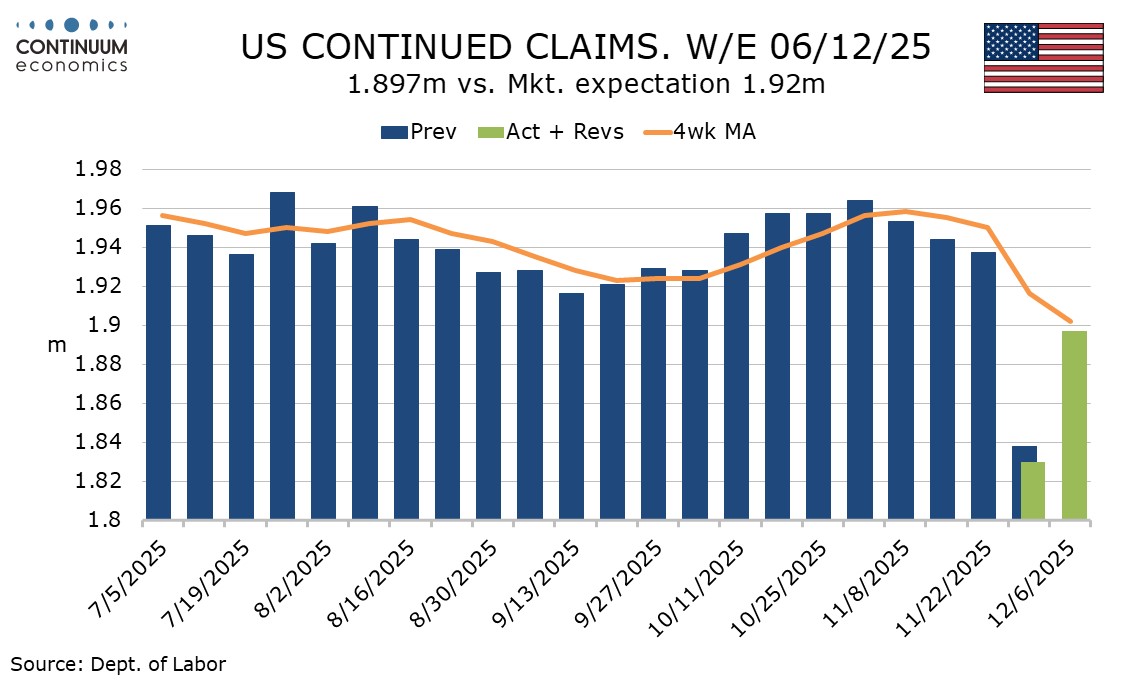

U.S. Initial Claims stable but Continued Claims moving higher

November 20, 2025 2:45 PM UTC

Today we saw the non-farm payroll for September, as well as eight weeks of initial claims that take us to the survey week for November’s non-farm payroll. Initial claims remain low, though continued claims have been rising in recent weeks, hinting at downside risks for non-farm payrolls in October

U.S. September Employment - Case for a December easing looks a little weaker

November 20, 2025 2:04 PM UTC

September’s non-farm payroll will be the last released before the December 10 FOMC meeting and is surprisingly firm at 119k, albeit with 33k in negative revisions. A rise in unemployment to 4.4% from 4.3% and a 0.2% rise in average hourly earnings provide only marginal offsets to the headline. Nov

November 19, 2025

South Africa Inflation Edged Up to 3.6% y/y in October, Marking the Highest Reading Since September 2024

November 19, 2025 3:53 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on November 19 that annual inflation edged up to 3.6% YoY in October due to accelerated transport, alcoholic beverages and tobacco, and recreation costs. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 percenta

U.S. August trade deficit slips back after bounce in July, still in correction from inflated pre-tariff deficits

November 19, 2025 2:00 PM UTC

August’s delayed trade deficit of $59.55bn is narrower than expected, down significantly from July’s $78.5bn, but still marginally above June’s $59.09bn. Despite July’s bounce, the deficit remains in a correction from the inflated pre-tariff levels of Q1 which saw a record deficit of $136.42

UK CPI Review: Down from Likely Peak?

November 19, 2025 7:50 AM UTC

It does seem as if the September CPI outcome (a third successive and lower-than-expected outcome of 3.8%) will prove to be the inflation peak. Indeed, the just released October figure fell a little less than the consensus but in line with BoE thinking, to 3.6%, helped by favourable energy base eff

November 18, 2025

U.S. November NAHB Homebuilders Index - Bounce extended but 6-month view corrects lower

November 18, 2025 3:09 PM UTC

November’s NAHB homebuilders’ index of 38 has marginally extended a 5-point October bounce and remains at its highest level since April. Details show increasing strength in current month data but a correction lower in the 6-month view.

November 17, 2025

U.S. November Empire State Manufacturing Survey - Activity sees 12 month high, prices slower but still firm

November 17, 2025 2:21 PM UTC

November’s Empire State manufacturing index at a positive 18.7 from 10.7 is the strongest in twelve months, and the third healthy number in four months, though with November 2024 strength at 20.7 not having persisted we would treat the latest strength with a degree of caution.

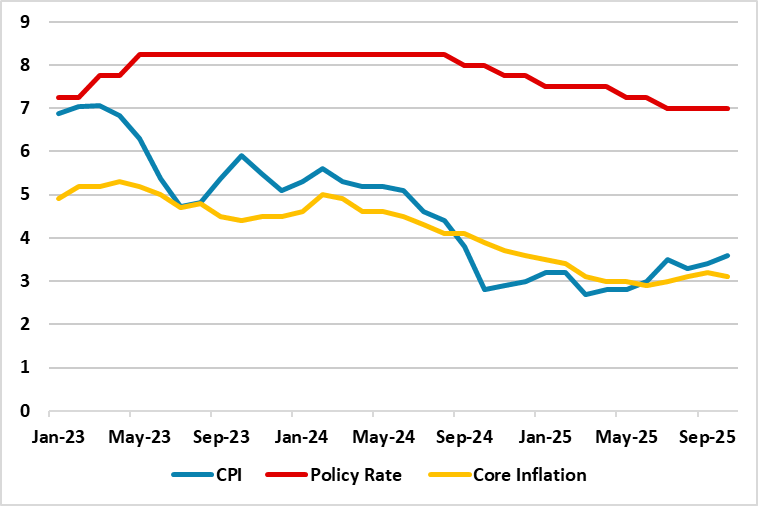

India CPI Review: Inflation Cools to Historic Lows

November 17, 2025 8:04 AM UTC

India’s October inflation print confirms a rare moment of macro alignment—low inflation, solid growth, and room for monetary easing. The RBI now faces a high-conviction window to cut rates in December, but must stay vigilant against creeping food price risks as FY26 progresses.

November 14, 2025

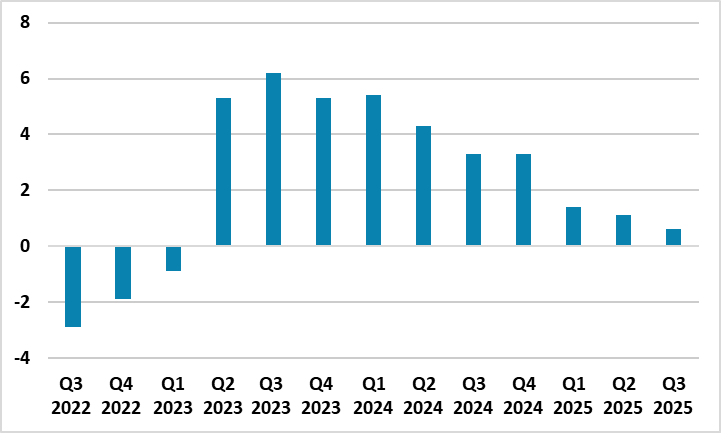

Slowest Rate of Growth for Russia Since Q1 2023: 0.6% y/y in Q3 2025

November 14, 2025 6:06 PM UTC

Bottom Line: According to Ministry of Economic Development’s preliminary figures, Russia's GDP expanded by a moderate 0.6% y/y in Q3, marking the slowest rate of growth since Q1 2023 showing the economic slowdown in Russia is more evident now. We think Central Bank of Russia’s (CBR) previous agg

Russia’s Inflation Softened to 7.7% y/y in October

November 14, 2025 5:00 PM UTC

Bottom Line: As expected, Russian inflation continued its decreasing pattern in October and edged down to 7.7% thanks to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB particularly after July. Despite fall in inflation; we think the inflation will continue

November 13, 2025

UK GDP Review: Underlying Economy Listless - At Best

November 13, 2025 8:10 AM UTC

As we have underlined, GDP has hardly moved since March and, again, the latest update undershot consensus thinking. Indeed, GDP has fallen in two of the last three months (Figure 1), albeit where some recovery should be in store for the current quarter as these September numbers were hit (temporar

November 11, 2025

U.S. October NFIB survey - Weaker but far from weak

November 11, 2025 1:33 PM UTC

October’s NFIB index of Small Business Optimism at 98.2 from 98.8 has seen a second straight decline, possibly influenced by the government shutdown which looks close to being resolved. The index is still well above pre-election levels and above April’s 95.8 when tariff alarm was at its peak.

UK Labor Market: Continued Private Sector Job Losses Weighing Even More Clearly on Wages

November 11, 2025 8:01 AM UTC

Previous signs that the labor market is haemorrhaging jobs less clearly have evaporated, with fresh and deeper falls in the more authoritative payrolls. Indeed, private sector payrolls are still falling, down almost a full ppt in y/y terms and more steeply so (Figure 1). Regardless, the latest l

November 07, 2025

U.S. November Preliminary Michigan CSI - Weak, possibly on shutdown or labor market worries

November 7, 2025 3:25 PM UTC

November’s preliminary Michigan CSI of 50.3 has seen a significant dip from 53.6 in October to reach its lowest level since June 2022. Current conditions led the slowing, perhaps due to the government shutdown or weakening in the labor market. Inflation expectations are mixed but within the recent